Intangible Assets

advertisement

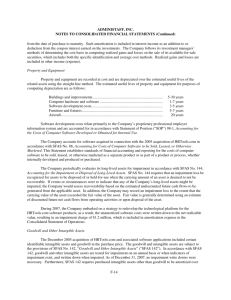

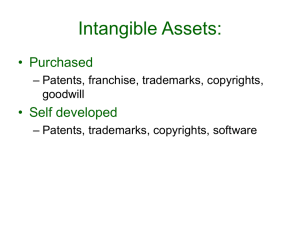

Slide 19.1 Chapter 19 R&D; Goodwill; Intangible Assets and Brands Slide 19.2 Main purpose The main purpose of this chapter is consider the accounting treatments of: Research and development Goodwill and intangible assets Brands Slide 19.3 Objectives By the end of this chapter, you should be able to: define and explain how to account for research and development (R&D), goodwill and other intangible assets; comment critically on the IASB requirements in IAS 38 and IFRS 3; account for development costs; account for impairment; prepare extract of the entries and disclosure of these items in the statement of comprehensive income and statement of financial position. Slide 19.4 Intangibles An intangible asset is defined under IAS 38, as: an identifiable non-monetary asset without physical substance Intangibles include systems, licences, intellectual property, market knowledge and trademarks (including brand names and publishing titles) – see p. 503 for more examples An intangible asset must be identifiable (para 12 IAS 38), and there must be control (para 13), as well as the production of future economic benefits and its cost can be reliably measured (para 21) before it may be recognised Slide 19.5 Intangibles Initial recognition is at cost (para 24) Two categories of intangible asset: externally acquired or internally generated . Slide 19.6 Intangibles Externally acquired: Purchased from another party either separately or as part of a business combination. If purchased separately, eg. buying rights to a book before making it into a film, cost can be established as the purchase price and any other expenses associated with readying the asset for its intended use. plus any duties and non-refundable taxes less any trade discounts or rebates (para 27) Slide 19.7 Intangibles Buying the business of a competitor may include, for example, the rights to copyrights, patents or mastheads. If these cannot be reliably measured or distinguished from other assets, they become part of purchased goodwill – the premium paid over and above the fair value of tangible and identifiable intangible assets (para 10). Where the price paid for the intangible can be distinguished from goodwill and the future economic benefits that arise can be identified, the test of identifiability is met and it can be recorded as a separate asset (para 34) at fair value at the date of purchase (para 33). This treatment differs from the separate purchase of an intangible, which is recorded at cost. Slide 19.8 Intangibles Goodwill is recognised as a separate intangible asset, subject to an annual test for impairment. A gain on bargain purchase – negative goodwill - (paid less than fair value) is taken to revenue. Where an identifiable intangible asset exists but cannot be reliably measured, it is included as part of goodwill. In such a case, there is a requirement to describe each intangible asset acquired in a business combination, and explain why its fair value could not be reliably measured. Slide 19.9 Intangibles – internally generated As the name suggests, these arise from the activities of the business. Expenditure on internally developed brands, mastheads (newspaper and magazine titles), publishing titles, customer lists, and similar cannot be distinguished from the cost of developing the entity’s overall business. Such intangibles (including internally generated goodwill) do not meet the definition of assets, and shall not be recognised as intangible assets (IAS 38, para 63). Slide 19.10 Research defined Research – original and planned investigation undertaken with the prospect of gaining new scientific or technical knowledge and understanding i.e. Obtaining new knowledge Search for alternatives Materials Products Processes Evaluation of alternatives. Slide 19.11 IAS 38 – accounting treatment for R&D Research: Expense in the year in which incurred Not to be carried forward in statement of financial position i.e research is not capitalised or shown as an asset on the balance sheet Slide 19.12 IAS 38 intangible assets Development defined Application of research findings to a plan for production of new or substantially improved • Products • Processes • Systems Prior to commencement of commercial production. Slide 19.13 Development costs comprise Directly attributable costs Materials Labour Fees such as patents Allocatable on a reasonable and consistent basis Necessary and identifiable overheads Depreciation Insurance premiums, rent. Slide 19.14 IAS 38 – development recognition criteria Technical feasibility Intention to complete and use or sell Generate future economic benefits Existence of market for asset or output Availability of adequate resources to complete Technical Financial Reliable measurement of costs possible Expense if not recoverable from future revenue. Otherwise, capitalise and show on balance sheet. Slide 19.15 Activities that are neither research or development Activities related to research and development, but cannot be classified for the purposes of the standard as R&D include: Engineering followthrough in an early phase of commercial production Quality control during commercial production, including routine testing Troubleshooting in connection with breakdowns during production Routine efforts to improve the qualities of an existing product. Slide 19.16 Goodwill and intangible assets The main requirements of IFRS 3 Business Combinations and IAS 38 Intangible Assets are: • Purchased goodwill and intangible assets should be capitalised as assets • Internally generated goodwill should not be capitalised and • Internally developed intangible assets should be capitalised only where it is probable that future economic benefits attributable to the asset will flow to the enterprise and the cost of the asset can be measured reliably • Capitalised assets are subject to amortisation and/impairment review. Slide 19.17 Accounting for research & development Why does the accounting differ between research and development? Research expenditure, whether pure or applied, cannot meet the definition of assets. There is no probability of service potential or future economic benefits arising as a direct result of the expenditure. Accordingly, it meets the definition of expense – consumption has occurred that has reduced assets (or increased liabilities) and it can be reliably measured. Development expenditure, when it passes the test criteria, meets the definition of assets. In meeting the test it is probable that service potential or future economic benefits will eventuate, and the cost or other value can be reliably measured. Slide 19.18 IFRS 3 business combinations IFRS 3 Business Combinations states: Goodwill is the difference between the cost of acquisition and the acquirer’s interest in the fair value of the identifiable assets, liabilities and contingent liabilities acquired at the date of the exchange transaction. Purchased goodwill is based on Transaction with third party at arm’s length Internally generated goodwill is based on Directors’ valuation of internal goodwill by valuing Business as a whole Separable assets. Slide 19.19 Accounting treatment of goodwill Purchased goodwill is recognised in the statement of financial position as an asset Amortisation prohibited Annual impairment reviews Inherent goodwill not normally recognised in the accounts. Slide 19.20 Economic consequence of writeoff/amortisation ROCE Write-off reduces shareholders’ reserves and capital employed Gearing Write-off reduces shareholders’ reserves and so capital employed How this affects investor decisions How this affects creditor decisions. Slide 19.21 Negative goodwill – related to expectation of losses and expenses Arises when the amount paid for the purchase is less than its fair value. Credit income statement immediately. Slide 19.22 Intangible assets – purchased Separately purchased, included in goodwill and with a finite life Capitalise as part of goodwill Separately purchased and capable of reliable measurement Capitalise separately from goodwill and amortise. Slide 19.23 Intangible assets – internally developed Capitalise – only if an enterprise can demonstrate all of the following: the technical feasibility of completing the intangible asset so that it will be available for use or sale; its intention to complete the intangible asset and use or sell it; its ability to use or sell the intangible asset; how the intangible asset will generate probable future economic benefits; the availability of adequate technical, financial and other resources to complete the development and to use or sell the intangible asset; and its ability to measure reliably the expenditure attributable to the intangible asset during its development. (para 57) Slide 19.24 Intangible assets – indefinite useful economic life Intangible assets with indefinite useful lives must, at each annual balance date compare carrying value against recoverable amount. If the recoverable amount is less, then the impairment amount is written off first to any related asset revaluation reserve and then as an expense to the Income Statement. Where impairment losses recognised in prior periods no longer exist or have decreased so that recoverable amount is now above carrying amount, the previous impairment loss is unwound – first to any amount expensed to the Income Statement and then to the revaluation reserve, if one exists. The reversal must not result in the asset’s carrying value exceeding that which would have resulted had no prior impairment loss been recognised. Improve transparency Improve comparability. Slide 19.25 Brand accounting Include in statement of financial position to pre-empt equity depletion caused by goodwill write-offs or amortisation Typically not amortised but subject to impairment review. Slide 19.26 Intellectual property – two categories Industrial property Inventions Trademarks Designs Copyright Literary and artistic works. Slide 19.27 OECD definition of intellectual capital The economic value of two categories of intangible assets: Organisational (structural) capital – Software systems – Supply chains Human capital – Internally – staff – Externally – customers. Slide 19.28 Discussion Explain how primary ratios were distorted by immediate write-off of goodwill against reserves Explain the criteria for recognising internally generated intangible assets. Slide 19.29 Discussion (Continued) Explain why companies began to recognise brands in their statement of financial positions Explain the requirement at the year end with respect to intangible assets with an indefinite useful economic life Why do you think companies were motivated to measure intellectual capital? Slide 19.30 Discussion (Continued) What indications may there be that an impairment review of an intangible asset is necessary? Explain the criteria to be satisfied for development costs to be capitalised Discuss why intellectual property has become increasingly important. Slide 19.31 Review questions 7.The Chloride 2005 Annual Report included the following accounting policy for goodwill: Goodwill is subject to review at the end of the year of acquisition and at any other time when the directors believe that impairment may have occurred. Any impairment would be charged to the profit and loss account in the period in which the loss occurs (a) Explain the indications that a review for impairment is required (b) Once there are indications of impairment, how is impairment measured? Slide 19.32 Review questions (Continued) 10.IFRS 3 has introduced a new concept into accounting for purchased goodwill – annual impairment testing, rather than amortisation. Consider the effect of a change from amortisation of goodwill (in IAS 22) to impairment testing and no amortisation in IFRS 3, and in particular: • The effect on the financial statements • The effect on financial performance ratios. • Continued … Slide 19.33 Review questions (Continued) Which method gives the fairest charge over time for the value of the goodwill when a business is acquired Whether impairment testing with no amortisation complies with the IASC’s Framework for the Preparation and Presentation of Financial Statements The effect on the annual impairment or amortisation charge and its timing Why there has been a change from amortisation to impairment testing – is this pandering to pressure from the US FASB and/or listed companies?