Setting expected profits equal to zero and solving for the interest rate

advertisement

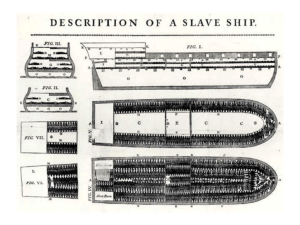

Development Economics ECON 4915 Lecture 12 Andreas Kotsadam Outline • Questions from you on corruption. • Long run effects of the slave trade (Nunn and Wantchekon 2009) • Recap, recap, and recap. Questions from you on corruption • When can corruption be good for economic development? • What is the relationship between inequality, institutions, development and corruption? Nunn and Wantchekon (2009) • Research question: Did the slave trade cause a persistent culture of mistrust? Interesting? Yes, long run effects of slavery. Culture and development. The origins of trust. Test the causal mechanisms behind the results in Nunn (2008). Original? Yes, their causal channel has not been credibly tested before. Feasible? Yes, by collecting innovative data and using IV. Why would slave trade affect trust today? • Early in the slave trade, slaves were primarily captured through state organized raids and warfare. • By the end of the trade individuals - even friends and family members - began to turn on one another, kidnapping, tricking, and selling each other into slavery. • This environment, where everyone had to constantly be on guard against being sold or tricked into slavery by those around them, generates a culture of mistrust. But why do we find these effects today? • Using ‘rules-of-thumb’ can be an optimal strategy in environments where information acquisition is either costly or imperfect. • These rules-of-thumb evolve according to which norms yield the highest payoff. • ”Our view is that in areas more exposed to the slave trade, rules-of-thumb or beliefs based on the mistrust of others would have been more beneficial relative to norms of trust and therefore would have become more prevalent over time.” Cultural transmission • For the explanation to work the culture must be transmitted over time or cultural change and social learning must occur slowly. • Note that these aspects are not tested in the paper and in that sense cultural transmission is still a black box. Data: Afrobarometer contains questions on trust. Data: Ethnicity level slave exports. • The country-level estimates are constructed by combining data on the total number of slaves shipped from all ports and regions of Africa with data on the ethnic origins of slaves shipped from Africa. • The individual samples are originally from a variety of historical records, such as slave runaway notices, plantation inventories, marriage records, death records, etc. Data: Ethnicity level slave exports. • The ethnic groups in the historic documents are matched to a common classification scheme and linked to the map provided by Murdock (1959). Estimation OLS: i, individuals e, ethnic groups, d, districts, c, countries. Basic results Problem • Less trusting groups may have been more likely to be taken during the slave trade and they continue to be less trusting today for other reasons. IV • We need an instrument that is correlated with slave exports, but uncorrelated with any characteristics of the ethnic groups that may affect trust today. • Historic distance of each ethnic group from the coast is used as an instrument for the number of slaves taken during the slave trade. Validity • The critical issue is whether an ethnic group’s historic distance from the coast is correlated with factors other than the slave trade that may affect how trusting the ethnic group is today. • What is the most obvious problem? Validity • Controlling for current distance to the coast, identification will be driven by the effect of the slave trade on the trust of individuals that live in a location different from their ancestors. • These may be different types of people, but they show that, if anything, are more trusting. Results • The first stage shows that the instrument is relevant and that slave exports is primarily explained by historic distance rather than current distance from the coast. • The second stage estimates show similar magnitudes as OLS. • Hence, OLS is likely not biased. Falsification tests • “As is generally the case with instruments, it is possible that despite our second stage controls, our instrument still does not satisfy the necessary exclusion restriction. For this reason, we also perform a number of falsification exercises to assess the validity of our identification strategy.” Falsification tests • If the assumption is satisfied, then we should not observe a similar positive relationship between distance from the coast and trust in the parts of the world where the slave trade did not occur. • They find no relationship between distance from the coast and trust outside of Africa. • Or in African countries not affected by the slave trade. Mechanisms • Are people less trusting today via the evolution of vertically transmitted norms? • Or because the slave trade damaged the institutions so that people are less trusty due to e.g. weak rule of law? Test • They create a measure quantifies the number of slaves that were taken from the geographic location where the individual is living today. • If the slave trade affects trust through internal factors, then mistrust should be correlated with the extent to which their ancestors were heavily impacted by the slave trade. • If the slave trade affects trust through its deterioration of domestic institutions, then mistrust should be correlated with whether the external environment that the individual is living in today was heavily impacted by the slave trade. Result • Both factors are significant but the magnitude of the internal channel is approximately twice the magnitude of the external channel. External validity • “it is important to keep in mind that all of the results in the paper apply only to the 17 subSahara African countries included in our sample. The effects of the slave trade for the countries not included in our analysis may be different from the effects we estimate here.” • What about other shocks? Slave trade in Norway. What about the mechanisms? Recap • Email me if you want something specific covered during next lecture. Rural credit markets • You should have some thoughts about: Why the poor often cannot borrow on the formal market. Why the poor pay so much interest on their loans, if they are able to borrow. The role of institutions. What can be done to improve the situation. Why is credit important? • Credit is needed for efficient production as well as smoothing out consumption. Production requires investments. Income streams often fluctuate. There are two basic (and related) problems • Moral hazard: Lenders cannot monitor the actions of the borrowers. • Adverse selection: Lenders cannot distinguish between borrowers with different characteristics. These problems are severe for formal lenders • They don´t have personal knowledge regarding the clients. • They cannot monitor how the loans are used. • Limited liability implies that borrowers take to much risk or default voluntarily. • Collaterals may solve this problem, but this is infeasible for the poorest. Characteristics of rural credit markets • Information problems (also for informal lenders) leading to: • High interest rates. • Segmentation. • Interlinkage. • Interest rate variation. • Rationing. • Exclusivity. Lender’s risk hypothesis for informal lending Assume perfect competition. Let L= Loan amount, r= Lender’s opportunity cost, p= Fraction of loans repaid, and i= Interest rate. The expected profit of the lender is therefore: p(1 i)L (1 r )L Setting expected profits equal to zero and solving for the interest rate gives: 1 r i 1 p Main lesson of the model • Hence, even under competition informal sector interest rates are very sensitive to the default risk. • But is it true? True with an important twist • Looking at data it is obvious that defaults are quite rare in rural credit markets. • So, this mechanism of potential default is largely circumvented but this is costly. • This cost is basically what drives the observed high interest rates. • And since some of these costs are fixed, small loans demand a higher interest rate. Information assymetries and rationing • Information assymetries may cause credit rationing as lenders are not able to fully observe if a borrower is of high or low risk. • Too high interest rates may drive away the low risk type of borrowers. • It may therefore be optimal to have a lower interest rate and a higher probability of receiving the money back. Now we know the theory behind: • Why interest rates are high. • Why there is credit rationing. • It all has to do with information asymmetries in the following way: Adverse selection and moral hazard • Adverse selection: If banks raise interest rates the project mix will become riskier. • Moral hazard: If interest rates increase, borrowers themselves choose more risky projects and/or put in less effort to repay. Typical exam question • 1a) Theoretically, informal sector interest rates are very sensitive to the default risk even under perfect competition. Show this using the lender’s risk hypothesis, discuss the implications and relevance. (5 points) Another possible exam question • Credit rationing: What is it? Why does it occur, in particular, why doesn’t the lender just raise the interest to lend out more? Explain intuitively how information asymmetries may cause credit rationing. Policies • A nice (but not so simple) solution would be to build up good institutions and eliminate poverty. • In the meantime, we have covered: Government intervention to expand credit (Burgess and Pande 2005). Microfinance (Banarjee and Duflo 2010). Typical exam question • 2a) Give some arguments for and against the idea that a state led expansion of rural banks should reduce poverty (2 points). • 2b) If we are interested in the effects of rural banks on poverty, why is it a bad idea to draw conclusions by simply comparing poverty in areas that have banks to poverty in areas that do not have banks? (1 point) Typical exam question • 2c) Burgess and Pande (2005) instead use a policy rule in India between 1977 and 1990 that forced banks who wanted to open in a location that already had banks to open banks in four areas that had no banks. In particular, they exploit the trend reversals between 1977 and 1990 and between 1990 and 2000 (relative to the 19611977 trend) in the relationship between a state's initial financial development and rural branch expansion as instruments for branch openings in rural unbanked locations. What arguments are provided for using these instruments? (4 points) Typical exam question • 2d) What are their conclusion and how can it be criticized? (3 points) Their conclusion • “We provide robust evidence that opening branches in rural unbanked locations in India was associated with reduction in rural poverty.” Critical questions • Have they really showed that rural banks matter or just that this policy had effects? • Does it matter that the bank openings were not randomly assigned? • Is the result generalizable to other contexts? • Do we know why the reform had an effect? • What about the long term effects? • Was it cost effective? Typical exam question • 3a) Banarjee and Duflo (2010) define microcredit as innovations that lower the administrative cost of making small loans. Describe these innovations and discuss their advantages and disadvantages (5 points). Some innovations and mechanisms • • • • • Dynamic incentives. Group liability. Repayment frequency and social interactions. Simplified collection technology. Temptation and self-control. Dynamic incentives. • Default implies a lost opportunity of larger loans in the future. • Theoretically, dynamic incentives cannot work alone… • … and competition may undermine them. Group liability. • Default by one member hurts the other members. • This should make clients invest in screening and monitoring. • But the drawback may be too little risk-taking. • Empirical evidence suggests joint liability is not the driving factor. Repayment frequency and social interactions. • Weekly repayment is the typical time period. • Evidence suggest that longer time periods are better for investment… • …but worse for default. • Compatible with a social capital story, which actually recieves empirical support. Simplified collection technology. • The costs of collecting the loans are very low. • Loan officers are able to collect payments from many people each day and it becomes very easy. Temptation and self-control. • What if borrowers have self control problems? Wouldn’t easy credit make this worse? • It actually seems to be the other way around: microcredit helps people commit to a savings plan. • But is it the best way to achieve commitment? Insurance • The problem of risk. • Why doesn’t insurance markets work well? • What can be done? To reduce risk, smoothing of consumption is necessary • How smooth consumption? • One way is via credit. • We have already seen that this is not very easy. • Another way is via self-insurance. Typical exam question • 4b) If we have data on individuals in a village and we observe that the change in consumption perfectly follows the change in village income and is completely unrelated to changes in income at the household level. Is this evidence of perfect insurance? (3 points) Natural resources • Overview (Frankel) • Institutions (Mehlum et al) Poosible exam question • Kenya has found oil. Discuss why this could make us fearful.