Victoria – Unique Energy Market

advertisement

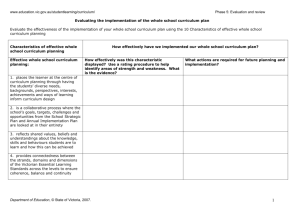

Victorian Energy Overview June 2010 Victoria – Unique Energy Market • • • • • • Large Reserves of Brown Coal – 500 years No Black Coal Offshore Natural Gas ~ 25 years Good wind resources Privatised Energy Market Many Assets Owned by International companies New Investments, wind, gas peaker, coal & solar Loy Yang A Hazelwood VENCorp Yallourn Loy Yang B Southern Hydro Snowy Mountains Scheme SP AusNet Powercor Jemena Ecogen AGL Interstate and other Generators Australian Energy Market Commission / Australian Energy Regulator Citipower United Energy Consumers of electricity have been able to choose their own electricity retailer since 13/1/2002. SP AusNet Regulated / Non-regulated Pricing • GENERATORS – Many – Less than 10 – Prices NOT regulated, can make or lose lots of money • TRANSMISSION – One only – Monopoly – Regulated, about a 6.8% Real Rate of Return (RROR) • DISTRIBUTION – Five – Regulated, about a 6.8% Real Rate of Return (RROR) • RETAILERS – Many – about 14 at present – Prices monitored, but NOT regulated, can make or lose lots of money Electricity and gas transmission MurrayLink +/- 220 MW Victorian Electrical Network Summer Peak ~10,300 MW Winter Peak ~7,500 MW Interconnection With SA 300 MW from SA Interconnection with Snowy/NSW 1900 MW from Snowy Major Load Major Generation Interconnection with Tas Electricity generating capacity in Victoria Natural Gas Solar Biomass Renewables Wind Hydro Brown Coal Total Electricity Generating Capacity 10,000 MW Total Renewable Generating Capacity 1,000 MW Technology Cost of Power 200 150 $ per MWh 100 CCS CPRS REC 50 0 Brown Coal Black Coal -50 -100 Closed Open Cycle Cycle Gas Gas Wind Geothermal Nuclear Solar Principal Power Stations Power Station Company MW Units Type Year Loy Yang A Great Energy Alliance Co 2100 525 x 4 Steam/Coal 1984/87 Tokyo Electric Hazelwood International Power – UK 1600 200x8 Steam/Coal 1964/71 Yallourn ‘W’ Yallourn Energy - CLP 1450 350x2 Steam/Coal 1973/75 375x2 1981/82 Loy Yang B International Power, Mitsui 1000 500x2 Steam/Coal 1993/96 Morwell Energy Brix 170 20x1 Steam/Coal 1958 30x3 Steam/Coal 1958/59 60x1 Steam/Coal 1962 Newport Ecogen Energy 510 500x1 Steam/Gas 1980 Jeeralang Ecogen Energy 468 57x4 Gas Turbine 1979 80x3 Latrobe Valley International Power, Mitsui 300 50x5 Gas Turbine 2002 Somerton AGL 150 150x1 Gas Turbine 2002 Wholesale Price Variation http://www.nemmco.com.au/mms/GRAPHS/INDEX.HT Regulatory System Australian Energy Market Operator (AEMO) The ‘manager’ of the market http://www.aemo.com.au Australian Energy Regulator (AER) The ‘regulator’, guidelines and price determination http://www.aer.gov.au Australian Energy market Commission (AEMC) The ‘rule maker’ http://www.aemc.gov.au http://www.aer.gov.au/content/index.phtml/tag/AERMarketSnapshot/ Average annual wholesale prices (March ’10) - $/MWh 19 98 -1 99 9 19 99 -2 00 0 20 00 -2 00 1 20 01 -2 00 2 20 02 -2 00 3 20 03 -2 00 4 20 04 -2 00 5 20 05 -2 00 6 20 06 -2 00 7 20 07 -2 00 8 20 08 -2 00 9 20 09 -2 01 0 NOMINAL $/MWh Victorian Wholesale Power Prices - In NOMINAL $/MWh 60 50 40 30 20 10 0 Years Energy Support Programs Commonwealth Government • • • • $1.6B renewable energy funds, including the $1.5B Solar Flagships $2.4B clean coal fund $50 million geothermal drilling program fund 45,000GWh of renewable energy certificates (eRET) Victoria State Government • • • $110m ETIS2 funds for CCS demonstration $72m ETIS2 funds for renewables demonstration $100m large scale solar power station Renewable Energy Target (RET) • Commonwealth Program / Policy • Changes in March 2010 – Yet to be legislated • Split into large scale (wind) and small scale (solar etc,.) • Large scale 41,000 GWh (~4500MW) by 2020 – Market to set the price • Small scale unlimited, set price of $40/MWh – To be reviewed in 2014 CPRS -5% Permit Price CPRS -5% Permit Price Planning Issues • • • • • • • • • Victorian Parliamentary review underway Need to plan well ahead Grid connections can take three years Some planning aspects two years Wind is particularly slow Flora/Fauna studies can be seasonal, requiring 12 months – Orange bellied parrots, legless lizards, growling frogs Parallel planning (environment / building planning / finance) – Fastest but is costly if projects don’t proceed Wind planning 100% (>2,000MW) over subscribed But is the policy there to give you certainty? Land reserved under the National Parks Act (1975) Victorian Wind Atlas Wind Speed (metres/second) 8 7 6 Wind Speed (metres/second) 5 4 Angahook – Otway Investigation 66 kV electricity network 220 kV electricity network 330 kV electricity network 500 kV electricity network Terminal station Substation Operating wind farm Wind Projects Status http://new.dpi.vic.gov.au/energy/projects-research-and-development/wind-projects Offshore Wind > 300 m • • Victoria’s coastal waters are deep compared to countries with installed offshore wind energy With current technologies, offshore wind energy is not commercially viable in Victoria 0 – 40 m Wave Energy • Victoria has excellent wave resources, particularly along the Western coast Mean Average Wave Energy (kW per metre) 20 to 50 10 to 20 0 to 10 Biofuels • • • • • • Victoria - 2005 Biofuels’ Action Plan – $5m biofuels infrastructure fund Mandates in NSW, Manildra, not in Vic’ review in 2010 Food vs Fuel, vs beer, wine, meat – – – – – http://en.wikipedia.org/wiki/Fuel_vs_food If move beer crops to food……. Energy cost in a packet of corn flakes, high fuel prices give more impact US President: Only 85% of cost increase fuel related (2008) 70% of USA crops for meat Australian input limits Need 2nd generation, cellulosic, straws, pasture grasses etc,. – Commonwealth - $12m, over three years….. Water and conditions tolerable opportunities – We have a lot of marginal land that could be used, (and improved) Biofuels Geothermal Feed in Tariffs (FiT) • • • • • Victorian legislation 1:1 Nett FiT for up to 100kW of renewables – Solar or wind or hydro – Liable party is the retailer – Cost passed through to all customers Victorian Premiuim Nett FiT for up to 5kW of solar. Solar specific. – Liable party is the distributor, cost passed through to all customers No Gross FiT, considered too expensive – NSW just announced a Gross PFiT up to 10kW, $500m No national consistency – Introduced state by state No energy efficiency FiT, for example for high efficiency combined heat and power VEET – Energy Saver Incentive (ESI) • • • • • Electricity and Gas retailers are liable – Three year phases, starting 1 Jan 2009 2.7MT CO2e per year (Vic’ total 110MT/y) Domestic only Six prescribed activities so far, more can be added – • Add a small amount to all bills Water heating, Space heating, Space conditioning (insulation, thermally efficient windows and weather sealing products), Lighting, Shower roses, Refrigerators/freezers Who pays? – All customers http://www.esc.vic.gov.au/public/VEET/ Energy Resource Efficiency Program (EREP) Mother of EREP was Industry Greenhouse Program (IGP) • At the end of 2007, IGP had delivered: – – – Cuts of 1.23 MTCO2e/year Savings to business of $38.2 million each year Average payback period was 20 months EREP • • • • 100 TJ of energy and/or 120 ML of water 250 liable companies in Victoria. They use 700 petajoules of energy and 300 gigalitres of water a year. 45% of Victoria's energy use, annual water consumption of around 1.5 million average Victorian households. Is this enough for energy efficiency? – Not sure, would like to look at the 2nd tier energy users http://www.epa.vic.gov.au/bus/erep Web Links • • • • • • • • • Sustainability Victoria http://www.sustainability.vic.gov.au/www/html/1517-home-page.asp Department of Primary Industries www.dpi.vic.gov.au http://www.dpi.vic.gov.au/dpi/dpinenergy.nsf/Home+Page/Energy~Hom e+Page?open Department of Sustainability and Environment www.dse.vic.gov.au Department of Premier and Cabinet www.dpc.vic.gov.au Thank You Leigh Clemow Regional Development Victoria Tel + 61 3 9651 9260 leigh.clemow@rdv.vic.gov.au