File - Seaview Nissan

advertisement

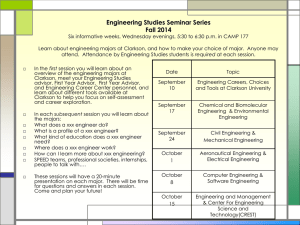

ASSIGNMENT COVER SHEET Electronic or manual submission Form: SSC-115-07-06 UNIT CODE: NAME OF STUDENT (PRINT CLEARLY) BES11200 BUSINESS KNOWLEDGE DEVELOPMENT TITLE: STUDENT ID. NO. STRAWBRIDGE AMBER 1032 7335 THOMPSON MONIQUE 1033 2717 ROBERTS NICHOLAS 1032 7865 CAO RUI 1029 3068 FAMILY NAME FIRST NAME NAME OF LECTURER (PRINT CLEARLY) DUE DATE ANGELA BEVILACQUA 23/10/2013 Topic of assignment SEAVIEW NISSAN Group or tutorial (if applicable) THURSDAY 8:30AM Course Campus G95 JO I certify that the attached assignment is my own work and that any material drawn from other sources has been acknowledged. OFFICE USE ONLY Copyright in assignments remains my property. I grant permission to the University to make copies of assignments for assessment, review and/or record keeping purposes. I note that the University reserves the right to check my assignment for plagiarism. Should the reproduction of all or part of an assignment be required by the University for any purpose other than those mentioned above, appropriate authorisation will be sought from me on the relevant form. If handing in an assignment in a paper or other physical form, sign here to indicate that you have read this form, filled it in completely and that you certify as above. Signature Date OR, if submitting this paper electronically as per instructions for the unit, place an ‘X’ in the box below to indicate that you have read this form and filled it in completely and that you certify as above. Please include this page in/with your submission. Any electronic responses to this submission will be sent to your ECU email address. Agreement X Date 23/10/2013 PROCEDURES AND PENALTIES ON LATE ASSIGNMENTS Admission, Enrolment and Academic Progress Rule 24(6) and Assessment Policy A student who wishes to defer the submission of an assignment must apply to the lecturer in charge of the relevant unit or course for an extension of the time within which to submit the assignment. Where an extension is sought for the submission of an assignment the application must : be in writing - preferably before the due date; and set out the grounds on which deferral is sought. Assignments submitted after the normal or extended date without approval shall incur a penalty of loss of marks. Academic Misconduct Rules (Students) All forms of cheating, plagiarism or collusion are regarded seriously and could result in penalties including loss of marks, exclusion from the unit or cancellation of enrolment. ---------------------------------------------------------------------------------------------------------------------- Checklist for submitting a team assignment WHY IS THIS NECESSARY? A team project requires a number of individuals to work together to produce a final product that meets certain specified requirements. It is important that the various sections of a team project, if created by different individuals, be seamlessly assembled and then carefully reviewed to ensure consistency of style and approach. If this is done successfully, it should be difficult for the reader or reviewer to identify different sections as being the work of different individuals. A further important point to remember is that the individual members of the team take joint and full responsibility for the final product. If one member of the team fails to address the project requirements, or commits plagiarism, the other members of the team should identify and rectify the problem, because the team as a whole is responsible for the final output. For this reason it is essential that every member of the team should review the entire product critically before it is submitted. It is a measure of the maturity of a team that individuals can approach other individuals in the team with suggestions, comments, and constructive criticism. Every member of the team should review the following checklist and ensure that all applicable items have been checked: I have carefully reviewed the task/project instructions to ensure that we have individually and collectively followed the instructions I have carefully reviewed the marking guide, to ensure that our final product meets the stated requirements I have proofread all the written elements of the final product (including headings and captions) for spelling and grammar mistakes I have reviewed the document in its entirety to ensure that the style and approach are consistent throughout I am familiar with the contributions made by all of my team members I have discussed any issues or problems that I might have with my team members (e.g. suspected plagiarism, contribution to the word count, contribution to the research and findings of the report) I have reviewed the document in its entirety to ensure that it is fully referenced in accordance with the ECU referencing guidelines at http://www.ecu.edu.au/CLT/pdf/refguide.pdf Name: Amber Strawbridge Monique Thompson Nicholas Roberts Rui Cao Date: 23/10/2013 Signature: X Seaview Nissan Report Task 1: Brain-storm, mind-map and give an overview of new business 1. The team’s prospective new business What is the Business? The business is an expansion from Nissan in Wangara to the Clarkson area. It will be called Seaview Nissan. This will be a smaller car yard that will be located within the Clarkson area. The business will be aimed at small to medium sized business, offering a relatively low finance rate on vehicles for business that are looking to purchase new or used vehicles. The business is also aimed at customer within and close to the Clarkson area, who want to get a good deal on finance for a new or used car, but do not want to travel all the way to Wangara to see a Nissan dealer close to their area. With our primary target market being small to medium business owners, we seek to open our office from 09:00 to 17:00, Monday to Friday and will be remaining closed public holidays. Any enquiries outside these hours will be diverted to our head office in the Wanneroo Area, which will be handled directly by the Wanneroo service managers and handed over to us in due course for follow up. Staffing In terms of staffing, our full time, regular employees will consist of a finance manager, a human resource manager and an advisor. Our part time employees will consist of a default manager. In order to cope with busy periods of the business financial year we plan to employ trainees. Not only will this benefit our company with cost reductions but it will also provide our trainees with a unique business experience where they are free to work and grow in an environment which will give them key employability skills within the workforce. 2. The business’ target market Who is the Target Market? The target market consists of small to medium sized business in and around the Clarkson area. Customers within and around the Clarkson area who are looking for a Nissan dealership but don’t want to travel as far Wangara or North or South of the River are also included in this target market. The aim of this target market is to enhance the client base for this small Dealership as well as for the larger partner dealership in Wangara. The economic status of these customers will be of medium to high economic status as we are looking mostly at businesses purchasing vehicles. Looking at the Clarkson area it is quite an expensive housing area so we would expect the economic status to be of medium to high level. The target market includes customers looking at new and used vehicles. 3. Mind map of the business 4. Potential competition for your business Potential Competition Commercial car yards With over 60 automotive brands in the Australian market we realise the need to beat/match our competitors. In doing so, we have identified our top 5 competitors to be Toyota, Holden, Mazda, Hyundai and Ford. From the following graphs we can see that our two strongest competitors (Toyota and Holden) appear to be getting stronger every year through the increase of new car sales. However, Mazda, Ford and Hyundai seem to have irregular increases and decreases in their sales throughout the year which can be due to a number of environmental factors. We have learnt that it hasn’t always been an easy road for our competitors and that it takes a rather long period of time to build credibility within the market place, especially within the global market. In order to gain sales and compete with our competitors we must appeal to what the customers want and so with our innovative customer service focus we will be able to listen to what our customer’s desire. Whilst many of our competitors offer similar services we aim to differentiate ourselves through our customer service and flexible financing opportunities as mentioned earlier. Task 2: Undertake a SWOT analysis of your new business A SWOT analysis of the business idea has been undertaken and the results are listed below under each of the SWOT headings. Strengths: The strengths of this business are that we have the Nissan name, which is a well recognised name and we are backed by AHG. We are customer focused and our business is aimed at small to medium businesses as well as any customers within the Clarkson area. We have full cover of warranties on cars purchased to cover any repairs as well as having a service and parts department. Weaknesses: The weaknesses of this business are that we will be without a building until AHG locate one in Clarkson. This business can be considered high risk as there are other car dealerships within the Clarkson area, however in saying that in the area of Clarkson that we will be based there are only 4 dealerships to worry about. Our marketing costs will be quite high within the first year as we are trying to get our name out that we are in the Clarkson area, however there are strategies we have come up with that will be mentioned later on in this section of the SWOT analysis. Opportunity: This business has many opportunities, one is that it is an expansion in which case we will have an existing customer base for customers that live in Clarkson but have come to Wangara and we already have the financing opportunities to operate and sell cars. We have the opportunity to expand to interstate branches and companies, as well as a large product category of Nissans. Threats: Opening up any business has its threats, to a car dealership one of the biggest threats aside from competitors is people with unstable credit ratings. Unstable credit ratings mean that we may not be able to sell cars to customers if there is the risk that they cannot repay the money; however this is where contracts come in to play. Competitors will be a threat especially if they have been established in Clarkson for a long period of time, however we have strategies to overcome this threat, particularly with the Nissan name behind us and having an existing customer base of customers that have previously come to Wangara but they live in Clarkson. Overcoming these weaknesses and threats: Competitors As previously mentioned one of our threats would be our competitors. To overcome this we will have to establish our name. We do have an existing customer base of customers that live in Clarkson that have come to Wangara. This will be more convenient for Clarkson customers having a Nissan dealership in their area. Building front Covering the weakness of the building, AHG are the ones who will locate the building for lease or purchase and we will have their backing for the credit rating and lease. Customers Being an expansion we will have some customers from Wangara that live in the Clarkson area that will come to the Clarkson dealership as it is closer to where they live. From here our existing customers will spread word of mouth to other people in the Clarkson area, these being businesses and other customers. Along with advertising, this is how we will gain customers and bring more customers into our business rather than other dealerships. How to decrease our marketing costs? In terms of marketing costs it will be hard to decrease these costs as advertising the business is vital. When first opening the advertising costs will be quite high due to the number of advertisements that will be used to promote the grand opening. For every year after the marketing costs could decrease slightly due to only running specific sales during specific times of the year, such as end of financial year and birthdays. To try and decrease costs we could prepay the advertisements for so many months or even years in advance. Of course we would pay more in the year that we decide to prepay the advertising but over the years where the advertising has been prepaid we have cut that cost from the budget. People with unstable credit ratings In terms of dealing with this issue, this one is quite simple to solve. The finance manager will get in touch with the bank and obtain a record of the customer’s credit history. If the customer has bad debts or unstable credit ratings, the manager will from there send an application to the finance company. If the finance application is rejected the customer will not be able to obtain a car through finance. Task 3: Summary of revenue and costs items for your new business Investors Seaview Nissan is a well-structured company that is self-funded from a small group of investors. The management team is working at the store to reduce agency costs in the short term eventually stepping back into part time roles where needed to save unnecessary staffing costs. Trainees will be employed on a permanent-part time basis and possibly a casual to ensure smooth running of business. The staff that will be employed will be full time, part time and some casual. The listing of full time staff will be; - Dealer principle Financial controller Finance department manager Human resource manager The part time employees will include; - Default agent Casual staff will include trainees that will be hired to cover for the busy seasons. We have begun with a substantial injection of private capital from our team. As we have no cost of loans and can use the capital already contributed to keep business running correctly. We are looking for potential partners in the long term to possibly replace the need for part-time staff further reducing agency costs. Initial Outlay After capital introduction our team conducted a net present value analysis into the viability of buying verses leasing for our dealership venue. Due to the available capital a buy decision was made, this allows us to have more control over fixed costs in the long run. Once this decision was made tangible purchases were made; this includes: - Our first cars from Nissan - Our dealership furnishings for customer comfort Office fittings such as computers, telephones, printers and general office supplies needed to do business. Furthermore continual purchasing of equipment will be organised on a fixed cost basis while unexpected damages or faults will be accounted for in variable costs. The next phase of setup included our intangibles. These include our: - Business licenses - Dealership license - Utility set up costs as a business Insurance costs for our business to limit risk of investment and to protect from unseen circumstances Once this is completed we will seek professional assistance from a law professional to draft our business’ sales and lease agreements along with potential contracts and future business solution options to show clients before a customized option is created for them. Costs Fixed All businesses incur fixed costs, fortunately fixed costs for our business can be easily organised and minimized through contracts for yearly terms. Insurance will be the first cost paid at a fixed rate monthly rate. As previously mentioned this serves to minimize risk and is an important and necessary cost for business in Australia. As business is able to come by fixed contracts easier than consumers we have structured our utilities (water, phone line and electricity) to be paid at a fixed rate also. Further costs will be accounted for by us in variable costs. Seaview Nissan operates in a business environment so we must abide by the corporate tax rate. This is set at 30% as of time of writing and may change given the government change but should not affect our viability in the long run. Staff wages will be a large expense. We plan to pay our staff on a salary/ commission base, therefor our wages cost is a fixed cost. Commissions are a variable cost shown later. As a franchise company Seaview Nissan must pay royalties to our parent company (AHG) this may vary between 2-10%. This will be offset given our differentiation by providing small- medium business solutions, a service which is not as prevalent as consumer car dealerships. Magazine and newspapers shall be made available to our customers as small touches can make all the difference and built rapport showing our potential clients way pay attention to business. A fixed yearly subscription cost is set aside for this as well as a water cooler will be provided as to avoid an un pleasant experience for our (potential) clients. Variable Commissions paid out to staff are a built into our cost of business as to not affect profitability. In the event of very good business outcomes we will have to pay additional tax on our income, this is a variable cost in the sense that we are unable to foresee this beyond budget measures. Additional cars to sell and additional office supplies fall into the variable cost section. Given that a need for extra inventory shows heightened success this will not be a draw back for us and given we operate within budget these costs will not be raised in the short run. As we must lease cars we show in our show room we need to account for this cost, this cost will be mainly paid from using start-up capital and will be paid on a fixed/variable basis so is shown in the section. Any business that that offers guarantees must honour them so a cost of our business will be to cover our warranties and service agreements. This will be a substantial cost for us if we do not manage our product correctly, best care is always taken and insurances and major faults will be forwarded to our supplier as we lease the product up until time of purchase. Lastly AHG well send us promotional packs and cover 50% of our advertising costs. This cost aside as we cannot structure our own promotions with freedom the cost of discounts and other negative (for our bottom line) outcomes will be accounted for as cost of advertising outcome. This is majorly a variable cost as this cost will vary from dealership to dealership. Revenue Nissan (AHG) our parent company will offer cars to us at varying prices. We will have a substantial basic selection of the most sought after cars on the market as well as some cars that we are able to sell to increase revenue. As a business we shall serve as a non-Nissan brand car brokerage buying cars from cheap auctions and on selling them on the request of a customer. This allows us to have a customer centric approach with this process being completed once the customer shows commitment in writing forming a contract to avoid unnecessary purchases. A small part of our incoming cash flows will be from optional extras and the mark-ups we will charge. We will also offer quotes for repairs at a low price for our customers as a potential product if we hire a part time mechanic in the future. Our primary revenue will stem from the solutions we provide to small and medium business. On being approached by a potential client we can provide some example of past solutions and ideas with the client to help them with our process. Our revenue will come from mark-ups in the interest rate charged as well as premium services and our time given to the client based on their needs. A general mark-up on our financing will apply to compensate us for our business as well as general sales made to all customers. Extended warranties are offered as they make money for us with premiums usually outweighing potential costs for fixing cars etc. Insurance products are offered and will briefly be discussed. Credit insurance can be issued to protect the customer from not being able to make payments - Disability insurance is offered to customers in the event of medium- long term disability GAP insurance is offered to customers to cover the large lump cost outstanding against the car in the event of extreme damage or total destruction of the car All of our insurance products will be factored out to our parent company to free our capital reserves and avoid lack of liquidity. Task 4: Design a promotional campaign to attract prospective customers To promote the business we have come up with a promotional campaign. This campaign includes the materials and mediums used, what the costs will be and the timing of the campaign. We are also going to include a basic marketing strategy for the business. Materials The materials chosen to promote the business are sales such as a grand opening sale to begin with to attract customers to the business. This sale will entail a low finance rate on vehicles. Other sales will include end of financial year sales, birthday sales and sales with low finance rates on certain vehicles. The mediums that we will use will be television, radio, a website, newspaper advertisements and a promotional package. Within the promotional package we will include brochures on certain new vehicles that have just been released on the Nissan market, sale promotions, fact sheets/ spec sheets, business cards, some price listings as we want people to come in and enquire about pricing on vehicles. It will also include information on finance, warranty and insurance. Costs The costs that will be involved in this campaign will be the costs of the advertising such as the promotional package, the mediums used to promote the business and what the sale promotions will cost the business, such as the grand opening sale and discounting cars or having a low finance rate. Timing The timing of this promotional campaign will be around the end of financial year time, when businesses and customers have done their tax returns and have money to invest on a new vehicle whilst we advertise vehicles for purchase at a low finance rate. For businesses this is time for them to update one or more vehicles if they wish to, to enhance their business. For example a tradesmen needing a new utility vehicle would invest in a new Navara for the room for all of his tools which would enhance his business by making it easier for him to take his tools to jobs and drive an attractive new car to catch customers eyes if they see him out on the street. Task 5: Re-assess the viability of your business and make any necessary adjustments Comment SWOT Give greater evidence of viability. Lack of experienced trainees. Train them during off peak seasons. Incorporate the use of charities (cancer council) into our Promotional campaigns. Mechanical expansion. AHG Mitigation Opportunity. Weakness. Action Taken Sales research of Nissan. Commence earlier training Rationale for Chosen Action To further prove financial viability. Will increase and effectiveness of staff efficiency Opportunity. No action Franchise legalities. Opportunity. Threat. Opportunity NPV Brain storm ideas to minimise weaknesses & threats Finance 6-12months Strengthen viability of business Task 6: Undertake a quantitative analysis to support the viability of your new business 1. A clear outline of who the target market is The business’ target market is initially small to medium sized business in and around the Clarkson area. We have expanded this to include any customers within and around the Clarkson area who are looking for a Nissan dealership but don’t want to travel as far Wangara or North or South of the River. The aim of this target market is to enhance the client base for this small Dealership as well as for the larger partner dealership in Wangara. The economic status of these customers will be of medium to high economic status as we are looking mostly at businesses purchasing vehicles. Looking at the Clarkson area it is quite an expensive housing area so we would expect the economic status to be of medium to high level. The target market includes customers looking at new and used vehicles. 2. Retrieve data from at least 2 secondary data sources i. Presence of your target market A census conducted in 2006 and recorded by the Australian Bureau of Statistics on small business operations, showed that 87% of business operators were in a family run business, and just over half (54%) had dependants. In addition to this, 39% of business operators indicated they had spent time caring for a child/children without being paid. These statistics highlight the need for a flexible-low cost financing option for the working class citizens of Australia. Through our research we were able to identify nine industries that residents in Clarkson operated within that would be most likely to require the use of company and private vehicles, they are as follows: - Manufacturing (7.4%) - Electricity, gas, water and waste services (1.2%) - Construction (13.6%) - Wholesale trade (3.4%) - Transport, postal and warehousing (3.5%) -Financial and insurance services (3.4%) - Rental, hiring and real estate (1.5%) - Administration and Support services (4.4%) - Public and administration safety (6.1%) In addition, the findings from the 2006 census have shown that business operators are likely to: - Run a small business (96%) - Employ between 1-19 staff (55%) - Be educated to year 12 or the equivalent (49%) - Have training in engineering (24%) - Have training in management and commerce (17%) - Have training in architecture and building (17%) - Earn $799 per week or less (52%) - Born in Australia (73%) ii. Adequate demand for your proposed product/ service In a national regional profile the following statistics concerning the Clarkson Area were retrieved from the Australian Bureau of Statistics website: Registered Motor Vehicles (March 31, 2011): Rate per 1000 population - Passenger vehicles (501) - Campervans (2) - Light commercial vehicles (86) - Light rigid trucks (2) - Heavy rigid trucks (5) - Articulated trucks (1) - Non-freight carrying trucks (0) - Buses (2) - Motorcycles (36) Occupation of Employed Persons (2011): - Managers (8.6%) - Professionals (14.3%) - Technicians and Trade Workers (20.2%) - Community and Personal Service Workers (11.3%) - Clerical and Administrative Workers (14.3%) - Sales Workers (10.5%) - Machinery Operators and Drivers (7.2%) - Labourers (12.1%) Method of Travel to Work: - Train/Tram (473) - Bus (82) - Car (3566) - Motorbike/Scooter (29) - Bicycle (15) - Other (101) - Walked (174) 3. Add visual displays using XL Australian Business Operators, 2006-2007 Operated with the family Have dependants Caring for a child/children with no pay Figure 1 Employed by Industry (Clarkson), March 2011 Public Administration and Safety Rental, Hiring and Real Estate Transport, Postal and Warehousing Construction Manufacturing 0 Figure 2 2 4 6 8 10 12 14 16 Figure 3 Registered Motor Vehicles (Clarkson), March 2011 Motorcycles Non-freight Carrying Trucks Heavy Rigid Trucks Light Commercial Vehicles Passenger Vehicles 0 Figure 4 Figure 5 100 200 300 400 500 600 Method of Travel to Work (Clarkson), March 2011 Walked Other Bicylce Motorbike/Scooter Car Bus Train/Tram 0 500 1000 1500 2000 2500 3000 3500 4000 Figure 6 4. Analyse data using Quantitative techniques used in class Minimum Mean Median Mode Range Maximum Figure 1 39 60 54 48 87 Figure 2 1.2 2.73 3.5 12.4 13.6 Figure 3 17 51.29 52 17 79 96 Figure 4 0 70.56 2 501 501 Figure 5 7.2 12.31 11.7 14.3 13 20.2 Figure 6 15 634.29 101 3551 3566 5. Interpret and explain your findings Data from Figure 1 shows that a high percentage of Australia’s population, run or work within a business in which they heavily rely upon to support their families. This aspect, along with many others, highlights the need and want of providing flexible-low cost financing options to our customers. We believe our flexibility will attract a high degree of customers which will help counteract for any initial loss in lowering our prices against our competitors. From the recorded data shown in Figure 2, we selected industries in which we believed would have a higher need of transportation within their industry. From our results we concluded that the highest demand was situated within the construction and manufacturing industries followed closely by public administration and support with the highest percentage of 13.6% and 7.4% respectively. This highlighted the need to target our marketing strategy to these industries. Figures 4 and 6 demonstrate the demand for passenger and light commercial vehicles within the Clarkson area. With a total of 587 passenger and light commercial vehicles registered within the Clarkson area and a total of 3566 persons travelling to work via car, the demand for a commercial dealership within Clarkson is sufficient enough for us to open a Nissan expansion dealership. Team Meeting Log Date In Attendance 29/08/2013 All 05/09/2013 Amber, Nic and Rui 12/09/2013 19/09/2013 All All 26/09/2013 Monique, Amber and Rui 03/10/2013 All What (needs doing) Brainstorm and mind map. SWOT Who (will do it) Everyone When (will it be done) 05/09/2013 Comments Everyone 26/09/2013 Group to think about SWOT idea further and give thought to revenue summary and promotional campaign. Task 3 & 4 Preparation, reinforcement and fine tuning of progress. Presentation. Everyone Everyone 26/09/2013 Prior to presentation on the 26/09 Everyone On the day. Nic’s Presentation. Everyone On the day. Everyone 10/10/2013 1 – Amber 2 – Monique 3 – Rui 4 – Amber/Nic 5 – Rui/Nic Monique 17/10/2013 General work on Task 1-4. 04/10/2013 Rui, Nic and Monique Discuss where we are at. Task delegations of Task 6 and Final. Presentation of the project. Research/Plan website layouts. 10/10/2013 All 17/10/2013 All Critical evaluation of viability. Task 6 delegation Website, finish task 6. Due Date References 8175.0 – Counts of Australian Business Operators, 2006 to 2007. [2008]. Retrieved from the Australian Bureau of Statistics website: http://www.abs.gov.au/ausstats/abs@.nsf/Latestproducts/8175.0Media%20Release12006%20to%2 02007?opendocument&tabname=Summary&prodno=8175.0&issue=2006%20to%202007&num=&vi ew= National Regional Profile: Clarkson (Statistical Area Level 2). [2013]. Retrieved from the Australian Bureau of Statistics website: http://www.abs.gov.au/AUSSTATS/abs@nrp.nsf/Latestproducts/505031101Industry120072011?opendocument&tabname=Summary&prodno=505031101&issue=2007-2011