Economic Impact Assessment

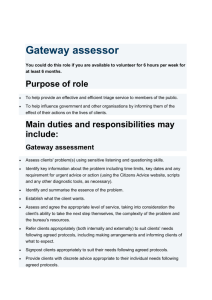

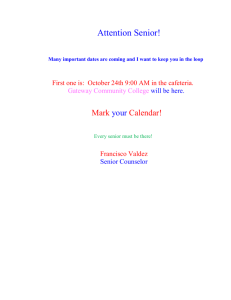

advertisement