Understanding a Credit Card

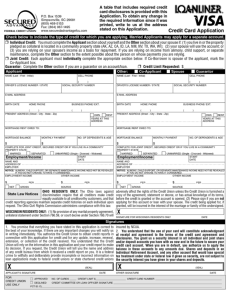

advertisement