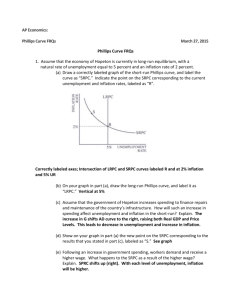

Unemployment Rate (Percent)

advertisement

The Curve The Phillips Phillips Curve • Demonstrates the short-run tradeoff between inflation and unemployment Concept Empirical Data 7 6 5 4 3 2 1 0 0 1 2 3 4 5 6 Unemployment Rate (Percent) LO3 7 Annual Rate of Inflation (Percent) Annual Rate of Inflation (Percent) Data for the 1960s 7 69 6 5 68 4 66 67 3 65 2 1 64 63 62 61 0 0 1 2 3 4 5 6 7 Unemployment Rate (Percent) 35-1 Inflation % OR THIS Inflation % The Phillips Curve • In the short-run, this is correct. • Typical short-run Phillips curve (SRPC) looks like this: SRPC SRPC Unemployment % Unemployment % What Questions Can We Answer Already? A. B. C. D. Aggregate demand curve Long-run Phillips curve Short-run Phillips curve Long-run aggregate supply curve E. Short-run aggregate supply curve. Inflation % • Which of the following is depicted in the graph below? Unemployment % What Questions Can We Answer Already? Inflation % • According to the short-run Phillips curve, lower inflation rates are associated with… SRPC Unemployment % What Questions Can We Answer Already? Inflation % • A short-run Phillips curve shows an inverse relationship between… SRPC Unemployment % What Questions Can We Answer Already? Inflation % • According to the short-run Phillips curve, a decrease in unemployment is expected to be accompanied by… SRPC Unemployment % What Questions Can We Answer Already? Inflation % • According to the short-run Phillips curve, there is a trade off between… SRPC Unemployment % Price Level LRAS SRAS PL1 PL2 AD AD2 Y2 Y1 Real GDP LRAS Price Level SRAS PL2 PL1 AD2 AD Y1 Y2 Real GDP Period Unemployment Rate 2% 5% This Year Last Year Inflation Rate 8% 4% Inflation % Draw a correctly labeled Phillips curve showing the actual unemployment and inflation rates for both years. Label this curve SRPC. 8 4 SRPC 2 5 Unemployment % Assume the United States economy is operating at full-employment output and the government has a balanced budget. A drop in consumer confidence reduces consumption spending, causing the economy to enter into a recession. Inflation % Using a correctly labeled graph of the short-run Phillips curve, show the effect of the decrease in consumption spending. Label the initial position “A” and the new position “B”. A B SRPC Unemployment % Assume that a country’s government increases domestic military expenditures. Using a correctly labeled graph of the short-run Phillips curve, show the effect of the increased military expenditures in the short run, labeling the initial point as A and the new point as B. Assume that a country’s government decreases personal income taxes. (a) Using a correctly labeled graph of the short-run Phillips curve, show the effect of the decreased personal income taxes in the short run, labeling the initial point as A and the new point as B. (This one’s not on the handout.) In the long run, however, as we learned yesterday, the unemployment rate will always return to natural rate of unemployment, or full employment. So the long-run Phillips curve looks like this: Inflation % LRPC SRPC Unemployment % The natural rate of unemployment is consistent with ANY RATE OF INFLATION in the LONG RUN!!! So what can we say about the Long-run Phillips Curve? Inflation % LRPC SRPC Unemployment % - It shows no trade-off between inflation and unemployment. - It is vertical at the natural rate of unemployment. How could we show an economy in long-run equilibrium with a graph of both the long-run and short-run Phillips curves? Inflation % LRPC A SRPC Unemployment % An economy is in short-run equilibrium at an output level above full employment. Demonstrate this using both a short-run and long-run Phillips curve. Label the equilibrium point A. LRPC Inflation % A SRPC Unemployment % An economy is in short-run equilibrium at an output level below full employment. Demonstrate this using both a short-run and long-run Phillips curve. Label the equilibrium point A. Inflation % LRPC A SRPC Unemployment % Changes in the inflation rate, in the long run, will shift the SRPC so that the new inflation rate lies on the Long-run Phillips Curve. If inflation is lower, the SRPC will shift to the left. Inflation % LRPC A B SRPC2 Unemployment % SRPC Changes in the inflation rate, in the long run, will shift the SRPC so that the new inflation rate now lies on the Long-run Phillips Curve. If inflation is higher, the SRPC will shift to the right. It turns out that inflationary expectations are just as important in shifting the SRPC. If workers and businesses expect inflation, they will build it into wages, which will actually cause inflation. LRPC Inflation % B A SRPC2 SRPC Unemployment % An economy is in short-run equilibrium at an output level below full employment. Demonstrate this using both a short-run and long-run Phillips curve. Label the equilibrium point A. Inflation % LRPC A SRPC Unemployment % Assume now that this economy is allowed to return to long-run equilibrium without government intervention. Demonstrate the effect of this on your graph. Inflation % LRPC B A SRPC SRPC2 Unemployment % Assume that the economy is in long-run equilibrium. Draw a correctly labeled graph of the short-run and long-run Phillips curves. Label the long-run equilibrium point A. Assume that consumer confidence falls. What affect will this drop in consumer confidence have on output and price level in the short run? Add a new point (B) to your Phillips curve that shows the short-run effect of this drop in consumer confidence. What effect will this have on the SRPC in the long run? Inflation % LRPC A B SRPC2 Unemployment % SRPC How do changes in the inflation rate or changes in inflationary expectations change the Long-run Phillip’s curve? They Don’t! Inflation % LRPC SRPC Unemployment % Could anything shift the long-run Phillips curve? Yes! What? A change in the natural rate of unemployment. Inflation % LRPC Unemployment % Assume that on-line job searches reduce the rate of frictional unemployment. Demonstrate this using a long-run Phillips curve. LRPC Inflation % LRPC2 Unemployment % Only a change in the natural rate of unemployment, or the full employment level, will shift the LRPC. Changes in aggregate demand, price level, actual unemployment rate, none of these will move it! True or False: According to the long-run Phillips curve, The natural rate of unemployment is independent of monetary and fiscal policy changes that affect aggregate demand. Inflation % LRPC Unemployment % Inflation % Inflation and expected inflation are important determinants of economic activity. (a) Draw a correctly labeled graph of a short-run Phillips curve. SRPC Unemployment % Inflation and expected inflation are important determinants of economic activity. (b) Using your graph in part (a), show the effect of an increase in the expected rate of inflation. Inflation % LRPC SRPC2 SRPC Unemployment % Inflation and expected inflation are important determinants of economic activity. (c) What is the effect of the increase in the expected rate of inflation on the long-run Phillips curve? • There is no effect on the long-run Phillips curve. The only thing that affects the long-run Phillips curve is a change in the natural rate of unemployment! (d) Given the increase in the expected rate of inflation from part (b), (i) will the nominal interest rate on new loans increase, decrease, or remain unchanged? It will increase. (ii) will the real interest rate on new loans increase, decrease, or remain unchanged? It will not change. (e) Assume that the nominal interest rate is 8 percent. Borrowers and lenders expect the rate of inflation to be 3 percent, and the growth rate of real gross domestic product is 4 percent. Calculate the real interest rate. • The real interest rate is 5%.