people resourcing

PEOPLE RESOURCING

Chapter Eighteen

Redundancy and Retirement

Defining redundancy

In the UK, the term ‘redundancy’ is defined by law as a situation in which, for economic reasons, there is no longer a need for the job in question to be carried out in the place where it is currently carried out.

The Employment Rights Act (1996) states that redundancy occurs only when a dismissal is due to:

• the cessation of the business in which the employee is employed

• the cessation of business activities at the place where the employee is employed

• the cessation/reduction of a work of a particular kind, where the individual is employed to carry that work out

• the cessation of work of a particular kind at the place where the individual is employed.

It is important to grasp the legal definition because it sets out the circumstances in which an employee is entitled to a redundancy payment.

Redundancies also require a procedural approach wholly different from those used in other forms of dismissal, as well as notification being made to the Inland Revenue.

Avoiding compulsory redundancies

Long-term approaches:

• Effective human resource planning – reducing recruitment activities and retraining existing employees

• Flexible working practices

• Sponsorship of early retirement incentives – an option only where an organisation has an established occupational pensions scheme, and where funds are in surplus.

Short-term approaches

:

• Asking formally for volunteers

• A recruitment freeze

• Cutting or radically reducing overtime

• Pay freezes and the abandonment of profit-based bonus schemes

• Redeployment.

Problems with asking for volunteers:

• Applications are most likely to come from the longest-serving employees who are in line to receive the largest redundancy payments – thus it is often a more costly exercise.

• It often allows the most employable and valuable staff to leave, leaving the less effective employees in employment.

• Too many employees can apply for redundancy, leading to disappointment for those who do not get it. This can be particularly damaging when the poorer performers are selected and appear to be rewarded with redundancy.

• Employees may fear that their careers may suffer if they are known to have applied unsuccessfully for redundancy.

Such problems can be overcome provided the volunteering process is carefully planned, is carefully controlled and remains transparent throughout.

The traditional selection criteria was ‘last in, first out’

(LIFO).

This is becoming less common as managers seek to use criteria that better distinguish staff with ability and potential.

Tribunals are increasingly looking with favour on points systems that use several criteria (appropriately weighted) to compare individuals, such as:

• length of service

• qualifications and relevant experience

• disciplinary record

• attendance

• adaptability/flexibility.

A different approach is to start by developing a new organisation structure. Job descriptions and person specifications, or competency frameworks, are then developed for the jobs that remain.

Where a job remains essentially unchanged and is currently undertaken by a single person, that person is then ‘slotted in’.

Others then apply for the jobs in the new structure and, if necessary, undergo a competitive selection process.

The main disadvantage of the approach is the effect on morale and teamworking, as employees compete with one another for positions in their own organisation.

Providing help for redundant employees

Initiatives include:

• providing counselling to help employees come to terms with their fate and then to contemplate their future options

• providing time off work to look for new employment

• providing outplacement or career consultants – individual advice and job-search workshops

• negotiating re-hire agreements whereby ex-employees are employed as subcontractors or consultants.

Providing help for redundant employees

(cont.)

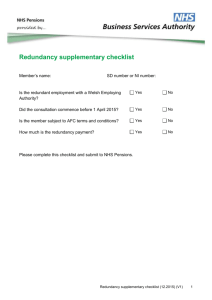

The law sets out the minimum levels of compensation to which redundant employees are entitled:

• Compensation is based on the individual’s length of service (in complete years) and weekly salary at the time their notice period expires.

• The maximum weekly salary that can be used for the basis of the calculation is determined by the government.

• The maximum number of years’ service that can be used is 20.

• Only employees with more than two years’ service are entitled to redundancy payments.

The statutory scheme is, however, only a minimum standard. Many employers make higher payments.

Managing the survivors

The long-term success or failure of the redundancy programme depends on the ability of the remaining employees to come to terms with new structures and working practices.

There are often strong feelings of guilt, ‘shell shock’ and fear for the future.

Managers can help to minimise these feelings by:

• managing the process in a fair and open way

• maintaining two-way communication, and responding to employee suggestions and criticisms at the different stages of the process

• reassuring the remaining employees of their value and continued employment prospects.

Notification

Employers proposing to make 20 or more employees redundant are obliged to notify the DTI in writing.

The need to dismiss

There is a requirement for employees to be formally dismissed in order to qualify for the receipt of a tax-free redundancy payment.

‘Bumping’

‘Bumped’ or transferred redundancies occur when an employee whose job is to be made redundant is given a position elsewhere in the organisation, leading to the dismissal of someone else. This is potentially

‘reasonable’ where there are sound operational reasons.

Offers of alternative work

Where employees under threat of redundancy are offered suitable alternative work by their employer before they are dismissed, and refuse to take the offer up, the employer is under no obligation to pay them a redundancy payment.

The law allows for four-week trial periods where new jobs are offered on different terms. If a job proves unsuitable after the trial, the employee is still entitled to a redundancy payment.

Waiver clauses

These apply only in fixed-term contracts entered into before 1 October 2002.

The law on retirement

Age discrimination law was introduced in the UK in 2006.

It contained a great deal of controversial new law on the management of mandatory retirements.

• It is lawful to dismiss at a set retirement age of 65 or higher, provided a statutory procedure is followed.

• Mandatory retirement ages between 60 and 65 can continue, provided an employer can objectively justify them.

• There is a duty on employers to write to employees 6–12 months before the employees reach retirement age.

• Employees can request to work beyond retirement age.

• Employers must give such requests serious consideration, although they are not obliged to grant them, or even provide a reason for refusing.

There have already been challenges to the legislation, and the specifics may change over time as a result of case law.

The main controversy results from the fact that although unfair dismissal law now applies to employees of any age, employers are allowed to enforce retirement at 65 with no good reason.

Critics argue that the effect in practice is to encourage employers to dismiss at 65 when previously (before the advent of age discrimination law) they would have kept people on.

Early retirement

This is commonly associated with membership of the employer’s occupational pension scheme.

Precise terms vary between employers, but most in some circumstances (eg to avoid redundancies) pay a reduced pension to retirees who choose to leave before the contractual retirement age.

It is often a very tempting option for employees, especially where there is a possibility of continuing to work on a part-time or consultancy basis.

Most employers do reserve the right to refuse such requests – to avoid a general exodus of valued employees.

Preparing employees for retirement

Retirement is a major life event. Employers can make it easier by providing pre-retirement training, which tends to blend individual counselling with group-based training to cover:

• financial concerns (pensions, taxation of savings, etc)

• developing leisure activities

• health and nutrition

• re-employment and part-time working.

Smooth transitions can also be aided through the maintenance of formal contacts between the individual and the organisation – either some form of ongoing economic relationship or social events.