International Session-Capital Markets Regulation and

advertisement

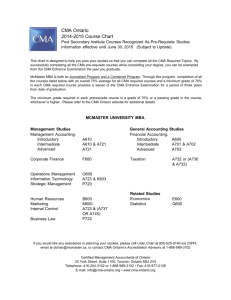

1 CS. Nicholas Letting’ Chairman Institute of Certified Public Secretaries Of Kenya (ICPSK) December 17-19, 2015 The 43rd National Convention of Company Secretaries Institute of Company Secretaries of India New Delhi, India Outline of Presentation 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. ICPSK About ICPSK Introduction Nairobi Securities Exchange Products and Services at NSE Listing Incentives Listing Requirements in Kenya Eligibility Requirements for Public Offering of Shares and Listing Continuing Obligations Highlights on corporate governance regulations Capital Markets Authority Statutory Objectives of CMA Regulatory Model Investigative Powers of CMA Enforcement Powers of CMA Conclusion 2 About ICPSK • The Certified Public Secretaries of Kenya Act 1988 (Cap 534) established the Institute of Certified Public Secretaries of Kenya (ICPSK) and the Registration of Certified Public Secretaries Board (RCPSB). • The membership of the Institute has continued to grow since the inception of the Institute and now stands at 3,000 members. • The mandate of the Institute is to promote good governance in both private and public Institution. Key among the recent achievements include development of: Code of Governance for Private Organizations Code of Governance for State Corporations Governance Audit Framework ICPSK 3 Introduction • • • In Kenya, the Capital Markets are regulated by the Capital Markets Authority (CMA) which is established under Capital Markets Act (Chapter 485A, Laws of Kenya) (“the Act”). The Nairobi Securities Exchange (NSE) is the only Securities Exchange in country. All listed Companies on the NSE are required to engage services of a Company Secretary who must be a member of ICPSK. ICPSK 4 The NSE 5 Direct Financing LOCAL AND INTERNATIONAL P.E FIRMS AND INSTITUTIONAL INVESTORS COMPANIES LISTED ON THE NSE CMA (Regulator) Regulation Equity Investments RETAIL INVESTORS Share Immobilization Savings through The Capital Markets NAIROBI SECURITIES EXCHANGE CDSC: CENTRAL DEPOSITORY ADVISORS: IB/Nominated Advisors/Brokers/Lawye rs/ Accountants/ Financing through capital markets Share Immobilization NEW PROJECTS Products and Services at NSE 1. Shares 2. Bonds 3. NSE Real Estate Investment Trusts Market Segment; 4. NSE Derivatives Market; 5. Exchange Traded Funds. ICPSK 6 7 Listing Incentives INVESTOR COMPANY STAMP DUTY Exemption of stamp duty and VAT on the transfer of listed securities No stamp duty payable on share capital or increase in share capital of a company listed on the exchange TAX INCENTIVES Kenyans and members of the EAC pay a withholding tax of 5% on dividends. Foreigners: 7.5% •40% issued share capital listed – tax rate 20%(5yrs) •30% issued share capital listed – tax rate 25%(5 years) •20% issued share capital listed – tax rate 27%(3 years) LEGAL COSTS Legal and other incidental costs relating to introduction is corporate tax deductible. 8 Listing Incentives contd. INVESTOR IPO COSTS Tax deductible. Therefore leaving more value to shareholder Capital Gains Tax Suspended for listed companies ESOPS COMPANY Tax deductible CIS set up by employers on behalf of employees to invest in listed shares is exempts from income tax Listing Requirements in Kenya • • 9 The NSE offers Company’s an option to either list on: The Main Investment Market Segment (MIMS), The Alternative Investment Market Segment (AIMS) or The Growth Enterprise Market Segment (GEMS). Each of the above category has its own listing requirements. ICPSK Eligibility Requirements for Public Offering of Shares and Listing Requirement MIMS AIMS GEMS Incorporation status Must be a public company limited by shares and registered under the Companies Act Must be a public company limited by shares and registered under the Companies Act Must be a public company limited by shares and registered under the Companies Act Minimum Kshs 50 million Authorized and fully paid up share capital Kshs 20 million Kshs 10 million Net Assets before the offer Kshs 20 million Not less than 100,000 shares in issue Kshs 100 million 10 Cont’ Eligibility Requirements Requirement MIMS AIMS GEMS Free Shares to be listed transferability must be freely of shares transferable Shares to be listed must be freely transferable Shares to be listed must be freely transferable Availability and reliability of financial records Must have audited financial statements in compliance with IFRS which are no more than four months old Must have audited financial statements in compliance with IFRS which are no more than four months old - Accounts must have been prepared on a going concern basis and should not have emphasis of matter or qualification Accounts must have been prepared on a going concern basis and should not have emphasis of matter or qualification - Cont’ Eligibility Requirements Requirement MIMS AIMS GEMS Competence and suitability of directors and management As at date of application and two years prior, no director shall have any petition under bankruptcy, any criminal proceedings, any ruling that has prevented them from being directors As at date of application and two years prior, no director shall have any petition under bankruptcy, any criminal proceedings, any ruling that has prevented them from being directors As at date of application and two years prior, no director shall have any petition under bankruptcy, any criminal proceedings, any ruling that has prevented them from being directors Issuer must have at least a third of the Board as nonexecutive directors. Issuer must have at least a third of the Board as nonexecutive directors. Must have a minimum of five directors, with a least a third of the Board as nonexecutive directors Cont’ Eligibility Requirements Requirement MIMS AIMS GEMS Competence and suitability of directors and management Must have suitable senior management with relevant experience for at least one year before listing Must have suitable senior management with relevant experience for at least one year before listing A third of the directors must have completed the Directors Induction Program before listing and the rest must complete the same within six months after listing. Must not have committed serious offences so that it may be inappropriate for them to manage a listed company Must not have committed serious offences so that it may be inappropriate for them to manage a listed company Must not have committed serious offences so that it may be inappropriate for them to manage a listed company Retain senior management for at least one year Retain senior management for at least one year Retain senior management for at least one year Cont’ Eligibility Requirements Requirement MIMS AIMS GEMS Dividend Policy The issuer must have The issuer must have a a clear future clear future dividend dividend policy. policy. - Track record, profitability and future prospects Must have declared profits after tax in at least three of the last five years Must have been in existence in the same line of business for a minimum of two years one of which should reflect a profit with good growth potential. - Solvency and adequacy of working capital Issuers should not be insolvent and have adequate working capital Issuers should not be insolvent and have adequate working capital Issuers should not be insolvent and have adequate working capital Cont’ Eligibility Requirements Requirement MIMS AIMS GEMS Share ownership structure Following the IPO, at least 20% of the shares must be held by not less than 1,000 shareholders excluding employees of the issuer Following the IPO, at least 20% of the shares must be held by not less than 100 shareholders excluding employees of the issuer The Issuer must ensure at least 15% of the issued shares are available for trade by the public. Certificate of comfort If issuer is licensed by any regulator the Authority shall obtain a certificate of no objection from the relevant regulators. If issuer is licensed by any regulator the Authority shall obtain a certificate of no objection from the relevant regulators. Listed shares to be immobilized. - - All issued shares must be deposited at a central depository Continuing Obligations After they have been listed, Companies are required to: • the shareholders are aware of the major developments in the company • Help shareholders to make informed decisions regarding their investment in the company • comply with the continuous obligations • Immediately disclose any development that will lead to change in the financial position of the company or movement of its share prices Continuing obligations • Issue cautionary statements where the happening of an event could lead to material movements in prices • Inform NSE and CMA on announcement of dividends within 24 hours following the board resolution • Pay Dividends declared within ninety days from date of books closure for interim dividends or ninety days after shareholder approval for final dividends Continuing obligations • All interim and audited accounts to be prepared in accordance with IFRS • Interim reports to be prepared and published within two months while audited to be prepared and published within four months • Every issuer to notify the exchange and the CMA within 24 hours after the approval of the accounts by its board of directors • Every issuer to hold an AGM within six months after the end of the financial year Continuing obligations • Make a public announcement where there are any changes relating to its capital structure • File with CMA the shareholding structure indicating the top shareholders of the companies and significant changes in shareholding in the company • Issue a 21 day notice for a shareholders meeting • Always comply with the corporate governance regulations Highlights on corporate governance regulations • Every issuer must establish an audit committee of the board • Directors not to hold more than five directorship positions in listed companies at the same time • A chairman of a company not to hold more than two such positions in the listed companies at the same time • Company secretaries to be members of ICPSK • Chief Finance officers or heads of finance to be members if ICPAK • An auditor of a listed company should be a member of ICPAK The CMA • • 21 CMA is Charged with the prime responsibility of developing and regulating a fair, orderly efficient and transparent Capital Markets In that regard, it facilitates capital formation and therefore needs to balance between needs of business to raise capital and the needs of the investors to be protected when they provide capital ICPSK Statutory Objectives of CMA Development 22 of all aspects of the capital markets. Facilitate existence of a nationwide system of stock market and brokerage services to enable wider participation of the public. Facilitate use of electronic commerce for capital markets Creation, maintenance and regulation of an orderly, fair and efficient securities market Operation of compensation fund to protect investors from financial loss due to failure of a licensee. Protection of Investor Interests. Regulatory Model • • • 23 In its regulatory role, CMA uses a disclosure based approach where it sets down minimum disclosure obligations to ensure that the investor has adequate information to make an informed decision. In this approach, CMA as a regulator does not take any responsibility for the investment decision. To ensure that the disclosed information is reliable, liability is imposed for the disclosure of false or misleading information. ICPSK CAPITAL MARKET PRODUCT STRUCTURE IN KENYA Equity markets (EMs) Debt market (DMs) 24 Derivatives markets (DVs) Already in the market • Not yet launched In the pipeline MARKET LICENSEES Licensed/Approved institutions 1. 2. Securities Exchange (NSE) Central Securities Depositories(CDSC) 3. 4. Investment Banks Stock Brokers 5. 6 7. 8. 9. 10. 11. 12. 13. 14. 15. REIT managers REITs Trustees Investment Advisers Fund managers Collective investment schemes Authorized Depositories Credit Rating Agencies Venture Capital Companies Dealer ESOPs Authorized securities dealer Total 25 *30Th September 2015 1 1 14 9 7 3 17 25 20 14 3 1 2 11 1 129 STATE OF THE KENYAN CAPITAL MARKETS AS AT 2015 OCTOBER- PERFORMANCE 26 • The NSE20 share index as at November 2015 stood at 4017 points down from 5,212 index point in January 2015. • Reflection of a number of macroeconomic factors. • Market capitalization stood at 1,930.81 bln in October 2015 while equity turnover as at October 2015 stood at Kshs. 181.12 billion. • The NSE index return as at the end of 2014 was 5113. NSE was best performing market in Africa and third best globally in 2013 with an index return of 44%. • As at October 2015 the bond turnover was at 263.71 billion. Annual bond turnover in 2014 was. 506.05 billion, as compared to Kshs 452.5 billion annual bond turnover figures in 2013. • As at October 2015 equity turnover stood at Kshs. 181.12billion. Annual equity turnover in 2014 was 215.7 billion, as compared to Kshs 155.7 billion annual equity turnover figures in 2013. 27 2,600.00 Market Capitalization Levels Jan 2014 to November 2015 2,500.00 Market capitalization 2,400.00 2,300.00 2,200.00 2,100.00 2,000.00 1,900.00 1,800.00 Date/Year 28 NSE 20 share index Trends Jan 2014-October 2015 Market Capitalization Levels 5,600.00 5,200.00 4,800.00 4,400.00 4,000.00 Date/Year 29 FUND RAISING CAPACITY OF THE MARKET • Kshs 3.4 trillion raised through Kenyan capital markets in the last 10 years: bonds and equities • Over Ksh 550 billion raised in the last 6 years notwithstanding the global financial crisis • Eurobond success demonstrates absorptive capacity outside Kenyan borders-highest subscription level in Africa’s history (500%) 30 ABSORPTION CAPACITY Bonds 31 2015* 2014 2013 2012 2011 2010 2009 2008 2007 2006 263.71 506.1 453.7 194.5 228.6 373.5 316.9 98.9 146.9 130.3 - - - - - 4.32 Additio nal Offers - - - TOTAL 2578.72 4.32 Equity - (POs) - 1.23 0.7 - - - 1.93 Equity 4.79 0 0 5.1 0 0 271.4 10.5 35.6 (IPOs) Total 327.39 263.71 510.8 453.7 195.7 233.7 *As at October 2015 **Bonds figures are for total received 374.2 316.9 370.3 157.4 170.2 2,782.99 32 THE PILLAR BEHIND THE CAPITAL MARKETS STRATEGIC DIRECTION IN KENYA “THE CAPITAL MARKETS MASTER PLAN” Summing up the overarching aspiration 33 • Deep capital markets that support domestic economic development under Vision 2030 • The gateway for regional and international capital flows into and from Middle Africa 34 35 IMPLEMENTATION ROADMAP Approval by CMA Board and Exposure to the public CMA Approval and Launch of the Master Plan Cabinet Secretary, National Treasury Implementation of recommendations CMA Relevant government agencies Relevant market institutions and participants Monitor progress Update Master Plan Report progress Implementatio n Committee and Industry Working Groups 36 • CMMP National Steering Committee • • • • • • • • CS, National Treasury – Chairman CS, Ministry of Agriculture, Livestock and Fisheries; CS, Mining; CEO, Capital Markets Authority; Governor, Central Bank of Kenya; Attorney General; CEO Communications Commission of Kenya; Secretary, NESC 37 • CMMP Implementation Committee • • • • • • • • CEO, Capital Markets Authority - Chairman; Rep. National Treasury; Rep. Central Bank of Kenya; Rep. Vision 2030; Rep. Development Partners; Rep. Academia; Corporate Governance Practitioner Rep. Industry 38 • 4 CMMP Working Groups • • • • Government Institutions: NSE, CDSC, market practitioners Academia Industry associations (Fund Management, CIS, KASIB, Lease Finance and other markets participants) • The WGs are: • • • • Supporting the domestic economy Financial markets Legal and Regulatory Regional and International 39 • Launch of the plan – 21st Nov. 2014 • Appointment of the CMMP Implementation Committee (CMMPIC) – January 2015 • Constitution of the Working Groups – February 2015 • Launch of WG 2 – March 2015 • Gazettement of the National CMMP Steering Committee – March 2015 • Meetings of CMMPIC – from April 2015 • Various stakeholder engagements • Inaugural National Steering Implementation Committee meeting held in October 2015. 40 Upscaling the scope of Risk Based Supervision; Demutualization and Self Listing of the NSE; Approval of NSE as a Derivatives Exchange; Review of the Legal Framework in line with IOSCO principles; • Development of a harmonized legal and regulatory framework for the EAC capital markets; • Introduction of international certification standards in Kenya’s capital markets industry; • • • • • Module One of Certification completed in collaboration with CISI. CMA pilot staff and trainers completed exam. Full implementation to begin in January 2016 • Overhaul of the Corporate Governance Framework and Development of a Stewardship code. 41 • Securities settlement through Central Bank of Kenya; • First REIT approved in October 2015; • Final policy guidance note on Exchange Traded Funds Issued; • Joint Financial Sector Regulators Project Management Office (PMO) for the development of Islamic Finance Markets in Kenya. 42 • The introduction of fiscal incentives to support the roll out of REITS and ABS; • Reduction of the NSE trading participant admission fees from Ksh250 million to Ksh25 million to lower barriers to market access; • Initiatives to enhance market liquidity through Securities Lending and Borrowing, Margin Trading, and Short-Selling; All introduced in the Finance Act (No. 14 of 2015), 43 • Authority continues to implement a multi-tier Investor Education and Public Awareness Strategy that includes among others, several County engagements: • 17 Counties have already been covered with various target groups such as gender, youth, issuers, intermediaries learning institutions • Finalized a policy paper on County securitization; • CMA institutional capacity development ongoing. Investigative Powers of CMA 44 Investigative powers includes: To investigate upon request or in its own motion To request and direct submission of information To summon witness and suspects To take statements under oath or affirmation To enter, search and seizure To Trace assets of persons found to have engaged in fraudulent dealings in securities To order caveats pending investigation To appoint an auditor to undertake a specific audit Enforcement Powers of CMA 45 Enforcement powers includes: Levy financial penalties Order a person to remedy or mitigate the effect of the breach, make restitution or compensation Publish findings of malfeasance by any person Issue a public reprimand Suspend trading of the shares of the listed company for a specified period Enforcement Powers of CMA 46 Issue restrictions on the use of a license Recover an amount equivalent to twice the amount of the benefit accruing to the person in respect of the breach Revocation of the license Issue Directives like cease and desist Disqualification of a person from appointment as Director of a licensee, listed company or securities exchange To intervene in the management of a licensee through appointment of statutory managers Remove any officer/employee of the Licensee Power to prosecute upon request to the DPP Enforcement Powers of CMA 47 Issue restrictions on the use of a license Recover an amount equivalent to twice the amount of the benefit accruing to the person in respect of the breach Revocation of the license Issue Directives like cease and desist Disqualification of a person from appointment as Director of a licensee, listed company or securities exchange To intervene in the management of a licensee through appointment of statutory managers Remove any officer/employee of the Licensee Power to prosecute upon request to the DPP Conclusion ICPSK 48 49 Institute of Certified Public Secretaries of Kenya (ICPSK) CPS Governance Centre, Kilimanjaro Road, Off Mara Road, Upper Hill P.O. Box 46935 00100,Nairobi. Tel.: +254 20 3597840/2 / +254 734603173, +254 770159631 E-mail: info@icpsk.com Website: www.icpsk.com ICPSK