Private Company …contd.

advertisement

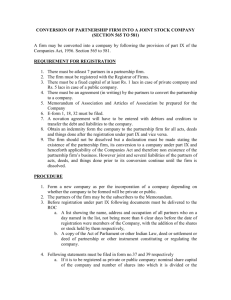

Companies Act, 1956 IMI Meaning and Definition of a Company Section 3(1)(i) of the Companies Act, 1956 defines a company as: “a company formed and registered under this Act or an existing Company”. ‘Existing Company’ means a company formed and registered under any of the earlier Company Laws. Characteristic Features Separate Legal Entity Case: Salomon v. Salomon & Co. Ltd. Limited Liability However, liability of a company is never limited. It’s liability of members only that is limited. Free Transferability of Shares Other Features: Perpetual Succession: Separate property and Common Seal. Types of Companies Private Company Public Company Private Company [Section 3(1)(iii)] A private company means a company which has a minimum paid up capital of one lakh rupees or such higher paid-up capital as may be prescribed and by its articles : (a) restricts the right to transfer its shares, if any; (b)limits the number of its members to 50, not including: Private Company (i) …contd. persons who are in the employment of the company, and (ii) persons who, having been formerly in the employment of the company, were members of the company while in that employment and have continued to be members after the employment ceased; (c) prohibits invitation to the public to subscribe for any shares in or debentures of, the company; and Private Company …contd. (d) prohibits any invitation or acceptance of deposits from persons other than its members, directors or their relatives. Where two or more persons hold one or more shares in a company jointly, they shall, for the purposes of membership, be treated as a single member. Public Company [Section 3(1)(iv)] A public company means a company which: (a) is not a private company [In other words, it should not have the restrictions of Section 3(1)(iii) in its articles ]; (b) has a minimum paid-up capital of five lakh rupees or such higher paid-up capital, as may be prescribed; and (c) is a private company, which a subsidiary of a company, which is not a private company. How to form a company? The whole process of formation of a company may be divided into four stages, namely: (i) Promotion (ii) Registration (iii) Floatation/Raising of Capital (iv) Commencement of Business. Promotion Who is a Promoter? Bowen, L.J. The term promoter is “a term not of law but of business”, usefully summing up, in a single word— promotion, “a number of business operations familiar to the commercial world by which a company is brought into existence”. However, the persons assisting the promoters by acting in a professional capacity do not thereby become promoters themselves. Legal Position of a Promoter Promoter stands in a fiduciary position towards the company. In other words, he is not allowed to make secret profits. Case: Gluckstein v. Barnes Pre-incorporation contracts Void-ab-initio. However, pre-incorporation contracts shall be valid if: The contract is made for the purpose of the company and the contract is warranted by the terms of incorporation. The company adopts the transactions after incorporation. Registration/Incorporation Private Company Minimum Number of Members required – 2. Public Company Minimum Number of Members required – 7. Steps 1. Application for availability of name: Three names in order of priority conforming to the provisions of the Act and the Guidelines issued by Department of Company Affairs in this regard: Name to end with the word(s) ‘Limited’ or ‘Private Limited’, as the case may be, except: (i) Section 25 Companies (ii) Govt. Companies (need not use Pvt. Ltd.) (iii)Producer Companies. Steps …contd. Name should not be identical or too similar to the name of an already existing company. Should not include the name of a registered trade mark. 2. Preparation of Memorandum and Articles of Association Memorandum defines and limits the scope of activities of a company. …contd. Steps Contents of Memorandum 1. 2. 3. Name clause Registered office clause Object clause 4. 5. Doctrine of ultra-vires Liability clause Capital clause Steps …contd. 3. Preparation of other documents Power of Attorney in favour of a professional to effect registration. Consent of Directors (in case of a Public Company) Particulars of Directors, Manager, Secretary, etc. in the prescribed form. Notice of registered address To be supplied within 30 days of incorporation. …contd. Steps Statutory Declaration To the effect that all requirements of law with respect to incorporation have been duly complied with. The declaration to be signed by: Advocate of Supreme Court or High Court; OR C.A../C.S. practising in India and associated with the formation of the company; OR Director, Manager, Secretary of the company (as named in the Articles) 4. Filing of documents with ROC Certificate of Incorporation Effect of Certificate of Incorporation (Section 34) On incorporation, the association of persons becomes a body corporate by the name contained in the memorandum, capable forthwith of exercising all the functions of an incorporated company and having perpetual succession and a common seal but with such liability on the part of the members to contribute to the assets of the company in the event of its being wound-up as is mentioned in the Act. Conclusiveness of Certificate of Incorporation (Section 35) Conclusive to the effect that all requirements of law relating to registration and matters precedent and incidental thereto have been duly complied with. Case Laws: Moosa v. Ibrahim Jubilee Cotton Mills Ltd. v. Lewis Provisional Contracts Contracts entered into by company after incorporation but before getting the certificate to commence business are called ‘provisional contracts’. Provisional contracts are, therefore, relevant to public companies only. Such contracts become void, if company fails to obtain certificate to commence business and automatically become valid, and binding if company obtains the certificate. Raising of Capital A company may raise capital through Private placement Issue of Prospectus Private placement means raising of capital from friends, relatives and through brokers. Commencement of Business (Section 149) Where Company has issued a Prospectus: a company cannot commence business or exercise borrowing powers unless: (a) shares up to the amount of the minimum subscription have been allotted by the company; (b) every director of the company has paid to the company, on each of the shares taken or contracted to be taken by him and for which he is liable to pay in cash, Commencement of Business …contd. the same proportion as is payable on application and allotment on the shares, offered for public subscription; (c) no money is, or may become, liable to be repaid to the applicants for shares or debentures offered for public subscription, for failure to obtain permission for the shares to be dealt in on any recognised stock exchange; Commencement of Business …contd. (d) there has been filed with the Registrar a duly verified declaration by one of the directors or the secretary or, where the company has not appointed a secretary, a secretary in whole time practice in the prescribed form that clauses (a), (b) and (c) (mentioned above) have been complied with. Penalty: Every person at fault may be fined upto Rs.5,000/- for every day of default. Memorandum of Association Every company has to have a Memorandum of Association. It contains, besides other significant information, the objects for which the company is formed. ‘Object clause’ defines as well as confines the powers of the company. Anything done beyond these objects is ultravires the company and void. Contents of Memorandum 1. Name Clause: It contains the name with which company is proposed to be registered. Companies Act requires that: (a) (b) The name chosen should end with the word ‘Limited’ or the words ‘Private Limited’, as the case may be. The name should not be undesirable i.e., it should not be identical or too similar to the name of an already existing company OR include the name of a registered trade mark unless consent of the owner of the trade mark is obtained. Contents of Memorandum 2. Registered Office Clause: This clause states the name of the State in which registered office of the company is to be situated. 3. Objects Clause This clause is to be divided into: (a) (b) Main objects and objects incidental or ancillary to main objects Other objects A company cannot commence any business stated under other objects unless ‘special resolution’ by the shareholders is passed. Doctrine of Ultra-Vires Case Law: Ashbury Rly. Carriage Co. v. Riche. Effects of Ultra-vires transactions (i) void-ab-initio (ii) Injunction (iii) Personal liability of directors towards the company towards the outsiders Contents of Memorandum 4. Liability Clause 5. Capital Clause This clause states the authorised capital and the number of shares into which the same shall be divided. Alteration of Memorandum Various clauses of memorandum of association can be altered by following the procedure laid down in the Act. Different requirements are prescribed for different clauses: 1. Name Clause: can be altered by: (a) (b) Passing a special resolution; and Obtaining the approval of the Central Govt. Alteration of Memorandum 2. Registered Office Clause: may be shifted: (a) (b) within the same city by passing Directors’ Resolution; From one city to another city within the same State: by passing special resolution only, if no change in jurisdiction of Regional Director by passing special resolution, and Obtaining the approval of Regional Director. Alteration of Memorandum 3. Objects Clause Special Resolution Only on Grounds stated in Sec.17(1). 4. Liability Clause Cannot be increased without written consent of each and every member. Can be reduced: by passing special resolution Confirmation of court Alteration of Memorandum 5. Capital Clause Authorised capital may be increased by passing an ordinary resolution at a meeting of the shareholders. Articles of Association The articles of association of a company are its bye- laws or rules and regulations that govern the management of its internal affairs and the conduct of its business. The articles regulate the internal management of the company. They define the powers of its officers. They also establish a contract between the company and the members and between the members inter se. This contract governs the ordinary rights and obligations incidental to membership in the company [Naresh Chandra Sanyal v. Calcutta Stock Exchange Association Ltd. (1971)]. Companies which must have Articles Unlimited Companies: The Articles of such a company must state: Total number of members; and Share capital. Companies limited by Guarantee: Articles of such company must state total number of members. Companies which must have Articles …contd. Private Companies limited by shares: must include requirements of Section 3(1)(iii). No Article Company A public limited company having share capital may be registered without Articles. Alteration of Articles Articles may be altered by a company by passing special resolution at a general body meeting of shareholders. However, where alteration has the effect of converting a public company into a private company (i.e., introduction of restrictive clauses of Section 3(1)(iii), approval of Central Government must be obtained. Doctrine of Constructive Notice According to Section 610, every person dealing with the company is deemed to have read M/A and A/A and understood the contents thereof in the correct perspective. Doctrine of Indoor Management The rule was first laid down in Royal British Bank v. Turquand. Rule of Indoor Management is an exception to the Doctrine of Constructive notice. Exceptions of Indoor Management 1. Knowledge of irregularity : Case: Howard v. Patent Ivory Co. 2. Negligence : Case: Anand Behari Lal v. Dinshaw & Co. (Bankers) Ltd. 3. Forgery : Case: Ruben v. Great Fingal Consolidated [Secy. Forged signatures of two directors] 4. No knowledge of articles : Case: Rama Corporation v. Proved Tin & General Investment Co. Prospectus A prospectus, as per Section 2(36), means any document described or issued as prospectus and includes any notice, circular, advertisement or other document inviting deposits from the public or inviting offers from the public for the subscription or purchase of any shares or debentures of a body corporate. Prospectus … contd. Thus, a prospectus is not merely an advertisement; it may be a circular or even a notice. A document shall be called a prospectus if it satisfies two things: (a) It invites subscription to shares or debentures or invites deposits. (b) The aforesaid invitation is made to the public. What constitutes Invitation to Public As per Section 67, Invitation to public includes: invitation to any section of the public howsoever selected provided the invitation is made to all the members of that section of public indiscriminately. Invitation calculated to be made available even to those who do not receive the same. Invitation to 50 or more persons. Mis-statement in a Prospectus and its consequences What is Mis-statement? According to Section 65(1) of the Act: (a) a statement included in a prospectus shall be deemed to be untrue, if the statement is misleading in the form and context in which it is included; and (b) where the omission from a prospectus of any matter is calculated to mislead, the prospectus shall be deemed in respect of such omission, to be a prospectus in which an untrue statement is included. Case: Rex v. Kylsant Remedies Liability for Mis-statements in a Prospectus Civil Liability (Sec.62 & 56) Criminal Liability (Sec. 63) Against the Promoters, Directors, other Officers and Experts mpany Rescission of Contract Damages Claim for Damages Against the Promoters, Directors and Other officers (not available against experts) Against the Company Compensation under Sections 62 and 56 Fine upto Rs. 50,000 Imprisonment Fine upto R Bot Share and Share Capital According to Section 2(46), A ‘Share’ represents a unit into which capital of a company is divided. However, courts have held that a share is not merely a unit of capital, it represents a bundle of rights and obligations. Holder of a share is entitled to certain rights (say, right to receive dividends, to receive notice of meetings, to participate in the proceedings of a meeting, to elect directors) and is also subjected to a number of obligations (say, to abide by Articles of Association, to maintain decorum of the meetings). Kinds of Shares The following kinds of shares may be issued by a company: 1. 2. 3. 4. Equity shares carrying voting rights. Equity shares carrying differential rights as to voting or dividend (commonly called Non-Voting Equity Shares) Preference Shares Cumulative convertible Preferable Shares Kinds of Shares … contd. Preference Shares carry preference with respect to two things: 1. 2. Preference with respect to dividend at a fixed rate or of a fixed amount. Preference with respect to return of capital in case of winding up. Equity Shares means a share which is not a preference share. Allotment of Shares ‘Allotment’ is an acceptance to an offer for purchase of shares. Where allotment does not conform to the statutory requirements, it is called irregular allotment. For allotment to be valid, following requirements must be satisfied: 1. A copy of prospectus or statement in lieu of prospectus must have been delivered to Registrar of Companies. Allotment of Shares … contd. 2. Application money must not be less than 5% of the nominal value. 3. Minimum subscription (i.e., at least 90% of the issue) must have been received. 4. Application money must be kept deposited in a Scheduled Bank till the minimum subscription has been received. 5. Shares must have been listed on the stock exchange(s) mentioned in the Prospectus. Administration/Management of a company A company functions through the medium of Board of Directors. However, certain powers have been reserved to be exercised by shareholders in general body meetings. Section 291 of the Companies Act, 1956 confers general power on the Board of Directors. It provides: “Subject to the provisions of the Act, the Board of Directors of a company shall be entitled to exercise all such powers, and to do all such acts and things, as the company is authorised to exercise and do. Powers which are exerciseable only by the shareholders. 1. Sell, lease or otherwise dispose of the whole, substantially the whole, of the undertaking of the company, or where the company owns more than one undertaking, of the whole or substantially the whole, of any such undertaking. 2. Remit or give time for the repayment of any debt due by a director except in the case of renewal or of continuance of an advance made by a banking company to its directors in the ordinary course of business. Powers …contd. 3. Invest, otherwise than in trust securities, the amount of compensation received by the company in respect of compulsory acquisition of any property or fixed assets of the company. 4. Borrow monies exceeding the aggregate of the paid-up capital of the company and its free reserves. ‘Borrowing’ does not include temporary loans (i.e., loans payable on demand or within six months but excluding loans for capital expenditure) obtained from the company’s bankers in the ordinary course of business. Powers …contd. The resolution passed at the general meeting must specify the total amount upto which moneys may be borrowed by the Board of directors in any financial year. 5. Contribute in any year, to charitable and other funds not directly relating to the business of the company or the welfare of its employees any amount exceeding Rs. 50,000 or five per cent of its average net profits of the last three financial years, whichever is higher. Powers …contd. However, the resolution must specify the total amount that may be contributed by the Board of directors in any financial year. However, contributions to National Defence Fund, the Prime Minister’s National Relief Fund or any other fund approved by the Central Government* for the purpose are exempted from the above provisions. Qualifications and Disqualifications for Directors Qualifications A public company cannot prescribe any qualifications for directorship except share qualification. Again, share qualification requirement cannot exceed holding of shares exceeding Rs. 5000/- in nominal value or value of one share where nominal value of one share exceeds Rs.5000/-. A director may obtain his share qualification within 2 months after his appointment. Disqualifications Section 274 of the Companies Act, 1956 provides that the following persons shall not be capable of being appointed as directors of any company : (a) a person found by a competent court to be of unsound mind and such finding remaining in force; (b) an undischarged insolvent; (c) a person who has applied to be adjudged an insolvent; Disqualifications …contd. (d) a person who has been convicted by a Court of an offence involving moral turpitude and sentenced in respect thereof to imprisonment for not less than six months, and a period of five years has not elapsed from the date of the expiry of the sentence; (e) a person who has not paid any call in respect of shares of the company held by him, whether alone or jointly with others and six months have elapsed from the last date fixed for the payment of the call; and Disqualifications …contd. (g) a person who is already a director of a public company which,— (i) has not filed the annual accounts and annual returns for any continuous three financial years commencing on and after the first day of April, 1999; or (ii)has failed to repay its deposit or interest thereon on due date or redeem its debentures on due date or pay dividend and such failure continues for one year or more. Number of Directorships Whole-time Directorship A person cannot be appointed as a whole-time director in more than one company. Part-time Directorship Not more than 15 companies excluding the directorships of, No. of Directorships …contd. private companies [other than subsidiaries or holding companies of public company(ies)]. ii. unlimited companies, iii. associations not carrying on business for profit or which prohibit payment of a dividend, and iv. alternate directorships (i.e., he is appointed to act as a director only during the absence or incapacity of some other director). i. Remedies Liability for Mis-statements in a Prospectus Civil Liability (Sec.62 & 56) Civil Liability (Sec.62 & 56) Against the Company Rescission of Contract Criminal Liability (Sec. 63) Criminal Liability (Sec. 63) Against the Promoters, Against the Directors, other Company Officers and Experts Claim for Damages Against the Promoters, Directors and Other officers (not available against experts) Fine upto Rs. 50,000 Compensation Fine upto Damages Compensation under Imprisonment Both Damages under Sections 62 and Imprisonment 56 upto 2 years Rs.50,000 Fine upto Sections 62 and 56 upto 2 years Rs.50,000 Both