EIGCA/TORO Business Management Seminar

advertisement

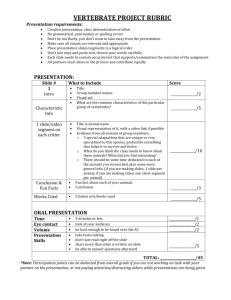

Strategic Insight in 3 Circles* A G E B D C F A Management Seminar for EIGCA Members Co-sponsored by Toro and EIGCA October, 2011 Presented by Mike Etzel A G E B D C F *copyright 2007 Urbany and Davis, Revised and used with permission A G E B D C F ©copyright 2007 Urbany and Davis A G E B D C F ©copyright 2007 Urbany and Davis • • • • 70% of players who moved forward found the game more enjoyable 90% played faster or at least at the same speed as they normally did 91% like the concept enough to recommend it to a friend 52% said they would play more golf as a result of the program A G E B D C F ©copyright 2007 Urbany and Davis A G E B D C F ©copyright 2007 Urbany and Davis MARKETING consists of coordinated activities to plan, price, promote, and distribute want-satisfying offerings to targeted prospects A G E B D C F ©copyright 2007 Urbany and Davis Marketing is challenging because it… • Emphasizes planning before action • Requires discipline in implementation • Makes the needs of the prospect, not the business or the offering, the focus A G E B D C F ©copyright 2007 Urbany and Davis The 3-Circles Market You Competition Determine How they Overlap Market You Competition . You Market Competition Use the Interactions to Formulate Strategy Objectives • Prepare to serve a defined market (a segment) better than the competition • Identify unmet opportunities in that market segment The Core of Marketing • Segmenting - Dividing the market into groups with similar purchase-related characteristics • Targeting - Selecting one or more segments to pursue • Positioning - Designing strategies and tactics for one or more specific segment(s) A G E B D C F ©copyright 2007 Urbany and Davis S-T-P Examples • Ray Kroc with McDonald’s • Herb Kelleher with Southwest Airlines • Howard Schultz with Starbuck’s A G E B D C F ©copyright 2007 Urbany and Davis The area of the first circle represents a market segment’s requirements, needs or desired attributes. Segment’s Desired Attributes Your Equities and Disequities Next, add a circle that represents the value you are perceived to offer this segment Your Equities/ Disequities These are the assets, skills, and capabilities the segment perceives you have to offer Segment’s Desired Attributes Market segment’s requirements, needs or desired attributes Your Equities/ Disequities How much does what you are viewed as offering overlap with this segment’s needs? Segment’s Desired Attributes Your Equities/ Disequities … in other words … Segment’s Desired Attributes Your Equities/ Disequities This is the value customers in this segment believe you can create for them Segment’s Desired Attributes Your Equities/ Disequities Segment’s Desired Attributes Positive Value or Equities This overlapping area is called positive value or “equities.” Your Equities/ Disequities Segment’s Desired Attributes You need to determine how much your firm’s equities overlap with this segment’s needs… Your Equities/ Disequities Segment’s Desired Attributes These areas are also meaningful Your Equities/ Disequities Disequities and Potential Equities Maybe customers feel they don’t need some of the value you create (yet?) Segment’s Desired Attributes Your Equities/ Disequities Disequities and Potential Equities Segment’s Desired Attributes Unmet needs … and there likely are needs the segment has that are unmet… Your Equities/ Disequities Segment’s Desired Attributes Disequities and Potential Equities Unmet needs Next it is important to recognize… Your Equities/ Disequities Segment’s Desired Attributes Disequities and Potential Equities Equities Unmet needs Some of this space is shared with competitors… Your Equities/ Disequities Segment’s Desired Attributes Equities Disequities/ potential equity … there are competitors who also create value for customers… Unmet need Competitor Equities/ disequities Your Equities/ Disequities Segment’s Desired Attributes When Competitors are added… Competitor Equities/ Disequities Your Equities/ Disequities Segment’s Desired Attributes Every unique area in the model takes on meaning… Competitor Equities/ Disequities Your Equities/ Disequities Segment’s Desired Attributes B Points of Parity … Area B contains the table stakes… value you must create to be in the game… Competitor Equities/ Disequities Your Equities/ Disequities Segment’s Desired Attributes A Your points of Difference B Points of Parity … Area A is your unique value to customers, the most important concept in competitive strategy… Competitor Equities/ Disequities Your Equities/ Disequities Segment’s Desired Attributes A Your points of Difference B Points of Parity Yet, the competitor has desirable points of difference as well… C Their points of Difference Competitor Equities/ Disequities Your Equities/ Disequities Segment’s Desired Attributes A Your points of Difference B Points of Parity C Their points of Difference Your profitability depends upon the relative size and importance of your Area A compared to competitors’ Area C Competitor Equities/ Disequities Your Equities/ Disequities Segment’s Desired Attributes A Your points of Difference B Points of Parity D Common disequity/ Potential equity Area D …? This is value we both create that may not seem valuable to the customer ! C Their points of Difference Competitor Equities/ Disequities Your Equities/ Disequities Segment’s Desired Attributes E Your disequity/ Potential equity A Your points of Difference B Points of Parity D Common disequity/ Potential equity … and each competitor has its own unique area of “non-value.” C Their points of Difference F Their disequity/ Potential equity Competitor Equities/ Disequities Your Equities/ Disequities Segment’s Desired Attributes E Your disequity/ Potential equity A Your points of Difference B Points of Parity D Common disequity/ Potential equity Most significantly for the future, every customer/segment has “white space” G “White Space” C Their points of Difference F Their disequity/ Potential equity Competitor Equities/ Disequities Your Equities/ Disequities Segment’s Desired Attributes E Your disequity/ Potential equity A Your points of Difference B Points of Parity D Common disequity/ Potential equity … an area representing customers’ needs that haven’t yet been met… G “White Space” C Their points of Difference F Their disequity/ Potential equity Competitor Equities/ Disequities Your Equities/ Disequities Segment’s Desired Attributes E Your disequity/ Potential equity A Your points of Difference B Points of Parity D Common disequity/ Potential equity This is the model… it captures value as the CUSTOMER Perceives it G “White Space” C Their points of Difference F Their disequity/ Potential equity Competitor Equities/ Disequities Conducting a 3-Circle Analysis A G E B D C F ©copyright 2007 Urbany and Davis Ten-Step Process • Identify a Context • Gather External (Outside) Data – Customer analysis – Sorting data into 3 circles – Deeper diving • Gather Internal (Inside) Data – Firm’s resources – Competitors’ resources – Overlaps • Analyze the Data – Align capabilities with market needs – Factor in change – Identify growth options and tactics Step 1: The Context • Market - organizations with needs to satisfy, money to spend, and a willingness to spend it. • You - you, your firm, or a unit of your firm • Competition - one or more organizations pursuing the market being analyzed Customers’ Desired Attributes Segment A Segment B Segment C Priorities, rather than major differences, often distinguish segments of a market Market Segmentation • Market Segments - Prospects in a broader market who share demand-related characteristics and can be most effectively served by a tailored marketing program. • Markets segments are based on: – Particular need/benefit and/or priorities – Particular behaviors – Observable characteristics Step 1 Outcome Is a Context Statement “My goal is to figure out how (I/we/my company/division) can grow by creating more value for (customer/market segment) than (my competitor) does.” Step 2: Customer Analysis • An internal and external exercise to determine the segment’s: – Desired benefits – Perceptions of your capability – Perceptions of your competitor’s capability A “Before” View of a Market Segment • Put yourself in the shoes of the customer • Using the “Before” Worksheet: – List the top reasons customers in this segment choose a design firm – Estimate the importance of each reason as low, medium, or high – Estimate how the segment rates your firm and the selected competitor on each reason (below expectations = 1, meets expectations = 2, exceeds expectations = 3) – Anticipating Step 4: Probe why you believe each reason is important using laddering An “After” View of the Segment • Do the same thing using the “After” Worksheet but this time use information OBTAINED DIRECTLY FROM THE SEGMENT – Talk to recent buyers – See the equity and disequity questions in the Analysis Guide – Be a good listener – Anticipating Step 4: Probe beyond the obvious responses using laddering Reconciling Before and After Worksheets • Resolving differences: – Confirms the value of getting outside yourself – Produces new insights Step 3: Sorting • You now know the segment’s: – Important needs and their priorities – Perception of your capabilities – Perception of the competition’s capabilities • Place these dimensions in the 3-circle worksheet Step 4: Deep Diving • Determining the “why” of choice attributes – Attributes are good; consequences are better • “Laddering” is a frequently used probing technique Laddering Technique • A simple technique for identifying what drives choices. – It consists of repeating probes and listening to the answers • For “Before” Worksheet: – “Why is (attribute) important to customers” – “What do customers really get from (attribute)” • For “After” Worksheet: – “Why is (attribute) important to you” – “How do you benefit from (attribute)” Completing Step 4 • Add to the 3-Circle Worksheet the reasons (the consequences to the buyer) why each attribute is important to the segment – Consequences are often assumed or “hidden” – Success of a strategy often turns on understanding consequences Step 5 & 6: Assessing CARs YOU Capabilities, Resources, Assets, Culture, Social Capital, Leadership, Structure, Knowledge Competition Capabilities, Resources, Assets, Culture, Social Capital, Leadership, Structure, Knowledge INSIDE is where you find the capabilities, resources, and assets used to create customer value. Step 5: Your Capabilities, Resources, and Assets • Develop an organized list of your organization’s capabilities, resources, and assets – Weak versus strong – Heavily utilized versus under utilized – Core versus peripheral • Test your assessments externally Step 6: Competitor’s Capabilities, Resources, and Assets • Develop an organized list of your competitor’s capabilities, resources, and assets Step 7: Overlap Assessment • Identify capabilities, resources and assets that: – You have in common with the competitor • Unlikely sources of distinctiveness – Are unique to you • Potential sources of differential advantage – Are unique to the competitor • Potential sources of differential disadvantage Step 8: Align Perceptions and Realities of Capabilities, Resources, and Assets • Compare the results from Step 2 (Customer Analysis) and Steps 5, 6 and 7 (Your and Competitor’s CARs) – What characterizes the CARs? • • • • Unique? Substantive? Difficult to duplicate? Is the market informed? • Add these to the 3-Circle Worksheet Step 9: Dynamics • How is the market changing or likely to change? – – – – – Size of the circles Overlaps Needs of the market Your attributes Competitor’s attributes Step 10: Growth Opportunities • Strategy questions addressed by the model: – Can we identify, build, and defend meaningful differentiation? – Do we have hidden capabilities that could enhance customer value? – Are there disequities we can eliminate or improve? – Do competitors have advantages we can neutralize? – What unmet segment needs provide new growth opportunities? • Identify value numerator and denominator ideas – Use the 3-Circle Worksheet – Develop tactics to accomplish the goals – Estimate the likelihood of success (costs versus return) Conclusions • Strengths of the 3-Circle planning model – – – – – Puts strategy ahead of tactics Focuses on the market Addresses all potential areas of strategy Can be conducted at different levels of complexity It works!