Opportunities & Challenges of Fisheries Globalization

advertisement

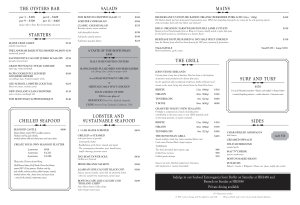

Selling Lobster in the U.S. Opportunities and Challenges U.S. Restaurant Industry ATLANTIC LOBSTER SUMMIT HALIFAX , NOVA SCOTIA October, 2007 Opportunities in the U.S. Market Darden Restaurants, Inc. Not Only at Red Lobster… Lobster Spaghetti Lobster & Shrimp Pasta 1st Red Lobster 1968 -- Lakeland, Florida Red Lobster Lobster Menu Offerings Lobster Fest Food & Beverage Spending $1.3 Trillion Commercial “Away from Home” $491 Billion 38% Restaurant Sales “Away from Home” $314 Billion “Food at Home” $778 Billion 61% Other Sales “Away from Home” $177 Billion Other $12 Billion 1% 2006 U.S. Restaurant Industry Sales $314 Billion Mid-Scale Quick Service Casual Dining Fine Dining Source: CREST & USDC U.S. Restaurant Growth 935,000 restaurants will hit $536.9 billion in sales in 2007 Restaurant Industry Sales (Billions of Current Dollars) $536.9 60% Increase in Last 10 Years $322.5 $199.7 $42.8 1970 1987 Source: National Restaurant Association 2007 Restaurant Industry Forecast 1997 2007 Est. 2006 U.S. Restaurant Industry Sales $314 Billion Mid-Scale $50B Quick Service $181B 58% Average Meal Price $5 Source: CREST & USDC 16% Average Meal Price $9 2006 U.S. Restaurant Industry Sales $314 Billion Quick Service $181B Mid-Scale $50B 16% Average Meal Price $9 58% Average Meal Price $5 Casual Dining $68B 21% Average Meal Price $15 Fine Dining $15B 5% Average Meal Price $30 Source: CREST & USDC Darden 8% Share of Casual Dining Restaurant Industry U.S. Lobster Market 9% 29% 62% Cold Source: National Marine Fishery Service Warm American North American Clawed Lobster Production 1982 – 2007 90,000 Metric Tons 80,000 70,000 60,000 50,000 40,000 30,000 82 84 86 88 90 92 94 96 98 00 02 04 06E Florida/Caribbean/Brazil Lobster Production Western Hemisphere 1982 - 2007 42,000 Metric Tons 40,000 38,000 36,000 34,000 32,000 30,000 82 84 86 88 90 92 94 96 98 00 02 04 06E Spiny Lobster Stock Status Regional Workshop on the Assessment and Management Status of Stock Countries of CaribbeanVenezuela Spiny Lobster (Panulirus Under Exploited (some areas) Fully-exploited or stable Over-Exploited Unknown argus) Puerto Rico & Virgin Isles; Turks and Caicos; U.S.A., Belize; Mexico, Costa Rica; Cuba; Antigua & Barbuda; Venezuela (some areas) Nicaragua; Jamaica; Dominican Republic; Brazil; Colombia; Honduras Martinique; Guadalupe; Haiti; Bahamas; other Lesser Antilles countries Global Seafood Procurement… Not Without Controversy Darden Environmental Trust Global Aquaculture -- Darden Actions Seafood Guides – United States • Audubon Society (http://seafood.audubon.org/seafood_wallet.pdf) • Blue Ocean Institute [Seafood MiniGuide: www.blueoceaninstitute.org] • Monterey Bay Aquarium [Seafood Watch Pocket Guide: www.seafoodwatch.org] • Environmental Defense [Seafood Selector: www.oceansalive.org] • NRDC [Mercury in Fish: www.nrdc.org] • Shedd Aquarium [Rite Bite Seafood Wallet Card: www.sheddaquarium.org] • Wildlife Conservation Society [Go Fish card: www.wcs/gofish.org] • Steinhart Aquarium [California Academy of Sciences Seafood Guide: www.calacademy.org] • ECHO Fund [Seafood Surveillance Card: www.echofund.org] • Eartheasy [Sustainable seafood guide: Standards/Certification Programs Global Aquaculture Alliance FAO & WHO/CODEX alimentarius commission International Standards Organization (ISO) Marine Stewardship Council Naturland Office international des épizooties (OIE) Safe Quality Food -- SQF WWF Agriculture, Fisheries and Conservation Department of Hong Kong/Accredited Fish Farm Scheme Alter-trade Japan BIO-GRO New Zealand BIO-Suisse Brand Canada Carrefour Quality Line Conseil ds appellations agroalimentaires du Québec (CAAQ)/Quebec Organic Reference Standard EurepGAP: Integrated Aquaculture Assurance Friends of the Sea Fundaciòn Chile IFOAM Label Rouge Marine Aquarium Council (MAC) Milieukeur NASAA National Code System for Responsible Aquaculture Quality Approved Scottish Salmon/Tartan Quality Mark Safe Quality Food Shrimp Seal of Quality Soil Association SPLAM Swiss Import Promotion Programme (SIPPO) Thai Quality Shrimp USDA USDA - Organic Whole Foods Global Global Global Global Global Global Global Global Hong Kong Japan, Indonesia New Zealand Switzerland Americas Internal Quebec Scotland Jamaica Chile International France International Netherlands Australian and South Pacific Canada Scotland Canada Bangladesh UK Malaysia Switzerland Thailand US US Internal Proposed Solutions -- Short Term The Role of International Organizations • Companies in the United States, Japan, European nations, and other developed nations work to reduce number of standards. – Effort should be led by international organizations such as the Food and Agriculture Organization of the United Nations Proposed Solutions -- LongTerm The Role of Governments • Consumer facing companies, production companies, and supply chain companies should petition their respective governments to enhance national laws pertaining to environment and social justice – For emerging nations, credibility of their laws and their enforcement is key to government supplanting private standard setting organizations • Partnerships can be developed with stakeholders, such as non-governmental organizations to avoid Summary of Market Opportunities and Challenges • The Casual Dining and Fine Dining segments of the U.S. restaurant industry will continue to grow • Increasing sales to the Casual Dining segment will require creative approaches where the average meal price is $15.00 • A static Western Hemisphere lobster resource is an opportunity tempered by consideration for consumers’ price