In-Service Introductory Presentations

advertisement

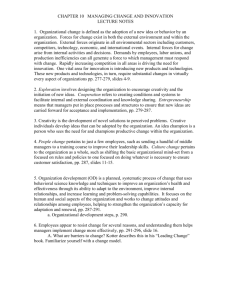

LOCAL GOVERNMENT IN-SERVICE DECEMBER 15-16, 2011 In-Service Design Committee: Alan Probst Local Government Center Steven Deller Ag & Applied Econ Kate Lawton Local Government Center Craig Maher MPA Program UW-Oshkosh LOCAL GOVERNMENT IN-SERVICE DECEMBER 15-16, 2011 Objectives: Outline a model for local government finance as a subset of the core competency Overview of current conditions Overview of a “take home” educational program for local elected officials Overview of additional needs LOCAL GOVERNMENT IN-SERVICE DECEMBER 15-16, 2011 Day I Noon-1pm: Box Lunch and introductions 1-1:30: What is happening at the state level as it pertains to local governments? 1:30-2 Types of local governments in Wisconsin 2-3 Major revenue and expenditure trends for counties and municipalities. Objective: move elected officials from looking only at last year’s budget when setting this year’s budget. Focus on elected officials needing worry about the “big picture” and not the day-to-day details. (analogies, the Board of Directors setting general directions, or Generals thinking about the big picture).Plans is to put the template on-line LOCAL GOVERNMENT IN-SERVICE DECEMBER 15-16, 2011 3-3:15 Break 3:15-4:30 Making the case for why public finances matters to CNRED Karl Green – Housing Pat Malone – County jail Arlen Albrecht – Local towns Art Lersch – Visioning with local governments The “talking points” to be addressed: How was a request for technical information turned into an educational program. Role of the Educator. Balance between technical advice and educational programming. 4:30-5:30 How do we engage the community? Annie Jones LOCAL GOVERNMENT IN-SERVICE DECEMBER 15-16, 2011 8:30-10:30 How do we analyze and discuss local trends (computer lab)? 10:30-11 Break 11-noon Local Governance Preparedness Index Noon-1 Lunch: Dean Rick Klemme 1-2 Local Governance Preparedness Index (continued) 2-2:30 How to move to an action plan for local government elected officials. Steven Grabow 2:30-3 Review of the “Big P” program 3 Adjourned LOCAL GOVERNMENT IN-SERVICE DECEMBER 15-16, 2011 Idea of a “take home” educational program for local elected officials Balance of process and content Built in the spirit of the Pulver-Shaffer Community Economic Analysis program (e.g., Take Charge but for local governments) How do we engage the community in the conversation. LOCAL GOVERNMENT IN-SERVICE DECEMBER 15-16, 2011 General Introductions What do you hope to walk away with from this in-service? What is happening at the state level as it pertains to local governments? Per Capita Income What is happening at the state level as it pertains to local governments? State Government Total Tax Rev What is happening at the state level as it pertains to local governments? State Government Sales Tax Rev What is happening at the state level as it pertains to local governments? Property Tax Rev What is happening at the state level as it pertains to local governments? State Government Employment What is happening at the state level as it pertains to local governments? State Coincident Index The Coincident Economic Activity Index includes four indicators: nonfarm payroll employment, the unemployment rate, average hours worked in manufacturing and wages and salaries. What is happening at the state level as it pertains to local governments? Leading Economic Indicators Jan. ’08 GAO Report: Growing Fiscal Challenges will Emerge during the Next 10 Years “…in the absence of policy changes, large and recurring fiscal challenges for the state and local sector will begin to emerge within a decade.” “Continuing on this unsustainable path will gradually erode, and ultimately damage, our economy, our standard of living…” -David Walker, Comptroller General, January 2008 GAO Report (Jan. 2008) “Tax receipts would need to rise considerably faster than historical experience to enable the operating balance to remain in the historical range.” “Substantial policy changes would be needed to prevent the fiscal decline in the state and local government sector.” Long Term Fiscal Gap • The GAO simulation shows that by the mid2020’s states will be in strong fiscal distress • Fiscal gap requires a 15.2% tax increase or a 12.9% spending reduction • Tough choices on spending and tax policy – Balanced budget requirements – Bond ratings Current and Future City and Village Financial Prospects 2010 Current and Future City and Village Financial Prospects 1997, 2004, 2007,2010 Quotes from Survey “I wouldn't say 2007-2010 was particularly stressful, but 2010-2012 will be.” “Levy limits and maintenance of effort requirements will ultimately deplete our reserves and force reduction/elimination of services.” “Loss of jobs, forced foreclosed properties. Poor economy, reduced new homes to be built in our TIF district and no businesses to come to expand into our TIF district.” “Limited funds based on population, hard to get grant funding.” Quotes from Survey Con’t “No incurring debt and "good old fashioned home budgeting" has helped this small municipality to thrive in this challenging economy.” “Wisconsin doesn't provide municipalities another revenue generating source other than property taxes, user fees, revenue sharing, and other State aids, the overall financial conditions of most Wisconsin municipalities will be depressed greatly for the following reasons: Increased cost of operations & maintenance; the replacement of aging infrastructure and the increasing costs associated with it; and the continued cuts in State revenue sharing and continued imposition of levy” Quotes from Survey Con’t “We could have somewhat adequate revenues if the Council would allow reasonable Property Tax increases. They required 0% last budget (2010)and are demanding 0% or a reduction for 2011. Significant property tax increases in 2008 and 2009 for debt service intended to respond to a long term infrastructure maintenance deficit helped address that issue, but that was after 12 years of belt tightening and expanding demands for municipal services. Now there is no cushion and the anti tax/fee fervor is as hot here as anywhere. Yet most everyone wants us to do more...” What is happening at the state level as it pertains to local governments? What is happening at the state level as it pertains to local governments? What is happening at the state level as it pertains to local governments? What is happening at the state level as it pertains to local governments? What is happening at the state level as it pertains to local governments? Type of WI Local Government by Population (2005) Cities Villages Towns less than 500 129 251 500-999 7 106 480 1,000-4,999 88 127 487 5,000-9,999 33 20 37 10,000-24,999 36 17 4 25,000-49,999 14 3 50,000+ 12 Total Number 190 402 1,259 Average Population 16,097 2,055 1,328 Counties 2 3 21 19 27 72 77,174 Wisc Employment (FTE) Town City/Village County 10,000 20,000 2007 2002 30,000 1997 40,000 50,000 Wisc Employment (FTE) 2007 Education Total Elementary and Secondary Instructional Employees All Other Elementary and Secondary Education Libraries Public Welfare Hospitals Health Highways Air Transportation Water Transport and Terminals Police Protection Total Police Officers Only Other Police Employees Fire Protection Total Firefighters Only Other Fire Employees Corrections Natural Resources Parks and Recreation Housing and Community Development Sewerage Solid Waste Management Financial Administration Judicial and Legal Other Government Administration Water Supply Electric Power Transit All Other and Unallocable County City/Village 411 0 385 0 26 0 275 2,476 12,194 177 1,214 65 5,457 832 3,662 3,655 371 32 1 16 5,035 9,669 3,645 7,616 1,390 2,053 60 4,549 40 4,343 20 206 3,740 100 597 229 1,227 1,657 62 440 8 1,250 207 1,383 1,374 1,614 3,014 413 1,826 2,121 2 1,631 10 498 1,081 634 1,656 1,564 Town 0 0 0 63 1 0 30 1,337 1 0 323 278 45 254 238 16 0 1 28 3 49 70 356 14 1,046 21 0 0 136 What is happening at the state level as it pertains to local governments? Limits to the flexibility of Local Governments…. Property Tax Limits (or TELs) Limits on Fees and Charges Bankruptcy is NOT an option Empowering the flexibility of Local Governments…. Cooperative Agreements to provide services Not at all Not very much Somewhat A lot Don't Know Improved productivity through better management Contracted out services 7.0 12.3 60.8 17.0 2.9 16.8 33.0 39.9 9.3 1.2 Consolidated departments 42.2 22.5 26.0 8.1 1.2 Pursued regional cooperative agreements 24.4 23.8 40.1 8.7 2.9 Reduced hours for public facilities 51.7 27.0 18.4 1.7 1.2 Eliminated services Drawn down cash reserves to meet daily operations Raised property tax levies 39.5 34.9 24.4 0.6 0.6 30.0 22.4 34.7 11.2 1.8 13.5 32.8 50.3 3.5 0.0 Adopted or increase user fees and charges 12.9 18.7 54.4 13.5 0.6 Created or expanded enterprise funds 39.6 25.4 20.1 5.9 8.9 Pursued grants from federal/state government 4.1 5.3 44.4 46.2 0.0 Refinanced outstanding debt 36.6 15.1 34.3 13.4 0.6 Increased short-term debt 56.5 18.8 20.0 4.1 0.6 Delayed routine maintenance expenditures 17.9 27.2 39.3 15.0 0.6 Delayed capital expenditures 11.6 18.5 39.9 28.9 1.2 Laid off workers 73.4 11.6 13.9 1.2 0.0 Hiring freeze 44.5 12.7 28.3 12.7 1.7 Across the broad budget cuts 28.9 25.4 33.0 12.1 0.6 Targeted budget cuts 12.1 20.8 51.5 15.6 0.0 Response strategies: 2011 Wisconsin Municipality Survey Response strategies: 2011 Wisconsin Municipality Survey Bottom line Municipality have pretty much played out all the “marginal” adjustments and “accounting fixes” that are possible; extended periods of fiscal stress will necessity structural changes. Most serious problem? Tendency to think in the short-term by local elected officials…. ”we set policy by tweaking last year’s budget” Tendency to “micromanage” administrators...