NAFTA group paper - Department of Economics

advertisement

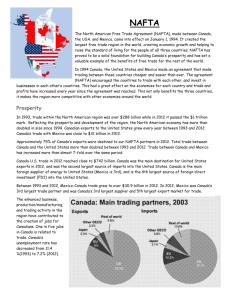

The University of Akron Department of Economics ST Economics: Regional Trading Arrangements and Integration NAFTA and the Mexican FDI Flows By Robert Baape, Nina Johnson-Kanu and Brandon Palmer Spring 2013 Abstract In this paper we analyze the effect of belonging to the North American Free Trade Agreement (NAFTA) on the Foreign Direct Investment (FDI) flows of Mexico- a small country. We find that NAFTA does indeed increase Mexico’s FDI flows by a large magnitude. We also include background information on NAFTA, its history, trade flows and patterns and its trade policies. 1. Introduction In January 1994, the North American Free Trade Area (NAFTA) came into force between Canada, United States, and Mexico. It was largely pushed by the Mexican government after the Canada- US Free-Trade Agreement (CUSFTA). NAFTA, the first trilateral trade bloc in North America aimed to eliminate barriers to trade and investment among the three member countries. The FTA was the first trading agreement between a developing country and two developed countries. The opposition against NAFTA in U.S. and Canada prior to its formation gave credence to the fact that Mexico stood to benefit so much from the FTA. Some of the purported benefits were; Mexico getting access to the larger United States and Canada markets and a huge capital flight in the form of foreign direct investment to Mexico from the two developed nations. Mexican labor unions were opposed to NAFTA membership on the grounds that free trade would lead to loss of Mexican jobs to the high-skilled America labor. The Mexican government, on the other hand, had a vested interest in the likely huge capital inflows from the United States and Canada. Many economic pundits argued that NAFTA would serve as a catalyst for businesses to relocate from the United States to Mexico to escape increasing cost of production from the strict regulations in the United States. Some also argued that the cheap labor in Mexico would be a pull factor for firms from the United States and Canada to move to Mexico in order to reduce cost of production, especially with the lower wages found there. Foreign direct investment flows into Mexico, from the two member countries, has been and still is a subject of interest to many economic researchers. Partly due to the huge political opposition NAFTA faced prior to its final ratification by the three countries, and also because of its expected economic benefits to Mexico as the only developing country among the three. This paper aims to analyze the possible effects NAFTA may have on the Mexican net foreign direct investment flows. We try to answer the question: Did Mexico see an increase in its net foreign direct investment due to its membership in NAFTA? We analyze the effect of factors that affect Mexico’s FDI with the gravity model for periods pre and post-NAFTA and across countries within and without NAFTA. 2. History of NAFTA a. Type of RTA NAFTA was initially notified under GATT on January 29,1993. The agreement came into force on January 1, 1994. NAFTA was signed in 1992, in Ottawa on the 11th and 17th of December, Mexico on the 14th and 17th of December and in the US on the 8th and 17th of December1. The agreement was spurred by the U.S.-Canada free trade agreement (CUSFTA) and Mexico did not want to be left behind. While CUFSTA was implemented in 1989, talks of NAFTA actually began before CUFSTA's implementation. CUFSTA's key objectives eventually became objectives of NAFTA showing that NAFTA continued were CUSFTA left off. The objectives include: elimination of tariffs, reduction of non-tariff barriers, address trade in services, and a mechanism to settle disputes. Every member of NAFTA faces no barriers to trade when they trade with the other countries within the bloc. However, each country is able to set up different trade barriers to a nonmember country. The differing tariffs on nonmember countries can become an issue, and lead to problems dealing with rules of origin. This is because it may be cheaper for a country to export to one 1 Information obtained from the NAFTA secretariat archived files. http://www.nafta-secalena.org/en/view.aspx?x=283 country and have that country be an intermediary that transfers the goods to another country within the bloc. For example a third country such as Guatemala can export goods destined for U.S through Mexico in order to avoid higher import duties on the U.S border. To stop this however, it is necessary to have rules of origin to keep countries from cheating the system. These ‘Rules of Origin’ can be very complex; in fact, the written agreement of NAFTA has a whole chapter devoted to the rules of origin. It has been annexed, or adjusted four different times to clarify things that weren’t already in the agreement. b. Trade in NAFTA In all trade agreements, one must know about the trade creating and trade diverting effects among the countries to analyze the RTA's effectiveness. Trade diversion occurs because countries eliminate tariffs towards other member countries, but trade with an actually cheaper, nonmember, country to be passed up. The reverse is the case with trade creation where the imports are made from the least cost and most efficient producer. With NAFTA, the trade creation and diverting effects are ambiguous at best. While there was rapid growth in trade flows between the member countries during the first few years after NAFTA ratification, this trade increase was as a result of Mexico’s tariff reductions and not entirely as a result of NAFTA (Krueger, 1999). The volume of trade between members of an RTA should increase after it forms (Krueger,1999). In her paper, exports from U.S. to Canada increase from 35.4 billion USD in 1980 to 154.2 billion USD in 1998; also a change from 16 percent to 22.7 percent. An incremental change was also seen from US to Mexico from 6.9 percent to 11.96 percent. The only trade numbers that don't appear to improve are trade between Mexico and Canada. Mexican imports from Canada actually drop from 1.8 percent to 0.8 percent. It appears the greatest increases in trade are between the United States and Mexico. Overall, it seems that the increased trade seems to gravitate more to the United States. This is probably likely due to the fact that the US is geographically the center of the FTA which would lower the amount of distance needed to trade among partners. c. Tariff Rates Mexico began to liberalize trade in the mid 1980’s (Krueger 1999). That means that, Mexico started reducing its tariffs before it even became a member of NAFTA. This likely put Mexico in a better position when proposing the RTA, as the United States and Canada thought they were serious about liberalizing. It was estimated that Mexico had an average tariff level of 10 percent on imports from the US in 1990 (Krueger 1999). The average tariff on imports from Mexico (to the U.S.) dropped from 2.0 percent in 1992 to 1.4 percent in 1998 (Krueger 1999). So Mexico was able to export at a much cheaper price than previous. The U.S. has also liberalized trade with East Asia. However, it still has an average tariff rate of 3.2 percent toward East Asian products (Krueger 1999). The tariff may actually be leading to trade diversion if an East Asian country is more efficient at producing a particular good than Mexico. Hence, the Mexican trade share with the United States grew while East Asian trade share with the US decreased. 3. Current Trade Patterns Trade patterns have really changed from what they were before NAFTA. For example, before NAFTA, Mexico's trade extensively regulated its trade. They had tariffs, import licensing requirements, domestic-content provisions, and restrictive FDI policies. Where Mexico appeared to be closed, the United States and Canada had relatively more open economies. This should not come as a surprise because Mexico is a developing country and developing countries tend to be more closed than developed ones. A developing country is likely to assume that in order for them to boost their home market and increase GDP growth, they have to restrict trade. In 1994, NAFTA created the world's largest free trade area, which now covers about 450 million people producing about 17 trillion dollar worth of goods and services2. This is a trade agreement that deals with more goods and services than the entire European Union. The EU is considered the second largest, with GDP value of 15 trillion dollars. The current data available indicates that US exports to Mexico accounted to 163.3 billion dollars in 2010 and 248.2 billion dollars to Canada. That is to say, about 411 billion dollar value of goods and services are exported from the United States to other NAFTA countries. US exports to the other NAFTA member countries comprise of; machinery, vehicles, electrical equipment, mineral fuel and plastic. Most of these imports from U.S to Mexico are similar to those imported from Canada to Mexico which explains the reason why the volume of trade between Canada and Mexico decreased after the formation of NAFTA. From 1992 to 2002, Mexico increased agriculture imports from the US by 93 percent. US exports of agriculture products to the rest of the world grew by only 37 percent within this period3. Bilateral trade between the US and NAFTA grew 111 percent compared to the 79 percent with the rest of the world. US investment in Mexico also increased much more than it did in the rest of the world within that period. Overall, NAFTA has led and increased in the volume of trade between the partners. 2 Information obtained through the web from the office of the US trade representative. http://www.ustr.gov/trade-agreements/free-trade-agreements/north-american-free-trade-agreement-nafta. 3 Obtained from the US department of Commerce website at http://www.ita.doc.gov/media/Publications/pdf/nafta10.pdf. According to the data obtained from the World Bank, NAFTA's openness measure has actually decreased from around 58 percent to 56 percent. This openness measure is in comparison with the rest of the world. This shows a lot of trade is going on within the regional bloc due to the formation of NAFTA which tends to reduce their trade flows with the rest of the world. Trade flows between NAFTA and the EU is however increasing steadily. In 2008, the value of trade between NAFTA and the EU stood at 516,636 million euros while in the year 2012, the value stood at 606,746 million euros. 4. Current Trade Policies NAFTA aims to remove trade barriers on goods and services. They also aim to eliminate investment restrictions and protect intellectual property rights among the three member countries. The formation of NAFTA led to an immediate removal of 50 percent of all tariffs on goods and services among the three member countries with the rest of the tariffs to be gradually phased out within a fifteen year period. The targeted areas for tariff elimination by NAFTA in all the member countries include the following: construction, accounting, management or consulting, healthcare, engineering, tourism, advertising among others. All tariff and nontariff barriers were eliminated by January 2008. The major nontariff barriers to trade that were faced by the three member countries included border restrictions, environmental standards and licensing requirements. NAFTA as a free trade agreement does not have a harmonized trade policy between the three member countries and the rest of the world. Each individual member country is allowed to pursue its own trade policy with nonmember countries. This means that each NAFTA member country has its own external trade policies as defined by the Most Favored Nation (MFN) principle under the General Agreement on Tariffs and Trade (GATT) towards nonmembers. All the three member countries however, pursue open trade policies with the rest of the world. The United States has negotiated and continues to negotiate trading agreements with other nations and trading blocs such as the trans-pacific partnership (TTP) and the Southern Africa Custom Union (SACU). Canada has ratified many trading agreements with other regional blocs such the European Free Trade Association (EFTA) and the European Union (EU). Mexico has also entered into free trade agreements with the Central American Countries and the European Union among others. In order to ensure security and unrestricted flow of goods and services through the borders of the three member countries, an agreed policy on NAFTA’s ‘Rules of Origin’ has been introduced for custom officials to determine which goods are entitled for the preferential tariff treatment as defined by NAFTA and which goods are not. NAFTA certificate of Origin has been adopted as the official document to be used by both the exporters and importers within the three member countries if their exports or imports qualify for preferential tariff treatment under NAFTA provisions. By definition, the ‘Rules of Origin’ in NAFTA implies that firstly, a good should be wholly obtained or produced entirely from at least one of the member countries. Secondly, all non-originating materials do undergo the required change in tariffs classification as spell out in Annex 401 in the NAFTA constitution. Thirdly, if a good is wholly produced in any of the member countries exclusively from originating materials then it qualifies for preferential tariff treatment. It is required for each exporter to calculate the regional value content (RVC) of the good produced using either the Transaction Value or the Net Cost Content formulas. The Transaction Value Content formula measures the value of non-originating material as a percentage of the GATT transaction value of the good (total price paid for the good by the producing country) If the RVC calculated using this formula is at least 60 percent then the good is qualified for preferential NAFTA tariffs treatment. The Net Cost formula calculates the regional value content as a percentage of the net cost to produce the good. If the RVC calculated using this formula is at least 50 percent then the good is qualified for the preferential NAFTA tariffs treatment. Under NAFTA, each member country retain the right to apply their antidumping and countervailing duty laws to goods imported from another NAFTA country if the recipient country found those goods harmful to its domestic market or environment. 5. Environmental and Developmental Issues Prior to the final ratification of NAFTA, several concerns were raised on the possibility of inefficient and highly polluting industries relocating from areas with strict environmental regulating laws like in the United States and Canada to a relatively less strict environmental regulation Mexico in order to minimize cost of production. While some economists argued that NAFTA will lead to an automatic improvement of environmental conditions in Mexico, some thought otherwise. The major concern was therefore based on the fact that environmental law enforcement in Mexico was relatively lax relative to the enforcement in the United States or Canada. Therefore, the likelihood that high polluting industries would locate in Mexico for less regulatory reasons appeared great. These concerns prompted the United States to renegotiate a supplemental agreement to protect its American workers and also to ensure that the other member countries would observe strict environmental policies and regulations similar to that of the US. The North American Agreement on Environment Cooperation (NAAEC) was therefore proposed and a commissioned (Commission for Environment Cooperation) under the agreement, with the sole responsibility of continually conducting ex post environmental assessment of NAFTA. With four evaluations done so far by the commission, no systemic threat to the environment has been found to have been caused by NAFTA. The only sectors found to have experienced an increased in pollution with a link to NAFTA were the Mexican Petroleum Sector and the Transportation and Equipment Sectors in the United States and Mexico. No sector has been harmed in Canada in connection with NAFTA. a. Disputes Settlement In order to encourage free flow of cross-border investment among NAFTA member countries, provisions are being made to protect cross-border investors and facilitate the settlement of investment disputes. Each member country has to adhere to non-discriminatory principles in awarding of contracts to investors from other member countries. Chapter eleven of the agreement therefore permits an investor from any member country to seek financial damages from actions of another member country who violates any of the provisions spell out in the chapter. NAFTA secretariat was therefore established with offices are in all the capitals of each member country to provide assistance to the free trade commission in resolving trade and investment disputes. The secretariat is accountable to the NAFTA free trade commission which is established to oversee the implementation of the agreement. An aggrieved party can either initiate arbitration against another party under the arbitration rules of the United Nations Commission on International Trade Laws (UNICITRAL) or rules of the International Centre for Settlement of Investment Disputes (ICSID Additional Facility Rules). Disputes involving antidumping and countervailing duties are also handled by the secretariat. Since the establishment of the secretariat, about seventeen cases have been filed against the US, thirteen cases filed against the Mexican government and Canada just like Mexico has also been involved in thirteen cases. The commission has also established an Alternative Dispute resolution (ADR) at the various committee levels4. 6. Policy Evaluation a. Survey of Literature Foreign direct investment (FDI) flows are an important aspect of multilateral and regional interactions between countries. FDI flows encourage GDP growth and total factor productivity growth (Ramirez, 2006). Within an RTA, the expected GDP growth and TFP growth are expected to increase as seen in Canada (Leitao, 2010). Liberalization multilaterally and economic stability tend to increase the gains from FDI flows (Blomstrom & Kokko, 1997). This means that belonging to a multilateral and/or regional trading arrangement not only increase FDI flows, they encourage the proper use of the investment flows which in turn leads to total factor productivity and GDP growth (Macdermott, 2007). In line with the previous papers, Waldrick (2010) found that FDI affects Mexico’s total factor productivity and GDP growth positively; they also found however, that it decreases skilled wages in Mexico. Being in an RTA encourages FDI for the small countries in the RTA (Mollick, Ramos-Duran & Silva-Ochoa, 2006). Mexico is a small country in NAFTA and thus benefits from more FDI inflows that the other countries in NAFTA (Cuevas, Messmacher &Werner, 4 Most NAFTA related information is obtained from the NAFTA secretariat website in English unless otherwise specified. 2005). As a result the positive effects of FDI are greater for Mexico than it is for the US. Studying the effects the NAFTA has on Mexico’s net FDI flows is therefore important and we add to previous literature by also comparing the effect Mexico’s membership in OECD affects its FDI net flows. While we focus on NAFTS’s effect on Mexico’s flows we compare that effect to the OECD’s to get a better understanding of the magnitude of NAFTA’s effect. b. Empirical Design This paper uses the empirical foundations provided in McDermott (2006) although we add other variables as suggested by other papers. We use the gravity model to understand Mexico’s net FDI flows. We test to see if belonging to NAFTA creates an increase in the Mexico’s net FDI flows. We add other factors that may affect the flow of FDI as used in gravity models in other papers. The gravity model for FDI is as follows: 𝐿𝑜𝑔(𝐹𝐷𝐼𝑖𝑗𝑡 ) = log(𝐺𝐷𝑃𝑖𝑡 ) + log(𝐺𝐷𝑃𝑗𝑡 ) + log(𝐷𝑖𝑠𝑡𝑎𝑛𝑐𝑒𝑖𝑗 ) + 𝑁𝐴𝐹𝑇𝐴 + 𝑂𝐸𝐶𝐷 + 𝐿𝑎𝑛𝑔𝑢𝑎𝑔𝑒 + 𝐴𝑑𝑗𝑎𝑐𝑒𝑛𝑐𝑦 + 𝐸𝑐𝑜𝑛𝑜𝑚𝑖𝑐 𝐹𝑟𝑒𝑒𝑑𝑜𝑚𝑖𝑡 + log(𝑅𝑒𝑙𝑎𝑡𝑖𝑣𝑒 𝐹𝑎𝑐𝑡𝑜𝑟 𝐸𝑛𝑑𝑜𝑤𝑚𝑒𝑛𝑡𝑖𝑗𝑡 ) + 𝜀𝑖𝑗𝑡 Where 𝐹𝐷𝐼𝑖𝑗𝑡 is the dependent variable. It is the bilateral Foreign Direct Investment between Mexico and its investment partners in time t. it is the absolute value of the difference between the FDI outflow and the FDI inflow. 𝐺𝐷𝑃𝑖𝑡 is the GDP of Mexico the host country who receives the FDI in time t. it is expected to positively affect FDI flows. 𝐺𝐷𝑃𝑗𝑡 is the GDP of the source country who gives the FDI in time t. it is expected to positively affect FDI flows. 𝐷𝑖𝑠𝑡𝑖𝑗 is the distance between the two countries. It is expected to have a negative sign because the farther apart countries are the less likely investment flows would move between them. 𝑁𝐴𝐹𝑇𝐴𝑖𝑗 is the independent variable of interest. It is the RTA dummy variable showing that the countries belong to NAFTA. This is expected to be positive as belonging in an RTA should increase the investment flows between the countries in that RTA. OECD is a dummy variable showing if the partner country is a member of the OECD. It is expected to have a positive sign. We use the ease of doing business, investment rank and trade freedom indexes as proxies for Economic freedom as used in Turan and Soritis (2011), and is expected to affect FDI flows positively. Relative factor endowment consists of relative labor endowment and relative Capital endowment. Relative Labor factor endowment is the relative labor endowment from Mexico as a ratio of the relative labor endowment of their investment partners and is expected to affect FDI flows positively. Relative capital endowment of Mexico as a ratio of the relative capital endowment from their trading partners and is expected to affect FDI negatively. Relative factor endowment in the gravity model for FDI derived by Kleinert and Toubal (2010) significant in two of their models and so we include it in ours. The language variable is 1 if both countries share the same official language and adjacency if they share a common border. 𝜀𝑖𝑗𝑡 is the error term in time t. All other variables in the model above not included in the standard gravity model for bilateral trade are included here based on the explanatory power of those variables in determining FDI flows in previous work. Summary statistics for all variables can be found in table 3 in the appendix while further variable definitions can be found in table 2. We estimate our model using Ordinary Least Squares (OLS) method. We include variables from Kleinert and Toubal (2010) that use factor endowment variables to explain bilateral FDI flows. They calculate the relative factor endowment as follows: 𝑠𝑖 𝑙𝑖 RFEL= [𝑠𝑖+𝑠𝑗] / [𝑙𝑖+𝑙𝑗] Where RFEL is the relative labor factor endowment of Mexico to its partner countries. Si is the skilled labor force of Mexico and Sj is that of the partner country. Li is the unskilled labor force of Mexico and Lj is that of the partner country. 𝑘𝑖 RFEK=[𝑘𝑖+𝑘 ] 𝑗 Where RFEK is the relative capital factor endowment of Mexico to its partner countries. Ki is the capital stock of Mexico and Kj is that of its partner country. c. Data A panel consisting of twenty six countries from 1985 to 2010 is analyzed in this study. The complete list of the countries can be found in table 1 in the appendix. FDI data would be collected from the Organization for Economic Cooperation and Development (OECD) databases. The GDP data was collected from the World Bank World Development Indicator (WDI). The Relative Factor Endowment is author computed from data obtained from the World Bank WDI. Distance data used is the Centre d'Etudes Prospectives et d'Informations Internationales (CEPII) computation of distance. Other indexes and rankings data are collected from the Heritage foundation economic freedom index database. d. Gravity model with Zeroes We came across problems collecting complete bilateral FDI datasets. The data we collected from the World Bank WDI included a lot of missing observations. To correct for this problem, zeros are included to make the dataset more balanced and save the number of observations (Kleinert and Toubal, 2010). The Mexican FDI outflow is an incomplete data set with many countries with missing entries for most years. A few countries like the United States have values for all the years but other countries like Sweden or Argentina have very few or no data entries at all. e. Results All results from the OLS regressions can be found in table 4 in the appendix. We find that the NAFTA variable is significant in most of the models especially the models that contain all observations from 1985 till 2010 making us believe that Mexican bilateral FDI flows benefit from belonging to NAFTA. For the sample from 1995 till 2010 the NAFTA variable is only significant in the last specification where the labor endowment variable is taken out of the model. In the first specification we find belonging to NAFTA increases Mexico’s FDI flows by 4.5 times the value it would have been otherwise5. In the second specification were we take the capital endowments into account, NAFTA increases Mexico’s FDI inflows by more than 5 times its original value. In the third specification the impact of NAFTA on Mexico’s FDI is even greater at 8.76 times the original value. This value may be somewhat biased because the sample size is almost half what it was in specification I or II. The same goes for the OECD, where we find that belonging to the OECD increases Mexico’s FDI flows by 2.6 times what it would have been with the first specification and increases it by almost 3 times what it would have been with the second specification. The OECD variable is not 5 We take the antilog of the coefficients in table 4 to get the magnitude of the effect of the dummy variables on FDI. significant when the sample size decreases just like the NAFTA variable in specifications III and IV. We can conclude that Mexico’s membership in the OECD increases its FDI flows but not as much as its membership in NAFTA does. We find that unlike Turan and Soritis (2011), the economic freedom variable does not affect the FDI flows between Mexico and its investment partners. The Relative labor endowment variable is significant in both models it is used in and has the expected signs leading us to believe that when Mexico’s labor endowment is relatively greater than that of the partner country, investment flows tend to increase. The relative capital endowment variable is negative on all models it is present and we can conclude that if Mexico is relatively more endowed in capital, capital flows between Mexico and the investment partner would decrease significantly with and elasticity of 0.77. The adjacency variable is somewhat imprecisely estimated and is barely significant in any of the specifications. We assume this is because the US is the only country in the sample that is adjacent to Mexico and the possible effects from this relationship may have been swallowed by the fact that the US is the other country in NAFTA besides Canada. The language variable is significant in all specifications of the model and shows that sharing a common language encourages FDI flows. 7. Recommendations and Concluding Remarks Belonging to NAFTA is beneficial to Mexico as a small country as suggested by Mollick, et al (2006). Furthermore, belonging to the OECD seems somewhat beneficial to their investment flows. Mexico has done well be aligning itself with big countries and forming RTA’s with them. Mexico can also benefit from relations with other countries that share its official language. References Blomstrom, M., and Kokko, A. (1997). Regional Integration and Foreign Direct Investment. NBER Working Paper Series. EconLit. Web. 27 Feb. 2013. Cuevas, A., Messmacher, M., and Werner A. (2010). "Foreign Direct Investment in Mexico since the Approval of NAFTA." World Bank Economic Review 19.3 473-88. EconLit. Web. 27 Feb. 2013. Kleinert J. and Toubal F. (2010). Gravity for FDI. Review of International Economics 18.1 1-13 . EconLit.Web. 16 Mar. 2013. Krueger, A. O. (1999). Trade Creation and Trade Diversion under NAFTA. NBER Working Paper Series. 7429. 16 Mar. 2013. MacDermott, R. (2007). "Regional Trade Agreement and Foreign Direct Investment." North American Journal of Economics and Finance 18.1 107-16. EconLit. Web. 27 Feb. 2013. Mollick, A. V., Ramos-Duran, R. and Silva-Ochoa, E. (2006). "Infrastructure and FDI Inflows into Mexico: A Panel Data Approach." Global Economy Journal 6.1 1-25. EconLit. Web. 27 Feb. 2013. Leitao, N. C. (2010). "Foreign Direct Investment: The Canadian Experience." International Journal of Economics and Finance 2.4: 82-8. EconLit. Web. 27 Feb. 2013. Ramirez, M. D. (2003). "Mexico under NAFTA: A Critical Assessment." Quarterly Review of Economics and Finance 43.5. 863-92. EconLit. Web. 27 Feb. 2013. Turan, S. and Sotiris, B. (2011). Economic Freedom and Foreign Direct Investment in Latin America: A Panel Gravity Model Approach. Economics Bulletin 31.3. 20532065. EconLit. Web. 16 Mar. 2013. Waldkirch, A. (2010). "The Effects of Foreign Direct Investment in Mexico since NAFTA." World Economy 33.5 : 710-45. EconLit. Web. 27 Feb. 2013. Appendix: Tables Table 1: Countries included in data set NAFTA United States Canada Others Argentina Denmark Italy Norway Australia Finland Japan Portugal Austria France Korea, South Singapore Belgium Germany Luxembourg Spain Brazil Greece Netherlands United Kingdom Chile Iceland Netherlands Czech Republic Ireland New Zealand Table 2 Variable description Source FDI FDI is the net foreign direct investment OECD StatExtract inflow to Mexico from the 26 partner countries. GDPI This is the GDP of the home country Mexico World Bank WDI for that year GDPJ GDP for the host country for each year World Bank WDI DIST Distance from the capital city of each country CEPII calculated as the crow flies. ADJ 1 is the countries share a common border and CEPII 0 otherwise LANG 1 if the countries have the same official CEPII language, 0 otherwise. NAFTA 1 if the countries are members of NAFTA, 0 Author computed otherwise RFEL Relative capital factor productivity measured Assets: World Bank WDI as the ratio of Mexico’s Capital endowment to that of its partner country. RFEK Relative Labor factor endowment measured Labor stocks: World Bank as the ratio or Mexico’s labor (skilled and WDI unskilled) to the labor endowment (skilled and unskilled)of its partner country TradeFree The country’s level of freedom to trade The Heritage Foundation measured in percentages BusinessFree The country’s level of ease of doing business. The Heritage Foundation Measured in percentages InvestRank The countries investment attractiveness to The Heritage Foundation potential partners measured in percentages OECD 1 if the country is a member of the OECD (excludes Canada and the US), 0 otherwise Author Computed Table 3 Variable Observations Mean SD Max Min FDI 657 518.3754871 1855.94 21611.66 -2453.38 GDPI 728 5272616851 29682782443 1.0944803E1 12944019134 65 0 2 0 8689480755 1.8911777E12 1.44194E13 4537763200 GDPJ 728 07 DIST 728 9376.71 2931.57 16623.59 3267.29 ADJ 728 0.0357143 0.1857045 1 0 LANG 728 0.1071429 0.3095074 1 0 NAFTA 728 0.0714286 0.2577164 1 0 RFEL 343 0.8268168 0.3150999 3.5372762 0.2981718 RFEK 717 0.5328113 0.2694023 0.9976520 0.0378834 TradeFree 438 78.9940639 6.8649550 90.00 51.00 BusinessFree 438 79.8312785 10.7532233 100.00 53.500 InvestRank 438 70.0799087 12.2401787 95.00 45.00 OECD 728 0.8214286 0.3832564 1 0 Table 4 Ordinary Least Squares Estimations Variable (I) (II) lnGDPI 0.80*** 1.27*** (4.97) (6.12) lnGDPj 1.07*** 0.83*** (13.81) (8.17) lnDIST -0.52* -0.84*** (1.65) (2.58) ADJ 1.10* 0.59 (1.82) (0.95) LANG 0.54* 0.63** (1.83) (2.15) NAFTA 1.50*** 1.68*** (2.77) (3.13) RFEL RFEK -0.77*** (3.53) (III) 1.20*** (2.64) 1.07*** (6.59) -0.51 (0.94) -0.75 (0.72) 1.35** (2.27) 1.49 (1.40) 1.91*** (3.81) -0.80 (1.63) 1.03*** (3.57) -46.59*** (8.90) 0.43 528 0.77 (1.33) -53.60*** (4.64) 0.47 294 TradeFree BusinessFree InvestRank OECD Intercept R-Squared Observations 0.96*** (3.33) -42.42*** (8.23) 0.42 528 (IV) 0.26 (0.26) 1.02*** (6.30) -0.56 (1.03) -0.79 (0.76) 1.30** (2.20) 1.45 (1.36) 2.11*** (4.16) -0.95* (1.92) 0.03 (1.51) 0.01 (0.37) -0.28 (0.95) 0.84 (1.46) -27.58 (1.05) 0.48 294 (V) 1.25*** (2.65) 1.09*** (6.59) -0.43 (0.77) -0.69 (0.65) 2.01*** (3.45) 2.17** (2.01) -0.71 (1.42) 0.50 (0.85) -56.17*** (4.76) 0.44 294 The values in parenthesis are the t-values. ***, **, * represent 1%, 5% and 10% significance levels respectively