PSTI_Power_Trading in India 2

advertisement

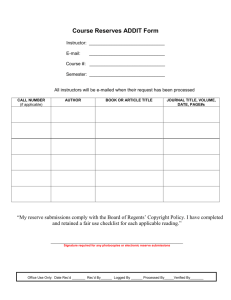

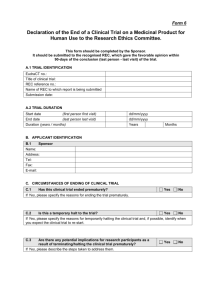

IEX: Building Power Market for India... Devesh Singh – Regional Head (SR) Email: Devesh.Singh@iexindia.com Website: www.iexindia.com www.iexindia.com In this presentation … • Power Trading in India • Power Exchange - Mechanism Trading of Power Trading of REC www.iexindia.com Who are we ? Promoters Joint Equity Partners: Technology : www.iexindia.com EA 2003 and enabling provisions on Power Market • Electricity Act 2003 – The intent and object of the EA 2003 is to develop power market through increased competition, more players and protect consumer interests – Development of Power Market – EA 2003, Section 66, “The Appropriate Commission shall endeavor to promote the development of power market…”, guided by the National Electricity Policy – Suitable safeguards to prevent adverse effect on competition – Recognize Trading as a distinct activity – Definition under section(2) (47): “Purchase of electricity for resale thereof” – Adequate and progressive provisions governing open access both : • to transmission networks (inter-state and intra-state) and • to distribution networks www.iexindia.com Introduction of New Products • Short & Medium Term transactions for peak/off-peak load balancing • Duration of Transactions (Few hours to 3 years) • Hours of Supply • Round the Clock • Evening Peak / Morning Peak • Night Off Peak / After Noon Off Peak • “As and When Available” Power for balancing Scheduled Interchanges • “Weekend / Holiday Power” • Banking of Power www.iexindia.com Indian Power Market Long Term Upto 25 Years Medium Term 3 months- 3years Short-Term Intraday - 3 months Power Purchase Agreements OTC Licensed traders (42) OTC Intraday- 3 months Exchanges 1. Intra-day 2. DAM 3. DAC 4. Daily 5. Weekly Balancing Market Real Time Unscheduled Interchange www.iexindia.com What is IEX Voluntary Delivery… On-line National •Spot Standardised Contracts Automated •Intra-Day •Day-ahead •Forward •Weeks •Months Electronic Central Counterparty Exchange as Organized Marketplace www.iexindia.com Power-specific IEX capabilities • • • • • Spot Auction (Closed or Open) for real time prices Continuous Trading for Long-term contracts Automated matching engine Online risk management system Online clearing & banking interface for margins & trade proceeds payment • Derivatives - for Hedging & Price Discovery ⁻ Forwards ⁻ Futures • Physical or financial settlement www.iexindia.com IEX Self Regulating Institution • • • • • • Due diligence before Membership Networth Criteria Security deposit & Margins Voluntary participation IEX Counterparty SLDC Clearance www.iexindia.com Tried & Tested Global Technology • NASDAQOMX • Six Sigma Efficiency • “Error Free” operation since inception • Capable for handling – Day Ahead Auction – Term Ahead Bilateral – Market splitting upto 30 areas – National, Regional and State level Contract – RPS & Certificates Trading www.iexindia.com IEX: Market Segments… Day-Ahead Market Term-Ahead Market REC Market (Since June,2008) (Since Sep,2009) (Since February,11) Hourly Contracts Matching through Close Auction* • Intra Day • Day-Ahead Contingency • Daily REC Contracts Matching through Continuous Trade Session Weekly Contracts Matching through Open Auction • Market splitting feature * Without Market split feature www.iexindia.com Matching through Auction* Day-ahead Market www.iexindia.com IEX Bid Areas www.iexindia.com IEX - DAM Product Description • Order Types: – Hourly or Portfolio Orders • Min 1 hour • Different Price-Quantity Pairs • Partial Execution Possible – Block Orders • Relational Block Bid • Consecutive hours during the same day – Customized block bid allowed • Firm commitment to purchase or sell • Order Characteristics – – – – SLDC Clearance should be ≥ 1 MW Minimum Order quantity can be less than 1 MW Minimum volume step: 0.1 MW Minimum price step: Rs 1 per MWh ( 0.1p/kWh) www.iexindia.com [1/2] IEX - DAM Product Description [2/2] • Trading Availability – Every Calendar Day • Bidding – Double sided Closed Auction • Order Entry / revise /cancel – Entry of orders on D-1 from 10:00 hrs to 12:00 hrs related to Delivery Day (D day) • Contract – – – – Clearing Price : Area Clearance Price Cleared Volume Total Contract Value: Cleared Volume multiplied by ACP Final settlement adjusted for any force majeure deviations • Delivery Point – Periphery of Regional Transmission System in which the grid-connected entity, is located www.iexindia.com Time Line for scheduling of Collective Transaction 10:00 Market Participants to place their Bids 12:00 13:00 14:00 PX to send provisional unconstrained solution to NLDC and flow on TS as informed by NLDC 15:00 17:30 NLDC to check for congestion. In case of congestion shall intimate PX regarding to the period for congestion and available margins www.iexindia.com 18:00 NLDC to confirm acceptance. PX to send files to SLDCs for scheduling PX to send Scheduling Request to NLDC based on margin specified by NLDC RLDCs/SLDCs to incorporate Collective Transactions in the Daily Schedule Price Calculation Algorithm ….each hour Price (Rs./kWh) 0 1 1.1 2 2.1 2.5 3 3.1 20 20 0 40 40 40 -40 -60 -80 Portfolio A, MW 20 Portfolio B, MW 60 60 Portfolio C, MW 40 20 0 0 SUM, Purchase 120 100 80 80 SUM, Sale 0 0 Net transaction 120 100 80 80 40 60 4 4.1 20 0 40 20 20 -81 -120 60 60 -40 -60 -80 -81 -120 -120 20 -20 -21 -80 -100 -100 0 40 40 -120 20 20 250 Price Purchase 200 4 Sale Price ($/MWh) 4 5 MCP: 3 Rs./kWh 2.5 3 150 Rs/kWh 2 100 2 50 1 MW 40 80 60 MW 120 2.5 0 -150 MCV (Market clearing volume): www.iexindia.com -100 -50 0 MW balance 50 100 150 Trader Station: Single Bid www.iexindia.com Trader Station: Block Bid www.iexindia.com Treatment of Losses • Both Buyers and Sellers to absorb losses – Buyer • draw less than Contracted Power (Contracted Power – losses) – Seller • inject more than Contracted Power (Contracted Power + Losses) • Average Transmission Losses of the Region where the Entity is geographically located • Additional Losses for Wheeling, if necessary – To be notified in advance by NLDC – Only for Injection www.iexindia.com Treatment of Losses… for buyer • NR (Regional) Loss: 6% • S1 (State) loss: 4.85 % • Buyer X bids for 100 mw at its respective regional periphery Scheduled Drawal <= SLDC Clearance Bid Volume NR 100 MW at NR Loss periphery 6% S1 94 MW at S1 periphery Loss X 89.441 MW at Buyer End (Buyer) 4.85% Maximum Bid= Volume in standing clearance + Regional & State losses www.iexindia.com Treatment of Losses… for seller • SR (Regional) Loss: 6% • A1 (State) loss: 4.85% • Seller Y bids for 100 mw at its respective regional periphery Scheduled Generation <= SLDC Clearance Bid Volume SR 100 MW at regional periphery Loss 6% A1 106 MW at state periphery Loss 4.85% 111.14 MW Injected by seller at its end Y (Seller) Maximum Bid= Volume in standing clearance – Regional & State losses www.iexindia.com Congestion Management www.iexindia.com Congestion Management SR WR S3 S1 B2 B3 S2 B1 50 MW 50 MW 150 MW 30 MW 407500 50 MW RS RS 8000 RS 7000 8500 RS 9000 Deficit 100 MW S3 50 MW Rs 7.5/u S1 50 MW Rs 8/u S2 40 MW Rs 8.5/u B2 150 MW Rs 9/u S1 B1 S2 S3 Surplus 120 100 MW 80 MW RS 9500 6000 8000 5500 RS 100 MW Required Flow 100 MW B1 50 MW RS 8.5/u B3 30 MW Rs 7/u S2 100 MW Rs 5.5/u S2 20 MW Rs 8/u www.iexindia.com S1 80 MW Rs 9.5 B1 100 MW Rs 6/u Congestion Management SR WR Deficit 100 20 MW MW Surplus 100 20 MW MW Lowest Buyers getting rejected S3 50 MW RS 7500 S1 50 MW RS 8000 S2 40 MW RS 8500 B2 150 MW RS 9000 Highest Seller getting rejected Allowed Flow 20 MW B1 50 MW RS 8500 B3 30 MW RS 7000 S2 100 MW RS 5500 S2 20 MW RS 8000 www.iexindia.com S1 80 MW RS 9500 B1 100 MW RS 6000 Risk Management System Trader Member D-1 At 09:30 Hrs : Pre-trade Margin Check. equal to the initial margins or average of last 7 days’ trading value, whichever is more. D-1 At 12:30 Hrs : Preliminary Obligation Margin Check Preliminary Obligation =< Funds Available (incl initial margin) Block funds. D-1 At 15:30 Hrs : Pay-ins Facilitator Member D-1 At 09:30 Hrs : Pre-trade Margin Check. equal to the 100% of the bid value to be provided by Client directly to IEX in Client Settlement account D-1 At 15:30 Hrs : Pay-ins At D+1 14:00 Hrs : Pay-out. At D+1 14:00 Hrs : Pay-out. www.iexindia.com Performance so far… IEX won India Power Award for “ Best e-enabled consumer platform” 17th November,2009 www.iexindia.com OA status in India Northern Region States Buy East & North Eastern Region States Sell Buy Sell Assam & Bihar Haryana Manipur & Mizoram Punjab Tripura & Sikkim Rajasthan Jharkhand Arunachal Pradesh HP & J&K Meghalaya Uttaranchal Orissa Delhi & UP West Bengal Western Region States Madhya Pradesh Buy Southern Region Sell States Andhra Pradesh DNH&DD-UT Gujarat Chhattisgarh Maharashtra 23-Mar-16 Karnataka Tamil Nadu Kerala www.iexindia.com Buy Sell Participation at IEX STATE No. of Private Generator Open Access Industrial Consumers Maharashtra 9 0 Rajasthan 10 48 Karnataka 15 0 Andhra Pradesh 10 17 Punjab 3 235 Orissa 1 2 Madhya Pradesh 10 4 Chhattisgarh 28 0 Haryana 1 28 Tamil Nadu 0 384 Gujarat 9 6 Uttarakhand 0 10 Arunachal Pradesh 0 3 Others 14 1 www.iexindia.com Over 2 years of Adequate Liquidity • • • • • • 29 State Utility 990+ Portfolios 738 Direct consumer 520+ participants on single day Cleared Volume :19 Billion Units DAM Volume Record 59.98 MUs constrained (23rd September ’ 10) 61.58 MUs unconstrained (23rd September 10) www.iexindia.com IEX monthly Average Price www.iexindia.com IEX Monthly Volume www.iexindia.com IEX Dominant Market Share (DAM+TAM) www.iexindia.com Who Can become Members of IEX ? Entities eligible for Membership: Inter-State Generating Stations (ISGS) Distribution Licensees State Generating Stations IPPs CPPs and IPPs (with consent from SLDC) Open Access Customers (with consent from SLDC) Electricity Traders / Brokers www.iexindia.com IEX Membership Category Proprietary Member (right to trade and clear on its own account) Generator- Distribution licensees- IPPs - CPP- MPPs –O A consumers Professional (trade and clear on behalf of its Clients) NO CREDIT /FINANCING Electricity Traders (trade and clear on behalf of its Clients) CREDIT /FINANCING www.iexindia.com Clients Grid Connected Generator, Distribution licensees, IPPs, CPP, MPP, OA consumers Trader Client With valid PPA Financial Requirements Membership Category: Proprietary / Professional Member The financial criteria for payment options available on IEX are: Fees Professional & Proprietary & Electricity Trader (Full Payment Option) Proprietary member (Light Payment Option) Admission fee Rs. 35,00,000* Rs. 10,00,000 Interest Free Security Deposit Rs. 25,00,000 Rs. 10,00,000 Annual Subscription Fees Rs. 5,00,000 Rs. 2,50,000 Rs. 10,000 Rs. 10,000 Rs. 65,10,000 Rs. 22,60,000 1p/kWh 2p/kWh Processing Fees TOTAL Exchange Transaction www.iexindia.com How to Move Ahead… ► Become Member or Client (of a Member) » Rs 22.6 Lacs +2p/kWh transaction fee or » Rs 65.1 lacs + 1p/kWh transaction fee or » Client @ 1Lakh ► Technical Requirements – Standing Clearance from UTs/State SLDC » ABT Meters » Sufficient transmission capacity – Connectivity with exchange can be done in two ways » Internet Immediate » Leased Line ► Start Buying from IEX or Sell surpluses to IEX www.iexindia.com Financing by REC Members can get finance from Rural Electrification Corporation to fulfill their trade obligations at a nominal interest rate(8.5%). Procedure : Member will apply to REC for sanction of credit limit. After due verification, REC shall sanction the credit limits Tripartite agreement between IEX – REC – Member Member allowed to bid to exposure limit, net of utilization till date. Each tranche of disbursements by REC to IEX on behalf of the participants shall be treated as a separate loan for the purpose of determination of loan period, payment of interest, other charges and repayment of loan. www.iexindia.com Renewable Energy Certificates www.iexindia.com Introducing an another option… REC Feed-in Tariff REC Option [State Regulated Tariff] Electricity Sale of Electricity at Market Price in open market Sell to DisComs at Price ≤ Pooled Cost of Power Purchase* Green Attributes REC [Solar & Non-Solar] Sale of electricity to DISCOMs at State regulated tariff Sale of RECs at Power Exchange * - Weighted Average Pooled Price at which distribution licensee has purchased electricity (including cost of self generation, long-term and short term purchase) in the previous year, but excluding the cost of RE power purchase www.iexindia.com Salient Features of REC Mechanism Participation Voluntary REC Denomination 1 MWh Validity 365 Days after issuance Categories 1. Solar REC 2. Non-Solar REC Trading Platform Power Exchanges only Banking Not Allowed Borrowing Not Allowed Transfer Type Single transfer only , repeated trade of the same certificate is not possible Penalty for Non-compliance ‘Forbearance’ Price (Maximum Price) Price Guarantee Through ‘Floor’ Price (Minimum Price) www.iexindia.com Trading at IEX Trading Day Last Wednesday of every Month Market Clearing Closed Double sided auction Trading Time 1300-1500 Hrs By 1530 Hrs Verification by Central agency for Valid REC by cleared seller at IEX By 1600 Hrs Central agency confirms REC By 1630 Hrs IEX finalizes trade By 1700 Hrs Buyer & Sellers informed to Central Agency By 1800 Hrs Invoice raised (proof of REC trade) www.iexindia.com 2200 300 REC Sell @ Rs 2000 MCP: Rs 2200/REC 200 REC sell @ Rs 1700 100 REC Buy @ Rs 3900 100 REC Sell @ Rs 1500 Cleared volume : 600 RECs BUY SELL A 100 REC @ A 100 REC @ Rs 1500 B 200 REC @ Rs 1700 C 300 REC @ Rs 2000 Rs 3900 B 600 REC @ Rs 2200 C 200 REC @ Rs1700 MCP Rs. 2200 /REC, Cleared Volume : 600 RECs 200 REC Buy@ Rs 1700 600 REC Buy @ Rs 2200 600 www.iexindia.com REC - Fee & Charges State Nodal Agency Central Agency Accreditation Fee & Charges Registration Fee & Charges Application Processing Fee Rs. 5000 Application Processing Fee Rs. 1000 Accreditation Charges (One Time – Rs. 30,000 Accreditation Rs. 5000 Charges (One Time – for 5 Years) for 5 Years) Rs. 10,000 Annual Charges Rs. 1000 Re-Validation Fees Rs. 15000 Re-Validation Fees (After 5 Years Rs. 5000 Annual Charges (After 5 Years Central Agency IEX Issuance Fee & Charges Redemption Fee & Charges Fees Per REC issued Rs. 10 Fees Per REC issued Rs. 10 www.iexindia.com REC - Fee & Charges Impact Cost Impact of Fee and charges in First Year Assumptions: • Project of Capacity = 1 MW • Capacity Utilisation Factor = 22% • • Cost Head REC @ 1500 REC @ 2600 REC@3600 Accreditation 45000 45000 45000 Registration 7000 7000 7000 Issuance 19270 19270 19270 71720 71720 71720 2890500 5010200 6937200 2.48% 1.43% 1.03% 3.7 Paise 3.7 Paise 3.7 Paise TOTAL COST No. of Units Generated = 19.27 MU Revenue from REC No. of REC Issued = 1927 % Cost Incurred Paise Impact Per Unit Similarly the cost impact (in Paise / Unit) for: TWO Year THREE Year FOUR Year FIVE Year 2.15 Paise 1.65 Paise 1.32 Paise 1.20 Paise www.iexindia.com REC trade at IEX www.iexindia.com Benefit for RE Generators from REC Mechanism Installed Capacity of a Plant in MW 10.0 Average RE Generation PLF/CUF over a Year 22.0% Annual Generation in MUs 19.272 Option 1: PPA with State Utility Description Option 2: Availing REC Benefit Amount (Rs) Description Amount (Rs) 1A. State Regulated Tariff (Rs./kWh) 3.75 2A. Market Rate/APPC for Electricity (Rs./kWh) 2.60 1B. Income from CERs (Rs./kWh)) 0.40 2B. Income from RECs (Rs./kWh)) 2.615 1C. Total Revenue per year (Million Rs.) 79.98 2C. Income from CERs (Rs./kWh)) 0.40 2D. Expenses for availing and trading RECs (Rs/kWh) -0.15 2E. Total Revenue per year (Million Rs.) 105.321 Net benefit derived by an RE Generator from REC Mechanism [2E – 1C] (Amount in Million 25.343 Rs.) www.iexindia.com How to commence …participation on IEX • New Membership only for those interested in REC trading • Professional REC Member • Proprietary REC Member • New Clients : No Registration fees ( FY 11-12) • Buyers : Very Simple Process of filing registration with IEX • Sellers : Complete 4-step procedure before registration with IEX www.iexindia.com IEX Initiatives Continuous communication with Users IEX Daily SMS Service for Trade Details IEX hourly Trade Prices displayed on its website www.iexindia.com IEX Monthly Bulletin Thank You !!! www.iexindia.com Promoters Joint Equity Partners: Technology : www.iexindia.com