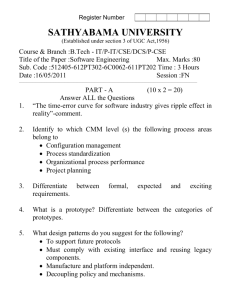

Financial Policies And Procedures

advertisement