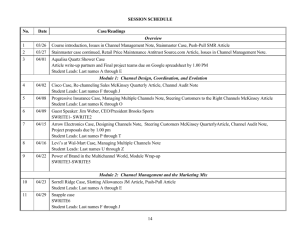

Urbanization in China and the Impact on Infrastructure

advertisement

RIC, 4th annual conference New Delhi November 21, 2008 Preparing for China's Urban Billion Stefano Negri, McKinsey Global Institute This report contains information that is confidential and proprietary to McKinsey & Company, Inc., and is solely for the use of McKinsey & Company, Inc., personnel. No part of it may be used, circulated, quoted, or reproduced for distribution outside McKinsey & Company, Inc. If you are not the intended recipient of this report, you are hereby notified that the use, circulation, quoting, or reproducing of this report is strictly prohibited and may be unlawful. McKinsey developed an innovative, unique perspective on the booming urbanization in China Methodology Sources of distinctiveness • Econometric model • Granularity – Yearly (22,000+ equations) – macro and demographic forecast 2007-2025 • Scenario analysis – 4 alternative scenarios depicting contrasting directions for China's future urbanization, size and pattern • City visits – visited 14 different cities and interviewed >100 local government officials and business leaders to complement the model findings 1 Harbin, Heilongjiang historical and forecast data at national and city level • Comparability – Urban Xingping, Shaanxi definition consistent with international standard and applied to all indicators Beijing Huhehaote, Inner Mongolia Taiyuan, Shanxi • Completeness – Time Suzhou, Anhui Nanchong, Sichuan Shanghai Taizhou, Zhejiang Chengdu, Sichuan Changsha, Hunan Cangnan, Zhejiang Xiamen, Fujian Shenzhen, Guangdong series data consistent with theory and individual city behavior, providing data and forecasts for 858 cities, including 195 "unofficial cities" Chinese cities are redefining urbanization scale, over the next 20 years … How many additional people will live in Chinese cities vs today? More than 350 million people, more than the population of the entire United States How many cities in China will have more than one million inhabitants? More than 200 cities; in Europe today there are only 35 cities of that size How many new skyscrapers will be built? There will be up to 50,000 new skyscrapers, the equivalent of building ten New York cities How many new mass transit systems will be built? Up to 170 new mass transit systems; in Europe today there are about 70 By 2025, two-thirds of China’s citizens will live in cities … … that’s nearly 1 billion people Source: Demographia; China-All-City model output, McKinsey Global Institute analysis 2 China's urbanization could follow different paths Scenarios Super cities Hub and spoke • A small number • 11 economic of very large cities emerge (>20 million), 4 of them reaching 30 - 40 million people each Examples of “boosted cities” in each scenario • Shanghai • Beijing clusters of large cities of 30 - 90 million people each emerge • Yangtzi River Delta cities Distributed Growth Townization • Major and very • Many small small cities decelerate, and a large number of cities from 1.5 million 5 million emerge cities (500,000 1.5 million) emerge, including almost 300 rural counties becoming cities • Taizhou • Harbin • Xingping Country examples Japan Korea Concentrated urbanization Source: McKinsey Global Institute analysis 3 US Germany Dispersed urbanization China's energy demand will more than double in all scenarios by 2025 Urban energy intensity BTU per Renminbi 2005 Super cities Hub and spoke Distributed growth Townization 5,233 Urban GDP Renminbi trillion 12 60 1,920 2,140 131 68 2,082 2,258 Urban energy demand QBTUs 142 68 139 60 54 123 +138% Source: McKinsey Global Institute analysis 4 Mass transit requirements could vary widely depending on urban shape Qualified cities by 2025 Criteria* Light rail • City population: ≥ 1.5 million • City GDP: ≥ RMB 60 billion Subway • City population: Distributed growth 171 Trend Line 131 Hub & Spoke 130 ≥ 3 million • City GDP: Super cities 102 ≥ RMB 100 billion Townization • In all Europe (including Russia), there are approximately 70 subway and light rail systems • 150,000 to 400,000 additional rail cars needed • Between 4.5 and 7 trillion RMB over the next 20 years 85 * Based on Chinese Government criteria, population and GDP in 2020 Source: Urban Statistical Yearbook of China; Criteria of subway/light rail development issued by Ministry of Construction 5 China will build a Chicago every year POTENTIAL ANNUAL CONSTRUCTION OF LARGE SKYSCRAPERS* Number of buildings above 30 floors, 2005 - 2025 5,000 Hub and Spoke 4,500 4,000 3,500 3,000 2,500 Super cities Number of Skyscrapers in Chicago 2,000 Trend line Distributed growth Townization 1,500 1,000 500 0 2005 2010 * Smoothed to 5-year intervals Source: NBS; press clippings; team analysis, city visits 6 2015 2020 2025 Contact information For more information and to download the full report http://www.mckinsey.com/mgi/ Stefano Negri, McKinsey Global Institute McKinsey & Company 17/F Platinum - 233, Tai Cang Road 200020 Shanghai - PRC Mobile: +86-15821665209 Email: stefano_negri@mckinsey.com 7 BACKUPS 8 To tell the future, we had to understand the past POPULATION BY CITY SIZE Millions of people Populatio n Mega (10M+) Big (5 - 10M) Mid-sized (1.5 - 5.0M) Small (0.5 - 1.5M) Big town (<0.5M) 254 21 0 51 CAGR, 1990-2005, percent Real GDP 572 32 5.6 N/A 14.5 N/A 84 9.5 17.4 161 8.0 15.8 150 2.0 9.3 145 5.0 13.6 112 • We discovered that there are various ways to define Chinese cities (e.g. Chongqing) • We corrected statistical distortions (e.g. hukou vs census) • We uncovered 195 “hidden cities” • We established that migration is only half the story 70 1990 2005 * Include 663 official cities and 195 additional areas that we consider as cities using various government criteria to qualify them. These criteria were discontinued in 1996 for practical reasons but, in our view, remain valid Source: McKinsey Global Institute analysis, China-All-City model output 9 The urbanization research produced a set of insights which are very relevant for businesses Urbanization is inevitable – and cities will be the clear drivers of China's economic growth • 1 billion urban population • >90% GDP from urban areas City clusters will provide a new lens to assess opportunities in China • 11 clusters are emerging, with average Different urbanization paths could drive significantly different outcomes for China Variability between urbanization scenarios: • 20% in GDP • 15-30% of demand for natural resources Investment growth will continue, and public spending will come along • 40+ trillion USD (2005 through 2025) • 170+ new MT systems, 360'000+ km of Burgeoning middle and upper middle class will take off China's "growing pains" will generate new markets and business opportunities Source:McKinsey Global Institute analysis 10 population of ~60 millions and ~60% of total urban investments new water pipe, x6 healthcare spending • Middle class (household income 40k-200k RMB/yr) will make up almost 80% of total consumption • Spending in key areas such as environmental protection is bound to raise (e.g., 100% SO2 scrubbers) China is moving toward an urban billion TREND LINE FORECASTS POPULATION BY CITY SIZE Millions of people Mega cities (>10 million) Big cities (5 - 10 million) Midsized cities (1.5 - 5 million) 572 32 84 XX 926 2.4 120 6.9 104 1.1 316 • Mega and midsized city populations will grow faster over the next 20 years • An urban billion 161 233 2.2 0.3 Small cities (0.5 - 1.5 million) 150 Big towns (<0.5 million) 145 154 2005 2025 Source: McKinsey Global Institute CAC model, McKinsey Global Institute analysis 11 3.4 CAGR, percent will be attained by 2030 Six new megacities will emerge by 2025 TREND LINE FORECASTS Millions of people 2007 14.7 Beijing 26.8 17.1 Shanghai Tianjin Shenzhen Wuhan Chongqing Chengdu Guangzhou 25.1 8.7 12.6 Beijing 8.3 Tianjin 12.4 8.6 11.9 7.9 10.7 Shanghai Chengdu Wuhan Chongqing 6.4 10.3 8.2 10.1 Source: McKinsey Global Institute CAC model, McKinsey Global Institute analysis 12 Beijing and Shanghai already megacities in 2007 Shenzhen Guangzhou 2025 Even with conservative assumptions, urban GDP will more than quadruple by 2025 SENSITIVITIES Urban GDP RMB trillions 2005 2025 Low Urban GDP/ total GDP Percent 75 12 54 90 Urban GDP/capita RMB thousand 21 62 +350% 2025 High 68 +467% Source: McKinsey Global Institute analysis, China-All-City model output 13 +195% 92 76 +262% Clusters of cities with average population of ~60mln provide a new lens to assess market opportunities Hubs ECONOMIC REGIONS Regional hubs Number of cities in the region Beijing / Tianjin 28 Shenyang / Dalian 22 Qingdao / Jinan 35 Xian 14 Shenyang Beijing 8 Zhengzhou 23 Shanghai 58 Chengdu / Chongqing 31 Wuhan 27 20 Xiamen / Fuzhou 14 Guangzhou / Shenzhen 23 Dalian Tianjin Huang River Qingdao Xian ` Yangtze River Changsha Source: McKinsey Global Institute analysis Fixed asset investment in 11 economic regions will represent almost 60% (13 trn RMB) of total urban investment in China by 2025 Jinan Zhengzhou Shanghai Wuhan Chengdu Chongqing Changsha Fuzhou Guangzhou Xun River Xiamen Shenzhen Each scenario has pressures – But these appear less intense overall in concentrated urbanization Concentrated urbanization Pressure points Super cities Land development Congestion Jobs and skills Funding Water Energy Pollution Source: City visits; interviews; McKinsey Global Institute analysis 15 Hub and spoke Distributed Growth ALL URBAN CHINA Townization At local level, regardless of scenarios, it is possible to define an "urban productivity agenda" for Chinese cities NOT EXHAUSTIVE High-level initiatives Examples of detailed initiatives Land • Create strategic land development plans Resources Economics People Build dense cities with integrated urban planning design Manage demand, not only supply of resources • Incentivize energy and water efficient industrial equipment • Establish and enforce energy saving building codes • Increase control, emission standards on pollutants Increase productivity in public services and capital expenditures • Introduce productivity based performance systems Improve quality and relevance of educational process • Partner with local companies to increase Source: McKinsey Global Institute analysis 16 (combining zoning, building heights, transit plans) • Develop integrated, mixed use areas • Implement car traffic demand management on public service provision (e.g., healthcare) • Increase transparency in city budgets and infrastructure spending internship / team work (e.g., establishing joint vocational education and training institutions) • Introduce performance management systems on labor productivity and employability measures rather than, for example, enrollment rate The China urbanization story • China's urban success story will continue, with massive changes in the next 20 years – China has set ambitious economic goals. Urbanization is key to make that happen – urban GDP / capita will grow five times and cities will generate more than 90% of China's GDP – Urbanization will continue, but with it will be different from the urbanization China experienced in the past 15 years (e.g., migration will be the driving force) – Pressure will intensify on several areas and will need to be managed, especially if China continues to follow a dispersed pattern of urbanization – land and spatial development, resources and pollution, human capital, funding • There is an opportunity to shape China's future towards a more productive urbanization – with policy interventions both at national and local level – Between all possible urban shapes, concentrated growth is the most efficient and beneficial way to go for China (higher GDP, more efficient use of resources, more productivity from its talent pool) – "City level productivity initiatives" are an opportunity to reduce the cost of urbanization while increasing quality of life (China could cut its public spending needs by 2.5% of GDP, reduce SO2 and NOx emissions by upwards of 35%; halve its water pollution; and deliver private sector savings equivalent to an additional 1.7% of GDP in 2025) and opening new business opportunities 17