the english east india company

advertisement

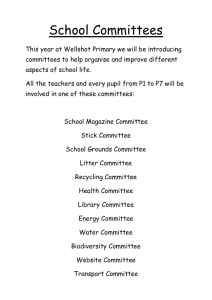

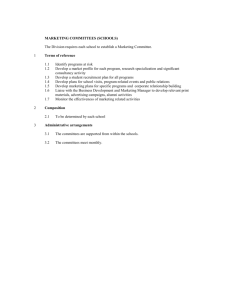

THE ENGLISH EAST INDIA COMPANY The organisation of the company. Comparison to others. How/why it was more successful. Overview • • • • • • • • The East India Company (also the English East India Company, and sometimes the British East India Company), was an early English joint-stock company that was formed initially for pursuing trade with the East Indies, but that ended up trading with India and China. The oldest among several similarly formed European East India Companies, the Company was granted an English Royal Charter, under the name Governor and Company of Merchants of London Trading into the East Indies, by Elizabeth I on 31 December 1600. A New East Indian Company was given a Charter by Act of Parliament in 1698 in return for a loan of 2milion to the government. The Old Company had a partial renewal of its charter in 1693, but due to its finances and its personal links with James II which gave it political opponents, the Old Company was criticised as an oligarchy for its own benefit and opposed. In practice it proved impossible to eliminate the Old Company as it had bought part of the New Company’s stock, and the expertise and facilities built up by its servants in Asia proved to be indispensable for successful trade. The two companies were merged in 1708 to form the United Company of Merchants of England Trading to the East Indies, commonly styled the Honourable East India Company, and abbreviated, HEIC; the Company was colloquially referred to as John Company, and in India as Company Bahadur ("bahādur": Hindustani, lit. "brave") The East India Company traded mainly in cotton, silk, indigo dye, saltpetre, tea, and opium. However, it also came to rule large swathes of India, exercising military power and assuming administrative functions, to the exclusion, gradually, of its commercial pursuits. Company rule in India lasted until 1858, when, following the events of the Indian Rebellion of 1857, and under the Government of India Act 1858, the British Crown assumed direct administration of India in the new British Raj. The Company itself was finally dissolved on 1 January 1874, as a result of the East India Stock Dividend Redemption Act. Structure • • • • • The Court of Committees performed the role of an independent administrative unit responsible for managerial direction in the Company. In 1709 its name was changed to the Court of Directors. It composed of 24 stock-holding members who were elected annually. All decisions relating to the raising and management of trading capital, the determination of the volume of trade, and the introduction of new ideas on the administrative running of the Company were strictly reserved for the Directorate and its subcommittees. The decision-making of the Company fell into 2 parts: a superior body in London, the Court of Directors, and a subordinate one in Asia. The Court of Directors had the supreme authority to set, modify or change the goals of the Company even to the point of suspending trading activities, the Presidencies in Asia could only vary their action within certain prescribed limits. There were regular weekly meetings of the full Court and the subcommittees which provided an opportunity for reviewing the Company’s problems. Although the Company’s commercial operations had an impersonal character, it wasn’t independent of either its personnel or the contemporaneous social environment expressed in a system of patronage and family connection. Behind the formal structure there was an informal one composed of many different family groups whose relation to one another was defined by mutual ties of ambitions, service, or faction. The only way these groups could control the policy of the company was by operating within the system. Organisation http://books.google.co.uk/books?hl=en&id=9xt7Fgzq9e8C&dq=Chaudhuri+The+Trading+ World+of+Asia+and+the+English+East+Indies+Company&printsec=frontcover&source=we b&ots=1rlWujIrL&sig=bvZknFfZwJMsc6KcM8CCFEUsHBQ&sa=X&oi=book_result&resnum=1&ct=r esult#PPA26,M1 Court of Committees and General Court • • • • • • The two most important components of the Company’s administrative machinery: the Court of Committees, with 24 members, and the General Court comprising all shareholders. Court of Committees consisted of the Governor, the Deputy and ordinary members, was the main executive organ, while the General Court supervised it by exercising final control. The Court of Committees initiated policy which was either ratified or altered by the General Court according to majority votes. The Court of Committees also had specific admin duties and was generally grouped into subcommittees. The General Court seldom interfered with this day-to-day work. The General Court elected the Governor, Deputy, and members of the Court of Committees. Earl Viscount Canning - British Governor General, in 1857. Governor general of India 1865 - 1862. Viceroy of India 1858 - 1862. The Crown • The Crown’s motive for supporting the Company wasn’t always consistent, and its attitude to the Company varied. However, the Company wanted Crown support on its own terms, and rejected King James’ offer to become a Company adventurer, fearing that it would lose the free election of its officers who would, they thought, eventually become nominees of the court. Business - The contract system • • • • • • • Lines of communication ran vertically from the Court of Directors to the Presidents in Asia then to officials next in rank at other trading stations. The freedom and privilege of communicating directly with the Company in England was only rarely given to factories under a President and Council. The Court of Directors attempted to secure compliance to its orders first by allowing generous salaries to their senior servants and later by granting freedom of private trade. Purely coercive powers like dismissals, forfeiture of financial guarantees, or prosecution in the courts of law were used as a deterrent to wrongdoing, but were a last resort. Treasure was supplied by various international sources. The dependence on more than one centre is seen in the complex banking and shipping arrangements made by the Committee of Treasure, which allowed the treasure to be paid for and transported to London in time for the departing East India Company ships. The basic rule was to send out to each factory in Asia a list of the commodities it was required to provide. Based on the results of the auction sales in London, the lists specified the exact quantities and often also the price of the goods to be supplied. To get full cargoes, fixed contracts were frequently used, although the goods wouldn’t reach home until 2 and a half years after they were ordered in London. The disadvantage of the contract system was the possibility of the merchants failing to deliver the goods on time, and the laborious checking procedure to verify the goods’ quality. The Court of Directors, acting through the Committees for Warehouses and Private Trade, arranged four quarterly auction sales which turned the goods into cash. These were held in the East India house itself. The Committee of Correspondence held a series of meeting before the approach of the shipping season in the autumn and winter, and made an estimate of the total amount of good they wanted to order from the Indies. Foundation Four arguments are suggested to account for the foundation in 1600: 1) The exclusion of English and Dutch merchants from Lisbon by Philip II after 1585, debarring them from the Portuguese spice market. 2) Increasing consciousness of the maritime strength of England after the Armada 3) Fear of a Dutch stranglehold on spice supplies. (The threat to the spice trade through the Red Sea impelled the English merchants to follow the Dutch example. If we look at the rise of the English East India Company not as an independent commercial ) 4) The desire to find new markets for English woollen cloth Comparisons • Dutch - There were proposals to imitate the Dutch by establishing armed bases which would pay for themselves by customs duties levied on Indian shipping and by taxing local populations. In the 1680s this became official Company policy under Sir Josiah Child, who believed the Company could only succeed by operating from secure fortified settlements outside the control of any Asian ruler and sustained by their own revenues. The Dutch • The majority of foreign merchants among the Company investors seem to have been Dutch, probably those who couldn’t gain admission to the VOC. Reasons for admitting them might have been that it would enhance the Company’s reputation among foreigners and might be a way of hearing intelligence from Holland about the VOC’s activities. Also, there were close trading connections with Europe, so foreign members residing abroad could prove useful. Authority and violence • • • • The official policy of the English East India Company had been to renounce the use of force as unnecessary expenditure with no commercial justification. They liked to contrast their reliance on the protection of Asian rulers, negotiated trading contracts or open competition with Asian and other European merchants with the violent coercion and enforced monopolies of the Dutch and Portuguese. It couldn’t t rely on the diplomatic support of the Crown and its ministers to put pressure on foreign European governments to subdue small rival companies on the continent. In Asia it had established a number of trading settlements which had semi-sovereign status, distinguished by an elaborate procedure of government, courts of law, a municipal system and a military force. The Company’s organisational structure and bureaucratic apparatus shared many of the attributes of a great department of state. Although the Company didn’t try to control Asian markets by the use of force or political pressure, it was still compelled to despatch large fleets of heavily armed ships annually to provide protection against possible Portuguese attacks. Success • • • • In the long run, the reason for its great commercial and political strength lies in the underlying structural system created by the Company’s entrepreneurial and managerial committees. There was a constancy of the Company’s aims and methods: continued insistence on a high level of profits, reduction of overhead costs, and the acquisition of special commercial or political privilege. The success of the Company depended on reducing uncertainty and risk, which was done through the regular exchange of information and advance warning about market conditions. As a means to this end, it preserved as much of its historical records as possible to be included in this information. What methods allowed it to preserve its vital interests and thus survive as an organisation? The organisation of the Company as a joint stock, implying supposed separation between ownership and utilisation of capital, enabled the Court of Directors to develop a collective managerial personality. Also, the existence of a regular procedure for dealing with everyday problems of trade contributed to its survival, and here the subcommittees played a leading role. The company needed educated locals to carry out its business properly in India, and the local masses started feeling the need for proper certification of qualification for the purpose of serving the administration and other government departments. The result was the foundation of the first three universities of the country by Earl Viscount Canning, the British Governor General, in 1857. Problems • The type of problems which the Company faced in the routine organisation of trade include maintaining an operational schedule, decision-making under uncertainty, and in resolving conflict among its members and servants. • Problems in the 1620s stemming from conflicts between the different groups of investors: 1st group) Active control and admin of the Company lay with a group of City merchants who invested heavily in it and were directly engaged in the trade of commodities at home or reexports. nd 2 group) Members of the aristocracy, high-office holders, gentry, shopkeepers, widows and orphans and foreign merchants, who saw the enterprise only in terms of financial gain and not with a view to participation in trade. • The principal weakness of the Company was that many of its shareholders were unable to get rid of the desire to get rich quick from East India trade, which the Company failed to achieve in this period. EIC ship Key Ideas • The English EIC was a state within a state for the greater part of its history as an active commercial enterprise. Its total trading capital after 1709 was permanently lent to the Crown and the interest on the loan was secured by assigning to the Company the duties on salt and paper. - Chaudhuri • The Company was the embodiment of mercantilism with its policy of harnessing political power and privileges for commercial ends - Chaudhuri. • By 1620 the policy of expansion had reached its limit and the dominant theme from then on was retrenchment and greater efficiency. Coin from the Modern East India Company Books ‘The English in Asia to 1700’ by Peter Marshall, in ‘The Oxford History of the British Empire: The Origins of Empire’, Nicolas Canny (ed.) ‘The Trading World of Asia and the English East India Company’, K.N. Chaudhuri ‘The English East India Company: The study of an early joint-stock company, 1600-1640’, K.N. Chaudhuri