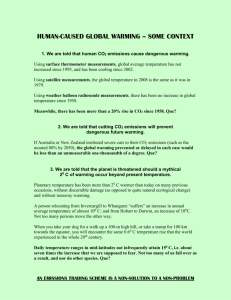

Collision Course: Will the World Accommodate the Rapid Rise of

advertisement

Structure of the Presentation 1. 2. 3. 4. 5. 6. 7. Brief Historical Overview Present and Future Trends Historical Experience of Power Shifts Positive and Negative Impact for the World Frictions What Has to be Done? What are some of the Longer term implications? 1. Brief Historical Overview Both are Millennial Civilizations Were Largest Economies of World for First Three Quarters of Last Two Millennia Both Missed the Industrial Revolution Fell behind Rising European Powers Major Regime Change in 1950s Are becoming major world players Economically Politically In education and R&D 2.The Present and Future Trends The Present China has already become second largest economy in world India is tenth largest By extrapolation of current trends China will be as big as U.S. in 5 years in PPP terms, in 10 years in nominal terms India will surpass Japan in 2 years in PPP terms to become third largest economy, in 10 years it will surpass Germany to be fourth largest economy in nominal terms Historical and Projected Growth in Purchasing Power Parity 90 GDP for BRIC and Top 4 Developed Economies in PPP 30000 80 70 60 20000 Brazil 50 East West North China India 40 15000 Russia Germany 30 Japan 10000 United Kingdom 20 United States IMF forecaste from 2010-2015. 10 5000 0 0 1st Qtr 2nd Qtr 3rd Qtr 4th Qtr 19 80 19 82 19 84 19 86 19 88 19 90 19 92 19 94 19 96 19 98 20 00 20 02 20 04 20 06 20 08 20 10 20 12 20 14 20 16 E 20 18 E 20 20 E GDP in Current International Dollar (billions) 25000 2016E-2020E based on IMF average growth rate from 20112015 Historical Growth and Projections in Current US$ 90 GDP for BRIC and Top 4 Developed Economies in Current US$ 27000 80 70 60 Brazil 17000 China 50 India Russia 40 Germany 12000 Japan East West North 30 United Kingdom 20 China Currency Appreciates by 20% United States 7000 China Currency Appreciates by 40% *IMF forecaste from 2010-2015. 10 *2016E-2020E based on IMF average growth rate from 2011-2015 2000 0 1st Qtr 2nd Qtr 3rd Qtr -3000 *Currency appreciation is expected to reach 20%/40% by 2020E, and 4th Qtr 19 80 19 82 19 84 19 86 19 88 19 90 19 92 19 94 19 96 19 98 20 00 20 02 20 04 20 06 20 08 20 10 20 12 20 1 20 4 16 20 E 18 20 E 20 20 E 22 20 E 24 E GDP in Current US$ (Billions) 22000 3. Historical Experience of Power Shifts is not Encouraging Rise of new powers lead to frictions over Wealth (trade and resources) Power Security These tend to degenerate into Trade Wars Resource Wars Cold Wars Conventional Wars Rise and Fall of Powers Over Time Share of Global GDP as a % of World Total 1990 PPP 40.00% 35.00% France Germany 30.00% Italy United Kingdom United States 20.00% Napoleonic Wars Axis Title 25.00% 15.00% 10.00% Western Europe Colonial Expansion European Powers W W I W W II Japan Cold War China India Former USSR 5.00% 0.00% 0 1000 1500 1600 1700 1820 1870 1913 1950 1973 1998 China SWOT Strengths Weaknesses Strong and capable government Large, growing unsaturated market Large skilled labor force Rapid increase in educational attainment Very high savings rate Rapidly increasing technological capabilities Strong manufactured goods exporter Strong military Natural resource poor Rising income and regional inequality Rapid deterioration of the environment Poor rule of law Real estate bubble Limited English ability constrain IT enabled service exports Opportunities Threats Large investments in green technology may make it a market leader Development of strong service economy built on knowledge rather than natural resources Global warming threatens drought and rising sea levels Risk of global protectionist backlash to its strong export orientation Risk of pushback from established powers to its rapid rise India SWOT Strengths Weaknesses Increasing savings rate Strong rule of law on paper (but not so much in practice) Core of English speaking technical workforce Strong information enabled service export Young and growing labor force will give demography dividend if can be productively employed Weak coalition governments with limited capacity to implement change Corruption Natural Resource poor Weak physical infrastructure Very low educational attainment Weak military Weak and over bloated government Relatively weak technological capabilities Opportunities Threats Strong potential to build on exports of information enabled services Leverage growing labor force with strengthen education Leverage its growing innovation capability to --Improve its competitiveness --Develop and deliver better goods and services to its large poor population Unstable neighborhood Global warming threatens drought and rising sea levels Risk of spreading Naxalite insurgence because benefits of growth have not trickled down to rural population Risk of water war with China 4. Five Positive Impacts Growing Markets Lower Prices of Goods and Services for Importers Higher prices for natural resource and commodity exporters Lower interest rates for world Financial flows and investments in the rest of the world Contribution to Global Growth Five Negative Impacts Tremendous competitive pressure on other countries producing manufactured goods and services they export Increase in price on natural resources and commodities Downward pressure on wages Rapid technological catch-up through copying and imitation, plus now large domestic innovation effort, and purchasing of high tech companies Negative environmental impact, including global warming 5. Frictions 1. 2. 3. 4. Trade Resources CO2 Geopolitical 5.1 Trade Frictions Both countries, but particularly China have rapidly expanded exports Export expansion is putting strong pressure on manufacturing (China) and services (India) jobs around the world Politically charged in context of high unemployment in developed countries Additional frictions arguments about currency manipulation by China intellectual property piracy using access to domestic market to extract technology purchases of national resource and high technology companies China’s Exports Surpassed US in 2006 and Germany in 2009 Share of Total Global Merchandise Exports 1980-2009 14.00% 12.00% 10.00% China India Germany Japan France 6.00% Italy United Kingdom United States 4.00% 2.00% 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 1984 1983 1982 1981 0.00% 1980 % of Global total 8.00% ©cjd Change in China’s Market Share in World (Four Global Markets by SITC Categories 6-8) Developed Developed Asia Developing Asia Other Developing 1995 2009 % change 1995 2009 % change 1995 2009 % change 1995 2009 6: Manufactured goods classified by material 2.0 9.9 390.5 15.9 27.5 73.4 4.2 12.8 207.6 2.0 14.5 7: Machinery and transport equipment 1.8 14.2 680.2 8.5 32.8 283.5 1.3 17.3 1216.7 1.1 17.0 8: Miscellaneous manuf. articles 11.3 27.5 143.2 41.0 52.6 28.4 5.0 17.4 249.8 4.2 25.3 Total for All STIC Imports from China 2.9 10.4 258.6 13.4 23.6 76.1 2.3 10.9 356.1 1.4 11.7 % change 638.0 1498.2 497.5 730.0 Global Trade Imbalances Continue Ten Largest Tertiary Student Populations 2007 Country China US India Russian Brazil Japan Indonesia S. Korea Iran Ukraine 25,346 17,759 12,853 % of World Enrollments* 16.8 11.8 8.5 9,370 5,273 4,033 3,755 3,209 2,829 2,819 6.2 3.5 2.7 2.5 2.1 1.9 1.9 Number Enrolled The R&D Input Landscape 5.2 Resource Frictions Both countries are resource poor on per capita basis (except for coal) Put pressure on global resources, (energy in particular) Access to resources is national security issue for these countries and raises frictions with rest of world For example, China relationship with rogue regimes because it needs their resources China building blue water navy to secure access petroleum shipped through Malacca Straits China claim to islands in South China seas, Ecological Footprint of Ten Largest Users of Environment 2007 WWF 2008 Biocapacity vs Ecological Footprint-2007 U.S. China Europe India Russia Japan Brazil % of World Ecological Footprint 13.71 16.32 15.60 5.82 3.47 3.32 3.06 % of World Biocapacity 10.03 10.02 10.96 4.85 6.74 0.64 14.25 -14.47 -12.49 -3.88 1.54 -4.35 9.66 Net Position as -10.54 % of World Biocapacity 5.3 CO2 Emissions Frictions China became larger CO2 emitter in 2008, and largest energy user this year India is still far behind, but within 20 years will be in similar position By 2035 emissions from China, US, India will be as large as total emissions by world in 1990 while world needs to reduce emissions 50% those levels to avoid global warming Both countries argue that problem is due to prior emissions by now developed countries and that they are too poor on per capita basis to incur higher costs of curbing emissions US has refused to commit to reducing its own emissions unless China and India also commit—therefore world is caught in deadlock over C02 emissions Additional risk that US will impose border tax on carbon content of imports from China and India which would exacerbate trade frictions 5.4 Geopolitical China’s successful authoritarian cum socialist economy model is gaining adherents Has performed remarkably well for 30 years, plus much less affected by crisis Offers an alternative to Washington Consensus development model for other developing countries Concerns about security in access to natural resources leads it to Trade with natural resource rich rogue regimes Strengthen its military capability to ensure supply of natural resources and project military power to defend its interests Increasing Frictions Trade & Environment Trade War Subsumes: -exchange rate -global imbalances -FDI China and rest of world India and rest of world Between China and India Friction because of China’s exchange rate undervaluation and large trade surpluses. Not as likely as China since it has trade deficits. Compete in many product areas. May have diverging position s in Doha trade Concern about China buying natural resources and technology firms. Like China, although Indian state-owned firms are not as active. Some competition -Intellectual piracy Extensive complaints about Fewer complaints about IP Chinese IP piracy. piracy than with China. Resource Wars Possibly over energy and resources, such as over islands in East and South China Seas. Climate Change Not controlling emissions will lead to global warming China argues that it’s unfair Same argument as China, plus to make it pay for CO2 the fact that it is smaller since problem was created emitter and a poorer country. by earlier emissions of now-developed countries. Risk of geo-engineering attempts with unknown consequences if mitigation efforts fail China may go for geoengineering if it begins to experience negative consequences of climate change. Possibly over energy in general, and water with neighbors, including China. India may go for geoengineering if begins to suffer costs of climate change. May become more problematic as they compete more in trade. Yes, especially over water from Himalayan Glaciers that feed main rivers in Asia Perhaps, because China is already above global average per capita energy consumption and CO2 emissions, while India will be below global averages even up to 2035. Increasing Frictions-Geopolitical/Security China and rest of world India and rest of world Between China and India Geopolitical Competition and Ideological War Note this is also over human rights, nuclear nonproliferation, and form of government. Yes with respect to Western democracies and Japan. Not so likely with Western democracies and Japan because India’s democratic government and marketoriented system are more consistent with those countries. Yes because of different ideologies combined with frictions on borders, water, and possibly trade. Security Conflicts Cyber warfare Many current cyber India potentially has great attacks are traced to China. capability in this area, but there is little evidence that it is active. Possible if frictions between them increase. Military Conflict Possibly over Taiwan or Possibly with Pakistan other neighbors in South because of old rivalries and China Seas. China’s support unstable region. of N. Korea is also a potential problem. Limited to border frictions in short run. Hegemonic War Perhaps with U.S. in long term. Less likely since India is Hegemonic war between ideologically closer to existing them unlikely until both powers and not considered as become dominant powers. big a security threat as muchlarger China. Global Governance System Was set up after WW II led by U.S. Is having trouble dealing with issues it was supposed to cover Does not address major new issues Trade (GATT/WTO) Global financial imbalances (IMF/WB) Security (UN/Security Council) Climate change Cyber security Terrorism with weapons of mass destruction U.S. which has de facto been main provider of global public goods (open trading and financial system, security, technology, education) is overextended and fiscally constrained Other countries are not stepping in to provide these global public goods 7. What has to be done? Have growing friction points which the international governance architecture is not addressing Represent old power structures-need to be rebalanced Do not cover some of critical global issues such as International financial system and its regulation Environment, both from resource use as well as global warming Developing effective new institutional architecture will take time and will be messy Main countries/blocks have to do more at their own domestic level to manage problems to keep them from becoming worse Alternative Scenarios Environmentally Sustainable System 4. Desirable state: Requires cooperation on trade, finance, technology, environment, security, increased aid for poor countries, and more sustainable development strategies. 3. Alternative undesirable state: Protectionism slows global growth, increases poverty, ad hoc geoengineering solution to climate change with unknown results. Fractured Global Economic System Integrated Global Economic System 1. Current unsustainable state Moving toward protectionism, new financial crisis, insufficient technology cooperation, resource conflicts, negative effects of climate change, growing inequality. 2. Most likely, but undesirable state Protectionism and regional trade/economic blocks, negative impacts of climate change. Likely to spiral into military confrontations over resources, exacerbated by disruptions from climate change. Environmentally Unsustainable System Key Tasks Developing better rules for viability of global system Rebalancing Trade deficit countries Trade surplus countries Reducing CO2 Very difficult to do through fully representative global forums Start with agreements among main powers US China India EU and Japan But these things are difficult to do for political economy reasons Involved painful restructuring Require strong vision and leadership Also require greater awareness among population at large of what is at stake China Let exchange rate adjust upward Undertake structural reforms Reduce savings, increase consumption Expand social safety need Promote growth of domestic market Develop the service sector Undertake more aggressive action on increasing energy efficiency and reducing CO2 emissions U.S. Increase personal savings, reduce consumption Reduce growing budget deficits Increase taxes Reduce government expenditure and improve efficiency of government spending Streamline growing entitlement costs Reduce trade deficit-but through increased productivity and structural change not through protectionism India Improve government efficiency and effectiveness Reduce red tape and corruption Strengthen fiscal stability, Leverage its growing labor force with more investments in basic and higher education Deregulate labor markets and develop competitive traded sector to modernize economy beyond ICT enclaves Improve energy efficiency and reduce CO2 emissions Learn from mistakes of other developed countries and China in going for a more environmentally sustainable development path EU Sort out the currency problems of the Euro Zone Strengthen fiscal discipline of different economies and the incentive regime to ensure it Improve flexibility of labor markets Take advantage of realignment of Euro to strengthen competitiveness Strengthen European Research Area Avoid pressures for protectionism 7. Longer Term Issues Essentially issue of accommodating large rapidly growing new entrants Challenges Competitiveness and economic adjustment challenge (large global rebalancing of relative wages) Addressing increasing global inequality Finding more sustainable development models Dealing with geopolitical competition Changing Shares of Global Population Thank You! Carl J. Dahlman Georgetown University carl.dahlman@gmail.com 202 687 8045