Chapter 4: Payroll Benefit Basics Payroll Source FPC Review

advertisement

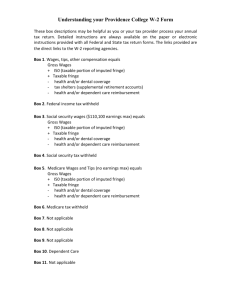

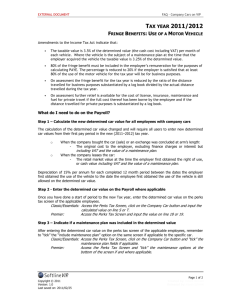

Chapter 4: Payroll Benefit Basics Payroll Source FPC Review Course 2013 Presented by: Carmela Miller, CPP howardcarmmiller@msn.com Chapter 4 • • • • • • 4.1 Fringe Benefits 4.2 Prizes and Awards 4.3 Company Vehicles 4.4 Group-Term Insurance 4.5 Deferred Compensation 4.6 Section 125 Flexible Benefit Plans 4.1 Fringe Benefits Taxable Compensation • Back Pay Awards • Bonuses, Overtime Pay, Regular Wages, Tips • Sick pay and disability benefits • Commissions • Company Vehicle (personal use) • Dismissal and Severance Pay or Final Vacation • Employee-paid commuter fees in excess of $125/month • Bicycle Commuters reimbursement of $20/month • Employer-paid parking greater than $240/month • Fringe Benefits (unless specifically excluded) • Gifts, Gift Certificates, Prizes and Awards • Group Legal Services • Group Term Life Insurance over $50,000 • Non-accountable reimbursed business expenses • Noncash fringes, unless excluded by the Internal Revenue Code • Non-Qualified Moving Expenses Fringe Benefits, Cont. Non-Taxable Compensation • Dependent Child Care assistance (up to $5000) under a Section 129 plan • Company vehicle (Business use only) • De minimis fringes • Educational assistance for job-related courses (no limit) • Group-term life insurance premium ($50,000 or less of coverage) • Medical/Dental/Health plans (Employer Contributions) • Qualified employee discounts on employer goods/services Fringe Benefits, Cont. Non-Taxable Compensation • Qualified moving expenses • Qualified transportation fringes ($125 Transit/$125 Car Pooling) • Reimbursed business expenses (if accounted for in a timely manner) • Working condition fringes which would be deductible if paid by employee • Non-job-related education assistance up to $5,250 under a qualified plan • Long-term care insurance • Health Savings Accounts Fringe Benefits Fair Market Value of Non-Cash Compensation In general, the fair market value of a fringe market value of a fringe benefit is determined on the basis of all the facts and circumstances. Specifically, the fair market value of a fringe benefit is the amount the employee would have paid a third party to buy or lease the fringe benefit. When determining the value of the benefit, keep the following two statements in mind: The employee’s perceived value of the benefit is not relevant The amount the employer paid for the benefit is not a determining factor. Fringe Benefits, Cont. Imputed Income • Imputed Income the value of the benefits employees receive that need to be included in the employee’s income. • Imputing income reduces employee’s net pay by increasing taxes. • Employee does not receive additional pay in the form of cash – Example is the group-term life insurance *** Inputting should occur as often as possible. Inputting at year end could be reduce the employee income drastically and result in little of none net pay. Fringe Benefits, Cont. Example of Imputed Income An employee has $50.00 included in income for non-cash taxable fringe benefit. The employee’s salary is $1,500.00 for the monthly pay period. A calculation of the employee’s taxes follows: Pay Without Pay With Imputed Salary Imputed Income Income $1,500.00 $1,500.00 Noncash Taxable Fringe Benefit Taxable Pay 50.00 $ 1,500.00 $1,550.00 Federal Income Tax (35.55) (43.05) Social Security Tax (63.00) (65.10) Medicare Tax (21.75) (22.48) Non-cash Fringe benefit Net Pay (50.00) $ 1,379.70 $1,369.37 Fringe Benefits Cont. Noncash fringe benefits • Benefits must be recognized as income • Taxable income requires all income/employment taxes be withheld and deposited. • Employers must collect the tax from the employee or PAY the tax on behalf of the employee. Fringe Benefits Cont. Non-reportable Fringe Benefits Most cases these benefits are not reported on W2. Benefits are so small in value it is unreasonable or administratively impractical to account for. Section 132 benefits include: • De minimis fringe benefits – Occasional typing of a personal letter or use of phone for personal use – Occasional personal use of the copier (<15% of total use of the machine) – Occasional parties, donuts, coffee for employees – Occasional tickets to the theater or sporting events – Occasional supper money for working late – Traditional holiday gifts like a turkey or a ham (Cash gifts, cards or gift certificates that are treated like cash are taxable) Fringe Benefits Cont. No-Additional Cost Services A good example of this is free flights for airline employees or free telephone service for employees of AT &T. Qualified Employee Discounts To qualify property and services must be offered for sale to customers in the ordinary course of an employer’s line of business. – Discount is not greater than 20% of retail price – Discount on property is not greater than the gross profit earned on the property at the price normally sold to customers. Fringe Benefits Cont. Working Condition Fringes Business use of a company car or plane Subscriptions to business periodicals Fees to join professional organizations Use of Athletic Facilities Facility must be located on employee premises, and operated by the employer. (If can be used by public, exclusion does not apply.) QUIZ TIME COMPANY VEHICLES Business use of a vehicle is nontaxable Personal usage is taxable Accounting procedures for properly taxing company vehicles require proper documentation Business miles driven Date of trip Purpose of trip Expenses incurred COMPANY VEHICLES Reporting requirements – Personal usage Federal tax is optional SS/MED must be withheld Reported on the W2 Reported at least once a year Fringe provided in November and December may be reported in following year. This means that if the expense was incurred in Nov or Dec 2012 you can report it in Jan 2013 when you do the 2012 W2’s COMPANY VEHICLES Valuation Method 3 Safe Harbor Methods o Annual Lease value method o Cents per mile method o Commuting Value method **** WARNING!! Once you decide on a method it MUST be used throughout the time the employee has the vehicle! COMPANY VEHICLES Annual Lease Method 1. Find the cars fair market value 2. Use the table to find the Annual Lease Value (ALV) 3. Divide the personal miles driven by the total driven 4. Multiply the FMV by the personal miles driven. *** REMEMBER: If the employee has the car less than a year and more than 30 days you MUST pro-rate to get the Annual Lease Value (ALV) PRO-RATE FORMULA: ALV (number of days driven/365) COMPANY VEHICLES Safe Harbor 2 ***Cents per mile method*** o 2012 $0.555 Vehicle put in service in 2012 Under $15,900 value Fleet, under $21,100 or SUV fleet under $21,900 o Qualifications Business expectations use throughout the year Vehicle must be driven 10,000 miles annually (including personal use) and be used primarily by employees COMPANY VEHICLES Safe Harbor 3 **Commuting Valuation Method** Include $1.50 one way or $3.00 roundtrip if company vehicle is (includes car pools): Not by a “Control Employee” Restricted to driving between work and home Non-compensatory business reasons Check your understanding A salesperson drives a company owned vehicle valued at $12,000. In the year, he logs 10,000 miles for business and 5,000 miles for personal use. 1. Use the annual lease value method to calculate the value of his personal use of the vehicle. Answer Lease value of a $12,000 vehicle is $3,600. $3,600 x 1/3 = $1,200. Check your understanding 2. Determining the value of the salesperson’s personal use of this vehicle using the cents-permile method based on 10,000 business miles and 5,200 personal miles. Answer A: 5,200 x $0.5555 per mile = $2, 286.00 Check your understanding 3. What federal taxes, if any must the salesperson’s employer withhold for his personal use of the company vehicle? a. Social Security tax and Medicare Only b. Federal Income tax only c. Federal income tax, social security tax and Medicare tax d. No taxes are required to be withheld GTL- Group Term Life Insurance o Group Term Life GTL>$50,000 is taxable income Exempt from FIT Withholding Taxable for SS/Med Holds true even EE pays via cafeteria plan Exempt from FUTA – Federal Unemployment Tax Calculating the value excess GTL – Must use Chart Calculating the Value of Excess GTL 1. 2. 3. 4. Determine the amount of coverage Amount of coverage minus $50,000 = Excess Coverage Excess coverage/1,000 x Value from the Table =Taxable Value per month. Taxable Value minus EE after tax contributions = Taxable value of GTL per month. EXAMPLE: Employee age 32 1. Coverage 30,000 x2 = $60,000 Amount of Coverage 2. $60,000 - $50,000 = $10,000 Excess Coverage 3. $10,000/$1,000 x .08 = $ 0.80 (.08 taken from chart) 4. $0.80 Benefit Value per month 5. $0.80 - $0.00 (EE Contrib) = $0.80 Taxable value of GTL per month NOTE: Pretax contributions do not reduce the taxable value After tax contributions cannot reduce the taxable value below $0 Dependent GTL o Dependent GTL < $2,000 excluded as a de minimis o Dependent GTL > $2,000 includes entire amount o Fully Taxable Subject to all withholding o If not withheld for SS/Med Employer is liable for these amounts o Exempt from FUTA Deferred Compensation Deferred Compensation Plans Qualified Plans 401(K) Non-Qualified Plans 403 (b) 457 (b) Deferred Compensation o Qualified vs. Non-Qualified Plans “Qualified” means not taxable Deferral of current income until retirement Qualified plans must meet provisions of IRS 401 Be written and communicated to employees Exclusive benefit for employees or beneficiaries Non Transferable, Non Forfeitable, (Vested) Satisfy eligibility and vesting rules of employer Cannot discriminate in favor of HCE, Officers, Shareholders Benefits may vary based on tenure Deferred Compensation o 401 (k) – Qualified Plan 2012 Maximum contribution $ 17,000 Catch Up Contribution (Age 50+) $ 5,500 Non-Taxable for Federal or State Income Tax (except in Pennsylvania) 401(k) Taxable for Social Security/Medicare and usually for 403(b) and 457(b) o Annual MAX on all plans combined is $50,000 in 2012 or 100% of eligible compensation whichever is less Employer Options Plans may offer: Employee match Ceilings for contributions Caps for matching Deferred Compensation o 403(b) Plan for tax-exempt organizations, as Public Schools, Colleges, Universities, Religious Groups, Charities.. 2012 Maximum Contributions $17,000 Catch Up Contribution $5,500 Non Taxable for Social Security/Medicare 2 plans available Tax Sheltered Annuities (TSAs) Tax deferred annuity issued by a life insurance company Tax Sheltered Custodial Accounts (TSCAs) Invested in mutual funds held by a qualifying custodian Annual MAX on all plans combined is $50,000 or 100% of eligible compensation whichever is less. Deferred Compensation o 457(b) Plan for Governmental Employees, some tax exempt organizations Complete deferral of wages sometimes 2012 Max Contribution $17,000 Max Catch Up $5,500 Not Taxable for Federal Income Tax May be taxable for Social Security/Medicare Treated in some ways as a non-qualified plan Non-Qualified Plans o Non-Qualified Deferred Compensation Allows for discrimination in participation Includes Written Agreement No Federal tax until distribution Generally taxable when services are performed NOTE: Always seek legal advice for these plans Quiz Time 1. All of the following deferred compensation plans limit the employee to making a deferral contribution of $17,000 in 2012, EXCEPT: a. 401(k) b. 403(b) c. 457(b) d. Non-Qualified Quiz 2. An employee may provide all of the following features in a 401(k) plan EXCEPT: a) Matching contributions b) Lower ceilings on contributions c) Higher benefits for highly compensated employees d) Catch up contributions Quiz 3. A superintendent of schools who will be 49 years of age on December 31, 2012 earns $100,000. His school district has a 403(b) plan. What is the maximum that he can contribute to this before taxes in 2012? a) b) c) d) $16,000 $17,000 $22,000 $22,500 Quiz 4. Which of the following plans applies only to employees of public schools, colleges, and universities and public charities? a) b) c) d) 401(k) 403(b) 457(b) Both b and c Quiz 5. Payroll must withhold federal income tax from a) Contributions to a 401(k) plans b) Contributions to a 457(b) plans c) Contributions to a non-qualified deferred compensation plans d) Contributions to Roth 401(k) plans Section 125 Flexible Benefit Plans Means to accommodate the diverse structures of today’s Families Known as cafeteria plans Tax free benefits Open enrollment times or life status change (marriage, divorce, death, birth, new employment) Section 125 Flexible Benefit Plans Section 125 Benefits may include: Offer for cash vs. benefit (qualified nontax benefit) Medical/Dental – single, spouse, family Long term care insurance Group term life insurance o WARNING! If converted to cash this becomes taxable Disability/accident coverage Dependent care – limit of $5,000 or $2,500 if Married and filing separately Section 125 Flexible Benefit Plans Section 125 Cont….. Adoption assistance Vacation choices – buying additional time CODA – Cash or deferred arrangement (Only 401(k) plans, 403(b) and 457(b) plans cannot be included) 2 separate Flex accounts for qualified non covered expenses and dependent care Health Savings accounts Section 125 Tax Implications Cafeteria plans are not federal, social security/Medicare taxable Remember 401(k) plans are the exception they are taxable for SS/Med Exception: Cash received for selling of purchased time, opting out of a benefit is fully taxable Flexible Spending Accounts (FSA) – reimbursement fund previously mentioned – pretax $$ to cover medical expenses that are not eligible under plan Flexible Spending Accounts Flex Spending Use it or Lose it….Plain as can be Employers must pay claim up to the annual contribution election Employer can utilize the remaining balances at the end of a plan year for overhead and administrative costs for the plan QUESTIONS ???????