De Beers Group of companies

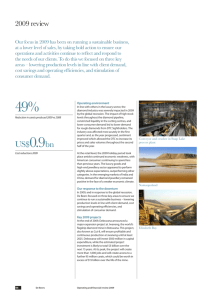

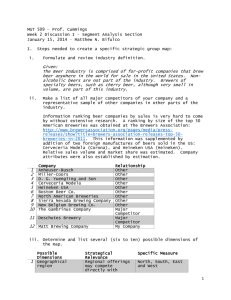

advertisement

De Beers Seminar to Anglo American Analysts 23rdBeers September 2004 Copyright De 2004 Agenda • Welcome by Nicky Oppenheimer, Chairman • Introduction by Gary Ralfe, Managing Director • Paddy Kell, Finance Director • Gareth Penny, Managing Director, DTC Copyright De Beers • Gary Ralfe, Managing Director • Q&A • Advertising Commercials 2004 De Beers Group of companies Debswana Group Central Holdings Group 11% Anglo American Group 89% Central Investments (DBI) Lux 10% 45% 45% DB Investments (Lux) 100% De Beers sa (Lux) Copyright De Beers 100% De Beers Centenary (Swtizerland) 50% Debswana (Botswana) 2004 100% De Beers Consolidated Mines (South Africa) 50% Namdeb (Namibia) 100% DTC* (UK) *DTC (Pty) Ltd (South Africa) wholly owned by DBCM De Beers & the Diamond Industry Size of the Diamond Business 2003 World Production of Rough ($bn) De Beers Group + $3.6 World Supply of Rough ($bn) + $5.6 Polished Equivalent of Supply ($bn) Global Sales of Diamond Jewellery ($bn) = $9.1 = $10.1 $5.5 De Beers Group Copyright De Beers Other Producers Other Producers $4.5 2004 $16.1 $57 Change in business model Custodianship to Leadership Supply Control Driving Demand Growth Utilising key assets: – – – – Mystique of the natural diamond Producer partnerships Diamond knowledge and expertise “De Beers” brand potential Copyright De Beers 2004 With full legal compliance Driving demand Supplier of Choice De Beers’ Brand Effective Organisation Privatisation - 2001 Dedicated diamond mining and marketing business Since delisting we have: – Liberated $2.06 billion from stocks – Generated operating cash flow of $4.5 billion – Reduced net gearing level from 57% to 21% Copyright De Beers 2004 – Repaid $4.5bn acquisition facility ahead of schedule – Refinanced on favourable terms with $2.5bn revolving facility – Paid ordinary dividends of $838m (pref dividends $266m) Primary strategic levers Profitability Sustainability 1. Demand growth 5. Producer proposition 2. Profitable production growth 6. Synthetics response 3. Creating value through Copyright DetheBeers DTC 4. Cost and working capital efficiencies 7. Organisation effectiveness 2004 Paddy Kell Copyright De Beers Finance Director De Beers 2004 Agenda • Results for 6 months ended 30 Jun 2004 • Trends: • • • • • • EBITDA ROCE ROE Cash flow / debt Costs Copyright De Beers Looking forward 2004 Results 30 June 2004 • DTC sales $2,983m ( 2.2%) • Headline earnings $424m ( 12.8%) • Net debt $1,169m ( $593m) Copyright De Beers • 2004 Operating cash flow $870m Headline earnings June 2003 - 2004 650 600 550 112 89 9 500 US$ M 63 450 400 350 300 107 24 424 376 68 82 Copyright De Beers 2004 250 200 Headline June 2003 Currency Price & volume Trade investment & other income Sorting and marketing Financing Tax JV's Other Headline June 2004 EBITDA NFO/GMR appointed 2000 Privatisation 1800 1600 1400 US$ M 1200 1000 800 600 Copyright De Beers 400 2004 200 0 Dec1994 Dec1995 Dec1996 Dec1997 Total Dec1998 Dec1999 Dec2001 Dec2000 Diamond business only June Dec- Jun- Dec- Jun2002 2003 2003 2004 ROCE 25.0% 20.0% 15.0% 10.0% Copyright De Beers 5.0% 2004 0.0% Dec1994 Dec1995 Dec1996 Total Based on headline earnings Dec1997 Dec1998 Dec1999 Diamond business only Dec2000 Dec2001 Dec- Jun- Dec- Jun2002 2003 2003 2004 Diamond business (June) ROE 25.0% 20.0% 15.0% 10.0% Copyright De Beers 2004 5.0% 0.0% Dec1994 Dec1995 Dec1996 Dec1997 Total Based on headline earnings Dec1998 Dec1999 Dec2000 Diamond business only Dec2001 June Dec- Jun- Dec- Jun2002 2003 2003 2004 Operating cash flow 2500 2000 US$ M 1500 1000 500 Copyright De Beers 2004 0 -500 Dec1994 Dec1995 Dec1996 Dec1997 Total Dec1998 Dec1999 Diamond business only Dec2000 Dec2001 Dec- Jun- Dec- Jun2002 2003 2003 2004 Diamond business (June) Net Debt 4500 4000 4008 3500 3290 US$ M 3000 2572 2500 2000 1500 Copyright De Beers 1783 2004 1762 1169 1000 500 0 Dec 2001 Jun 2002 Dec 2002 Jun 2003 Dec 2003 Jun 2004 Dec 2004 Net working capital 6000 5000 US$ M 4000 3000 2000 Copyright De Beers 2004 1000 0 Dec94 Dec95 Dec96 Dec97 Dec98 Dec99 December Including diamond stocks Dec00 June Dec01 Dec- Jun02 03 Dec- Jun03 04 Cash costs 1,700 1500est 1,500 1292 1,300 US$ M 1,100 995 878 900 700 500 Copyright De Beers 2004 300 100 (100) 2001 Production costs Exploration & research 2002 2003 2004F Sorting, selling & marketing Corporate Increasing carat production… Millions SOUTH AFRICAN, DEBSWANA & NAMDEB OPERATIONS - DIAMOND RECOVERY 50 0.2 1.5 45 40 0.2 1.3 0.2 1.4 0.3 1.9 35 Carats 30 30.4 25 29.6 28.4 26.4 20 15 Copyright De Beers 2004 10 5 10.7 10.4 11.9 13.4 2001 2002 2003 2004 Forecast (Aug) DBCM Debswana Namdeb Williamson Diamonds Limited …together with more waste tons mined... Millions SOUTH AFRICAN, DEBSWANA & NAMDEB OPERATIONS - WASTE TONS MINED 180 1.0 160 - 140 Waste Tons Mined - 120 24.4 33.6 31.5 25.5 66.4 100 62.1 80 60 60.4 54.2 Copyright De Beers 2004 83.9 40 20 51.0 52.2 2001 2002 60.9 - DBCM Debswana 2003 Namdeb 2004 Forecast (Aug) Williamson Diamonds Limited …resulting in increased mining costs 16 160,000,000 14 140,000,000 $11.56 12 Waste Tons Mined 120,000,000 10 100,000,000 8 $7.53 80,000,000 6 60,000,000 40,000,000 Copyright De Beers 2004 4 $4.53 $3.25 20,000,000 2 - - 2001 DBCM Debswana 2002 Namdeb 2003 US$ cash cost per ton treated 2004 Forecast (Aug) US$ cash cost per mined US$ cash cost per Ton Treated SOUTH AFRICAN, DEBSWANA & NAMDEB OPERATIONS - WASTE TONS MINED vs US$ CASH COST PER TON 180,000,000 Finance focus • Risk management, governance • Cost of capital • Copyright De future Beers capital funding Cash flows and 2004 De Beers WACC (real) • Before privatisation: • Immediately after : 10.4% 8.2% • End Copyright De2003: Beers9.4% 2004 • End 2004: • Optimum target: 9.8% 6.7% Finance focus • Risk management, governance • Cost of capital • Copyright De future Beers capital funding Cash flows and 2004 De Beers Sales and Marketing Gareth Penny Copyright Beers Managing De Director Diamond Trading Company 2004 De Beers’ 1999 Strategic Plan Driving demand Supplier of Choice Copyright De Beers De Beers’ Brand 2004 Effective Organisation Driving Demand % Growth in World Nominal DJ Sales (CAGR) 4.0% 3.6 3.0 2.0 Copyright De Beers 1.0 0.0 -1.0 2004 -0.2 94-98 99-03 The rate of growth in World diamond jewellery sales is increasing (% growth US$ PWP) % change 10% 8% 6% Copyright De Beers 2004 3% 0% 2002 2003 H1 2004 Estimated H1 world retail markets up +5.5% in LC and +8% in PWP LC Retail Sales Growth Est. H1 2004 7 USA Italy Germany -4 -3 France 6 UK Japan 8 1 Taiwan Copyright De Beers Thailand China Gulf 2.5 5 6 7 India 12 Turkey WORLD 17 2004 19 5.5 +8.0% PWP H1 DJ sales growth encouraging with cautiously optimistic outlook • Rough markets still strong – Rough imports up from Jan-Jul ‘04 v. same period ‘03 – Premiums on DTC goods have come down • Polished market – Polished exports up +21% from Jan-Jul ’04 v. same period ‘03 – Stocks down -17% from July ‘03 – Price increases experienced since beginning of ’04 still holding by sustainability being tested by slower trading • Copyright De Beers 2004 Retail markets – Preliminary PRG estimates of world H1 LC DJ sales up +5.5% → +8% in USD PWP – Slowdown of economic activity in US and Japan expected – DJ trade still optimistic with backdrop of strong DTC marketing 2004 New Initiatives USA Japan Copyright De Beers India 2004 China De Beers built two thirds of the US Market New Occasions New Products Copyright De Beers Copyright De Beers 2004 2004 New Segments Driving Incremental Sales USA: Three Stone Jewellery Sales Retail Sales 3500 3000 2500 $m Copyright De Beers 2000 2004 1500 1000 500 0 1999 2000 2001 2002 2003 Right Hand Ring advertising is a huge hit in 2004 Copyright De Beers 2004 2004 New Initiatives USA Japan Copyright De Beers India 2004 China Highly visible presence in-store Copyright De Beers 2004 3-stone Diamond Jewellery growing rapidly Value Share and Growth Trend (12mmt) 80 70 60 50 (%) 40 30 20 10 0 -10 Copyright De Beers 3.4 3.5 3.5 3.5 3.5 3.3 3.4 3.4 3.4 3.5 3.4 3.3 3.4 3.4 3.5 3.5 3.6 3.7 3.8 3.8 3.9 4 4.3 4.7 5 5.2 5.5 5.9 2004 Jan- Feb- Mar- Apr- May- Jun- Jul- Aug- Sep- Oct- Nov- Dec- Jan- Feb- Mar- Apr- May- Jun- Jul- Aug-Sep- Oct- Nov-Dec- Jan- Feb- Mar- Apr02 02 02 02 02 02 02 02 02 02 02 02 03 03 03 03 03 03 03 03 03 03 03 03 04 04 04 04 -20 % share (3 stone) Total DJ 3 stone Source : DDB 2004 New Initiatives USA Japan Copyright De Beers India 2004 China Nakshatra Flagship • Nakshatra (Constellation) revitalised floral jewellery • Launched October 2000 Copyright De Beers • Sales over $100m in 3 years. No. 1 brand in India 2004 • Awarded status Aishwarya Rai – Brand ambassadress Copyright De Beers 2004 2004 New Initiatives USA Japan Copyright De Beers India 2004 China The DWR cultural imperative has been quickly adopted in China’s major cities DLJ acquisition amongst all recently married women 84% 73% 66% 54% 1997 2000 2002 43% 33% Copyright De Beers 2004 21% 13% Shanghai Beijing Source: China DWR 1997; China DCJ 2000, China DCJ 2002 Guangzhou 1999 Strategic Plan Driving demand Supplier of Choice Copyright De Beers De Beers’ Brand 2004 Effective Organisation Driving demand through efficient Channels for Trilogy DTC and Six Clients Three Major Manufacturers Copyright De Beers Most Major Retailers 2004 Strong Consumer Campaign Supplier of Choice Copyright De Beers 2004 What Has Been Achieved…. Post SOC Pre SOC • Commodity focus • Consumer dreams and needs focused • Little product differentiation • Product differentiation • Low investment in marketing • Higher investment in marketing • Few brands • Some recognised brands • Luxury goods beating us • Diamonds closing the gap Copyright De Beers 2004 • Few proprietary channels • Many proprietary channels • Price driven • Added value driven • Unhealthy declining industry • Healthy growth driven industry • High stocks poor business • Low stocks good business Major Competitors • Luxury travel • Luxury watches • Hi-Tech equipment Copyright De Beers • Luxury leather goods • Luxury fashion 2004 Areas of focus: Conflict Diamonds Copyright De Beers 2004 Area of focus : Synthetics! Firms currently producing synthetics: •Apollo •Gemesis Copyright De Beers 2004 Current workstreams • • • • • Enhance Consumer Confidence Trade education Diamond promotion Detection technology Promoting Disclosure Copyright Debest Beers practice • Vigilance • Maintaining perspective 2004 Our Strategic Objectives We will be focussed on: 1. 2. 3. 4. 5. 6. Driving consumer demand Maintaining consumer confidence “Supplier of Choice” “Purchaser of Choice” Copyright De talents Beersof our employees The skills and Providing exceptional value to our shareholders 2004 Gary Ralfe Copyright Beers Managing De Director De Beers 2004 Mining and Exploration Historic Performance DE BEERS GROUP Total Diamond production (1995 - 2003) 50,000 + 9% 45,000 +9% CAGR 7% Diamonds Recovered (Carats 000's) 40,000 35,000 30,000 25,000 Copyright De Beers 2004 20,000 15,000 10,000 5,000 1995 1996 1997 1998 1999 2000 2001 2002 2003 Mining and Exploration 2004 Production issues Diamonds recovered 2003 Annual 2004 Annual Actual Million Carats DBCM Namdeb Debswana Williamson Total August 2004 Budget Million Carats Budget YTD Million Carats Actual YTD Million Carats Variance Budget v Actual YTD Year-end Forecast Million Carats 11.9 14.2 9.1 8.5 -7.2% 13.4 1.5 1.7 1.2 1.4 15.9% 1.9 20.3 18.1 -10.8% 29.6 Copyright De Beers 30.4 30.9 2004 0.2 0.3 0.2 0.2 13.9% 0.3 44.0 47.0 30.8 28.1 -8.6% 45.2 Continuing to Drive Supply Beyond 2004 - Production Forecast Supply Growth 2004 - 2009 54 In the project pipeline Projects under review Carats recovered - Million 52 Base Case 50 48 Copyright De Beers 2004 46 44 42 2004 2005 2006 2007 2008 2009 Continuing to Drive Supply Beyond 2004 - Current Projects • Major Planned Expenditure (Base Case) Total additional production1 Production commences Full prod. Estimated capex2 $m 2m carats 2004 2004 62 Finsch Block 4 17m carats 2004 2006 302 BB1E Cullinan 5m carats 2004 2007 30 2008 2008 512 2008 2010 447 Elizabeth Bay Upgrade Snap Lake Orapa 3 Total 1 2 carats Copyright19mDe Beers 8.5m carats 2004 51.5m carats Total additional production shown for the life of the project. Approved capex is converted to US$ at R6.35 = US$1 and CS$1.34 = US$1 as per 2004 forecast average exchange rate. 1353 Continuing to Drive Supply Beyond 2004 - Current Projects • Projects under review: Total additional production1 Production commences Finsch Plant Upgrade 2m carats Victor 6m carats C-Cut Cullinan 115m carats Finsch Block 5 16m carats Total 139m carats Copyright De Beers 1 2 2006 2008 2009 2009 Full prod. 2007 2008 2012-14 2010 2004 Total additional production shown for the life of the project. Approved capex is converted to US$ at R6.35 = US$1 and CS$1.34 = US$1 as per 2004 forecast average exchange rate. Estimated capex2 $m 90 625 1291 425 2431 Continuing to Drive Supply In the project pipeline – South Africa • Voorspoed (production from 2007) • Venetia – Underground (2015) – Satellite pipes – Copyright Deat existing Beers 2004 Botswana: multiple projects mines – Canada • Gahcho Kué (production from 2012) Continuing to Drive Supply Advanced Exploration Projects Canada o Attawapiskat Satellites o Forte a la Corne JV o Knife Lake JV o Hardy Lake JV o Rockinghorse JV Russia o Copyright De Beers Grib 2004 Botswana o Jwaneng DK7 o Orapa Satellites Guinea, Gabon, Zimbabwe, South Africa, Brazil Mining and Exploration Supply side challenges • Jwaneng Lease Renewal • Rand strength - impact on marginal mines • Working stock levels Copyright De Beers • De Beers market share • Alrosa contract 2004 New Organisation DBsa Nicky Oppenheimer DBsa De Beers Group Services Gary Ralfe Gary Ralfe Strategy & CFD Business Group Development Director Ollie Oliveira Ollie Oliveira Debswana Louis Nchindo Blackie Marole Namdeb IngeZaamwani DTC Gareth Penny (MD Designate) DBCM Jonathan Oppenheimer (MD Designate) (MD Designate) Group CFO Group CFO Kell Paddy Paddy Kell Group Mining/Tech. Group Mining & Services Director Exploration Director Gavin Beevers Beevers Gavin Copyright De Beers Group IT IT Director Group Director 2004 Debbie Farnaby Debbie Farnaby Group General Group General Counsel Counsel Glenn Turner Turner Glenn Group HRHR Director Group Director Craig Mudge Craig Mudge External Affairs Director Being recruited External Relations • USA – DoJ settlement – Civil litigation • Angola – Arbitration settlement • Russia – Copyright De Beers Alrosa trade agreement 2004 External Relations • RSA – Transformation and Black Economic Empowerment transaction – Diamond Amendment Bill • Botswana – Jwaneng Lease Renewal • Namibia – Renewal of sales agreement Copyright De Beers 2004 Adjacent Businesses • Element 6 Sales H1 2004 up 20% compared to H1 2003 to $121m Net earnings H1 2004 more than tripled compared to H1 2003 from $4.5m to $14.6m due to efficiency improvements • De Beers LV Copyright De Beers 2004 Total sales 2004 YTD $10.5m (+4% > budget) New Chief Executive and strengthened management team US rollout planned for 2005 Both shareholders committed to long term investment of $400m ($80.5m invested to date by De Beers) Primary strategic levers Profitability Sustainability 1. Demand growth 5. Producer proposition 2. Profitable production growth 6. Synthetics response 3. Creating value through Copyright DetheBeers DTC 4. Cost and working capital efficiencies 7. Organisation effectiveness 2004 Strategic Goal Maintain the leadership position of the De Beers Group of Companies and deliver sustainable returns on capital in line with this position. Copyright De Beers 2004 Q & A SESSION Copyright De Beers 2004