Nett incidence of License Fee, Spectrum Charges & Service

advertisement

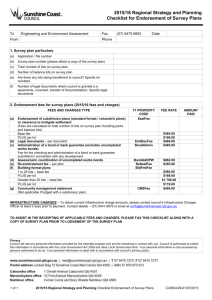

Presentation on Taxes and Levies to Department of Revenue on 6.11.2006 by Association of Unified Telecom Service Providers of India 1 Reduction in Revenue Share License Fee – Why? • There is a strong case for reduction of revenue share license fee in consideration of : Unprecedented growth of telecom sector resulted in exceeding target of NTP 99 much ahead of stipulated time. This growth has been facilitated due to reduction in license fee after migration to revenue share regime. • India has one the highest tax regimens in the world, and levies must be reduced to bring them in line with international best practices. 2 Reduction in Revenue Share License Fee Internationally, telecom services attract much lower levies than those of India. (Refer Table 1). Table-1 Pakistan Sri Lanka China India Regulatory charges % age of revenue %age % age of revenue % age of revenue Service tax, GST GST VAT 3% 12.2% + GST License Fee 0.5% + 0.5% R & D 0.3% turnover (t.o.) + 1% of capital invested (inv) Nil 5 – 10% Spectrum Charge Cost recovery ~1.1% to t..o ~0.5%* (China Mobile) 2 ~ 6%** USO 1.5% Nil (only on ISD calls) Nil Incl in license fees Total Regulatory charges 2.5% +GST+ cost recovery 1.3% t.o.+1% inv+VAT 0.5%+3% (Tax) 19%~28% + GST * Backbone spectrum charges extra **Est. from Spectrum fees & revenue of China Mobile •High percentage of revenue share to be brought down to 6% including levey for USO fund. •High service tax of 12.2% to be brought down (already 1/3 of the total collection of service tax is estimated to be from telecom services) •With growth of 5 - 6 million subscribers per month, the additional revenues will in any event compensate for reduced taxes and levies. 3 Reduction in Revenue Share License Fee • Reduction in revenue share license fee would not affect government revenue as with increase of subscriber base, government revenue also increases substantially. (Refer Table-2) Table-2 Rs in Crores ESTIMATE OF GOVT. LEVIES FROM LICENSE FEE, SPECTRUM FEE &SERVICE TAX ON ALL TELECOM SERVICES Year Gross Revenue AGR License fee Service tax * 5-10% Spectrum Charge 2-4% Total Govt. Levies 2002-03 48000 40800 4080 2040 206 6326 2003-04 61000 51850 4770 4148 434 9353 2004-05 80000 68000 6256 6800 856 13912 2005-06 100000 85000 7820 8500 1530 17850 2006-07 139000 118150 10869.8 11815 2458 25142 2007-08 169000 143650 13215.8 14365 3275 30856 [Source: TRAI] * Rate of service tax taken as 5% upto 13.5.2003, 8% upto 31.3.2005 and 10% thereafter. 4 Reduction in Revenue Share License Fee In line with recent government decision of reduction in revenue share license fee for long distance services, there should be uniform reduction in license fee to 6% including USO levy for UASLs. 5 Single Taxation for telecom services sector Telecom service sector faces multiple taxes and levies some of which are one of the highest in the world. Total levies including license fee, service tax, spectrum charge etc. on the telecom sector are around 26% of the revenue. Customers pay at least 30% of the telecommunication bill directly or indirectly as taxes and levies. Telecom tariffs in India are among the lowest in the world due to competition. With very low ARPU and rock-bottom tariffs, the present exponential growth of subscribers is not sustainable unless drastic policy interventions are made. Convoluted tax structure needs to be addressed to make the sector investorfriendly, industry friendly as opined by Hon’ble FM in the 77th FICCI AGM in December, 2004. 6 Reduction in annual spectrum usage charges Telecom subscribers pay about 30-35% of their bill as taxes and levies including spectrum charges. To provide affordable services and to meet the projected teledensity target, access spectrum usage charges be brought down to 0.5% of the AGR – just to recover the cost of administering and regulating the spectrum resource. Reduction of usage charges to 0.5% of AGR, would be more than sufficient to cover the cost of administering and regulating the resource, considering that subscriber growth has increased many fold in comparison to that at the time of fixing the charges. The Second ITU Forum of the Regional Working Group on Private Sector Issues, held on 26-27 April, 2004, opined that : Quote “As regards the annual usage charges for spectrum there could be a view that once the right to use the spectrum has been acquired by the licensee, then the usage charges should be limited only to the cost of administering and regulating that resource” Unquote 7 Special emphasis on growth of broadband Broadband services require heavy investment and can reach the urban and rural consumers only if services are offered at affordable and easy terms under Govt. support as follows: Tax deductible status for expenditure on broadband connectivity / usage (similar to policies for other public welfare services such as education allowance, medical allowance etc). Provision of fund and allowing of loans at low interest rate to the users through bank. Lower price for access device i.e. PC, set top box etc. Zero import and excise duties on CPE . Cent percent depreciation in CPEs like PCs, STB etc from the first year itself. 8 Special emphasis on growth of broadband Zero Customs duty and no CVD for imported broadband equipment & parts. Allow operators to set off the excise duty paid by them for procurement of indigenous equipment. No entertainment tax (currently upto 30% in some states) applicable to broadband in the short and medium term. Service tax be waived off for this sector in the short and medium term. Support to industry for setting up experience centres through tax breaks on such expenses / investments. Telecom sector income tax breaks be extended to broadband sector as well. 9 Indirect Taxes Customs Duty: All items required for the Telecom Projects including the spares be brought under 0% basic customs duty category. With growth of 5-6 million subscribers per month, the additional revenue will in any event compensate for reduced taxes and levies. Additional duty of 4% on Handsets be removed to reduce the burden on the customers and also reduce the losses to the telecom companies as these are sold below cost price to make it affordable. Import tariff & excise duty on Customer Premises Equipment (CPE) be brought to zero to make broadband affordable to masses, particularly in rural areas. Custom duty on microwave equipment be zero (currently 27.8& including 10% basic duty) similar to Base Transceiver Station (BTS) under nptification No. 7/2004-customs dated 8th January, 2004 10 Indirect Taxes “Wireless data modem/card with PCMCIA/USB/PCI Express ports” which is an internet data card used as an accessory for PC be inserted as item (h) at sl No.17 to notification No.6/2006-CE dt. 1.3.2006. Imports under EPCG and fulfillment of Export Obligation by group company be permitted by suitably amending notification no: 97/2004 Customs dated 17/9/2004. Excise Duty on all indigenous telecom equipment be pegged at a level of 8%. A notification be issued clarifying that BTS/Cell Sites(Towers) are not goods and therefore not liable for excise duty, in view of the circular no:58/1/2002 dated 15/1/2002. 11 Indirect Taxes Service Tax be reduced to 10% or lower level which will lead to higher consumption of services and thereby a larger collection by the Government. The proviso to Rule 3(4) that distinguishes between manufacturers and service providers may be deleted from CENVAT Credit Rules, to enable the service providers to avail credit of ACD on imported equipment. Clarification be issued stating that credit on 17 services specified under Rule 6(5) can be utilised in toto. Clarification be issued stating that ‘Interconnection Usage Charge’(IUC) consisting of originating/transit/terminating charges is not liable to service tax. Telecom service sector like other service sectors be allowed the same benefits under CENVAT for motor vehicles used for maintenance. 20% limit on CENVAT Claim be reverted to earlier limit of 35%. 12 Indirect Taxes Rule 6(3)(c) of CENVAT Credit Rules 2004 be amended and Service providers providing both taxable and exempted services should have the option of paying back the proportionate CENVAT Credit on input services used to provide exempted output services. The provisions of Rule 6(6) be extended to output service providers also enabling them to take input CENVAT Credit on input services used for providing output services to specified units like (a) units in SEZ (b) EOUs etc. A clarification regarding Service tax on import of services be issued to do away with the requirement of registration of foreign company in India. Credit should also be allowed of VAT or any other duty paid in foreign country on the same income. Service tax should not be applicable on revenues from in-roaming. 13 Direct Taxes Restore earlier Section 80 IA of the Income Tax Act to provide 100% tax exemption for 10 years to telecommunication service providers in line with infrastructure facilitiy providers. Clarification on TDS for payment of interconnect usage charge (IUC) by one operator to another is needed as TDS is not applicable for the said payment. TDS on reimbursements be discontinued. Tax under section 115(O) on distributed profits of domestic companies with respect to companies availing tax holiday U/S 80 IA be exempted. 14 Direct Taxes TDS provisions should not apply on bandwidth charges and payments for software to foreign companies. These payments be exempted from with holding tax in India as these are business income and not royalty income. Restoration of Exemption in respect of taxes on royalty & fees under section 10(6A) to a foreign company for technical services be restored. Clarification with respect to International roaming agreement regarding applicability / non-applicablity of withholding tax u/s 195 of IT Act. 15 Thank you! Contact us at auspi@auspi.org 16