Advanced Placement Annual Conference, 2011 San Francisco, CA

advertisement

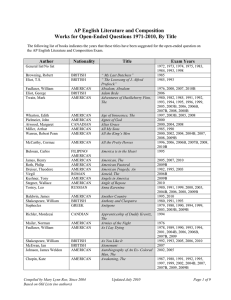

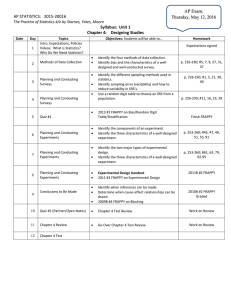

Cracking the Free Response in AP Macroeconomics and Microeconomics Patricia Brazill Co-Chair, Macro Test Development Irondequoit High School Rochester, NY Patti_Brazill@westiron.monroe.edu Sandra Wright Micro Test Development Adlai Stevenson High School Lincolnshire, IL swright@d125.org Emphasize the concepts and skills so they know how to drive the AP Econ Car and read the Map (FRQ Questions) so that no matter what question is asked they can rely on their knowledge of how to drive and read the map to go where ever the question asks… 2010 Macro 53% 3 or above What can your students do well? What can you do to help them improve? How did they compare to the national average? You want your students FRQs to exceed average scores! When answering the Macroeconomics or Microeconomics free response questions, a student should respond clearly and concisely. Including paragraphs or even full-sentence responses is not always necessary; however, it is important to address the verb prompts appropriately (as explained below). A written response that presents conflicting answers is likely to lead to the loss of points. “SHOW” means use a diagram (graph). Correct labels are critical! “EXPLAIN” means to take the reader through all the steps or linkages in the line of reasoning. Often a formula or graph will work. “IDENTIFY” means provide a specific answer, a list, a point on a graph, without explanation “CALCULATE” means us math to determine a specific numerical answer and show work Correctly drawn and labeled AD/AS models Correctly drawn Production Possibilities model Showing a recession on a PPF Content Areas: Foreign Exchange Market Fiscal Policy Effect on AD Content Areas: The Mechanics of Money Creation Categories of Unemployment Classical Adjustment to Recession General Content Areas: Money and Banking Real vs. Nominal Distinction International Economics Determining Pe and Qe on a Monopoly graph Firm Graph in PC market Price ceiling on a PC market graph Finding Allocative Efficienct Quantity when an externality exists Elasticity Consumer surplus when price discrimination PC Labor market graphs finding DWL when externality exists Monopoly Graph ◦ Marginal Revenue and Demand Curves ◦ Profit Max Quantity where MR = MC ◦ Price on Demand Curve above Q* Finding Total Utility by Summing MU Identifying Domestic Production Level in Situation with Imports and a Tariff 9. Optimal Consumption Rule 7. Effect of Subsidy on Quantity Produced 6. Effect of Lump-Sum Subsidy on Deadweight Loss 5. Tariff Revenue 4. Value of Consumer Surplus 3. Cross-price Elasticity 2. Effect of Price Increase on Total Revenue 1. Surplus-maximizing Tariff Special Mention: Labels! Ask students to show their work for calculation problems. They should include both the formula used and the numbers used in their calculations. This will help you find the errors in their thinking GO BACK TO THE BASICS AT THE END OF THE COURSE Use the notes from the Chief Reader (Scoring plus Samples and Commentary Use your Instructional Planning Report from College Board Teach the VERBAGE GRAPH GRAPH GRAPH!!!!! Score FRQs from a grid Take frequent timed FRQ TESTS Short FRQs are 12 minute questions Teach students to grade from rubric Mini white boards – look at their models! Sidewalk chalk – muscle memory Presentations of Macro and Micro 1 to class Production Possibilities Supply and Demand Aggregate Supply and Demand with vertical Long Run Aggregate Supply Phillips Curve Money Market Model Loanable funds Currency market with simple Supply/Demand Production Possibilites Supply and Demand – Include tariffs, tax incidence, and world prices in your analysis Perfect Competition side-by-side graphs Monopoly Monopolistic Competition Payoff matrix in Game Theory Labor market – side by side graphs Monopsony Fiscal Policy, discretionary and automatic Frequently Tested Concepts in Macro FRQ’s 1995-2011 2000 #1 2001 #1 2002 #1 2003 #1,2 2003B #3 2011/B#1 2011 #1 auto 1995 #1 2009 B#1 1995 #2 2010 #1 auto 1997 #3 2010B #1 2005#1 2005 #3 AD/AS Model 1995 #1 2003B-1 2010 B-1 1996 #1 2004 #1 2010B #3 1997 #3 2004B-1 2011 #1 1998 #1 2005 #1 2011B #1 1999 #1 2006 #1 2012 #3 2000 #1 2007#1 2001 #1 2006B #1 2002 #1 2007B #1 2002B #1 2009B#1 2003 #1 2010 #1 Money Market Model 1999 #1 2007B #1 2000 #3 2209 #1 2002 #1 2009 #3 2003 #1 2009B #2 2004 #1 2010 #2 2005B-1 2010B#2 2005 #1 2012#1 2006 #2 2007#1 2006B #2 Interest rate effects (on I or growth or 4-x) Monetary Policy 1995 #1 2009#2 1997 #1,3 1999 #1 2009B #3 2010 #1 2003 #3 2011 #2 2001 #1 2012#1 2002 #1 2003B #1 2004 #1 2007#2 2007B #4 1996 #2 2005B-1 1997 #1 2007#2 1997 #3 2009 #1 1999 #1 2010 #2 2000 #3 2010B #2 2002 #1 2011 #1 2002B #1 2011 #3 2003 #1,2 2004 #1 2011B #2 2012#1 2004B #1 Crowding Out 1995 #2 Keynesian v. Classical thought Inflation impact 1995 #1 2004 #1 2007B #1 2010 #1 2011 #1 2011B#1 1995 #1 1996 #1 2002B-1 2003 #1 2004B-1 2011B #3 Long run growth 1995 #1 4-X 1996 #2 2006 #1 2000 #1 2002 #2 2006 #3 2008 #1 2009 #2 2010 #1 2011 #1 1998 #3 2007#1 1999 #1 2006B #1 2000 #2 2007B #3 2001 #2 2012#3 2002 #3 2009 #2 2002B #3 2009B #3 2003B #1 2010 #3 Balance of Trade 1996 #2 2008 #2 1998 #3 2010 #3 1999 #1 2012#1 2001 #3 2002 #3 2002B-3 2003 #1,2 2003B-1 Multiple Expansion of $ Elasticity 1996 #3 2001 #3 2004 #3 2006#2 2009 #3 2009B #2 2011#3 2012#2 Loanable Funds 1997 #1 2010B #1 2002 #2 2011 #2 2003B-1 2011B 1 2004 #2 2006 #2 2007#2 2006B #2 Circular Flow 1997 #2 2003B-1 Nominal – real interest rates 1997 #1 2011B #3 1998 #1 2012#1,3 1999 #2 2005 #1 2005B-2 2006#2 PPF/comp. adv. 2003 #2 2003B-2 2004B-3 2005B-2 2007B #2 Phillips Curve 1999 #1 2010B #1 2001 #1 2011 #1 2003B-3 2011B #1 2004B-1 GDP 2007 #3 2011B#3 Inf Expectations Bond prices/rates 2004 #2 2010B #2 2005B #3 2011 #2 2004 #2 2005B #3 2007B #2 2008 #1 2010 #1 2007#2 2006B #2 2009 #1 2010B #2 2008#3 2010B #1 2102#1 2005B-1 2006 #3 2006B #3 2008 #1 2009 #1 2009B #1 2010#2 2011 #3 1997 #1 2009 #1 Frequently Tested Concepts in Micro FRQ’s 1995- 2011 Supply and Demand Grapsh 1995 #1 2010 #1 1998 #! 2010B #2 1999#1 2000 #3 2003#2 2004B#3 2004 #2 2005B#3 2005#2 2006B #3 Externalities 1995 #2 2011 #3 1992 #3 2001 #2 2002B #2 2002#2 2003 #1 2004 #1 2006 #3 2009 #1 2009 #2 Allocative (economic) efficiciency (MSC=MSB) 2004#1 2005 #1 2006 #3 2008#2 2009 #1 2009 #2 2009B#1 2010 #2 2010B #1 2011 #1 2011 #3 2011B #2 2001 #1 2002B #1 2002 #1 2003B #3 2003 #1,2 Relationship of P and MR 1995 #3 1996 #3 1999 #3 2003 #2 2010B #1 2011 #1 MR = MC rule 1995 #3 1996 #1,3 1997 #2 1998 #1,3 1999 #3 2000 #1 2004B#1 Monopoly Model 1996#1 2004 #1,3 1997 #2 Natural 2005B #1,2 2005 #1 1998 #3 1999 #3 2008 #2 natural 2009 #1 2006B #1 2006 #1 2007B #1 2000 #1 2003B #1 2003 #2 2010B #1 2011 #1 2008#1 2010 #1 2010B #1 2011 #1,2 2102 #1 2004B #1 2004#1 2005B #1 2006 #1 2006B#1 2007A Price Discrimination 1998 #3 2011 #1 Elasticity/TR test *cross elasticity* Income elasticity Perfect Competition Product market and firm, side by side 1996#2 1998 #3 2000 #3 2004B #1 2004B #2 2005B #3 2008 #1 2009B2* 2010B#3 2011 #1 2012#2 1995 #3 1996 #1 1999 #3 2000 #1 2001 #1 2002B #2 2002 #1 2003B #1 2003 #1 2004 #1 2005B #2 2006B #2 2007 #2 Labor 2008#1 2009 #1 Monopolistic Competition 2002B #1 2007B #1 2009B #1 Market power 1995 #1 Price Ceilings/Floors 1996 #2 1998 #1 2001 #1 2002B #3 2006B #2 2008#2 2011 #1 2011B #3 Labor Market MRP=MRC rule 1997 #1 1998 #2 2000 #2 2002 #1 2003B#3 2003#3 2005B#1 2005#3 2005B #1 2007 #2 2010 #2 2001 #3 2010B #2 2002B #3 2006B#2 S & D analysis of tariff/world market 2000 #3 2003B #2 2004 #3 2004 #3 2004 #2 2012#3 Consumer/producer surplus 2002B#1 2003B#2 2003 #2 2004 #2 2006B #2 2009 #2 2010 #3 2012#3 Tax incidence 2004B #2 2005 #2 2009 #2 Deadweight loss 2003B #1 2005 #1 2010 #3 2011 #3 2012#1 Equimarginal principal 2002 #3 2003 2008#2 2009B#2 2012#2 Oligopoloy/game theory 2007B #2 2007 #3 2009 #3 2009B #3 Lump sum, Per unit tax/subsidy 2008#1 2009 #1 2009 #3 2009B #3 Economies of scale 2009B #1 Income effect 2009B #2 Substitution effect 2009B #2 MONOPSONY 2011B3 2010 #1 2011 #2 2012#1 2011B#1 2011 #2 2011 #2 2012#1