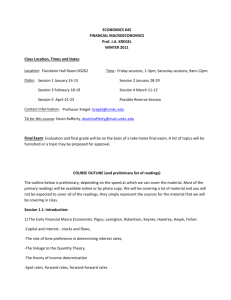

Concept of Interest and Rate of Interest

advertisement

Theory of Interest A brief overview of modern interest theories Knut Wicksell (1851-1926) Born in Stockholm, Sweden, 1851 Son of a successful businessman and real estate broker Orphan at the age of 15 Mathematics and Physics 1887: Economics 1898: Interest and Prices 1916: Swedish government advisor on financial and banking issues main intellectual rival was the American economist Irving Fisher Interest and Prices natural rate of interest real profit (r) MPK vs. money rate of interest money market (i) Cumulative Process model MPK > i I > S M rises Demand > Supply prices rise The demand for loans will continue accumulating, and the banking system's deposit creation continues indefinitely - with savings never really catching up. Money supply will expand endogenously without limit and prices will also rise without end. What can end this process? Reserve Requirement Constraint Irving Fisher (1867-1947) Born in New York, 1867 Yale University • 1888: B.A. • 1891: Ph.D. Mathematics & Economics 1930: The Theory of Interest The Theory of Interest: As determined by the impatience to spend income and opportunity to invest it. Income Capital Interest Income 3 stages: • Psychic income or enjoyment income • Real income • Money income or cost of living real income The Thames below Westminster about 1871 Oil on canvas 47 x 72.5 cm. Money Income Capital any asset that produces a flow of income over time “The value of any property, or rights to wealth, is its value as a source of income and is found by discounting that expected income” (Fisher, 1930, p.14). the value of capital is the present value of the flow of (net) income that the asset generates Capital goods Income Capital value Income value Rate of Interest capital value X rate of interest = interest IMPATIENCE OPPORTUNITY (a) the time preference people have for consuming today versus consumption at a later time, and (b)the expectation that income saved and invested today will yield greater income tomorrow – capital produced today will generate greater future production than was required to construct the capital Difference between Classical economists and Irving Fisher According classical economists there are four sources of income: • • • • Rent Wages Profits Interest Fisher treated interest not as a separate entity of income, but as sub-entity within each of the 3 sources of income Other non-economic factors that influence rate of interest: Foresight - intelligence Self-control – willingness Habit Life Expectancy The love of one's children Fashion Fisher, Irving. The Nature of Capital and Income. New York: The Macmillan Company, 1906. Octavo, 1st edition in original green cloth. $1600. Source: http://www.manhattanrarebooks.com/fisher.htm John Maynard Keynes (1883-1946) Born in Cambridge, 1883 King's College, Cambridge Mathematics in 1905 Alfred Marshall and Arthur Pigou 1936: General Theory 1942: was made a lord 1944: Bretton Woods Conference April 21, 1946 passed away General Theory “Liquidity-preference” Financial wealth i Illiquid assets Liquid assets Wealth is allocated between liquid and illiquid assets “Thus the rate of interest at any time, being the reward for parting with liquidity, is a measure of the unwillingness of those who possess money to part with their liquid control over it. The rate of interest is not the “price” which brings into equilibrium the demand for resources to invest with the readiness to abstain from present consumption. It is the “price” which equilibrates the desire to hold wealth in the form of cash with the available quantity of cash; — which implies that if the rate of interest were lower, i.e. if the reward for parting with cash were diminished, the aggregate amount of cash which the public would wish to hold would exceed the available supply, and that if the rate of interest were raised, there would be a surplus of cash which no one would be willing to hold.” (Keynes, 1936). Money Demand Theory People hold money for three reasons: Transaction Motive ► Precaution Motive ► Speculation Motive ► Uncertainty Expectation On expectation ► If E(Δi) > 0 Md > 0 ► If E(Δi) < 0 Md < 0 Md (E(Δi)) Interest Rate is a function of money demand and money supply; it is a monetary factor i* = i (Md, Ms) Sir John Hicks (1904 - 1989) Sir John Hicks Born in 1904 at Warwick, England Mathematics Clifton College (1917-22) Balliol College, Oxford (1922-26) 1937: IS-LM model IS-LM model Based on John M. Keynes’s General Theory All equilibria in both commodity and money markets IS curve: Y = f(i) equality of S and I LM curve: i = f(Y) equality of Ms and Md In 1982 Hicks rejected this model because although it is a very useful apparatus to understanding Keynes’ General Theory but it lacks one very essential thing that Keynes already knew: Uncertainty