Introduction to Public Private Partnerships

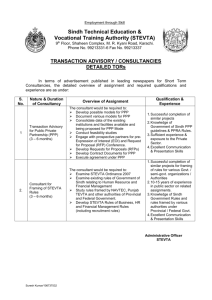

advertisement

Introduction to Public Private Partnerships; Where and How to Select Investments CHINCA – 22 June 2011 Ian Laing, Partner, Pinsent Masons About me • Advised exclusively on PPP projects for over 12 years. • Advised on over 50 PPP projects with a total value of over US$ 15 billion • Diverse range of sectors from roads and rail to renewables and waste water treatment facilities • Specialist in advising equity investors and those involved in infrastructure related joint ventures • Have advised parties at all levels within the “traditional” PPP structure • Part of a United Nations team (through UNECE) developing a “PPP Toolkit” for emerging markets. • Currently advising Chinese investors on US$ 7 billion of international PPP investments What is PPP? • Public Private Partnership • Many forms of a partnership between public and private sectors depending on the political environment, the nature of the assets and the level of private sector participation. • Adopted internationally across Europe and worldwide DesignBuild DesignBuildMaintain DesignBuildOperate DesignBuildOperateMaintain BuildOwnOperateMaintain Public Responsibility BuildOwnOperate Private Responsibility Service Contracts Management contracts Lease Concession Existing Services and Facilities Divestiture What is a PPP? • There is no one model for PPP. There are many possibilities. • PPP is not a defined procurement model with a common understanding across the world. When a project is described as a PPP, do not make assumptions as to what that means! • PPP is not simply a means of accessing private. Many forms of PPP involve no capital investment by the private sector. • Different models of PPP have gained popularity in different jurisdictions. • When reference is made to PPP, people are generally referring to private finance models so that is what we will focus on today. PPP is not….. • PPP is not the same as EPC Contracting (it requires a fundamentally different approach). • PPP is not EPC Contracting with some additional tasks (it requires a fundamentally different approach). If approached in a compartmentalised way, you will be at a disadvantage. Sectors where PPP has been successful • PPPs have been successful in many sectors where service outputs can be described objectively and are capable of verification. • PPPs are suitable for both primary and social infrastructure although in emerging markets generally limited to primary infrastructure (power, water and transportation). • Not suitable where technology is likely to change rapidly over the life of the contract (so PPPs in the IT sector are generally not considered to have been successful). Key Features of a “Good” PPP Project • A contractual arrangement between the public sector and a private entity to provide a public service (not an asset) based on: – Substantial risk transfer to the private sector; – An output specification stating the desired output quality and quantity; – Performance related rewards (payment depends on standards being met); and – Whole life costing (a balance between construction and maintenance costs). How to Identify PPP Opportunities • Many PPP projects are “solicited” government projects advertised in official journals or gazettes. • Some are “unsolicited” if legal framework allows. Unsolicited market opportunities are: – difficult to identify remotely; – require on the ground market knowledge • Many PPPs are announced and only some of them proceed (particularly true in Asia). • Less is more. PPP Structural Scorecard Macro management Vietnam Capital market support Philippines Subsidy management Malaysia Competent Regulators Lao PDR Failure support Unit Indonesia Law Cambodia Policy Bangladesh Pipeline/VMF No action Contingencies Partially developed MTEF Well developed Institutional framework Factors Influencing PPP Model Success • The 3 Ps – “pipeline, pipeline and pipeline”. • Integration with the fiscal management of the jurisdiction. • Strong institutional framework (including a strong PPP unit and the necessary legal framework). • An influential “champion” and political support essential (as line ministries are comfortable with traditional procurement) • A suitable regulatory environment and competent regulators. • Macro fiscal management that accounts for contingencies and operational costs. • Good concession design (duration of concessions). • Ability of bidders to respond to opportunity. Link to Fiscal Policy is Important Some success Little Success Success of PPP Program Much Success = South Africa Portugal South Korea UK Victoria (Australia) The Philippines Bangladesh Jamaica Not Located in Treasury Outside of But Directly Advisory to Treasury Located in Treasury Why use a PPP model? BENEFITS DISADVANTAGES • Bring in private capital and make projects affordable • Budgetary certainty and avoiding “soft budgetary constraint” • Whole life costing and synergies of integration of DBF and M • Maximise use of private sector skills • Public sector only pays when services delivered • Quality of service has to be maintained • Accountability • Ensures that assets are properly maintained •Strong Customer Service orientation • Long term relatively inflexible structures • Procurement delays and high procurement costs • Loss of management control by the public sector • Private sector has higher cost of finance • Does not achieve absolute risk transfer • Requires public sector capacity and skills that may not be available • Potential for negative public reaction to profit and control Basic Contractual Structure for Project Finance Direct Agreement Authority Project Agreement Direct Agreement Sponsors Subordinated Loans Equity Subordinated Loans Senior Debt Funder Construction Contract Construction Contract Guarantor Senior Debt Facility Project Company Holding Company Equity Construction/EPC Contract Operating Sub-Contract Guarantee Operating Contract Operating Contract Guarantor How to invest in a PPP project? • • • • • Necessary to determine where in the contractual matrix you want to enter the market. It is possible to fulfil more than one role. Common for international contractors to undertake EPC work and invest in the Project Company. If investor and contractor: – the potential for conflict of interest must be managed – the expectations of international partners will be for arms length relationships. Relative “value” of contracting and investing has been a significant driver of change for European Contractors. Understand market specific risks • Relief Events and Compensation Events – very limited protection and significant risk transfer compared to “standard” EPC contracting • Caps on liability high • Performance security robust • Change in Law • Indexation • Fit for purpose • Return as an investor often linked to matters that may feel outside your control Understand Sector Specific Risks - Demand • Standard & Poors study shows significant optimisation bias. Of 32 projects studied, traffic was on average only 70% of the forecast. • Traffic forecasting by lenders proved to be more accurate (traffic was 82% of their forecast) • “Measuring inaccuracy in traffic demand forecasting” looked at 210 projects over 30 years and showed rail projects overestimated demand by an average of 106%. Roads performed better but 1 in 4 projects still overestimated by more than 40%. • Willingness to pay may also present a difficulty particularly if there is no history of payment for the service (particular problem for water sector but also can apply to transport). How to submit a winning tender? • Whole life cost NPV/lowest tariff so; – ensure that risk is assumed by the party best able to manage it (assumption of risk by equity is generally expensive and represents poor value for money). – ensure that risk is priced once only. Integration of the legal, financial and technical advisers is essential. • Be careful to understand affordability criteria and evaluation criteria (as well as any underlying weighting). • Understand that in many jurisdictions transferring risk back to the public sector will either lead to disqualification or a risk weighting whereby the Employer will add the cost (estimated by him) to your price. What is the future for PPPs Reasons to be confused…… I know I am feeling bullish about Asia right now but… 1. 2. 3. 4. 5. What – sectors? Where – jurisdictions? When – timing? How – what role? Global trend impact – i.e. the Asian megacities? Regional “complex procurement” opportunities • Power, transport and (to a lesser extent) water • Social infrastructure • PPP as a driver for growth in the regional infrastructure market • ………..but moving to • Opportunities for Chinese outbound • Opportunities for Western inbound • Philippines and Indonesia • Vietnam Working hard to make it easier LONDON DUBAI BEIJING SHANGHAI HONG KONG SINGAPORE OTHER UK LOCATIONS: BIRMINGHAM BRISTOL EDINBURGH GLASGOW LEEDS MANCHESTER Pinsent Masons LLP is a limited liability partnership registered in England & Wales (registered number: OC333653) and regulated by the Solicitors Regulation Authority. The word 'partner', used in relation to the LLP, refers to a member of the LLP or an employee or consultant of the LLP or any affiliated firm who is a lawyer with equivalent standing and qualifications. A list of the members of the LLP, and of those non-members who are designated as partners, is displayed at the LLP's registered office: CityPoint, One Ropemaker Street, London, EC2Y 9AH, United Kingdom. We use 'Pinsent Masons' to refer to Pinsent Masons LLP and affiliated entities that practise under the name 'Pinsent Masons' or a name that incorporates those words. Reference to 'Pinsent Masons' is to Pinsent Masons LLP and/or one or more of those affiliated entities as the context requires. For important regul atory information please visit: www.pinsentmasons.com. © Pinsent Masons LLP 2008 www.pinsentmasons.com