oposiciones de ingreso al cuerpo de profesores de

advertisement

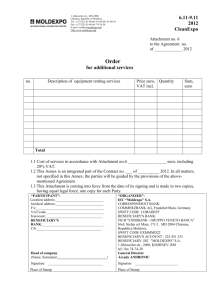

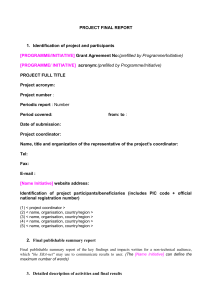

Leonardo Project Transfer of Innovation: “Enterprise as innovation to create new work places at time of global crisis” nº 2010-1-ES1-LEO05-21250. Carlisle, 13th-15th January 2011. 1 I. PROGRAMME: TOI CARLISLE 13th – 15th January 2011 Friday, January 14th: 9:00 Introduction by the project legal representative Pilar Gredilla and the Project coordinator in Carlisie Trudy Stammer. 09:45 “Enterprise as innovation to create new work places at time of global crisis” nº 2010-1-ES1-LEO05-21250.Leonardo Transfer of Innovation 1) Project: general approach: 10:15 2) Project financial management 1.1. New approved budget 1.2. Working schedule 1.3. Partner change 1.4. Detailed approach to the project: working packages, pilot project and the European final business fair 2.1. Purpose and principles 2.2. Contract commitments for beneficiary 2.3. Contract commitments for partner 11:00 a 11:30 Coffee break 11.30 Project financial management: continuation 2.4.2. Staff costs justification. Time Sheet. 2.4.3. Travel costs and subsitence rates justification 2.4.4. Justification of subcontracting costs, other costs and indirect costs 2 PROGRAMME: TOI CARLISLE 13th – 15th January 2011(2) 3. Contracts and amendments 4. Financial management 5. Auditing 12:15 6. Project reports: quarterly report, intermediate report and final report 13:00 Lunch 15:00 Aprende a Emprender programme and its implementation in different countries: 17:00 Coffee break 17:30 Problems at the time of implementing the programme in each country. (Around 10 minutes for each partner): Webpage. Translation of the documents Business plan. Vocational Training in each country. United Kingdom. Portugal. Turkey. Poland. (Greece). (Slovakia). 19:00 Free time 20:00 Dinner 3 I. 1 ESTIMATED EXPENDITURES AND REVENUE BY OF COST - TYPE OF COST - A. STAFF COSTS - B.1 TRAVEL SUBSISTENCE B.2 SUBCONTRACTING - EXPENDITURE REQUESTED APLICATION FORM February 2010 EXPENDITURE LEONARDO AGENCY September 2010 EXPENDITURE LEONARDO AGENCY (SLOVAQU IA) JANUARY 2011 Calculate Your COST ICO - 128.190 - 169.170,00 - 166.450 - + 40.980 AND - 104.656 - 75.353 - 75.353 - - 29.303 - 94.700 - 42.500 - 44.850 - - 52.200 B.4 OTHER - 48.000 - 34.000 - 34.000 - - 14.000 - TOTAL DIRECT COSTS - 327.546 - 321.023 - 320.653 - - 6.523 - INDIRECT COST - 12.000 - 12.000 - 12.370 - 0 - TOTAL PROJECT EXPENDITURE (A+B) CO-FINANCING % - 339.546 - 303.023 - 303.023 - - 36.523 74,98 % - 71,67 % - 71,67% - -3,31 PROPOSED COMMUNITY CONTRIBUTION PARNER´S OWN FUNDINGS - 254.601 - 238.692 - 238.686 - - 15.915 84.954 - 94.331 - 94.337 - + 9.377 - 4 1.2 Working schedule 5 1.3 Partner change : Organitation BIC Banská Bystrica, s.r.o. BUSINESS & INNOVATION CENTRE BANSKÁ B Legal address Rudohorská 33, cp 974 11 ; BANSKÁ BYSTRICA; SK – SLOVAKIA, phone number00421484716411; bicbb@bicbb.sk; www.bicbb.sk Contact person LIVIA HANESOVA livia.hanesova@gmail.com AND MIROSLAV ŠIPIKAL msipikal@gmail.com Description of organisation, IC Banská Bystrica is an institution with the mission to speed up the economical development of the region through the support of both businesses and public sector. The organisation began operations operating in 1994, and has gradually extended the range of provided services into the educational area and the area of quality management implementation. Nowadays, there is a broad network of Business Innovation Centres in Europe, which are linked together within the European BIC Network (EBN) and are considered as the key factor for regional development. BIC BB is a member of the Association of Advisory Centres (BICs and RPICs) in Slovakia and closely works in co-operation with National Agency for Development of Small and Medium Enterprises (NADSME). BIC Banská Bystrica has been granted the Quality Certificate from the reputable international company BVQI that enables it to provide the wide range of guidance, support and educational services. BIC Banská Bystrica was the first organization in Slovakia to start up the operation of Business Incubator and Technological Centre in Banská Bystrica, which was co-funded from the sources of the PHARE program. BIC Banská Bystrica provides guidance and support services for starting innovative businesses and enterprises placed in the incubator. Support is provided through consulting and educational services with the aim to strengthen the business and to prepare the company for the commercial environment. Banská Bystrica Self-governing Region was ranked among chosen regions that are achieving the highest rate of long-term disadvantaged job seekers. In June 2008 the Ministry of Labor, Social Affairs and Family approved financing of 8 projects of social enterprises, 4 of which are implemented in the Banská Bystrica Self-governing Region. The aim of these projects is to find an effective mechanism for functioning of social enterprises, the pilot check of the establishment and functioning of social enterprises focused on reduction of unemployment and prevention of social exclusion, especially through training, activation of the disadvantaged individuals, reinvestment of surpluses to the development of sustainable providing of 6 services and community development. DITRIBUTION OF FUNCTIONS IN THE COSORTIUM P0. ANPE ES Management of the project and partnership , Europass certification. Official announcement of the idea contest P1. JCYL ES Official announcement of the idea contest . Monitoring the materials of the programme P2.KERIGMA Portugal PT Financial supervision Coordination of internal evaluation P3 CEEI ES Technical management - coordination of technological innovation. Monitoring the materials of the programme P4. CLL CREDITS UK Coordination of the project image: marketing P5. BELKTRO TR Turkey; Monitoring the new materials and its compilation P6 MSCDN Poland PL Coordination of teachers / tutors training P7 EKPOL Greece EL Coordination / organization of final seminar/ European fair P8 BIC SLOVAQUIA Coordination and monitoring the quality of the mobilities and evaluation of the cost-benefit ratio of them. ALL PARNERS All the partners are responsible for the adaptation and implementation of the program in its own country; USAL ES the University of Salamanca External evaluation . will be also in charge of the translation of the programme materials.. 7 Detailed approach to the project: working packages, pilot project and the European final business fair P0 ANPE ES NEW EXPENDITURE NEW OBJECTIVE: 1.WEBPAGE TRANSLATION 2. MATERIALS ADAPTATION IN DIFFERENT COUNTRIES 3. CONCLUSIONS. 4. EUROEPAN GUIDE ON HOW TO USE IT AS AN EXAMPLE OF GOOD PRACTICE IN EACH COUNTRY 5. A PILOT PROJECT WITH STUDENTS IN 2012 6. EUROPEAN FAIR: IDEAS CONTEST 7. SINCE THE BEGINNING OF THIS PROJECT WE SHOULD KEEP IN MIND THAT THIS PROJECT IS ONLY A BEGINNING OF A MAJOR PROJECT. COMMON EXPEDINTURE P1 JCY ES STAFF COST P2 KERIGMA PT TRAVELING COST OVERHEAD COST P3 CEEI ES P4 CLL UK OTHER COST ACTIVITES PARTNERS P5 BELKTRO TR P6 MSCDN PL P7 EKPOL EL P8 BIC 8 WORKPACKAGES: WORK PACKAGE TITLE START MONTH END MONTH TOT EUROS: 333.023 PACKAGE LIDER Activities 1.PROJECT MANAGEMENT 01/10/201 0 01/09/201 2 47.059 ANPE CASTILLA Y LEON 2.TRANSLATION OF MATERIALS 01/11/201 0 01/01/201 1 44.990 ANPE FACULTA D TRADUCC IÓN 3.TECHNOLOGICAL TRAINING 01/04/201 0 01/04/201 1 20.172 CEEI JCYL COORDINATION OF THE PROJECT BY SPAIN TO ENSURE THE SUCCESS OF THE PROJECT, DEVELOPMENT OF THE PROJECT IN THE CENTRES, ENSURING THAT THE TASKS & RESPONSIBILITIES OF EACH PARTNER ARE FULFILLED • INTERNAL EVALUATION • COMMISSIONING EXTERNAL EVALUATION OF THE PROJECT • REGULAR MONITORING OF THE PROJECT MILESTONES AND RESULTS TO ENSURE THAT THE PROJECT IS ON TARGET AND ACHIEVING ITS AIMS • HANDING IN OF THE TRANSLATED MATERIALS TO THE PARTNERS, • TRANSLATION OF THE WEBPAGE, • REVISION OF THE PROGRAMME TO THE REALITY OF EACH ONE OF THE PARTICIPATING COUNTRIES • PROMOTION & FAMILIARISATION TO THE EUROPEAN PARTNERS VIA A LAUNCH CONFERENCE IN SPAIN TO LEARN MORE ABOUT THE PROGRAMME AND THE MATERIALS IN DETAIL AFTER RECEIVING TRANSLATED MATERIALS Results and products DRAFT OF MATERIALS TRANSLATION OF THE WEBPAGE AND APRENDE A EMPRENDER OTHER MATERIALS TRAINING EUROPASS CERTIFICATION 9 WORKPACKAGES: WORK PACKAGE TITLE START MONTH END MONTH TOT EUROS: 333.023 PACKAGE LIDER 4 .PROGRAMME IMPLEMENTATION IN TURKEY 01/02/2011 01/05/2012 14.680 5. PROGRAMME IMPLEMENTATION IN POLAND 01/02/2011 01/05/2012 13.000 POLONIA 6. PROGRAMME IMPLEMENTATION IN PORTUGAL 01/02/2011 01/05/2012 19.335 PORTUGAL 7. PROGRAMME IMPLEMENTATION IN GREECE 01/02/2011 01/05/2012 18.070 GRECIA 8. PROGRAMME IMPLEMENTATION IN UNITED KINGDOM 01/02/2011 01/05/2012 32.760 REINO UNIDO 9. PROGRAMME IMPLEMENTATION IN SLOVAKIA 01/02/2011 01/05/2012 8.830 ESLOVAQUIA Activities TURQUIA • PROMOTION & FAMILIARISATION TO THE EUROPEAN PARTNERS VIA A LAUNCH CONFERENCE IN SPAIN TO LEARN MORE ABOUT THE PROGRAMME AND THE MATERIALS IN DETAIL AFTER RECEIVING TRANSLATED MATERIALS CORRECTION OF THE TRANSLATED MATERIALS TO MOTHER TONGUE AND REVISION • FAMILIARISATION OF THE PROGRAMME WITH PARTERS AND ADAPTION TO THEIR OWN COUNTRY • ANALYSIS OF HOW THE PROGRAMME CAN BE IMPLEMENTED IN THEIR COUNTRY AND COHERENCE WITH THE EDUCATIONAL & VOCATIONAL EDUCATION & TRAINING SYSTEM • INVESTIGATION OF ACCREDITATION OF COMPETENCIES VIA LEOPASS OR NATIONAL VOCATIONAL EDUCATION SYSTEM IF APPLICABLE • RECRUITMENT & SELECTION OF TEACHERS • TEACHER TRAINING • RECRUITMENT OF STUDENTS • COURSE DELIVERY • INTERNAL EVALUATION OF THE COURSE0 Results and products PROGRAMME ADAPTATION TO THE EDUCATIONAL SYSTEM OF TURKEY PROGRAMME ADAPTATION TO THE EDUCATIONAL SYSTEM OF POLAND PROGRAMME ADAPTATION TO THE EDUCATIONAL SYSTEM OF PORTUGAL PROGRAMME ADAPTATION TO THE EDUCATIONAL SYSTEM OF GREECE PROGRAMME ADAPTATION TO THE EDUCATIONAL SYSTEM OF UNITED KINGDOM PROGRAMME ADAPTATION TO THE EDUCATIONAL SYSTEM OF SLOVAKIA 10 WORKPACKAGES: WORK PACKAGE START MONTH END MONTH TOT EUROS: 333.023 PACKAGE LEADER 10. METHODOLOGIC AL TRAINING IN POLAND 01/07/2011 11/07/2011 42.367 POLAND 11.PROJECT DISSEMINATION 01/02/2011 01/06/2012 43.340 ALL THE PARTNERS, ESPECIALLY SPAIN AND UNITED KINGDOM 12. FINAL VERSION OF THE MATERIALS: DVDS AND WEBPAGE 01/06/2011 01/05/2012 37.420 TURKEY AND SLOVAKIA Activities Results and products 1. Defining the teachers competencies in the use of ICT, especially regarding "Aprende a emprender" tools. 2. Previous knowledge and skills regarding the use of the tools. 3. Detection of training necessities. 4. Planning of the training. 5. Carrying out training activities 6. Evaluation of the training sessions. 7. Intermediate evaluation of the project (internal and external) INTERMEDIARY REPORT, CERTICATES, TRAINING • PROMOTION & FAMILIARISATION TO THE EUROPEAN PARTNERS VIA A LAUNCH CONFERENCE IN SPAIN TO LEARN MORE ABOUT THE PROGRAMME AND THE MATERIALS IN DETAIL AFTER RECEIVING TRANSLATED MATERIALS • BY EACH PARTNER TO THEIR MINISTRY OF EDUCATION AND LOCAL EDUCATION AUTHORITIES, THROUGHOUT THE PROJECT • PROMOTION TO TEACHERS IN EDUCATION & VOCATIONAL TRAINING • INTERNAL DISSEMINATION VIA NETWORKS IN EVERY COUNTRY • INTERNAL DISSEMINATION VIA REGULAR PRESS RELEASES & EVENTS TO LOCAL AND REGIONAL NEWSPAPERS IN EACH COUNTRY • EXTERNAL DISSEMINATION VIA THE WEBPAGE PROMOTION, BLOG AND ONLINE SOCIAL NETWORKS E.G. FACEBOOK • EXTERNAL DISSEMINATION VIA EACH ORGANISATION´S EUROPEAN NETWORKS • PROMOTION TO OTHER EUROPEAN ORGANISATIONS WITH SIMILAR OBJECTIVES • CLOSING EVALUATION CONFERENCE IN TURKEY AND PRESENTATION OF THE RESULTS OF THE PROJECT EXTERNAL DISSEMINATION VIA THE WEBPAGE PROMOTION, BLOG AND ONLINE SOCIAL NETWORKS E.G. FACEBOOK • TEACHER TRAINING SESSION ADDRESSED TO VET TEACHERS AND CARRIED OUT BY THE THREE PREVIOUSLY TRAINED CONSULTANTS. • OFFICIAL ANNOUNCEMENT OF THE IDEA CONTEST AND SELECTION OF THE STUDENTS FINAL REPORT PUBLICITY LEAFLETS Implementation of the new model to all the partner countries Preparation of new materials adapted to all the countries as far as language and content are concerned Dissemination of the results through mass media Organisation of the awareness raising European Fair with the participation of the students Sending of all the materials to the participating institutions and VET centres in each country FINAL VERSION OF ALL THE MATERIALS, EUROPEAN FAIR, IDEAS CONTEST 11 2. Project financial management 2. 1 PURPOSE AND PRINCIPLES The purpose of the financial guideline for Leonardo da Vinci II Programme project Proyecto Europeo Leonardo de Transferencia de Innovación “Enterprise as innovation to create new work places at time of global crisis” nº 2010-1-ES1LEO05-21250–is to follow the rules of the Leonardo da Vinci “Administrative and Financial Handbook for Promoters & Contractors” ( handbook ) to determine the financial management of the project and observe the budget performance of the project during the 01 de octubre de 2010 hasta 30 de septiembre de2012 The financial guideline does not set limits to project agreements and handbook in any way; it only explains different aspects of the agreements, handbook and the budget! It is very important to specify in every partner's organisation who (person entitled to sign) will endorse, pay and confirm accounting documents (expense receipts and payment documents) for the project accounting. It is obligatory to inform the Beneficiary about every single possible amendment in the budget before it will be realized! Please send information with amendment request to the technical coordinator of the project Pilar Gredilla and Guillermo. Beneficiary confirms your request with Leonardo for Jorge.torres@oapee.es Office in 10 business days. After accorded permission by Beneficiary the asked change is allowed to accomplish. 12 2. Project financial management 2. 2 CONTRACT COMMITMENTS FOR BENEFICIARY The Promoter must submit: a Contracting Form fully completed and signed by the person legally entitled to sign the agreement. When filling in the form the Promoter is required to take into account the breakdown of costs of the consolidated budget and to consider the experts` comments: The Financial Identification Form (to be submitted along with the Contracting Form) Which is to be completed and signed by the person legally entitled to sign the Agreement (or the person legally authorised to sign such documents by the organisation) and then further signed and stamped by the bank; Original Letters of Intent from Partners (where these have not previously been submitted and/or where new or replacement Partners are introduced at the contracting stage).* 13 2. Project financial management 2.3. CONTRACT COMMITMENTS FOR PARTNER Every Partner is obligated to: a) To use the grant according to the agreement and according to the financial guide; b) Ensure the required co-funding amount during the project duration time (from l 01-10-2010 of 30-09-2012 according to the agreements; c) Submit required information and reports (quarterly reports and the final report) inrequired forms by the required dates to the Beneficiary; d) Inform Beneficiary about changing the responsible person for the project during 5 business days; e) Guarantee that the costs, expense receipts and payment documents related to the project are distinguished from the other costs, expense receipts and payment documents among the partner's accounting system; f) Obey all instructions will be made in operations of controlling and auditing; g) Use the required forms for drawing up the agreements, reports 14 and expense receipts.* 2. Project financial management 2.4.1. BUDGET AND ELIGIBILITY In general, only costs meeting the following criteria are eligible for funding: they MUST relate to activities involving the ember States of the European Union and/or the European Economic Area and/or the associated countries participating officially in the programme (Bulgaria, Romania and Turkey). They must be directly connected with execution of the project in accordance with the work plan; they must be incurred by partner organisations; They must be actual costs ie the actual costs incurred must correspond to payments made by the Partnership, supported by invoices or accounting documents of equivalent value. Where national taxation and accounting rules do not require an invoice, an accounting document of equivalent value means any document produced in order to prove that the accounting entry is accurate and which complies with the applicable accounting law. The project duration ( 01-10-2010 to 30-09-2012) is that stipulated in the Agreement, ie the eligibility period. Only costs incurred as part of the project and during this period will be regarded as eligible. Costs incurred before or after will not be eligible.* 15 2.4.1. Estimated expenditures by work package and type of costs Estimated expenditures of the project are divided by Work Packages (WP). There are 12 WP in the project. Expenditures by each WP contain different type of costs (staff costs, operational costs and subcontracting costs) according to the budget lines WOK PACKAGE TITLE START MONTH END MONTH 1.PROJECT MANAGEMENT 01/10/2010 01/09/2012 47.059 2.TRANSLATION OF MATERIALS 01/11/2010 01/01/2011 3.TECHNOLOGICAL TRAINING 01/04/2010 4.IPROJECT IMPLEMENTATION IN TURKEY TRAVELLING COST OTHER COST SUBCONTRATING COST OVERHEADS COST 36.620 7.439 0 0 3.000 44.990 9.120 0 0 26.500 9.3570 01/04/2011 20.172 5.740 12.432 2.000 0 0 01/02/2011 01/05/2012 14.680 13.180 0 0 0 1.500 5. IPROJECT IMPLEMENTATION IN POLAND 01/02/2011 01/05/2012 13.000 11.500 0 0 0 1.500 6. IPROJECT IMPLEMENTATION IN PORTUGAL 01/02/2011 01/05/2012 19.335 11.150 6.684 0 0 1.500 7. IPROJECT IMPLEMENTATION IN GREECE 01/02/2011 01/05/2012 18.070 16.570 0 0 0 1.500 8. IPROJECT IMPLEMENTATION IN UNITED KINGDOM 01/02/2011 01/05/2012 32.760 31.260 0 0 0 1.500 9. IPROJECT IMPLEMENTATION IN SLOVAKIA 01/02/2011 01/05/2012 8.830 7.330 0 0 0 1.500 10. METHODOLOGICAL TRAINING IN POLAND 01/07/2011 11/07/2011 42.367 10.320 28.047 4.000 0 0 11.PROJECT DISSEMINTAION 01/02/2011 01/06/2012 43.340 5.740 20.750 10.500 6.350 0 12. FINAL VERSION OF THE MATERIALS: DVDS AND WEBPAGE TOTAL COST FOR WORKPACKAGES 01/06/2011 01/05/2012 37.420 7.920 0 17.500 12.000 0 01/10/2010 30/09/2011 333.023 75.353 34.000 44.850 12.370 TOT EUROS: 333.023 STAFF COST 166.450 16 2.4.2.1. Estimated staff needs and cost by partner (Budget Line A.) Staff costs comprise any salary and/or remuneration paid to persons employed by a Partner organisation or working regularly or recurrently for the project . This figure should include salary costs (for salaried and other staff) which are paid under the staff budget (for normal accountancy purposes) plus all the usual contributions paid by the employer, such as social security contributions, social fees, holiday payments and pension costs but must exclude any bonuses, incentive payments or profit-sharing schemes. This figure must not include costs relating to persons undertaking subcontracted tasks. 17 18 2.4.2.2. STAFF COST In the final report a final statement of costs must be presented. The maximum Community contribution towards Staff Costs (or the declared amount for Staff Costs, whichever is lowest) will only be paid in full where the project achieves its contractually agreed aim. Partner has a right to decide how to divide the last 30 % from the grant: 1) partner will pay staff costs to the individual on the basis of submitted time sheets and it will be compensated in the end of the project or 2) partner will pay staff costs to the individual on the basis of submitted time sheets after returning the final 30 % from the grant. All costs in Euro Cofunding from Staff LdV grant from Staff Total P1 P2 P3 P4 P5 P6 P7 P8 19 2.4.2.1 STAFF COST(Time sheet ) Time sheet is a reporting document that contains following information about every person employed by a partner organisation or working regularly or recurrently for the project: a) project name; b) project No: c) organisation name; d) name of the employee; e) staff category (ISCO); f) cost per day; g) project acronym; h) partner (No and name); i) project number; j) month; k) dates; l) day worked; m) No of WP; n) place of performance; o) activity/remarks; p) amounts paid from grant, from co-funding and total amount; q) date and signature of the employee; r) date and signature of the legal representative. 20 Time sheets of every month are required to submit quarterly. The reporting form for staff costs is following: Date (mm.yyyy) Name of the employee Staff category (ISCO) otal number of days Cost per day number of WP Co-funding (in euro) Grant from Leonardo (in euro Taxes cofunding (in euro) Taxes from Leonardo (in euro TOTAL STAFF COST (mm.aaaa) (……………..) Total mm aaaa (mm.aaaa) (…………….) Total mm yyyy Total staff costs 21 2.4.3.1. Travelling (Budget Line B.1.) TRAVEL COSTS = fixed daily subsistence rate (accommodation, hotel + meal costs or daily allowance + local transport) + international transport a) Subsistence Costs (accommodation costs, meal costs or daily allowance, local travel costs) Subsistence costs may be financed by the project, provided: 1. They are reasonable in the light of local prices; 2. They are calculated in accordance with the existing internal rules of the Beneficiary or Partner organisations, which may be on an actual cost (reimbursement of receipts) or daily allowance basis. 3. Subsistence Costs may not, however, exceed the maximum daily rate for the country being visited. Evidence of the applied payment system (documentation evidencing amounts reimbursed or evidence of payment of daily rates to an individual) should be readily available.Daily Subsistence Rate includes: - accommodation costs; - actual meal costs proved with invoices OR daily allowance paid to individual according to the national rate; - local travel costs (if appears). Daily allowance is a fixed daily allowance in concrete country paid to individual according to the national rate. In countries where daily allowance is not paid, actual meal costs will be taken into consideration for business travels. Actual meal costs should be proved with invoices. 22 2.4.3.1. Travelling (Budget Line B.1.) In calculating the number of days for applying the daily subsistence rate it should be noted that a FULL day normally includes an overnight stay (the National Agency or the Commission may consider an exception to this rule whereby a full day's subsistence is allowed without an overnight stay, according to the internal rules of the Contractor or Partner organisations, where this is the case the Contractor will need to provide a full explanation). Very simple formula for calculating the number of days for daily subsistence rate: nights + 0.5 days Example: Meeting in Riga from the 13 thtill 14th of October. You arrived on the 12 th of October and stayed in the hotel for 2 nights (12 th and 13 thof October). You left Riga on the 14 th of October. In this case you can calculate 2 nights + 0.5 days = 2.5 days for daily subsistence rate. The maximum daily subsistence rate is 174 Euros * 2.5 days = 435 Euros per person. NB! Planned as maximum day rates but must be supported with invoices afterwards! 23 2.4.3.1. Travelling (Budget Line B.1.) b) International transport Allowable Travel Costs under the Agreement will be the real Travel Costs. It is required to use the cheapest means of travel, and Partners will thus have to make every effort to use Apex tickets for air travel and take advantage of reduced fares. Where this is not the case a full explanation should be provided. Travel Costs should include all costs for travel (rail, bus, taxi, air) from the point of origin to the point of destination and should further include any related travel insurance costs. There can be several interpretations for international and local transport. According to the Leonardo rules the international transport contains travelling from the origin place to the meeting place (for example from the home to the airport by taxi, to the airport of the destination place by plane and from there to the hotel by taxi – all this together is an international transport). The local transport is a driving by taxi in the city the innovacreawork meeting takes place, for example taking taxi for driving from the hotel to the meeting place. 24 25 SOCIO P4 Meetings planned Time Max daily subsistence rate per day 13- 15 JANUARY 2011 276 LAUNCH CONFERENCE IN SPAIN TRAINING IN THE TECHNICAL DETAILS OF THE PROGRAMM Espana –ES 11-15 APRIL 2011 212 204 INTERMEDIATE EVALUATION OF PROJECT Portugal - PT JANUARY-FEBRUARY 2012 01-07 JUNE 2012 220 01-07 JULY 2011 213 1 MEETING OF CO-ORDINATORS United Kingdom - UK 2 3 4 FINAL EVALUATION OF PROJECT Turkey - TR 5 TEACHER TRAINING ININNOVATION IN POLAND PL P 8 ESLOVAQUIA subsistence cost Destination Daily subsistence rate per day per person Number of persons Total number of day Total cost of Partner 8 MEETING OF CO-ORDINATORS United Kingdom UK CONFERENCE IN SPAIN TRAINING IN THE TECHNICAL Espana –ES INTERMEDIATE EVALUATION OF PROJECT Portugal - PT 1 2 276 552 2 4 212 1.696 1 2 204 408 3 2 220 1.320 3 4 213 2.556 FINAL EVALUATION OF PROJECT Turkey - TR TEACHER TRAINING ININNOVATION IN POLAND PL 6514 Total 26 P8 ESLOVAQUIA international transport MEETING OF CO-ORDINATORS United Kingdom – UK 1 195 195 CONFERENCE IN SPAIN TRAINING IN THE TECHNICAL Espana –ES 2 143 286 INTERMEDIATE EVALUATION OF PROJECT Portugal – PT 1 225 225 FINAL EVALUATION OF PROJECT Turkey – TR 3 390 1170 TEACHER TRAINING ININNOVATION IN POLAND PL 3 142 426 27 Nº 1 Partn er Name Dates (including travel from (dd/ mm/ yyyy to (dd/ mm/ yyyy Duration Dates (includi ng travel) Nº Partner Name (days Origen Destination city Coun city try code Objec Mean Travel tive of s of cost trip transp (Euro ort ( + type of fare) Subsis tence costs (Euro Total Travel + Subsis tence (Euro Coun try code 2 3 4 5 6 7 8 Total: 28 2.4.4.1. Overheads (Budget Line C) Overheads can include the following costs, provided they are specific to the project:daily communications (fax, Telephone, mail, etc.); photocopying; office materials / stationery / office consumables; bank costs relating to the transfer of funds (this excludes account management costs). The following expenditure will not be accepted in any event: expenditure on rent, heating, electricity, water or any other accommodation costs normally paid for by the Contractor or Partner organisations; structural costs with no obvious link to the project; All figures in Euro B.4. Overheads (up to 7% of your costs). NB! Co-funding Total 12.370 P3 P4 ES P0 PT P2 p ES UK 3.000 1.500 370 1.500 p P5 P6 P7 P8 TR PL EL TR 1.500 1.500 1.500 1.500 NB! A maximum amount of not more than 7% of the total project costs will be allowed as overheads which will be provided for in full by the projects own funds or via local/national/regional contributions (to be specified during the contracting of the project). Community funds will provide 0% contribution under this heading. 29 2.4.4.2. Other costs (Budget Line B.5) Other costs are costs which do not fall into any other category of expenditure to be claimed under the Agreement, but which are however considered necessary to the proper performance of the tasks/activities as foreseen and contractually agreed. All figures in Euro B.4. Other: organising seminars (seminar room rent). NB! Catering not allowed for own staff! Total 34.000 P0 P2 p P3 P4 ES PT ES UK 6.000 4.000 0 4.000 p P5 P6 P7 P8 TR PL EL TR 4.000 4.000 4.000 4.000 • Other: organising seminars (seminar room rent). Costs under this heading must therefore meet the following criteria: they must not be covered by any other budget heading; they must be necessary to the proper performance of the project; they must not involve any fundamental change in the scope and content of the project; they must be eligible under the Agreement; they must be clearly identifiable.Catering is allowed for OWN STAFF of Partners: 1) if it is under subcontracting costs with invoice “Seminar organization”; 2) from Travelling budget but participants must then reduce their daily allowances (prearrangement needed!); 3) from Other Costs budget only room rent. 30 2.4.4.2. Other costs (Budget Line B.5) Please see the Table 23 “Reporting form for other costs” Nº Partner Nature and Specification Purpose Unit cost (Euro) Degree of use Total cost (Euro) for the project ( in %) 1 2 3 4 5 6 7 8 TOTAL: 31 2.4.4.3. Subcontracting costs (Budget Line B2.) Any amount paid to an external body or organisation carrying out a specific one-off task in connection with the project (eg translation, expert consultancy, interpretation, design and printing, conference/seminar organisation) must be charged against subcontracting costs. All figures in Euro Total: P0 P2 p P3 P4 P5 P6 P7 P8 ES PT ES UK TR PL EL TR TRANSLATION OF THE APRENDE A EMPRENDER KIT MATERIALS 24.000 6.000 3.000 0 3.000 3.000 3.000 3.000 3.000 DESIGNING OF NEW CD-ROM MATERIALS: EUROPEAN GUIDE ON HOW TO BECOME AN ENTREPRENEUR MATERIALS DESIGN: EUROPEAN GUIDE ON HOW TO BECOME AN ENTREPRENEUR ADAPTATION OF www.ecc.grundtvig.com PLATFORM 6.000 3.000 0 0 0 3.000 0 0 0 6.000 3.000 0 0 0 3.000 0 0 0 2.500 0 2.500 0 0 0 0 0 0 EXTERNAL EVALUATION TOTAL: 6.350 6.350 0 44.850 18.350 5.500 0 0 0 3.000 0 9.000 0 3.000 0 3.000 0 3.000 32 2.5. Subcontracting costs (Budget Line B2.) Subcontracting costs in INOVACREAWORK II are following: 1) translation costs (budget line C.1); 2) marketing materials (design, printing) (budget line C.2); 3) software development (budget line C.3); 4) IT management and design (budget line C.4); 5) organising of international conference DAAAM/INNOMET 2006 (promoted by DAAAM network of conferences) (budget line C.5); 6) intellectual property legislation (consortium agreement, trademark legislation, IP policy, licensing) (budget line C.6); 7) expert consultancy from sector enterprises and open sector (budget line C.7); 8) accountancy (C.8). Nº Partner Sub-contracted work Sub-contracting contract Start date (dd/mm/yyyy) Sub-contracting cost End date (dd/mm/yyyy) 1 2 3 4 5 6 7 8 TOTAL 33 B-3 LISTA DE LOS SOCIOS Y PRESUPUESTOS POR SOCIO DATOS PRESUPUESTARIOS Nº Socio Nombre de la organización en la lengua nacional 1 ANPE SINDICATO INDEPENDIENTE DE CASTILLA Y LEÓN 2 DIRECCIÓN GENERAL DE FORMACIÓN PROFESIONAL. CONSEJERÍA DE EDUCACIÓN. JUNTA DE CASTILLA Y LEÓN 3 KERIGMA-INSTITUTO DE INOVAÇAO E DESENVOLVIMENTO DE BARCELOS 4 Centros Europeos de Empresas e Innovación de Castilla y León, S.A. 5 CUMBRIA CREDITS LIMITED 6 Bursa Elektronikçiler Odası 7 Mazovian In Service Teacher Training Centre 8 ΕΤΑΙΡΕΙΑ ΚΟΙΝΩΝΙΚΗΣ ΠΑΡΕΜΒΑΣΗΣ & ΠΟΛΙΤΙΣΜΟΥ ΤΗΣ ΝΟΜΑΡΧΙΑΚΗΣ ΑΥΤΟΔΙΟΙΚΗΣΗΣ ΜΑΓΝΗΣΙΑΣ 9 Asignación Leonardo da Vinci concedida 66.714 % Co-funding % of grant 47.814 28,33 18.900 71,67 0 0 0 0 0 33.358,00 23.909,00 28,33 9.449 71,67 37764 27.065 28,33 10.699 71,67 54.354,00 38.958,00 28,33 15.396 71,67 42.728,00 30.625,00 12.103 71,67 32.834,00 23.534,00 28,33 9.300 71,67 38.847,00 27.843,00 28,33 11.004 71,67 26424 18.938 28,33 7.486 71,67 0 ,00 0,00 0 0,00 0,00 0 0,00 0,00 0 333.023 238.686 28,33 94.337 71,67 34 28,33 BIC BANSKA BYSTRICA DE ESLOVAQUIA 10 Uludağ Universitesi Teknik Bilimler Meslek Yüksek Okulu 11 DEMİRTAŞPAŞA ENDÜSTRİ MESLEK VE TEKNİK LİSESİ BURSA İL MİLLİ EĞİTİM MÜDÜRLÜĞÜ 12 Total Coste del Proyecto Total 3. CONTRACTS AND AMENDMENTS 3.1. Contracts Following contracts are signed for the INNOMET II project: 1) agreement between Leonardo and the Beneficiary ((ANPE) 2) consortium agreement between Partners; 3) agreements between the Beneficiary and Partners. Agreement between the Beneficiary and Partners includes the budget of the project and the “Financial Guideline for Leonardo da Vinci II Programme Project “INOVACREAWORK – Integrated Human Resources Development and onitoring System for Adding Innovation Capacity of Labour Force and Entrepreneurs of the Metal Engineering, machinery and Apparatus Sector”” as Annexes.Agreement between Leonardo and The Beneficiary is legally binding! 3.2. Amendments •Where it is proposed to change budget headings (not overheads or staff costs) simultaneously by more than 10 % (of the total cost of an individual budget heading) and 5 000 Euros, and provided the total cost of the project (estimated and consolidated budget), the maximum Community contribution and the co-financing % remain unchanged, the following procedure must be followed: •The Beneficiary (here the Beneficiary TUT) must complete, sign and submit to the National Agency or the Commission a Contract Amendment request Form justifying the proposed changes and presenting a revised budget (the revised budget must respect the maximum ceilings for of 15 % for ICT and 30 % for sub-contracting) to include the following annexes: •1) the agreement of all project partners to the proposed budget changes; •2) where formal approval is given and a Supplementary Agreement is thus signed by both parties, the Beneficiary will be subsequently required to submit copies of amendments to the Agreement concluded between the Beneficiary and the project partners (a Model Agreement is provided as an annex to the Agreement. 35 4. FINANCIAL MANAGEMENT 4.1. General remarks The project management must cover the whole of the budget and costs incurred. This requires that the Beneficiary sets up an accounting system that also includes Partners' expenses. 4.2. Bank account Where possible, a separate Bank Account should be established for the project. Where this is not possible, then as a minimum all income/expenditure relating to the project must be easily able to be identified. Costs relating to account management are ineligible; however bank costs relating to the transfer of funds (ie payments to Partners) are eligible under the budget for Overheads. Any interest earned in relation to pre-financing paid to the project (either by the Contractor or by individual Partners) must be declared within the relevant table of the final financial report for eventual reimbursement to the National Agency or the Commission. 4.3. Accounting System/Internal Control Contractors must set up an analytical system or an adequate internal system, which must make it possible to identify: The sources of project funding; Project expenditure incurred during the eligibility period All transactions within the eligibility period, relation to actual expenditure/income under the project, must be recorded systematically using a numbering system which specifically identifies the project. As far as possible, the persons responsible for managing the project should not be the same as those responsible for its financial 36 management 4. FINANCIAL MANAGEMENT 4.4. VAT, Customs Duties and Other Taxes on Goods and Services Partners must ascertain from the competent national authorities the provisions, rules and legislation governing the taxation of training and related activities in their countries. VAT cannot, in any case, be charge to the project unless it is a final charge, ie a charge that is not deductible and cannot be recovered by the Beneficiary or the Partners. Like VAT, other types of taxation, duty or charges which may arise from Community financing are eligible costs if they are actually and finally borne by the parties concerned. 4.5. Exchange rates All amounts given in the project reports must be expressed in Euro. In quarterly report please include also national currency equivalent. Where Euro account is held, the Contractor and Partners must report expenditure at the amount(s) debited in Euro from their account. Where accounts are held in national currency, then the Contractor and Partners should normally use the model shown in chapter III.3.5 in Leonardo da Vinci “Administrative and Financial Handbook for Promoters & Contracts”. 4.6. Payment Arrangements All requests for payment of the balance shall accompany the Final Report and shall present a final breakdown of costs actually incurred according to the structure of the budget in addition to a complete summary statement of both expenditure and income relating to the project. Payments arrangements and dates will be laid down in the Agreements. However, for Beneficiary' information and to allow them to plan their budgets, it can be indicated that payment transfers will be made as follow: • For twelve or eighteen-month projects: 70% on signature of the Agreement and 30% on receipt and Aceptance of the final report; • For twenty-four, thirty or thirty-six month projects: 40% on signature of the Agreement, 30% on receipt and 37 acceptance of the interim report and 30% on receipt and acceptance of the final report. 4. FINANCIAL MANAGEMENT 4.7. Registration and requirements for the invoices In principle, all documents must be original and dated ; documents from the Partners will be copies, the original being held by the Partner concerned. An original invoice must include as follows: 1. Partner's name, address and bank details; 2. Remitter's name, address and bank details; 3. Invoice number; 4. Invoice date; 5. Due date; 6. Contents of description; 7. Amount; 8. Accountant name and signature. On the back of every original invoice please write: • project number; • description of the content of the invoice in English (in case the invoice is presented in national languages). • date; • signature of the person responsible for the work The supporting documents required for each type of cost in as follows: 4.7.1. Personal costs Since personnel costs are covered by a lump sum, promotors will not be required to produce supporting documents. 38 4.7.2. Travel and subsistence costs Travel costs will be reimbursed as follow: for train travel: on the basis of original tickets; for air travel: on the basis of original tickets and boarding passes; for travel in a private vehicle: on the basis of a statement from the rail company or airline confirming the train or air fare for the journey; for travel in a hired vehicle: on the basis of the invoice; for taxi journeys; on the basis of the receipt and an expense form (or equivalent) 4.7.3. Subsistence costs, including accommodation and meals, will be reimbursed on a lump-sum basis and may exceed neither the daily rate per person applied by the organization to which the person travelling belongs nor the maximum daily rate per person. 4.7.4. Overheads Since overheads are covered by a lump sum which may amount to 7% of the total estimated project cost (which is thus fixed at the time of the tender and cannot change in the course of the project), no supporting documents need be produced. 4.7.5. Other costs Only actual costs as shown on the corresponding invoices can be charged to the project. 4.7.8. Subcontracting costs If Partners use the services of a subcontractor, they must be able to produce the agreement concluded with the latter, the invoice(s) paid and any other supporting document connected with the subcontracting costs set out in the report. The Commission reserves the right not to accept all or part of such expenses if they do not satisfy the eligibility requirements set out in the Agreement. Proforma invoices will not be accepted, except for expenditure committed and not yet paid, in which case the Partner will have to provide proof of payment at a later date. For payments which have already been made, only final invoices will be accepted and the Beneficiary will have to be able to supply bank statements or other 39 proof of payment. 5. Auditing As set out in the Agreement, an operational and/or financial audit can be carried out on the spot by the National Agency, the Commission or the Court of Auditors of the European Union. In such cases, Partners will be notified that an inspection visit is to be made.The purpose of these audits is twofold: Firstly, to check that the project's financial reports presented for payment are consistent with the Partner's basic accounts and to ensure that Community funds have been spent in accordance with the Agreement and its annexes, that the aims of the projects have been achieved and that the products/results have been generated. Secondly, audits provide a good opportunity for contact and dialogue between the auditors and the Partner. If any management problems are found, the auditors will work with the Partner to seek a solution and, if necessary, improve existing internal procedures in order to make the best possible use of Community funds. The auditors will be open to any comments and/or suggestions that to Beneficiary and the Partners may wish to make. The main evaluation criterion is transparency , rather than strict compliance with contract rules. It is essential for the auditors to have access to full, accurate and properly documented information. Lastly, the audit will cover the use of funds from all sources. An audit certificate may be presented in national language. The auditors must attach a certified translation in English (in case the invoice is presented in national languages). The audit certification must be signed (signature and stamp) and dated by external auditor (or competent public officer). 40 6. REPORTING As the quarterly and final reports are the main evaluation tools, they must provide as true a picture of the project as possible. Partners are therefore advised to read the report forms carefully, so that they are familiar with the content and aware of the financial and accounting information required for their completion. In each report, the various financial tables form a coherent whole: the figures must therefore be consistent . Before submitting the report, the Partner must check that the entries satisfy this requirement. The amounts given within the Report Forms must be expressed in EUR (in Quarterly Report also in national currency) and rounded to the nearest whole number. Before submitting the reports, the Beneficiary must also check that the totals and sub-totals given are arithmetically correct. Since the purpose of the final report is to allow an overall evaluation of the project, all contracted project activities must be completed before the Final Report is submitted. All the project partners have to submit quarterly reports to the Beneficiary in January, April, July and October 2011 and in January in January, April and July 2012. The requirement of quarterly report proceeds from the consortium agreement with the purpose of facilitating the compilation of final report and monitoring the budget allocation. 41 6. REPORTING Formal requirements for acceptance of reports. For a report form to be accepted and evaluated, the following formal requirements must be satisfied: 1. The original of the form must be sent. 2. The form must bear the original signature of the representative legally entitled to sign of the contracting organisation. The representative's name and position/title in the contracting organisation must be given below the signature, which must be accompanied by the organisation's official stamp. 3. The form must be returned in full (ie all its pages), duly completed and signed at the appropriate place. 4. The financial report must be correctly completed according to the model. 5. The following documents must be attached to the form: • Copies of the contracts concluded with the project Partners. The Beneficiary must number these using the serial number allocated to each in the financial report. • Copies of any subcontracting agreements. • Copies of all invoices relating to subcontracting costs. If the report does not meet the above criteria, the National Agency 2may not evaluate it until its formal presentation is correct. 42 8.1. Quarterly report The general purpose of the quarterly report is to facilitate the compilation of the final report. Quarterly report is based on a cash-basis accounting ie it records only transactions in which cash is received or paid. Quarterly report must be submitted five times (in January, April, July, October 2006 and in January 2007) during the period of the project by each partner. Quarterly report must be sent by e-mail and submitted signed to the Beneficiary (ANPE CYL) 20 days after the end of the quarter the latest. Reporting form of the quarterly report consists of the lists of all expenditures. Staff costs consist of salaries/wages (based on the time sheet) plus compulsory taxes, which include social security tax, unemployment tax and pension tax. Employee salaries/wages and compulsory taxes must be written on the separate rows. The time sheet must contain monthly staff costs by each person separately. Travelling costs include travel and subsistence costs. other and sub-contracting costs will be reported. The quarterly report does not include overhead costs separately by each partner. 43 6.1. Quarterly report Quarterly report consists of the following annexes: 1. Timesheets – to be completed by each person every month; 2. Reporting form for the staff costs; 3. Reporting form for the travelling costs – to be completed by each person, requires person's name, travelling date, destination, objective of the trip, means of transport, travel cost, subsistence costs and total travel cost + subsistence costs; 4. Reporting form for the ICT costs; 5. Reporting form for the production costs; 6. Reporting form for the other costs; 7. Reporting form for the subcontracting costs; 8. Reporting form for the expenditures by the type of cost - it consists of budget, grant from Leonardo, co-funding, total eligible costs and balance at the end of the quarter; 9. Copies of the original invoices: the copies must be numbered in the same order as in the quarterly report (eg Travelling B.1, etc.). For additional conditions please see chapter 7.8. 10. Payment orders (if partner does not have a separate bank account) or bank statement which shows its beginning and ending balances and listing the periods' transactions. 44 6.1. Quarterly report Quarterly report is required to submit after every quarter by the 20 th date of the next month: 1) 1stquarterly (activities in October, November, December 2010) report has to be submitted by the 20 th of January 2011; 2) 2ndquarterly (activities in January, February, March 2011) report has to be submitted by the 20thof April 2011; 3) 3rd quarterly (activities in April, May, June 2011 report has to be submitted by the 20 th of July; 4) 4 thquarterly (activities in July, August, September 2011) report has to be submitted by the 20thof the October 2011; 5) 5 thquarterly report (activities in October, November, December 2011) report has to be submitted by the 20th of the January 2012. If the Partner has not submitted the quarterly report by the deadline, the Beneficiary has the right to call in the forfeiture/penal fine from the Partner as fixed in the agreement. 45 6.2. Final report The final report consists of a balance sheet reporting expenditure over the entire project duration. Final report is accrual-basis accounting ie accounting that recognizes (records) the impact of a business event as it occurs, whether or not cash has been received or paid. After accepting the costs of the last quarter of the project the last 30% of total budget is received. After compiling and submitting the quarterly reports the final report should be basically ready. Final report of each Partner must be sent by e-mail and submitted signed to ANPE by 30 days after the end of the contract the latest. The analysis of the Final Report will include: Appraisal of the quality of the results of the project (this analysis includes verification of the conformity of the activities carried out compared with the forecast activities at the time of contractualisation and an analysis of the quality of each of the products/individual results of the project); Evaluation of the eligibility of declared expenditure and adherence to the budget of the project; Verification of the transfer of the Leonardo da Vinci funds to the Partners, so as to make sure that no major reduction of the European dimension has occurred, that the minimum European dimension has been espected and that changes made did not have any negative impact on the overall quality of the project. verification of all the sources of financing of the project including the own resources of each Partner and other possible income. verification of the measures taken to assure the dissemination of the project results. Partner has a right to decide how to divide the last 30 % from the grant: 1) partner will pay staff costs on the basis of submitted time sheets and it will be compensated by Leonardo grant in the end of the project or 2) partner will pay staff costs on the basis of submitted time sheets after returning the final 30 % from the Leonardo 46 DISSEMINATION: The Beneficiary will mention that the Lifelong Learning Programme grant was given to them in any dissemination document or publication, in all materials and products that have been issued with the help of the grant and in all communication and interviews that have been carried out according to the visual guide issued by the European Comission available at: http://ec.europa.eu/dgs/education_culture/publ/graphics/ident ity_en.html. The Beneficiary shall keep the track of the progress and the project results conitnuously in the ADAM date base available at: http://www.adam-europe.eu. 47 Meeting in Madrid The www.eccgrundtvig.es will be used by all partners to upload monthly the information about the costs. The information about the costs corresponding the previous month must be uploaded during the first week of the following month. No costs shall be claimed fifteen days before handing in of the quarterly or final report of September 2011. VAT is eligible cost if it cannot be recovered. The costs derived directly from the conditions of the present contract are dissemination of information, specified evaluation of the project, auditing, translations, reproductions, etc. including the cost of financial services and financial guarantees. The indirect eligible costs are those that according to the conditions of the contract detailed in the article 14.1 cannot be identified as specific costs linked directly to the project. That is why they cannot be claimed directly but they should be identified and justified as connected to the eligible direct costs through the accounting system of the Beneficiary. They cannot be claimed as direct eligible costs. 48 Meeting in Madrid In reference to any specific cost, the excell line it is related to must be mentioned. The rate for the cost of a car, either your own one or rented is 0,22€/Km Management commitee is formed by Trudy, Guillermo and Susana and supervised by Pilar. To plan all the travels for 2010-2011 Communication on a regular basis through weekly emails and videoconferences through Skype every first and third Thursday of a month. Project progress report after each meeting. To discuss the way the documents will be handed in to the partners and in which format. 49 Meeting in Madrid MONITORING AND EVALUATION: NATIONAL AGENCY EVALUATION. The evaluation will be cariied out by TOI department that will issue a monitoring sheet every six months. The visits will include: advisory service, correcting any Realiza visitas periódicas de asesoramiento, corregir desviaciones, conocer a las personas. Contenido de la visita: la evolución, resultados a fecha, asistentes, donde ha sido, fotos, evaluación, sostenibilidad, impacto, problemas, proceso de contractualización del proyecto, transferencias del proyecto, visitas de seguimiento no de control. 50