Chapter 6

advertisement

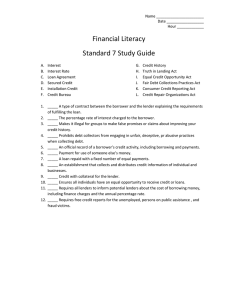

Chapter 8 Consumer Credit Question: What is credit? Is credit necessary/important? Why or why not? What type of things would you use credit for? The Importance of Consumer Credit to the U.S. Economy Credit: An arrangement to receive cash, goods, or services now and pay for them in the future Consumer Credit: Use of credit for personal needs. Creditor:An entity (bank, finance company, business, or individual)to which money is owed. Agrees to advance an individual the money, goods, or services. In turn the individual agrees to repay the creditor over a period of time Cont. Consumer Credit: Use of credit for personal needs Installment credit was introduced in the 1900’s as automobiles were introduced Especially helpful for expensive items Each installment includes part of the amount due on the purchase as well part of the cost of credit Major force in American Economy. Track consumer spending See Figure 1 pg. 226 Uses and Misuses of Credit Increases the amount of money you can spend now, however decreases the amount of money you will be able to spend in the future Factors to Consider Before Using Credit Finance: Give or get money for something See pg. 226 for list of things to consider before using credit Creditor may add to the purchase price, especially if you don’t pay your bill in full every month Interest: Periodic charge in exchange for the use of credit Make sure the benefit of using credit now outweigh the possible costs later Advantages of Credit Main advantage: Allows you to enjoy goods and services now (esp. if you have low funds) May get special deals or discounts if you pay your bills on time (store department credit cards) Often time only acceptable way to pay for services: Electric bill, telephone bill Often used for making reservations, renting a car, shopping by phone or internet Safer to use because don’t have to carry cash Disadvantages of Credit Temptation to overspend is greatest disadvantage Don’t buy things you can’t afford Could cause you to lose income or property Using credit does not mean you have more money, just delays payment Types of Credit Closed-end credit and open ended, both will be used sometime on your life Closed-End Credit Receive a one-time loan that you will pay back over a specified period of time and in payments or equal amounts For a specific purpose and involves a definite amount of money Mortgage, car payment, furniture, appliances Title: Document showing ownership to the item until all payments have been made Open-End Credit You borrow money for a variety of goods and services Company issuing the credit gives you a certain limit on the amount of money you can borrow Line of Credit: Maximum amount of money the creditor has made available to you (visa, MasterCard, store brand) Can make as many purchases as you wish as long as you stay below credit line Billed monthly for at least partial payment Sources of Consumer Credit Chart pg.231 Loans Borrowing money with an agreement to repay it along with interest, within a certain amount of time Inexpensive Loans Parents or family members are often common source May not charge any interest or very low interest May complicate family dynamics Medium-Priced Loans Usually moderate interest rates Get from commercial banks, creditunions, savings and loan associations Credit unions are often more patient and have better rates, because you are a member Expensive Loans Easiest to obtain, but will have the highest interest rates, often 15-25% Banks also offer cash advances, loans that are billed to charge account Usually higher interest rates on cash advances More expensive to take cash advance rather then use credit card Why are they the easiest to obtain? Home Equity Loans Based on the difference between the current market value of your home and the amount you still owe on the mortgage, interest you pay is tax deductible Should use these loans only for major items or emergency If you miss a payment, the lender can take your home Credit Cards Average cardholder has more than nine credit cards (bank, retail, gasoline, and telephone cards) Convenience Users: Those who pay off their balances in full each month Borrowers: Those who do not pay off their balances every month Grace Period: Time period during which no finance charges will be added to your account Finance Charge: Total dollar amount you pay to use credit, usually is you pay entire balance before due date you will not have to pay a finance charge See pg. 232 for “Choosing a Credit Card” tips Debit Cards Used for ATM’s and purchases Electronically deducts money from checking or savings account Cobranding Linking of a credit card with a business trade name offering points or premiums toward the purchase of a product or service Advantage to credit card? Very popular Smart Cards Plastic card with computer chip Stores 500 times more data then normal card Can combine credit card balances, drivers license, health care information, travel information Travel and Entertainment Cards (T&E Cards) Balance is due in full each month Diners club or American Express Section 8.2 Measuring the Cost of Credit and Obtaining Credit Can you Afford a Loan? Will you be able to afford all of your usual monthly expenses, plus a loan payment? Add all of your basic monthly expenses, then subtract the total from your takehome pay What could you give up to take out the loan? Could use the debt-payments-to-income ratio formula to decide if you can safely take on a loan Debt-Payments-to-Income Ratio The percentage of debt you have in relation to your net income Net Income: All income you receive Should spend no more then 20% of your net income on debt payments Monthly debt includes credit card and loan payments To figure: Divide your total monthly debt payments (except house payments) by your monthly net income If young, recommend staying under the 20% limit (Ideally 15%) The Cost of Credit 2 key factors will be finance charge and the annual percentage rate (APR) The Finance Charge and the APR Finance Charge: Total dollar amount you pay to use credit, normally paid for any unpaid balance Finance charge calculated using the APR Annual Percentage Rate: Shows how much credit costs you on a yearly basis, expressed as a percentage Ex: APR of 18% means you pay $18 per $100 you owe See fig. 6.4 for APR chart Truth in Lending Act says creditor must inform you in writing and before you sign anything of the finance charge and the APR Tackling the Trade-Offs Various decisions: Length of the loan, size of monthly payments, and the interest rate Term Versus Interest Costs: Choosing longer-term financing in exchange for smaller payments, disadvantage is you pay more interest. See pg. 236 Lender Risk Versus Interest Rate May prefer to have a down payment Lenders goal is to minimize risk Various ways to reduce lender risk…. Variable Interest Rate Based on changing rate in the banking system Interest rate you pay on your loan will vary from time to time Somewhat risky, recommend to avoid Secured Loan Receive a lower interest rate by pledging collateral Collateral: Form of security to help guarantee that the creditor will be repaid Ex: Savings, property, investments Pledged: What you promised as collateral. Lender can take if you fail to pay Up-Front Cash Lenders feel you have more of a stake in the loan if you put down a large down payment The bigger the down payment the more likely you are to get the loan The lower your credit score the more down payment you will need A Shorter Term Shorter the term of the loan, the less chance you will default on it Monthly payment will be higher Calculating the Cost of Credit Simple Interest Formula most commonly used. Based on the following: Principal*Rate*Time (computed only on the principle) Simple Interest on the Declining Balance: When simple interest loan is paid back in more than one payment, this method is used. You pay interest only on the principal you have not yet paid. The more payments you make the less interest you will pay (often used by credit unions) Cont. Add on interest: Interest calculated on the full amount of the original principal no matter how often you make payments. Longer you pay the loan the more interest you will pay Cost of Open-End Credit: Truth in lending act requires lender to let you know how the finance charge and APR will affect the cost Cost of Credit and Expected inflation: Each percentage increase in inflation decreases 1 percent of the cost of goods you can buy. Lenders try to let you know the expected inflation Continued Avoid the Minimum Monthly Payment Trap: Smallest amount you can pay and remain a borrower in good standing. Lenders often encourage this (why?) Ex: $500 charged at 19.8% per year. Minimum payment $21.67. Would take almost 2 years to pay off and additional $150 in interest Applying for Credit Most lenders establish credit policies on the 5 C’s of Credit Character, Capacity, Capital, Collateral, and Credit History 1) Character: Will you repay the loan Creditors want to know what kind of person they are lending money to May ask for references or check to see if you have had law trouble See pg. 241 for questions you may be asked 2) Capacity: Can you Repay the Loan? What income do you have, what debts do you already have? If you have large amounts of debt you may not get a loan See questions pg. 241 3) Capital: What are your Assets and Net Worth? Assets? Your capital is the amount of your assets that exceed your liabilities or the debts you owe Do you have savings or assets to sell to pay off the loan if needed Questions: What are your assets? What are your liabilities? 4) Collateral: What if you don’t repay the loan? What property and savings do you have? Creditor may take whatever you pledged as collateral See pg. 242 5) Conditions: what if your job is insecure? Economic conditions such as unemployment and recession can affect your ability to repay a loan Question focuses on security of your job and your company that employs you Credit Rating: Measure of a persons ability and willingness to make credit payments on time Credit Rating Factors that determine: Income, current debt, character, past debt payments If you have low debt and made payments on time you should be fine Pg. 242 Figure 5 See pg. 243 Figure 6 FICO and Vantagescore Info from credit report is used to calculate your FICO score Score ranges from 350-850 Higher the score the better Vantagescore: New scoring technique made by the 3 credit bureaus. More predictable for consumers. Ranges from 501-990. You want the 3 bureaus to be similiar Improving Credit Score 1st step is to review credit report to make sure its accurate Long-term responsibility is key Pay bills on time, lower balances, use credit wisely Some debt is good Credit and Equal Opportunity Equal Credit Opportunity Act states all credit applicants have the same basic rights Can’t discriminate based on age, race, nationality, sex marital status, etc. Age Can request you to state age on application If 18-21 (depending on state) creditor cant…. • Turn you down or decrease credit because of age • Ignore retirement income when rating • Close credit account because retired • Close after reaching certain age Public Assistance Can’t be denied because you receive Social Security or public assistance HOUSING LOANS Bans discrimination against you based on race or nationality of the people in a neighborhood known as REDLINING What if your Application is Denied? ECOA give you the right to know the reasons why you were denied for credit After you receive the denial you have 60 days to dispute anything on the report See figure 7 pg. 244 Your Credit Report Most lenders rely on them heavily Figure 8 pg. 246 Credit Bureaus Agency that collects information on how promptly people and businesses pay their bills Major Bureaus: Experian, Transunion, and Equifax Get info from banks, finance companies, stores, credit card companies, and lenders Also track payment habits and court records What’s in your Credit Files? Typically: Name, address, SSN, DOB May also include those items found on page 247 Every time you use a Credit Card the credit bureau is informed Fair Credit Reporting Fair Credit Reporting Act, enacted 1971 Requires deletion of out-of-date information and gives consumers access to their files as well as right to correct mistakes. Every 5 years, 10 if filed for bankruptcy Exceptions: If applying for more then $75,000 loan or $150,000 life insurance policy Legal Rights You have the right to sue a credit bureau or creditor that has cause you harm by not following rules established or filed wrongful claim Section 8-3 Protecting Your Credit Billing Errors and Disputes 1. 2. 3. 4. Even if you pay your bills all the time, errors may happen Billed Twice, lost payment Notify your creditor in writing and include any information that might support your case Pay portion of the bill not in question Creditor must acknowledge your letter within 30 days Within 2 billing periods (not longer than 90 days) creditor must adjust or tell you why it is correct If no errors are found you can be charged for the finance charges that accumulated Protecting your Credit Rating Creditor may not threaten your credit rating or do anything to damage your credit reputation while you’re negotiating a billing dispute Can’t take any action to collect the amount in question until your complaint has been answered Defective Goods and Services If used a credit card, and store will not accept a return you may call credit company and put a halt on the payment Identity Crisis: What to Do if your Identity is Stolen? Identity theft is the fastest growing major crime Identity Theft: Imposters using your personal information to commit fraud Often times don’t realize it happened till an inopportune time If victim…. Contact credit bureau, Contact creditors, file a police report Protecting your Credit from Theft of Loss Dumpster Divers, shred papers If believe someone got your account numbers, close account ASAP, get new pin numbers Tips: Make sure card is returned to you after a purchase, keep separate record of credit card numbers Contact CC Company immediately. $50 max if reported quickly. No responsiblility if reported before used Keeping Track of your Credit Don’t notice until something wrong Get a bill in the mail for accounts you didn’t open Suspicious activity on your credit accoun Steps to Protect Other Accounts Bank statements, checking account, atm Close immediately Get password only access Stop lost checks Get new pin if lose ATM Government Agency Protection If after taking the necessary steps you still have problems, contact the FTC Secret service has jurisdiction over financial fraud cases Often times your case is part of a bigger case May need a new Social Security # Credit Information on the Internet Internet may be the most important part to everyday life Investing, banking shopping Use secure sites/browsers Keep records of transactions Review all statements Read privacy and security policy Keep personal information to yourself Never give password Don’t download files from strangers Co-signing a loan Take time to think it over Co-signing: Agreeing to be responsible for loan payments if the other party fails to make them Lender would not take a risk on the person, that’s why the co-signer is needed. Are you willing to risk that? Negative feedback can appear on both your record and the borrowers Pg. 254 list Complaining About Consumer Credit If you feel lender is not following laws, first try to contact the lender After that follow consumer protection laws Consumer Credit Protection Laws If banks can’t help, get in contact with the Federal Reserve If take legal action, be aware of the following credit protection laws: 1. 2. 3. Truth in Lending and Consumer Leasing Acts: If fails to issue information or gives inaccurate information, you can sue for any money loss you suffer, also permits class action lawsuits Equal Credit Opportunity Act: Discrimination suits, sue for actual plus punitive damages up to $10,000 Fair Credit Billing Act: If don’t follow rules for correcting billing erros they will automatically give up the amount owed on the item in question and any finance charges on it, up to $50. May charge for actual damages plus twice the amount of any finance charge Cont. 4) Fair Credit Reporting Act: May sue any credit bureau that violates the rules regarding access to your credit records to that fails to correct errors in your credit file. Actual and punitive damages apply. 5) Consumer Credit Reporting Reform Act: Places the burden of proof for accurate credit information on the credit bureau rather than to you 6) Credit Card Act: 2009 act that est. clear practices for extending credit to consumers (list pg. 255) Your Rights Under Consumer Credit Laws 1. 2. 3. If you feel you have been refused because of discrimination: Complain to the creditor, let them know you know the law File a complaint with the government Sue the creditor as a last resort (actual damages, punitive, and fees) Section 6-4 Managing your Debts Warning Signs of Debt Problems Some people who appear to have a lot of money are actually barely keeping their head above water. Main problem is financial immaturity (lack self-discipline and impulses) Financial Trouble Warning Signs You make only the minimum monthly payment on credit cards Your having trouble making the minimum monthly payment The total balance on your credit card increases every month You miss loan payments or often pay late You use saving to pay for necessities You receive second or third payment notices from creditors You borrow money to pay off old debt You exceed the credit limits on your credit cards You have been denied for credit because of a bad credit report *If you experience 2 or more of these, consider your spending habits Debt Collection Practices Fair Debt Collection Practices Act: Prohibits certain practices by debt collectors Debt Collectors: Businesses that collect debts for creditors Financial Counseling Services Can try to work out payment plans with creditors Or contact a nonprofit financial counseling program Consumer Credit Counseling Service Nonprofit organization affiliated with the National Foundation for Consumer Credit Provide debt counseling services for families and individuals with serious financial problems. May charge small fee Divided into 2 parts: 1) helping families with debt problems by helping them setup a realistic budget (2) Helping people prevent indebtedness by teaching them the importance of budget planning, unwise credit buying, and encouraging credit institutions from withholding credit from them Other Counseling Services Universities, Credit Unions, Military Bases, some banks Debt Counselors of America Declaring Personal Bankruptcy Legal process in which some or all of the assets of a debtor are distributed among the creditors because the debtor is unable to pay his or her debts. May also include a repayment plan based on installments (Last Resort) See Figure 6.10 pg 190 The U.S. Bankruptcy Act of 1978 Majority of U.S. Bankruptcy are filed under Chapter 7 (straight Bankruptcy) others Chapter 13 (wager earner plan bankruptcy) Chapter 7 Bankruptcy Required to draw up a petition listing his or her assets and liabilities Debtor: Person who files for relief under the bankruptcy code. Submits petition to U.S. District court and pays a fee Assets Protected: Social Security Payments, unemployment compensation, net value of your home, vehicle, household goods and appliances, tools used for work, and books Still must pay alimony, child support, fines, some educational loans, and debts you fail to disclose Chapter 13 Bankruptcy If you have a regular income, propose a plan for using future earnings to eliminate debt over time Usually keep all or most property Plan can be as long as 5 years, makes payments to a representative who then distributes the payments to creditors The Bankruptcy Abuse Prevention and Consumer Protection Passed in 2005 by President Bush Government financial educational curriculum program to increase awareness in American citizens Debtors must take course Effects of Bankruptcy Some people actually say they have an easier time obtaining credit after they file for bankruptcy Easier for chapter 13 filers Kept on file for 10 years