Chapter 2 PowerPoint

advertisement

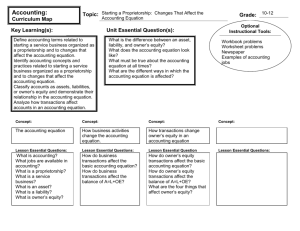

Chapter 2: Starting a Proprietorship: Changes that Affect Owner’s Equity Chapter 2 Objectives: Define accounting terms related to changes that affect owner’s equity for a service business organized as a proprietorship. Identify accounting concepts and practices related to changes that affect owner’s equity for a service business organized as a proprietorship. Analyze changes in an accounting equation that affect owner’s equity for a service business organized as a proprietorship. Prepare a balance sheet for a service business organized as a proprietorship from information in an accounting equation. Read page 24 together in class. NEW OWNER’S EQUITY ACCOUNTS Revenue Expenses Withdrawals Investments Sale on Account (aka Accounts Receivable, A/R) Transaction: A business activity that changes assets, liabilities, or owner’s equity. Each Transaction in this chapter will change owner’s equity: – Receive cash from sales – Sell services on account – Pay cash for rent and phone bill – Receive cash on account – Pay cash to owner for personal use Receiving Cash from Sales A transaction for the sale of goods or services results in an increase in the owner’s equity. – This is called REVENUE When cash is received from a sale, assets and OE are increased Interest paid on a savings account and an investment by the owner is NOT revenue. – Has to be BUSINESS operation $$ Sold Services on Account Sale on Account – a sale for which cash will be received at a later date – Aka: charge sale – THIS IS NOT THE SAME AS A CREDIT CARD SALE In Encore Music example, Barbara gives lessons to kids at a daycare. The daycare is allowed to pay at the end of the month for all of the hours Barbara put in – this is SERVICES ON ACCOUNT New Asset Account: Accounts Receivable Accounts Receivable (A/R) – Regardless of when the money is received, the revenue should be recorded at the time of the sale • This concept is called REALIZATION OF REVENUE Selling on Account – Both A/R and Owner’s Equity are increased REVENUE TRANSACTIONS increase OE Transaction 6 August 12. Received cash from sales, $325.00. Transaction 7 August 12. Sold services on account to Kids Time, $200.00. Lesson 2-1, page 26 Paying for Expenses Expense – A decrease in owner’s equity resulting from the operation of a business – Rent – Advertising – Donations to non-profit organizations – Equipment rentals Cash is decreased, as well as Owner’s Equity PAID CASH FOR EXPENSES Decrease OE Transaction 8 August 12. Paid cash for rent, $250.00. Transaction 9 August 12. Paid cash for telephone bill, $45.00. Lesson 2-1, page 27 Receiving Cash on Account When a company receives cash from a customer for a prior sale, it increases the cash balance and decreases the accounts receivable. Paying Cash to the Owner for Personal Use Withdrawals – assets taken out of a business for the owner’s personal use – Decrease owner’s equity – Can decrease any asset, but usually Assets A decrease in owner’s equity because of a withdrawal is not a result of the normal operations of a business. – Withdrawals are NOT expenses – Can be for simply paying him/herself OTHER TRANSACTIONS Transaction 10 August 12. Received cash on account from Kids Time, $100.00. –100 (withdrawal) Transaction 11 August 12. Paid cash to owner for personal use, $100.00. Lesson 2-1, page 28 Summary: The Owner’s Capital Account Expenses - Revenue + Withdrawals - Investment + Sale on Account + SUMMARY OF CHANGES IN OWNER’S EQUITY Transaction Number Change in Owner’s Equity Kind of Transaction 6 7 8 9 11 Revenue (cash) Revenue (on account) Expense (rent) Expense (telephone) Withdrawal +325.00 +200.00 –250.00 –45.00 –100.00 Net change in owner’s equity +130.00 Lesson 2-1, page 28 TO DO: Work Together, pg 29 On your own, pg 29 Ch 2-2: Reporting a Changed Accounting Equation on a Balance Sheet A balance sheet reports the business’s financial condition ON A SPECIFIC DATE: Assets, Liabilities, Owner’s Equity. May be prepared at any time. **Most businesses prepare a balance sheet on the last day of the month** Provide business owners, managers with frequent, regular info for making business decisions. The ‘total’ lines MUST be on the same line – Skip a line if needed to make them line up horizontally BALANCE SHEET PREPARATION 1. Write the heading. 2. Prepare the assets section. 3. Prepare the liabilities section. 4. Prepare the owner’s equity section. 5. Add and compare the totals. 6. Rule single lines. 7. Write the totals. 8. Rule double lines. 1 2 3 4 5 6 7 8 Lesson 2-2, page 30 TERMS REVIEW revenue sale on account expense withdrawals TO DO: Work Together, pg 31 On your own, pg 31 App 2-1, 2-2, 2-3 – Page 33-35 CHAPTER 2 QUIZ – TUESDAY!!! Lesson 2-1, page 29