What is corporate governance?

advertisement

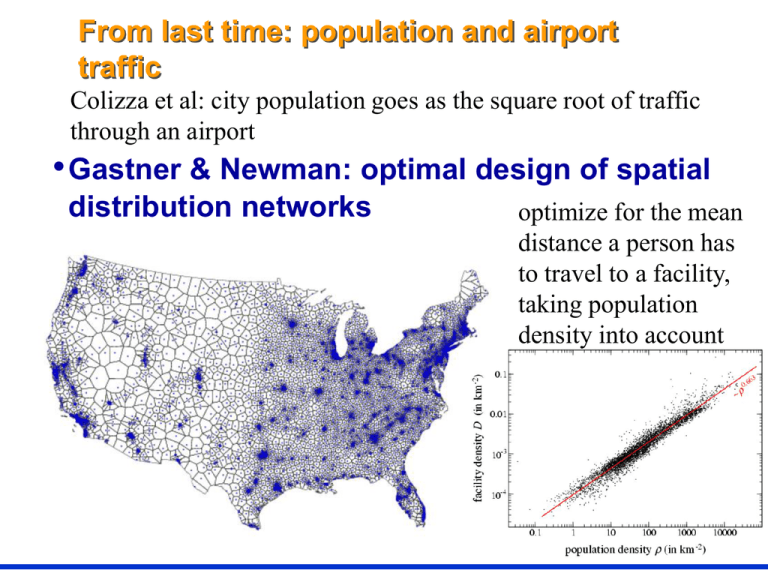

From last time: population and airport traffic Colizza et al: city population goes as the square root of traffic through an airport • Gastner & Newman: optimal design of spatial distribution networks optimize for the mean distance a person has to travel to a facility, taking population density into account GOLFING ALONE? ELITE COHESION AND COMMUNITY SOCIAL CAPITAL, 1986-1998 Jerry Davis and Chris Marquis University of Michigan February 25, 2003 Social Pressures in Informal Groups (Festinger, Schachter, and Back, 1950) The origins of social networks: “What three people do you see most of socially?” Networks and social construction “There are not usually compelling facts which can unequivocally settle the question of which attitude is wrong and which is right in connection with social opinions and attitudes as there are in the case of what might be called ‘facts’....The ‘reality’ which settles the question...is the degree to which others with whom one is in communication are believed to share these same attitudes and opinions,” which “tends to produce uniformity in the behavior of members” Festinger, Schachter, and Back, 1950 How are corporate boards like MIT student housing? TWA AMEREN ENERGIZER BROWN SHOE MAY DEPARTMENT STORES RALSTON PURINA ANHEUSER BUSCH Red arrows are execs of “sending” firm; blue lines are “neutral” directors EMERSON ELECTRIC FURNITURE BRANDS Bonus question: What do these firms have in common? How is Oakland like MIT student housing (ca. 1986)? How is Oakland like MIT student housing (ca. 2000)? Why study board interlocks? “Finance capital, concentrated in a few hands and exercising a virtual monopoly, exacts enormous profits…tightens the grip of financial oligarchies and levies tribute upon the whole of society for the benefit of monopolists” “The practice of interlocking directorates is the root of many evils. It offends laws human and divine....It is the most potent instrument of the Money Trust” Research hypotheses (cf. Brandeis, 1914) Corporate America is overseen by a network of rich white men who all know each other and who coordinate their actions via bank boards H1: Network H2: Rich white men H3: All know each other (“It’s a small world”) H4: Bank boards The JP Morgan Chase board’s ties Interlocking boards as a corporate elite network • Shared directors (“interlocks”) are pervasive among large corporations • Interlocks between firms are almost random WRT economic relations • Almost no “horizontal” ties (among competitors) • Very few “vertical” ties (~ 5% of firms have prospective buyer/supplier on board) • Some VC ties; few bank-sent ties • Where do interlocks come from? How directors are recruited Board Compositions in 1986 American Express Drew Lewis Henry Kissinger James Robinson III Ross Johnson Vernon Jordan ............... Union Pacific Drew Lewis William Grant Downing Jenks ............ “Centrality” as an outcome of the director selection process Intl Flvrs Boise Cascade RH Macy Time Warner Archer Daniels Natl Svc Inds CBS Freeport McMoRan AMEX BOARD (1994) (partial membership) Armstrong, Anne L. Bowen, William G. Culver David M. Duncan, Charles W., Jr. Furlaud, Richard M. Greenough, Beverly Sills Johnson, F. Ross Kissinger, Henry A. Jordan, Vernon E., Jr. GM Halliburton Merck Readers Digest American Cyanamid Panhandle Eastern Chemical Bank Coca Cola Xerox Sara Lee Ryder System JC Penney Corning Bankers Trust New York United Technologies When (and how) do firms recruit “central” directors? • The firm is subject to investor scrutiny • Greater levels of ownership by financial institutions • More “anti-management” shareholder proposals • The firm is already central (more pathways for recruiting; better gossip available) • The firm out-performs its industry (better learning opportunity) • What does added centrality buy the firm? • Higher subsequent “admiration” by analysts & execs • NO discernable effect on overall performance Microsoft board before McLaughlin (11/99) Microsoft board after McLaughlin (1/00) Ten most central firms in the interlock network, 1962-1982 (Eigenvector measure) 1962 1982 JP MORGAN [59] AT&T [43] CHASE MANHATTAN [54] JP MORGAN [48] CHEMICAL BANK [57] CHASE MANHATTAN [43] FIRST NATIONAL CITY BANK [52] SOUTHERN PACIFIC RAILROAD [41] MELLON BANK [34] CITICORP [43] MANUFACTURERS HANOVER [46] AT&T [37] CHEMICAL NY [38] PENNSYLVANIA RAILROAD [34] BANKERS TRUST [45] MANUFACTURERS HANOVER [36] MOBIL [28] IBM [38] GENERAL FOODS [31] BANKERS TRUST [39] Numbers in parentheses are counts of interlock ties Three possible networks: Regular, random, small world (from D. Watts) Regular p =0 Small-world Increasing randomness Random p =1 Data and sample I: The Fortune 1000 Strong ties only, all public firms Small worlds are surprising when: 1. Network is large 7,708 directors served on 916 Fortune 1000 boards in 1999 2. Network is sparse 79% of directors serve on 1 board; 14% on 2; 7% on 3+ 825 firms have >0 ties; among these, mean=8, median=6 3. Network is decentralized Most central director serves on 9 boards Most central firm has 34 ties 4. Ties are clustered 27% of ties are within same state 8% of tied companies shares 2+ directors The small world of the corporate elite • For firms (n=813 for largest component) • Mean geodesic (shortest path between two nodes)==3.7 • Mean geodesic for random graph==3.4 • For directors (n=6724 for largest component) • Average geodesic==4.6 • Average geodesic for random graph==3.2 From worst to best in four steps On average, any two Fortune 1000 boards are connected by less than 4 degrees through shared directors Business Week rated Conseco as one of the worst boards and Colgate as the best Six degrees of JP Morgan Chase: Shortest paths from the Fortune 1000 Chase # N of firms Cumulative 1 34 4.5% 2 233 34.1% 3 374 81.8% 4 121 97.2% 5 17 99.4% 6 2 99.6% 7 2 99.9% 8 1 100% Six degrees of Enron: Shortest paths from the Fortune 1000 Enron # N of firms Cumulative 1 10 1.2% 2 49 7.6% 3 259 40.8% 4 330 83.1% 5 113 97.6% 6 18 99.9% 7 1 100% From worst to second-worst Who is in the inner circle? Vernon Jordan Senior Partner, Akin, Gump, Strauss Rozanne Ridgway Former Assistant Secretary of State; former Ambassador to GDR President, Morehouse School of Medicine; former Sec’y of HHS Former CEO, Lucent Technologies; former CEO, Cummins Engine Former CEO, Xerox Louis Sullivan Henry Schacht Paul Allaire Drew Lewis Of Counsel, Womble, Carlyle; former senior partner, Arnelle, Hastie, McGee… Former CEO, Union Pacific John Clendenin Former CEO, BellSouth Edward Brennan Former CEO, Sears John Stafford CEO, American Home Products Jesse Arnelle How did Vernon Jordan get there? • 1972: joins board of Celanese; Celanese CEO serves on Bankers Trust board • 1972: joins Bankers Trust board; AT&T exec serves on boards of Bankers Trust and JC Penney • 1973: joins JC Penney board • 1974: joins Xerox board; Xerox and AmEx execs serve on boards of both Xerox and American Express • 1977: joins American Express board; 2 Celanese directors and 1 Penney director serve on RJR board • 1980: joins RJR board • 1982: joins Akin Gump Strauss at behest of Robert Strauss, a fellow Xerox director... How do interlocks matter? • “If we want a biological metaphor for cultural change, we should probably invoke infection rather than evolution” (SJ Gould, 1997) • The interlock network as a medium of “contagion”: • • • • • • Setting CEO compensation (O’Reilly & al. 1988) Recruiting directors (Davis 1993) Making acquisitions (Haunschild 1993) Changing structures (Palmer & al. 1993) Adopting takeover defenses (Davis 1991) Creating an investor relations office (Rao and Srivimakur, 1999) • Changing stock markets (Rao & al. 2000) What difference does it make? Diffusion of golden parachutes and poison pills among Fortune 500 firms Ten most central firms in the interlock network, 1962-2001 (Eigenvector measure) 1962 1982 2001 JP MORGAN [59] AT&T [43] JP MORGAN CHASE [28] CHASE MANHATTAN [54] JP MORGAN [48] PFIZER [26] CHEMICAL BANK [57] CHASE MANHATTAN [43] SARA LEE [28] FIRST NATIONAL CITY BANK [52] SOUTHERN PACIFIC RAILROAD [41] MELLON BANK [34] CITICORP [43] GEORGIA PACIFIC [29] IBM [38] AMR [25] GENERAL FOODS [31] DELL COMPUTER [19] MANUFACTURERS HANOVER [46] AT&T [37] CHEMICAL NY [38] VERIZON [28] BANKERS TRUST [39] 3M [25] PENNSYLVANIA RAILROAD [34] BANKERS TRUST [45] MANUFACTURERS HANOVER [36] MOBIL [28] ALLSTATE [24] BELLSOUTH [22] How has the network changed? N N (component) K (avg degree) L (avg geodesic) C L (random) C (random) SW quotient 1982 boards 648 581 10.0 3.38 0.24 2.76 0.017 11.34 1990 boards 591 524 8.8 3.46 0.24 2.88 0.017 11.87 1999 boards 600 546 8.6 3.46 0.22 2.93 0.016 11.84 1982 directors 6505 5854 19.0 4.27 0.88 2.94 0.003 186.82 1990 directors 5393 4768 17.0 4.30 0.87 2.99 0.004 169.21 1999 directors 5311 4760 16.0 4.33 0.87 3.06 0.003 183.03 Research hypotheses (cf. Brandeis, 1914) Corporate America is overseen by a network of rich white men who all know each other and who coordinate their actions via bank boards H1: Network H2: Rich white men H3: All know each other (“It’s a small world”) H4: Bank boards Social capital and community prosperity: Putnam’s lament • Social capital leads to “good government and economic progress”: • Networks foster “sturdy norms of generalized reciprocity” • Networks facilitate gossip to gauge trustworthiness • Networks house “templates” for successful forms of cooperation (e.g., business alliances) • Americans “bowl alone” at the expense of civic life • Substantial membership declines in voluntary organizations • Declines in voter turnout • Declines generalized “trust” Why has “social capital” declined? According to Putnam: • Generational changes (farewell, greatest generation) • Increased TV watching (hello, MTV generation) • Too much working, especially women (farewell, Mrs. Cleaver) • Urban sprawl (hello, Sunnyvale) An Organizational Alternative “How ironic would it be if, after pulling out of locally rooted associations, the very business and professional elites who blazed the path toward civic disengagement were now to turn around and successfully argue that the less privileged Americans they left behind are the ones who must repair the nation’s social connectedness.” -Theda Skocpol (1996, p. 25) “Pittsburgh’s not-for-profit sector misses the generous donations from Gulf Corporation and its employees. Gulf’s donations to United Way amounted to $700,000 in 1983, when the firm’s total giving to local organizations topped $2 million. Civic organizations that lost money and volunteer support on account of Gulf’s sale include hospitals, colleges, museums, and the world-renowned Pittsburgh Symphony.” -Hirsch, Pack your Own Parachute Business and social capital “Americans of all ages, all stations in life, and all types of dispositions are forever forming associations. There are not only commercial and industrial associations in which all take part, but others of a thousand different types…” Tocqueville, Democracy in America “People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public, or in some contrivance to raise prices” Smith, The Wealth of Nations (ch. 10) Social capital is (often) built while you’re doing something else “Members of Florentine choral societies participate because they like to sing, not because their participation strengthens Tuscan social fabric. But it does.” Robert Putnam, “The Prosperous Community” Non-profits play a central role in the business network (e.g., Carnegie Hall) Name Affiliation Sandy Weill (Chairman) CEO, Citigroup William B. Harrison, Jr. CEO, JP Morgan Chase C. Michael Armstrong CEO, ATT Harry P. Kamen CEO, MetLife Frank Newman CEO, Bankers Trust Ronald Perelman CEO, MacAndrews & Forbes Joe Roby Chair Emeritus, CSFB James D. Wolfensohn President, World Bank Rudy Giuliani Recovering mayor And ~ 50 others, including: Bill Cosby, Marilyn Horne, Peter Jennings, Yo-Yo Ma, Oscar de la Renta Six degrees of Citigroup: Shortest paths from 4157 Nasdaq/NYSE firms via shared directors Citi # N of firms Cumulative 1 31 31 2 310 341 3 1280 1621 4 1549 3170 5 722 3892 6 199 4091 7 45 4136 8 14 4150 9 5 4155 Research Approach • Unit of Analysis: US Community • Interviews with 19 civic/organizational leaders in a major metropolitan area and a small community • Statistical analyses of 62 communities (MSAs) with >10 public corporations and major nonprofits in 1986 and 1998 Network data • Boards of directors of all companies traded on NYSE or Nasdaq • Boards of all “major” non-profits (~700 listed in Taft Directory in 1987 and in Guidestar database in 1998 via Urban Institute) • Divided into 62 community sub-samples NATIONAL SAMPLE 1986 1998 Organizations 3,709 6,283 Directors 30,620 45,854 Detroit 1986 Non-local Organization Local Corporation Local Non-profit Local Bank Detroit 1998 Local Non-profit Non-local Organization Local Corporation Local Bank Local Non-profit Local Bank Minneapolis-St. Paul: 1998 Non-local Organization Local Corporation Local Non-profit Local Bank The benefits to communities of local business involvement “We have extensive programs in [headquarters city] that coordinate these activities and we provide a venue where that is possible. We had a clean-up day last May where employees were encouraged to help clean areas of the communities where they worked. In addition we fund a huge retiree volunteer association. They logged almost 100,000 of volunteer time last year. We provide them with a budget, but aside from that, it is entirely employee run.” – Manager of Corporate Philanthropy, Fortune 500 Retailer Why they give “A major commitment of ours is to the arts... we feel that our work with [art museum] is just as important to the economic stability of a region as more direct giving.” -Manager of Corporate Philanthropy, Fortune 500 Utility “Cultural things like the opera or [art museum] are important to our recruiting activities.” – Manager of Corporate Philanthropy, Fortune 500 Manufacturer Forging connections to local nonprofits “We encourage our employees to participate in nonprofit activities. For instance, one of my regional managers is taking the non-profit board member development program run by the local chamber of commerce. This is a program, where they take upand-coming corporate leaders and teach them what they need to know to serve on a board of directors. It is a rigorous program and we sponsor that person. Then they try to set that person up with an appointment to a board.” – Manager of Corporate Philanthropy, Fortune 500 Retailer The business case for community involvement “Strong communities make strong community banks, and vice versa…I require all my managers to serve in the non-profit community, and it’s a component of their annual evaluation” -Bank CEO Before bank CEO involvement After bank CEO involvement The cost of losing local banks “The local presidents are still involved in the non-profits because people want them on the board, but their giving is different because local presidents do not have discretion over it any more. The decisions always have to go through [city] or [city], or where ever the headquarters is.” -President, Community Foundation The costs of a well-connected elite “Because it was such a feudal society, they whole idea of corporate philanthropy and responsibility did not become as broad based and so a lot of the institutional structure that may have developed otherwise did not.” -Former Senior Manager, Fortune 500 Company, Current Fortune 500 Board Member Directors' Charities Got NYSE Money Contributions Went Up Under Grasso By David S. Hilzenrath Washington Post Staff Writer Friday, September 19, 2003; Page E01 During Dick Grasso's tenure as head of the New York Stock Exchange, the exchange and its charitable foundation made extensive contributions to organizations affiliated with NYSE directors, including almost $2.8 million to schools and charities affiliated with members of the committee that set Grasso's pay. Last year, the exchange and its foundation contributed more than $1.3 million -- about 18 percent of total giving -- to groups affiliated with members of the board's compensation committee, according to documents the NYSE submitted to the Securities and Exchange Commission in response to questions about Grasso's pay… Such contributions can help co-opt board members and make them less likely to challenge a chief executive they are for overseeing, said Sarah Teslik, executive director of the Council of Institutional Investors… “Accountability suffers if you buy off your overseers," Teslik said. Constructs underlying “community social capital” • Infrastructure: the density of non-profit organizations and organizations for civic engagement (e.g., Rotary) • Involvement: levels of grassroots volunteering Factors shaping infrastructure and involvement • Corporate density: counts of corporations per capita • Bank density: banks per capita • Elite cohesion: connections among corporate, bank, and non-profit boards Effects of Corporate Density Supporting Community Restricting Community Infrastructure More money for local programs (“80% local”) But where is the funding directed? “80% within” elite Arts Recruiting benefits Involvement Volunteering aggregators …but it is not always broad based Hypotheses More corporations, greater social capital, civic orgs and volunteering Fewer corporations, greater social capital, civic orgs and volunteering Effects of Bank Density Supporting Community Restricting Community Infrastructure Bank trust departments as former community foundations “Banks are very important local spenders” Consolidated banking networks leads to lower community investment (Ratcliff 1980) Involvement Bank executives as community leaders More banks, more cohesive elite Hypotheses More banks, greater social capital, civic orgs and volunteering Fewer banks, greater social capital, civic orgs and volunteering Effects of Local Elite Cohesion Supporting Community Restricting Community Infrastructure Enhances non profit involvement, esp. financial and expertise rewards Galaskiewicz (1997) Too concentrated on elite only. E.g. Local Feudalism Hunter (1953), Ratcliff (1980) Involvement More opportunities for volunteering Only focused on few, doesn’t become broadly based “majority within elite” Hypotheses Greater the elite cohesion, the greater the social capital, civic orgs and involvement Greater the elite cohesion, the lower the social capital, civic orgs and involvement Dependent variables • Number of large (assets>$10,000,000) non-profit organizations per million (from Urban Institute) • Elite-oriented: “Arts, culture & humanities;” “Philanthropy;” golf; business-oriented • Community-oriented: “Health care;” “Mental health & crisis intervention;” “Employment;” “Housing & shelter;” “Public safety;” “Youth development;” “Human services;” “Civil rights;” “Community improvement” • Voluntarism (DDB Needham annual lifestyle survey)-factor score of aggregated responses to: • “In the past 12 months, how often have you done volunteer work” • “In the past 12 months, how often have you worked on a community project” • For 1985/1986 and 1997/1998 Operationalizations • Corporate density per capita: # of corporate headquarters/population (1986 HQ/1990 pop; 1998 HQ/2000 pop) • Bank density per capita: publicly-traded banks/population (1986 and 1998) • Elite network • Network: ties through shared directors among all locallyheadquartered NYSE and Nasdaq firms and major nonprofits • Density, centralization, mean ties to non-profits… Main findings • Don’t believe Putnam; do believe Skocpol • Corporate density promotes elite-oriented non-profits but not community-oriented nonprofits • But: denser networks among elites do enhance community non-profits (to a point) • Both bank and corporate density promote grassroots voluntarism Elite network density and community nonprofits Community Non-Profit Organizations/Million Residents 7 6 5 4 3 2 1 0 1 3 5 7 9 11 13 15 17 19 21 23 Elite Network Connectedness 25 27 29 31 33