Facts and Possibilities - The Board of Pensions of the Presbyterian

advertisement

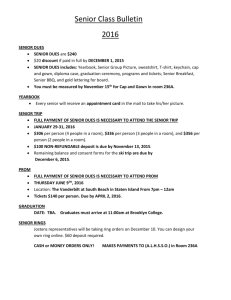

Facts and Possibilities Pat Haines, Senior Vice President, Benefits Todd Ingves, Director, Information Management Objectives • Serving MORE • Serving BETTER • Serving the CHURCH 2 The Plan NOW • Benefits • Funding 3 Income Security: Retirement • Defined Benefit Pension Plan • • • • Credit accrual Experience apportionments Asset based 11% dues 4 Income Protection for Members and Survivors: Death and Disability • Continued medical coverage and Pension Plan credit accrual during disability – no cost to employer • Education benefits for dependent children under age 25 • Asset based • 1% dues 5 Asset-Based Funding Employing Organization 12% Dues Pension Plan 11% Death & Disability 1% 2014 Short-Term Investments Pension, Death & Disability Benefits Paid to Members Board of Pensions Balanced Investment Portfolio 6 Dues Paid $75 million Investment Earnings $448 million Benefits Paid $344 million In Sickness and In Health: Medical Plan • PPO + Pharmacy • National networks: Blue Cross Blue Shield, Catamaran and Cigna Behavioral Health • Member cost sharing through income-based copayments and deductibles • Emphasis on wellness and prevention: 7 The Economics of Healthcare • • • • • • Self-funded Pay-as-you-go Inherent volatility 1% of the population = 30% of the expense Cost contributors: Lifestyle choices, age 23% / 24.5% dues, depending on family status 8 Pay-As-You-Go Funding Employing Organization 23% / 24.5% Medical Plan Dues 2014 Revenue $179.6 million Medical Benefits Paid for Members 9 Benefits Paid $180.8 million Supplemental and Optional Benefits • • • • Supplemental Death and Disability Dental Long-Term Care Retirement Savings Plan 10 Actuarial Forecasting: Art and Science • Key factors • Revenue: enrollment; salary increases; investment return • Expenses: enrollment; third-party costs; compliance; plan design; TREND 11 2015 – 2017 Forecast (October 2014) (in millions; rounded) 2015 2016 2017 Revenue $187.5 $185.5 $183.4 Expenses $189.8 $196.8 $203.8 Balance ($2.3) ($11.3) ($20.4) Prior Reserve $52.5 $50.2 $38.9 $50.2 (26.7%) $38.9 (19.9%) $18.5 (9.1%) Remaining Reserve 2016 - 2017 Forecast (March, 2015) (in millions; rounded) 2016 2017 Revenue $181.4 $177.8 Expenses $184.1 $188.6 Balance ($2.7) ($10.8) Prior Reserve Remaining Reserve $61.1 $58.4 $58.4 (31.7%) $47.5 (25.2%) 13 Demographics Who Can Participate? • Called and installed teaching elders are mandated • All other church workers must work at least 20 hours a week in an eligible church service • Includes non-mandated teaching elders and lay workers 15 Who Actually Participates? 50% 33% 16% 5,600 1,700 MANDATED TEACHING ELDER NON-MANDATED TEACHING ELDER 3,700 LAY Mandated Teaching Elders • 5,600 members at 4,700 employing organizations • All serving at local churches Average age 52 17.5 years of service Non-mandated Teaching Elders • 1,700 members serving 1,400 employing organizations • Approximately half are serving local churches and half serving agencies/mid councils/other employers Average age 55 18 years of service Lay Employees • 3,700 members (36% nonexempt, 64% exempt) serving 1,100 employing organizations • 62% serving churches, 20% serving agencies Average age 51 10.5 years of service Employing Organizations 90% Employers 79% Members 7% Employers LOCAL CHURCH 2% Employers >1% Employers 8% 5% 8% Members Members Members MID COUNCIL AGENCY OTHER EMPLOYER 20 Congregations with Plan Members 3700 Churches 1.1 1100 Average Members Churches 1.7 Average Members CONGREGATION SIZE 250 or less CONGREGATION SIZE Between 251 and 500 700 Churches 4.1 Average Members CONGREGATION SIZE 501 or more Churches and Employing Organizations 75% For churches and employing organizations covering members in the Traditional Medical Plan 20% 3% 1% 1 MEMBER 22 2-5 MEMBERS 6 - 10 MEMBERS More than 10 MEMBERS Demographics Church Affiliated Organizations Mandated Small Churches Teaching Elders NonMandated Teaching Elders Lay Members Agencies Large Churches Mid Councils Medical Plan Challenges Medical Claims Cost Trend 10% 8.9% 9% 8% 7% 6.4% 7.1% 6.7% 6% Linear Trend 5% 3.8% 4% 3.4% 3% 2% 1% 0% 2009 2010 2011 2012 Claims Cost Trend 2013 2014 Cost Drivers • • • • Demographics Chronic conditions High-cost claimants Prescription drugs Chronic Conditions 6.8% DIABETES 21% HYPERTENSION (High Blood Pressure) 21% HYPERLIPIDEMIA (High Cholesterol) "The only way to keep your health is to eat what you don’t want, drink what you don’t like, and do what you’d druther not.”- Mark Twain High Cost Claimants 1% of Medical Plan population responsible for 30% of Plan costs Conditions include cancer, musculoskeletal and heart disease Often complex cases with multiple co-morbidities 20% repeat rate over three-year period Prescription Drugs • Specialty drugs are less than 1% of prescriptions but account for 33% of drug costs • Includes treatments for cancer, Hepatitis C, and rare conditions • Specialty cost trends are significant and show no signs of abating • Generic inflation also a growing concern Cost Controls • • • • Vendor contracting Call to Health initiative High-cost claimant case review Stop loss insurance Challenges • Managing rising medical costs • Keeping up with changing healthcare landscape • Providing meaningful benefits at reasonable costs 31 Stability and Transition 2016: Stability and Transition • Board actions • March • Apportionment • Disability reserves • Disability cost of living increase • June • Medical dues • Alternate dues method 33 2016 Dues Methods Traditional Dues Method 2015/2016 Alternate Dues Method 2016 Medical Medical Member Only Family 23% 24.5% No Coverage Member Only Mbr. and Partner Mbr. and Child Member and Family 2016 ABP Rates Pension 11% Pension 11% D&D 1% D&D 1% Mandated, Non-mandated, Lay Non-mandated, Lay 34 Your Charge: Possibilities • Reminders • • • • Overall objective of Board of Pensions Covenant with teaching elders Context of facts and values Wide range of benefits “Start by doing what's necessary; then do what's possible; and suddenly you are doing the impossible." - St. Francis of Assisi "The possibilities are numerous once we decide to act and not react." - George Bernard Shaw 35