Factors Affecting the Decision of BOT Projects

advertisement

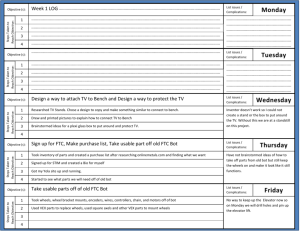

KING FAHD UNIVERSITY OF PETROLEUM & MINERALS BUILD OPERATE TRANSFER (BOT) PORJECTS DECISION FACTORS, RISKS, AND SUCCESS FACTORS BY ALAA BAQER ALBESHER g201001280 Dr. Soliman Almohawis 1. Abstract: The build-operate-transfer (BOT) mechanism is being used increasingly by governments to promote diverse infrastructure projects worldwide because of its advantages. This mechanism has different delivery variations depending on the occasion or depending on the host country. Also, there are many factors that affect the decision on whether to pursue a project or not. These factors need to be assessed to identify the feasibility of the project. The key for a successful implementation of any project is considering the risks associated with the project and anticipate solutions for them. Risks involved in BOT projects will be described in this paper. In addition, the critical success factors that a BOT tender must have to be successful will be described at this paper. 1 2. Table of Content: 1. Abstract 1 2. Table of Content 2 3. Introduction 4 3.1 What is BOT? 4 3.2 Types of BOT 4 3.3 Need for BOT 6 3.4 Advantages of BOT 7 4. Factors Affecting the Decision of BOT Projects 8 4.1 Country level 8 4.2 Project level 8 4.3 Decision under uncertainty 10 4.4 Decision sequence 10 4.5 Multiple alternatives 10 5.6 Multiple interests 11 5. Risks Involved in BOT Projects 12 5.1 Political Risk 12 5.2 Financial Risk 12 5.3 Operation Risk 12 5.4 Construction Risk 13 5.5 Market Risk 13 6. Critical Success Factors for BOT Projects (CSFs) 15 6.1 CSF 1: Entrepreneurship and Leadership 15 6.2 CSF 2: Right Project Identification 17 6.3 CSF 3: Strength of the consortium 18 2 6.4 CSF 4: Technical Solution Advantage 19 6.5 CSF 5: Financial Package Differentiation 19 6.6 CSF 6: Differentiation in Guarantees 19 7. Conclusion 21 8. References 22 3 3. Introduction: 3.1 What is BOT? The build-operate-transfer (BOT) project delivery method is being used increasingly by governments for many infrastructure projects. This scheme consist of a private sponsor finances, designs, builds, and operates a project for a specific time called concession period. The private sponsor recovers his investment and earns profit by operating the project during the concession period. When the concession period ends, the ownership of the project is transferred to the government (Schaufelberger and Wipadapisut 2003). BOT scheme is an integrated approach where the sponsor is required to select a viable project to develop, form a consortium company, prepare a proposal to win a contract for the project, design, finance, construct, own, operate the project for a concession period, and then transfer the project ownership to the government (Salman et al. 2007). The first successful modern BOT project was used in 1834 and completed in 1868 when the European capital supported the Egyptian government financially to build the Suez Canal (Algarni et al. 2007). 3.2 Types of BOT: There are different variations for BOT projects used on different occasions. These variations include: Build-own-operate (BOO): the ownership is possessed by the private entity and there is no obligation for the owner to transfer it back to the government. Build-transfer-operate (BTO): the ownership is transferred to the government before the start of operation by the private sponsor. Therefore, the sponsor earn by 4 either operating the facility during the concession period by getting certain payment or by collecting the revenue from users. Build-lease-own (BLO): the ownership of the facility is for the private sponsor after completion of construction and the sponsor leases the facility to the government. There is no transfer to the government in this BOT type. The government is responsible for the operation and maintenance of the facility in this type of BOT. Build-lease-transfer (BLT): this is different from BLO because the ownership is transferred to the government after the concession period. During the concession period, the private sponsor leases the facility to the government to collect revenue. Build-operate and renewal of the concession (BOR): this is a standard BOT but the private sponsor has the right to negotiate for renewal of the concession period after it ends (Algarni et al. 2007). There are more variations for BOT in different countries including: Design-build-operate-maintain (BDOM): this type has been used in North America for transportation projects. Design-build-finance-operate (DBFO): this type has been used for road projects in the UK where the revenue is taken from the government/sponsor instead of directly from the users. Build-own-operate-transfer (BOOT): this has been used in building the Olympic Stadium in Sydney and also has been used in the new Docklands sports stadium in Melbourne (Kumaraswamy and Morris 2002). 5 3.3 Need for BOT: After World War II, most public projects were built under the financing of government. However, due to remarkable changes in the 1980s especially in developing countries, different method was needed. These remarkable changes include: Infrastructure upgrade need because the growth of population and the growth of economy. Downturn of oil business made major international companies looking for creative approaches to promote projects. Developing countries had growing debts that prevent them from borrowing money which led to limited budgetary resources. Different countries in addition to the international lending institutions became interested in privatization of traditional public projects. Therefore, BOT is needed and popular especially in developing countries (Algarni et al. 2007). To emphasize the need for BOT projects not only in developing countries, we would take the United States as an example. A recent report from ASCE (ASCE 2005), regarding America’s infrastructure, gave the United States grade (D). On that report, grades were given on the basis of funding versus need, condition, and capacity. The report from ASCE concluded that $1.6 trillion in needed for the coming 5 years to improve the infrastructure condition in the United States. This huge need for improvement in the infrastructure needs large and immediate investment which is not available from public agencies. This situation of insufficient funds from public agencies makes it necessary to find innovative financing alternatives such as BOT (Algarni et al. 2007). 6 3.4 Advantages of BOT: There are several advantages from the BOT scheme which make it desirable: The reduction of public borrowing and improvement of host government credit rating by using private financing to provide capital sources. The ability to promote projects development which otherwise would have to wait for sovereign resources. The use of private sponsor would improve the efficiency of operation. Taking the risk of project from public sector. Training personal of hosting government and develop markets. Establish benchmark to compare similar public projects for enhancement (Askar and Gab-Allah 2002). BOT method had increased its popularity because of its success and because of its advantages. This drove governments and private investors to chase BOT projects without in depth studying of the feasibility of the projects. This rush pursue of projects led to suspension or demise of important projects and sometimes to the bankruptcy of involved contractors. Therefore, an accurate feasibility study must be carried out to determine the risks involved in proposed projects to develop successful BOT project (Salman et al. 2007). 7 4. Factors Affecting the Decision of BOT Projects: To ensure the success of a BOT project, the host country government should guarantee a helpful environment to BOT project delivery method. To achieve this status, an assessment of BOT feasibility factors must be carried out on the country level and the project level. 4.1 Country level: Government and investors need to evaluate the factors which make the host country attractive to foreign investors. Four main categories with twenty three country-related decision factors were collected and classified by (Salmanvet al. 2007). These four categories are political and legal, financial and commercial, economical, and environmental. These factors cannot be altered in a short period of time. Therefore, national government or regional agencies need to take steps to encourage private sector investment and decrease the negative impact of existing obstacles in the area when they decide to adopt a BOT strategy (Salman et al. 2007). 4.2 Project level: There are twenty one decision factors to assess the viability of a BOT project and there are three main levels; BOT project viability, three major categories (legal and environmental, technical, and financial and commercial), and the relevant attributes the three major categories. Figure 1 displays the flowchart of BOT project feasibility study for both the country and the project levels (Salman et al. 2007). 8 Fig.1: Flow chart for country and project BOT feasibility analysis (Salman et al. 2007) 9 As mentioned earlier, there are a lot of factors affecting the decision of BOT project. We will focus here on four factors. These four factors are decision under uncertainty, decision sequence, multiple alternatives, and multiple interests. A detailed description of the four factors is below. 4.3 Decision under uncertainty: At the early stage of identifying viable project, the information available is restricted. Moreover, there is also limited time for sponsors to investigate more information regarding the project. Most BOT proposals are required to be submitted within 150-180 days after the issue of the request for proposal (RFP). This gives the sponsors around a month to decide if they would take the project or not despite any doubts. 4.4 Decision sequence: There are a number of sequential decisions that need to be taken by the BOT sponsors. These decisions are; “Is a project good enough to choose? How big can the project be? How much money is needed? How much money can be borrowed based on the prospective revenue from the project? And Is it necessary to enhance project credit quality to borrow more money for the project?”. 4.5 Multiple alternatives: BOT project sponsors need a good decision methodology to prevent them from spending money on unacceptable projects. However, they should have a positive outlook when they evaluate prospective projects. By doing so, this will maintain the continuous growth and improve opportunities. As a fact, there is no insurance a BOT project will be successful. So, 10 sponsors must prepare different strategic alternatives and prepare plans for negotiations to allow for enhancing the feasibility of the project by reducing the impact of risk factors. 4.6 Multiple interests: There are several participants in a BOT project with different interests. Therefore, project sponsors must carefully check if a project will satisfy the interests of all participants and still be profitable. There are two entities that must be satisfied in particular; public agencies and financial institutions. Generally, these two entities interests are expressed in their proposal evaluation guidelines (Ock et al. 2005). 11 5. Risks Involved in BOT Projects: As a known fact, there are risks in any project. Therefore, after deciding the project is feasible and the sponsors decided to go for it. They must consider the major risks which they will face. These risks are political, financial, operational, construction, and market risks. Let us consider these risks in further details. 5.1 Political risk: The source of political risk is the potential of political events to occur such as war, revolution, tax code revisions, export restrictions, expropriation of assets, and any government action which could influence the project profitability. These type of risks are more significant in developing countries where the political status is not stable and polices are affected by changing governments. 5.2 Financial risk: The source of financial risk is oscillations in exchange rates between currencies, interest rates, and inflation. The risk of exchange rates is higher in developing countries because of rapid inflation. 5.3 Operation risk: This risk is related to the operation cost after the project is completed. The reason for this risk is the probability of actual operation and maintenance costs to exceed the planned figures. Another reason is the unanticipated operation costs which would affect the profitability of the project. 12 5.4 Construction risk: This risk is mainly related to the delays of project completion and cost overruns. The causes of delays could be technical problems, poor management, or might be both reasons combined together. The delay will affect the investment because the generation of revenue will be delayed until the completion and operation of the project. 5.5 Market risk: This risk contains two factors; a demand risk and a price risk. The first factor which is the demand risk is the doubt of demand regarding the project products or services. The second factor which is the price risk is related to the actual price that could be charged for the project products or services. In addition, the price might be forced by the host government like in toll road charges. John Schaurelberger and Isr Wipadapisut did a study of thirteen BOT projects in North America and Asia. The thirteen projects are in two categories; transportation projects and power generation projects. They analyse the projects and the result indicated that construction and operation risks were more manageable compared to the other three types of risks. The project sponsors of the thirteen projects handled the two risks, construction and operation, almost the same way. They contracted out the responsibilities and used advanced technology. Political, financial, and market risks were more difficult to manage. Political risks were low in the United States and Canada where there are good legislative regulations and strong government support. On the other hand, projects in Southeast Asia and China have high political risks because of the lack of legislative regulations and government support. 13 The financial condition of the host country was one of the main factors for financial risk. The other factor is the availability of financial resources. The result is low financial risks for projects in the United States and Canada because of the financial stability of the government and the accessibility to finance resources. In contrast, the financial risk is high in Southeast Asia because of the economic condition of the host countries and also high in China but because of limited financial resources. The main factors for market risks are the market demand, competition, purchase agreements, and government guarantees. Power generations projects have low market risks because there is a fixed fee agreed upon by the government side. For transportation projects, this risk is high because the forecasted need might not be achieved (Schaufelberger and Wipadapisut 2003). 14 6. Critical Success Factors for BOT Projects (CSFs): As seen in the previous section of this research, winning a BOT contract is not easy. The process is difficult and it needs time and money. Moreover, the risks are high and making the decision is complicated. There are six critical success factors (CSFs) that are very important for BOT sponsors to win the BOT contract. The importance of these six factors is agreed upon from both the government and sponsors. The six critical success factors are: 1. Entrepreneurship and leadership. 2. Right project identification. 3. Strength of the consortium. 4. Technical solution advantage. 5. Financial package differentiation. 6. Differentiation in guarantees. If these six factors are combined and given continued attention, the chances to win a BOT contract would be enhanced. These factors would be discussed in details (Tiong 1996). 6.1 CSF 1: Entrepreneurship and Leadership: Entrepreneurship for BOT projects could be defined as “the pursuit of opportunities beyond the financial and technical resources that the entrepreneur currently possesses”. Early BOT projects were pursued and contracted by either entrepreneurs or entrepreneurial corporations. Examples of the early BOT projects are Sydney harbour tunnel project in Australia, the Channel Tunnel in the United Kingdom and France, Shajiao ‘B’ power plant in China, and Eastern Harbour Crossing in Hong Kong. There are three sub factors of entrepreneurship in the perspective of BOT projects. These three sub factors are calculated risk taker, cultivating goodwill with host government, and leadership of a key entrepreneur or leading contractor. 15 The last sub factor, which is leadership of a key entrepreneur or leading contractor, is the most critical sub factor. The other two sub factors share the same importance. These three sub factors are explained in more details in the following section. Calculated risk taker: As mentioned in previous sections that there are risks involved in BOT projects. Therefore, the ability to win a BOT contract is related to the developer ability to retain the risks involved and offer guarantees. For example, risks of completion and cost overruns for traditional projects are the responsibility of the government. However, the responsibility is on the sponsors with BOT projects so they must prepare themselves to retain the risks. Cultivating goodwill with host government: This sub factor has special importance in developing and third World countries because the concept of BOT and foreign sponsors are not used to in these countries. Therefore, the BOT sponsors need to cultivate goodwill with the host country government to gain their trust. After gaining the trust and respect of the host government, the BOT sponsors can educate them of the essential characteristics of the BOT concept and also they can promote a longterm relationship by having a successful BOT project. Leadership of a key entrepreneur or leading contractor: As mentioned earlier, this is the most critical sub factor among the three sub factors for CSF 1. This sub factor states that an entrepreneur or a high level executive like a CEO must be supported by the board of directors and must be authorized to access other divisions. This person will be the key project champion who would deal with the government. This champion will be responsible for cultivating goodwill with the host government (sub factor 16 2). He is the front line negotiator of the team towards the host government. That is way this is the most critical sub factor. 6.2 CSF 2: Right Project Identification: Choosing the right project to pursue is very important factor for successful BOT project. There are so many projects that governments have opened for private sector to undertake. Therefore, the private sector must be extremely cautious in choosing the right project to pursue. There are four sub factors in this CSF which are; “accurate prediction of need, ideal candidate as a privatized project, potential to achieve near monopoly, and lack of funds by host government”. The most critical sub factor among the four sub factors is the accurate prediction of need. These four sub factors are explained in more details in the following section. Accurate prediction of need: Project sponsors must ensure the project is needed. For instance, to take tolled facility project, traffic congestion especially in rush hours and alternatives roads must be assessed to ensure the need for the project before accepting it. Another example is power plant projects, insurance of electricity shortage to meet domestic need must be demonstrated before accepting the project. Ideal candidate as a privatized project: BOT projects sponsors must ensure necessary factors are implemented for a successful private project. These factors include the existence of enabling legislation in the host country, polices regarding the proposed properties, the number of invited developers, the existence of strong capital markets, and the clear economic rationale of the project. 17 Potential to achieve near monopoly: There should be a near-monopoly situation in the service or product area. This means that bridges or tunnels with no other alternative crossing way are more feasible compared to roads where there is a traffic diversion. Lack of funds by host government: When the host government has lack of funds and also need the project as fast as possible, this combination will cause the government to be more responsive to the private sponsors proposals. In contrast, if the government has enough funds it might not need private sponsors to take charge of projects. 6.3 CSF 3: Strength of the consortium: The consortium must be strong in order to win the project contract. The sub factors needed to form a strong consortium are perseverance and financial strength, and a multidisciplinary and multinational team. Perseverance and financial strength: The consortium must be able to keep on and must have financially capable members to face the huge development costs. In addition, the consortium must have professional and personal characteristics in order to have perseverance and staying power. Theses professional and personal characteristics are acceptance of common goal, ability for analysis of country parameters, effective negotiation strategy, desire to take the project with the purpose to succeed, capacity to mix disappointment with improved rigor, and flexibility in relation and submerging of potential conflicts of interests. 18 A multidisciplinary and multinational team: A combination of various skills and talents is necessary in forming a strong consortium to study the requirements of a BOT project. This strong consortium must be formed from the beginning to perform the environmental impact study, traffic study, design, and other functions. The consortium team must consist of qualified professionals with technical and financial skills. 6.4 CSF 4: Technical Solution Advantage: An imaginative technical solution must provide a cost effective and simple solution using technology to meet the project requirements. This factor will generate a competitive advantage against other offers. This factor will also make the proposal attractive to the host government. There are other factors that would give extra advantages like shorter construction period, good environmental impact, and public safety. 6.5 CSF 5: Financial Package Differentiation: Financial package provides cost advantage which differentiates the proposal from other competing proposals. There are four elements that make the cost advantage sound and competitive. These four elements are low construction costs, acceptable tariff levels, reasonable equity to debt ratio, and short concession period of the project. The acceptable tariff level is the most important element among the other four elements. 6.6 CSF 6: Differentiation in Guarantees: Almost in every winning BOT project proposal, there is an imaginative or risk-taking element that makes the proposal unique. This uniqueness in the proposal is the result of special 19 features or guarantees that differentiate it from other proposals. There are two sub factors in this CSF which are contractual guarantees and imaginative features. Contractual Guarantees: There are two types of guarantees in BOT projects. The first are guarantees provided by the host government and the second are guarantees offered by the project sponsors. The guarantees offered by the project sponsors to differentiate their proposal are minimum and stable tool increases, standby credit, fixed interest rates, and revenues and profits sharing with host government. Governments support is important however they do not want to provide financial guarantees and be seen. Therefore, the proposal with the lowest guarantees requirements from government side has a positive differentiation. Special Features: There are two main themes for special features. The first theme demonstrates the humanity of the project sponsors and show they do not come for only profit taking. The second theme addresses the fears that the host government might have about the project. The host government might fear foreign ownership of local companies, overpricing, or hidden development gain. These fears must be identified and negotiated in early stages (Tiong 1996). 20 7. Conclusion: Infrastructure is essential for the quality of life. Because of the changes in economics, technology, and size of projects in recent decades, a viable mechanism was necessary to take charge of important projects in transportation, power generation, and other areas. BOT has emerged as a valid and adequate option to build infrastructure projects with private financing especially in developing countries. There are so many factors that affect the decision for BOT sponsors on either to take certain projects or not. There are some factors on the country level and there are some other factors on the project level. After deciding the project is feasible, the private sponsors must assess the risks involved with the project to anticipate solutions for them. There are political, financial, operation, construction, and market risks that need to be assessed carefully. Learning from others experience is very important especially when mistakes’ cost is very high, bankruptcy for example. Therefore, six critical success factors were studied at the end of the paper in order to enhance the chances of winning a contract and do it successfully. 21 8. References: Algarni, A. M., Arditi, D., and Polat, G. (2007). “Build-operate-transfer in infrastructure projects in the United States.” J. Constr. Eng. Manage., 728-735. Askar, M. M., and Gab-Allah, A. A. (2002). “Problems facing parties involved in build, operate, and transport projects in Egypt.” J. Manage. Eng., 173-178. Kumaraswamy, M. M., and Morris, D. A. (2002). “Build-operate-transfer-type procurement in Asian megaprojects.” J. Constr. Eng. Manage., 93-102. Ock, J. H., Han, S. H., Park, H. K., and Diekmann, J. E. (2005). “Improving decision quality: a risk-based go/no-go decision for build-operate-transfer (BOT) projects.” J. Civ. Eng. 32: 517-532. Salman, A. F. M., Skibniewski, M. J., and Basha, I. (2007). “BOT viability model for largescale infrastructure projects.” J. Constr. Eng. Manage., 50-63. Schaufelberger, J. E., and Wipadapisut, I. (2003). “Alternate financing strategies for buildoperate-transfer projects.” J. Constr. Eng. Manage., 205-213. Tiong, R. L. K. (1996). “CSFs in competitive tendering and negotiation model for BOT projects.” J. Constr. Eng. Manage., 122(3), 205-211. 22