Picture

Why Do Diamond Traders Need A Diamond Fund?

Presentation by Stephan Mueller

Product Management & Development

The exclusive manager of Julius Baer Funds. A member of the GAM group.

Picture

Product Idea – Key Elements

Product Innovation

Wrap the most precious goods in a transparent and fully regulated fund

Diamonds as an investment theme – the worlds’ first transparent diamond fund

• Diamonds are considered a hedge against inflation, uncertainty and crisis.

• Their popularity has risen since the 19th century as an important source of liquidity with

a diamond’s value not been determined by currency parity, government laws or

geopolitical concerns.

• Growth pattern similar to a synthetic bond (2% p.a. – 3% p.a.), due to the diversified

portfolio.

3

Source: PMD & PolishedPrices

Analogies between Metals and Diamonds – Suitability

The selection of standardised components and quality labels are the

prerequisite of product and portfolio engineering for financial assets

Selective diamond and metal segments are traded as commodities

• All segments from raw to refined diamonds cover pricing standards that facilitate

the trading and valuation. But not all of them are suitable for financial assets.

• Not all standards are suitable to match the needs of the financial industry as they

may not deliver the comfort level and transparency required:

4

Good

Valuation

Suitability re financial

asset

Remark

Precious metal coins,

medallions, semirefined bars

Auctions, individual

certifications by smelters

etc.

Not suitable: implicit

premiums can only be

discovered from auctions

Price determination and

methodology are not transparent to

the public

LBMA, LPPM precious Standardised price

metal bullion bars

discovery and publication

via BBG/Reuters etc.

Suitable: pricing standards,

good delivery rules are

worldwide recognized

Every bullion bar is an individual

good (fine weight, smelter, shape)

but its valuation is standardised

Raw diamonds,

jewellery, art pieces

Auctions, individual

negotiations

Not suitable: real value can

only be discovered from

auctions (affection is not a

price source!)

Like medallions and coins the price

determination is not standardised

and transparent to the public

Polished and certified

diamonds with GIA,

IGI, HRD international

digital passport

Pricing parameters are

standardised and certified

by laboratories and

published on BBG/Reuters

Suitable: pricing parameters,

standards, good delivery

rules are worldwide

recognized and public

The pricing of polished and

certified diamonds is transparent

and can be reconciled on its

standardised parameters

Source: PMD & PolishedPrices

Transparency & Liquidity

The combination of both is unique as the B2C market has no interest to

disclose pricings and profit margins

Support & project team

• The project is supported and critically assessed by un-conflicted stakeholders from the

diamond industry who bring in their particular expertise and whose independence and

credibility ensures the fund is fully transparent and carries no reputational risks in

relation to ‘conflict diamonds’ to realise the world’s first transparent fund on polished

certified diamonds.

Transparency

• The fund follows strict rules and regulations ensuring the traceability from the source up

to the purchase and trading of polished diamonds on behalf of the fund.

• The fund accounting and trading is based on the transparent methodology of

‘PolishedPrices’ an independent and transparent data provider that publishes up-to-date

wholesale diamond prices and indices on Bloomberg (PLPR<GO>) and Reuters

(<Diamonds/PP>).

Liquidity

• The investment objective is strictly linked to the most liquid and standardised categories

of polished certified diamonds (daily availability; i.e. colour distribution, clarity, cut and

carat weight).

5

Source: PMD & PolishedPrices

Picture

Product Conception &

Implementation of Key Elements

Investment Focus

The fund invests exclusively in polished certified diamonds

Restrictions in favour of the investors’ security and liquidity

• The fund provides access to polished certified diamonds that are stored in our bonded

vault in Zurich.

• The cooperation with ‘PolishedPrices’ and the additional requirements for selected

brokers guarantee that every link of the value chain takes on the full responsibility for

the sourcing and traceability of every single diamond.

• The fund will not get involved in processing or trading rough diamonds and its concept

ensures that every single diamond is certified.

• The diamond portfolio is focussed strictly on liquidity and the most promising mix of

standardised, certified diamonds.

7

Source: PMD & PolishedPrices

Transparency

Official data feeds on Bloomberg/Reuters guarantee transparency to everyone

Methodology – fair value price model

• Prices for single polished price points are based on currently traded selling prices

that are weighted intraday to calculate a fair value price for every polished

category, provided daily by companies in the different market centres all over the

world.

• The portfolio is based on those diamond categories for which ‘PolishedPrices’ has

the highest level of direct daily price feeds; i.e. official BBG ticker for every price

point.

8

Source: PMD & PolishedPrices

Liquidity

Assessment of the core investment objectives

The fund focuses on the most promising categories re liquidity and price stability

• The selection of core categories are based on the insight of ‘PolishedPrices’ and access

the most liquid part of the standardised polished diamond market.

• The whole retail market carried retail turnover of about US$ 84 bn in 2013.

• 2/3rd of the portfolio are invested in the following categories:

•

•

•

•

Colour:

Clarity:

Cut:

Carat Weight:

F to J

VVS1 to SI1

Excellent or Very Good

0.3 points to 2.0 carat

• 1/3rd of the portfolio is designated to select market opportunities

9

Source: PMD & PolishedPrices

Portfolio Management & Implementation

Fully automated portfolio engine with real time link to Bloomberg/Reuters

carat_color

D

E

2

0

1.5

0

1

13,629

0.90

0

0.70

6,127

0.50

14,742

0.40

8,572

0.30

23,075

carat_color / distribution

F

17,766

53,280

88,368

16,615

30,791

70,643

33,827

76,579

G

42,714

65,712

138,191

20,682

52,466

82,474

39,257

91,277

H

91,476

87,024

231,168

40,581

97,658

141,269

65,348

151,837

I

97,104

87,136

271,677

43,847

125,349

155,801

61,900

155,050

J

128,583

150,624

341,040

60,370

130,373

185,209

79,901

201,661

86,079

89,952

194,712

39,358

65,712

130,923

66,599

176,730

5,018,837

carat_clarity IF

VVS1

VVS2

VS1

VS2

SI1

2

0

0

106,785

76,839

126,693

153,405

1.5

0

13,136

144,912

92,448

100,736

182,496

1

22,481

88,862

264,621

203,774

318,381

380,667

0.90

0

13,469

47,895

40,176

52,504

67,408

0.70

9,087

36,578

108,425

76,094

141,318

136,974

0.50

28,809

96,293

158,463

118,714

198,639

180,144

0.40

12,940

39,451

73,895

68,498

83,404

77,217

0.30

31,117

94,368

177,498

173,437

211,171

188,618

carat_clarity / distribution

D

400,000

400,000

IF

E

300,000

I

200,000

H

G

100,000

F

E

0

2

1.5

1

5,018,837

carat_clarity / distribution

carat_color / distribution

0.90 0.70

0.50

J

F

G

H

200,000

I

J

0

0.30

All diamonds in the portfolio are 1:1 linked to the

corresponding BBG Ticker for the respective

category; i.e. similar to precious and industrial

metals.

Changes in underlying prices are reflected realtime in the portfolio engine and trade templates to

facilitate the automated daily flow handling.

10 Source: PMD & PolishedPrices

SI1

VS2

VS1

VVS2

VVS1

100,000

D

0.40

VVS1

300,000

2

2

1.5

1

0.90 0.70

0.50 0.40

0.30

IF

VVS2

VS1

VS2

SI1

Systematic Exclusion of Conflict Diamonds

Strict procedures and controls to ensure proper sourcing of all diamonds

Prosperity diamonds only with approved certification

• The fund will under no circumstances get involved in processing or trading rough

diamonds but will strictly invest in certified diamonds only.

• All diamonds purchased are accompanied by certificates from Gem Laboratories*: GIA,

IGI, HRD or AGS.

11

Source: PMD; *GIA = Gemmological Institute of America, IGI = International Gemmological Institute, HRD = Hoge Raad voor Diamant Antwerp,

AGS = American Gem Society Laboratories

Inventory Reports – Similar to Metal Custody

Customized logistics to provide state of the art vaulting and reconciliation

Every diamond is reported as a unique part of the funds portfolio

• Based on the GEM certification, every diamond is scanned with its specific parameters.

• Reconciliation, internal and external auditors as well as the portfolio management can

rely on the inventory report.

• Every change of the inventory is reported by end of each business day.

Audit SOP in relation to physical handling (Standard Operation Process)

• Auditors and GEM experts can physically examine the portfolio holdings on site.

• In order to avoid conflicts of liability custom made SOP have been developed and

implemented with special regard to the needs of internal and external audits.

Sample of inventory report

Barcode

number

Stone

GIA Report Shape and

number Number

cutting style Measurements

1111111111 BS001

6.90-6.97 x

123456789 Round Brilliant 4.20mm

1111111112 BS002

6.90-6.97 x

123456790 Round Brilliant 4.20mm

12 Source: PMD & BRINKS

Finish

Depth Table Girdle

Cullet

Polish

Medium to

slightly thick,

1.25 carat

60% 61% faceted

Very small Verg good

Medium to

slightly thick,

1.25 carat

60% 61% faceted

Very small Verg good

Weight

Finish

Symetry

Clarity Colour Flouresence

Very Good VS1

F

None

Very Good VS2

F

None

Picture

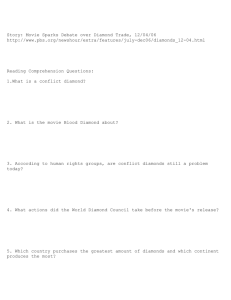

Investment Characteristics

Long-term Stable Growth

Diamonds show a stable growth between 2% p.a. to 3% p.a.

Uncorrelated to equities, fixed income, currencies and other asset classes

correlation: Overall Diamond Index vs. World Equities (11 yr)

1.0

0.5

+ days

0.0

- days

correlation (100)

-0.5

-

Jan-14

Jan-13

Jan-12

Dec-10

Dec-09

Dec-08

Jan-08

Jan-07

Dec-05

Dec-04

Dec-03

Dec-02

-1.0

Key to investors is to access diamonds through a regulated and transparent fund.

Source: PMD & PolishedPrices

Diamonds short in supply soon

Widening supply gap implies substantial price increase going forward, as

already seen for the last four years

Development of Polished Diamonds - Retail

Value in US $ bn.

USD 90

USD 80

USD 70

USD 60

USD 50

USD 40

USD 30

USD 20

USD 10

1980

1982

1984

1986

1988

1990

1992

1994

1996

1998

2000

2002

2004

2006

2008

2010

2012

USD 0

The left-hand chart aggregates rough production data. A majority of mining companies

have been reporting a stagnation of output since several years. Some of the expected

shortfall can be met by adding new mining capacity but the whole supply gap cannot be

closed.

The shortfall in supply will lead to both, less available stones for the cutting centres, and

an expected price increase of polished stones (right-hand chart).

Source: PMD & PolishedPrices

Executive Summary

Wrap the most precious goods in a transparent and fully regulated fund

Summary

•

The fund invests in the most liquid and standardised part of the polished diamond market;

similar to precious and industrial metals.

•

Conflict diamonds are systematically excluded, i.e.:

- no involvement in sourcing or trading rough diamonds and

- all polished diamonds purchased are accompanied by certificates from reputable

gemmological laboratories and can be traced to the source.

•

The fund carries maximum transparency as all prices are based on actual traded prices that

are provided daily by contractual brokers in the different market centres all over the world.

The price feeds/constituants are contributed on Bloomberg, Reuters and are publically

available.

•

«Real Assets» such as metals and diamonds will be in demand once the “reflation” trade of

central banks has to be unwound.

Investment Characteristics

•

Un-correlated to EQ, FI, FX and commodities.

•

Growth pattern similar to a synthetic bond (2% p.a. – 3% p.a.) due to the diversified portfolio.

•

Positive performance in the commodity and equity sell-off periods from 2008 – 2014.

16 Source: PMD & PolishedPrices

Important legal information

This document is destined exclusively for internal use by intermediaries appointed by Swiss & Global Asset Management and/or institutional or qualified investors and shall not be passed on

to third parties. Particularly, this document shall not be used as advertising material for public distribution or any other kind of public offering of funds, their sub-funds or

share categories. The responsibility for the further use of fund descriptions contained in this document lies solely with the intermediary.

The information in this document is given for information purposes only and does not qualify as investment advice. No liabili ty is assumed for the accuracy and completeness of the information. Opinions and assessments contained in this

document may change and reflect the point of view of Swiss & Global Asset Management in the current economic environment. Thi s document qualifies as marketing material. Investments should only be made after a thorough reading of the

current prospectus and/or the fund regulations, the Key Investor Information Document “KIID”, the articles of association, and the current annual and semi-annual reports (the “legal documents”), as well as after consulting an independent

finance and tax specialist. The legal documents can be obtained in hard copy and free of charge by calling [+41 58 426 60 00] or from the addresses indicated below. The value of the units and the return they generate can go down as well as

up. They both are affected by market volatility and by fluctuations in exchange rates. Swiss & Global Asset Management does not assume any liability for possible losses. The performance of past values and returns is no indicator of their

current or future development. The performance of values and returns does not include the fees and costs which may be charged when buying, selling and/or switching units. Swiss & Global Asset Management is not a member of the Julius

Baer Group. EU-harmonized funds qualifying as Part I funds of the Luxembourg law (Undertakings for Collective Investment in Transferable Securities, UCITS) are, as a general rule, registered for public offering in Luxembourg. Due to the

different registration proceedings, no guarantee can be given that each fund, sub-fund or share category is or will be registered in every jurisdiction and at the same time. Namely the funds of funds are registered exclusively in some of the

countries. You find an up-to-date registration list, on www.jbfundnet.com. As far as UCITS are registered for public offering in other countries, please refer to the country-specific information indicated below. Non-harmonised funds („nonUCITS“), such as funds under Swiss law, specialised investment funds („SIF“) as well as Part II funds under Luxembourg law, may not be eligible for sale in all jurisdictions or to certain categories of investors. Please note that in any

jurisdiction where a fund, sub-fund or share category is not registered for public offering, they may, subject to the applicable local regulation, only be sold in the course of private placement or institutional investments. Particularly, the funds are

not registered and, therefore, may not be offered for sale or be sold in the United States of America and their dependencies.

Particularities regarding Switzerland

The legal documents can be obtained in German, free of charge, from the following addresses: Funds according to Swiss law: Fund Management Company is Swiss & Global Asset Management Ltd., Hardstrasse 201, P.O. Box, CH-8037

Zurich, custodian bank is Bank Julius Bär & Co. AG, Bahnhofstrasse 36, Postfach, CH-8010 Zurich or RBC Investor Services Bank S.A., Esch-sur-Alzette, Zurich Branch, Badenerstrasse 567, CH-8048 Zurich or Royal Bank of Canada

(Suisse) SA, Rue François-Diday 6, CH-1204 Geneva or State Street Bank GmbH, München, Zurich branch, Beethovenstrasse 19, CH-8002 Zurich. Funds domiciled in Switzerland are admitted for public distribution and offering exclusively in

Switzerland. Representative in Switzerland for funds according to Luxembourg law: Swiss & Global Asset Management Ltd., Hardstrasse 201, Postfach, CH-8037 Zurich. Paying Agent: Bank Julius Baer & Co. AG, Bahnhofstrasse 36,

Postfach, CH-8010 Zurich.

Particularities regarding Germany

The legal documents can be obtained in German, free of charge, from the information agent. Paying Agent is DekaBank Deutsche Girozentrale, Hahnstrasse 55, D-60528 Frankfurt am Main; Information Agent is Swiss & Global Asset

Management Kapital AG, Taunusanlage 15, D-60325 Frankfurt am Main.

Particularities regarding Austria

The legal documents can be obtained in German, free of charge, from the paying and information agent: Erste Bank der oesterreichischen Sparkassen AG, Graben 21, A-1010 Vienna.

Particularities regarding the United Kingdom

As far as UCITS domiciled in Luxembourg described herein are recognised schemes under section 264 of the Financial Services and Markets Act 2000: Facilities Agent is GAM Sterling Management Limited, 20 King Street, London SW1Y

6QY. Copies of the legal documents can be obtained in English, free of charge, from the Facilities Agent or by Swiss & Global Asset Management (Luxembourg) S.A. - UK Branch, UK Establishment No. BR014702, 20 King Street, London

SW1Y 6QY (authorised and regulated by the Financial Conduct Authority). Investments in the funds are not protected by the Financial Services Compensation Scheme.

Particularities regarding Spain

The legal documents can be obtained in Spanish, free of charge, on the internet at www.jbfundnet.com. Registration number of the CNMV: Julius Baer Multibond (No. 200), Julius Baer Multicash (No. 201), Julius Baer Multistock (No. 202),

Julius Baer Multicooperation (No. 298), Julius Baer Multipartner (No. 421) and Julius Baer Special Funds (No. 1131).

Particularities regarding the Asia Pacific region

The funds mentioned herein are not authorised or registered for public sale in Asia Pacific. Therefore, no public marketing must be carried out for it in the region. In Hong Kong, the document is restricted to professional investors (as defined in

the Securities and Futures Ordinance (Cap. 571)) only. In Singapore, this material is limited to investors as defined in s. 305(5) of the Securities and Futures Act (Cap. 289)) ('SFA') only. The fund is not authorized by the Monetary Authority of

Singapore and Shares in the fund are not allowed to be offered to the retail public in Singapore; and any written material issued in connection with the offer is not a prospectus as defined in the SFA and, accordingly, statutory liability under the

SFA in relation to the content of prospectuses would not apply. This document may not be circulated or distributed to persons in Singapore other than (i) to an institutional investor specified in Section 304 of the SFA, (ii) to a relevant person, or

any person pursuant to Section 305(2), and in accordance with the conditions, specified in Section 305 of the SFA or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA. In Japan, the

funds mentioned herein are not registered for public sale or private placement pursuant to the Law on Investment Trusts and Investment Companies and shall not be disclosed publicly pursuant to the Financial Instruments and Exchange Law

(the "FIEL"). Therefore, none of the Shares of the funds mentioned herein may be solicited in Japan or to residents in Japan. This material is intended for circulation to professional, institutional and/or qualified investors only. Any person in

receipt of this material is not allowed to distribute it to residents in Japan nor communicate to residents in Japan about the fund mentioned herein. In other countries in Asia Pacific, this document is intended only for circulation to professional,

institutional and/or qualified investors (as defined in the jurisdiction of the reader).

Copyright © 2014 Swiss & Global Asset Management Ltd. – all rights reserved