Notes in Tax on Corporations

advertisement

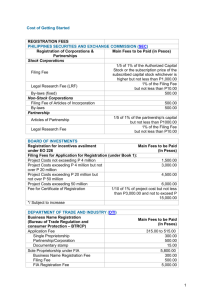

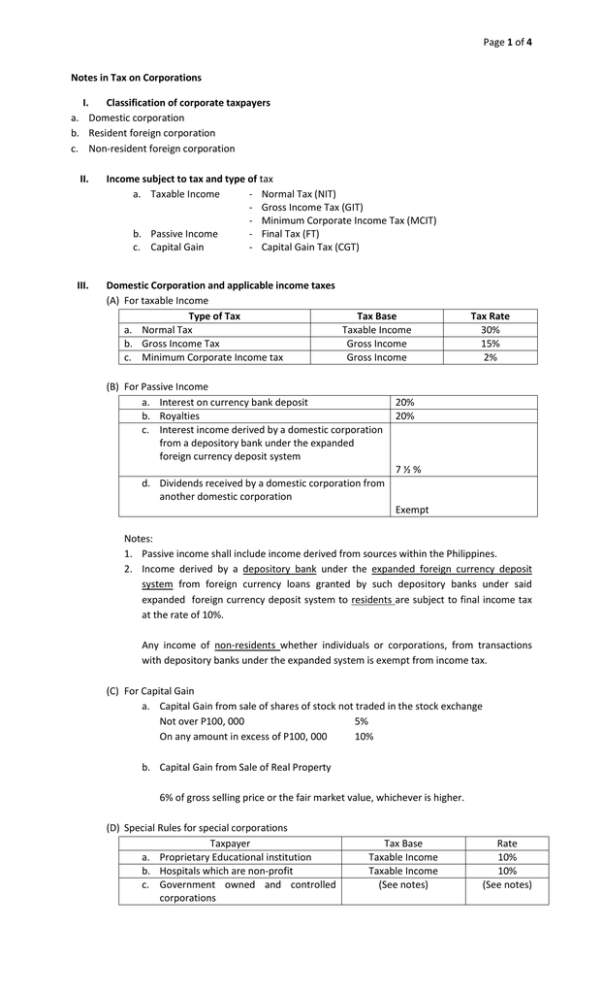

Page 1 of 4 Notes in Tax on Corporations I. Classification of corporate taxpayers a. Domestic corporation b. Resident foreign corporation c. Non-resident foreign corporation II. Income subject to tax and type of tax a. Taxable Income - Normal Tax (NIT) - Gross Income Tax (GIT) - Minimum Corporate Income Tax (MCIT) b. Passive Income - Final Tax (FT) c. Capital Gain - Capital Gain Tax (CGT) III. Domestic Corporation and applicable income taxes (A) For taxable Income Type of Tax Tax Base a. Normal Tax Taxable Income b. Gross Income Tax Gross Income c. Minimum Corporate Income tax Gross Income (B) For Passive Income a. Interest on currency bank deposit b. Royalties c. Interest income derived by a domestic corporation from a depository bank under the expanded foreign currency deposit system Tax Rate 30% 15% 2% 20% 20% 7½% d. Dividends received by a domestic corporation from another domestic corporation Exempt Notes: 1. Passive income shall include income derived from sources within the Philippines. 2. Income derived by a depository bank under the expanded foreign currency deposit system from foreign currency loans granted by such depository banks under said expanded foreign currency deposit system to residents are subject to final income tax at the rate of 10%. Any income of non-residents whether individuals or corporations, from transactions with depository banks under the expanded system is exempt from income tax. (C) For Capital Gain a. Capital Gain from sale of shares of stock not traded in the stock exchange Not over P100, 000 5% On any amount in excess of P100, 000 10% b. Capital Gain from Sale of Real Property 6% of gross selling price or the fair market value, whichever is higher. (D) Special Rules for special corporations Taxpayer a. Proprietary Educational institution b. Hospitals which are non-profit c. Government owned and controlled corporations Tax Base Taxable Income Taxable Income (See notes) Rate 10% 10% (See notes) Page 2 of 4 Notes: 1. If the gross income from unrelated trade, business or other activity of a proprietary educational institution or non-profit hospital exceeds 50% of the total gross income derived by such educational institutions or hospitals from all sources, the tax prescribed on ordinary corporations shall be imposed on the entire taxable income. The term “unrelated trade or business or other activity” means any trade, business or other activity, the conduct of which is not substantially related to the exercise or performance by such educational institution or hospital or its primary purpose or function. 2. Government owned or controlled corporations are subject to the same tax imposed on ordinary corporations engaged in similar business or industry. The following government owned or controlled corporations are exempt from income tax: a. Government Service Insurance System (GSIS) b. Social Security System (SSS) c. Philippine Health Insurance Corporation (PHIC) d. Philippine Charity Sweepstakes Office (PCSO) IV. Resident foreign corporation and applicable income taxes (A) For taxable income Type of Tax Tax Base a. Normal Tax Taxable Income b. Gross Income Tax Gross Income c. Minimum Corporate Income tax Gross Income Tax Rate 30% 15% 2% Notes: 1. Taxable income shall include income derived from sources within. 2. Rules on GIT applicable to domestic corporations are also applicable to resident foreign corporations. 3. Rules on MCIT applicable to domestic corporations are also applicable to resident foreign corporations. 4. Branch profit remittance tax. Any profit remitted by a branch to its head office shall be subjected to a tax of 15% which shall be based on the total profits applied or earmarked for remittance without any deduction for the tax component thereof. Interests, dividends, rents, royalties, including remuneration for technical services, salaries, wages, premiums, annuities, emoluments, or other fixed or determinable annual, periodic or casual gains, profits, income or capital gains received by a foreign corporation during each taxable year from all sources within the Philippines shall not be treated as branch profits unless the same are effectively connected with the conduct of its trade or business in the Philippines. (B) For Passive Income a. Interest on currency bank deposit b. Royalties c. Interest income derived by a domestic corporation from a depository bank under the expanded foreign currency deposit system 20% 20% 7½% d. Dividends received by a domestic corporation from another domestic corporation Exempt Page 3 of 4 Notes: 3. Passive income shall include income derived from sources within the Philippines. 4. Income derived by a depository bank under the expanded foreign currency deposit system from foreign currency loans granted by such depository banks under said expanded foreign currency deposit system to residents are subject to final income tax at the rate of 10%. Any income of non-residents whether individuals or corporations, from transactions with depository banks under the expanded system is exempt from income tax. (C) For Capital Gain a. Capital Gain from sale of shares of stock not traded in the stock exchange Not over P100, 000 5% On any amount in excess of P100, 000 10% b. Capital Gain from Sale of Real Property 6% of gross selling price or the fair market value, whichever is higher. (D) Special rules for special corporations Taxpayer a. International carrier doing business in the Philippines b. Regional or area headquarters of Multinational Companies c. Regional operating headquarters of Multinational Companies V. Tax Base Gross Philippine Billings Exempt Rate 2½% Exempt Taxable Income 10% Non-resident foreign corporation and applicable income taxes (A) For Taxable Income Taxable Income Interests, dividends, rents, royalties. Salaries, premiums (except reinsurance premiums), annuities, emoluments or other fixed or determinable annual periodic or casual gains, profits and income and capital gains, except capital gains subject to CGT Tax Base Tax Rate Gross Income 30% Notes: 1. Taxable income shall include income derived from sources within. 2. Rules on GIT applicable to domestic corporations are not applicable to non-resident foreign corporations. Rules on MCIT applicable to domestic corporations are not applicable to nonresident foreign corporations (B) For passive income a. Interest on foreign loans b. Dividends received from a domestic corporation 20% 15% Note: Passive income shall include income derived from sources within the Philippines. (C) For Capital Gain a. Capita Gain from sale of shares of stock not traded in the stock exchange Not over P100, 000 5% On any amount in excess of P100, 000 10% Page 4 of 4 b. Capital Gain from Sale of Real Property 6% of gross selling price or the fair market value, whichever is higher (D) Special Rules for special corporations Taxpayer a. Non-resident Cinematographic Film Owner, Lessor or Distributor b. Non-resident Owner or Lessor of Vessels Chartered by Philippine Nationals c. Non-resident owner or lessor or aircraft, machineries and other equipment VI. Tax Base Rate Gross Income Gross rental, lease or charter fees Gross rental fees 25% 4½% 7½% Improperly accumulated earnings tax (IAE Tax) Improperly accumulated taxable income 10% Notes: 1. Improperly accumulated taxable income is computed using the following formula: Taxable Income xx Add: Income exempt from tax xx Income excluded from gross Income xx Income subject to final tax xx Amount of net operating loss carry over deducted xx Less: Dividends actually or constructively paid xx Income tax paid for the taxable year xx Amount reserved for the reasonable needs of the business emanating from the covered year’s taxable income (Revenue regulation) xx Improperly accumulated Income xx 2. Improperly accumulated earnings tax shall be imposed on every corporation formed or availed for the purpose of avoiding income tax with respect to its shareholders or the shareholders of any other corporation by permitting earnings and profits to accumulate instead of being divided or distributed. 3. The fact that the earnings or profits of a corporation are permitted to accumulate beyond the reasonable needs of the business shall be determined of the purpose to avoid the tax upon its shareholders or members unless the corporation proves to the contrary. 4. The term ‘reasonable needs of the business’ means reasonably anticipated needs of the business. 5. The fact that any corporation is a mere holding company or investment company shall be a prima facie evidence of a purpose to avoid the tax upon its shareholders or members. 6. The Improperly Accumulated Earnings Tax does not apply to the following corporations: a. Banks and other non-bank financial intermediaries. b. Insurance companies. c. Publicly-held corporations d. Taxable partnerships. e. General Professional partnerships. f. Non-taxable joint ventures g. Enterprise duly registered with the Philippine Economic Zone Authority (PEZA) under R.A. 7961 and enterprises registered pursuant to the Bases Conversion and Development Act of 1992 under R.S. 7227. ***Nothing Follows***