Chapter 2

advertisement

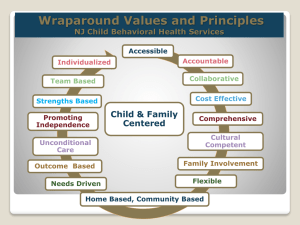

Chapter 2 Investments In Equity Securities © 2008 Clarence Byrd Inc. 1 Chapter Objectives ► Classification of equity investments ► Accounting for equity investments ► Matching classifications with methods © 2008 Clarence Byrd Inc. 2 Conceptual Basis For Classification Held for trading Available for sale 0% © 2008 Clarence Byrd Inc. Significantly Influenced companies Joint ventures 50% Subsidiaries 100% 3 Classification ► Non-strategic investments held-for-trading available-for-sale ► Strategic investments Subsidiaries Significantly influenced companies Interests in joint ventures © 2008 Clarence Byrd Inc. 4 Accounting Methods ► Cost method ► Equity method ► Fair value method (changes in Net Income) ► Fair value method (changes in Comprehensive Income) ► Full consolidation ► Proportionate consolidation © 2008 Clarence Byrd Inc. 5 Held-For-Trading ► Defined (Section 3855) Acquired principally for the purpose of selling or repurchasing in the short term; A derivative; or Any financial asset or liability that is so designated © 2008 Clarence Byrd Inc. 6 Held-For-Trading ► Application To Investments Equity securities held for short term trading Other non-strategic holdings that are designated as held for trading © 2008 Clarence Byrd Inc. 7 Held-For-Trading ► Accounting Procedures Initial and subsequent measurement at fair value Changes in fair value are allocated to Net Income Transaction costs charged to Net Income at acquisition © 2008 Clarence Byrd Inc. 8 Held-For-Trading Example EXAMPLE: On January 1, 2008, Holly Inc. acquires 1,000 shares of Helm Ltd. for $10 per share. The shares are classified as held for trading. On December 31, 2008, the Helm Ltd. shares are trading at $12 per share. During 2008, Helm Ltd. declares and pays dividends of $0.75 per share. On January 1, 2009, the securities are sold for $13 per share. © 2008 Clarence Byrd Inc. 9 Held-For-Trading Example ► Acquisition Of Investment January 1, 2008 Investments [(1,000)($10.00)] Cash © 2008 Clarence Byrd Inc. Debit Credit $10,000 $10,000 10 Held-For-Trading Example ► Receipt Of Dividends During 2008 Cash [(1,000)($0.75)] Investment Income (Net Income) © 2008 Clarence Byrd Inc. Debit Credit $750 $750 11 Held-For-Trading Example ► Year End Adjustment December 31, 2008 Investments [(1,000)($12.00 - $10.00)] Investment Income (Net Income) © 2008 Clarence Byrd Inc. Debit Credit $2,000 $2,000 12 Held-For-Trading Example ► Sale Of Investment January 1, 2009 Cash [(1,000)($13.00)] Debit Credit $13,000 Investments ($10,000 + $2,000) $12,000 Investment Income (Net Income) $1,000 © 2008 Clarence Byrd Inc. 13 Available-For-Sale ► Defined (Section 3855) Non-derivative financial assets that are designated as available for sale, or that are not classified as loans and receivables, held-to-maturity, or held-for trading © 2008 Clarence Byrd Inc. 14 Available-For-Sale ► Would include all equity investments other than: Investments in subsidiaries Investments in significantly influenced companies Investments in joint ventures Investments that are classified as held for trading. © 2008 Clarence Byrd Inc. 15 Available-For-Sale ► Accounting Procedures Initial and subsequent measurement at fair value Changes in fair value are allocated to Comprehensive Income Transaction costs: ► charged to Net Income at acquisition, or added to the initial cost © 2008 Clarence Byrd Inc. 16 Available-For-Sale Example EXAMPLE: On January 1, 2008, Holly Inc. acquires 1,000 shares of Helm Ltd. for $10 per share. The shares are classified as available for sale. On December 31, 2008, the Helm Ltd. shares are trading at $12 per share. During 2008, Helm Ltd. declares and pays dividends of $0.75 per share. On January 1, 2009, the securities are sold for $13 per share. © 2008 Clarence Byrd Inc. 17 Available For Sale Example ► Acquisition Of Investment January 1, 2008 Investments [(1,000)($10.00)] Cash © 2008 Clarence Byrd Inc. Debit Credit $100,000 $100,000 18 Available For Sale Example ► Receipt Of Dividends During 2008 Cash [(1,000)($0.75)] Investment Income (Net Income) © 2008 Clarence Byrd Inc. Debit Credit $750 $750 19 Available For Sale Example ► Year End Adjustment December 31, 2008 Investments [(1,000)($12.00 - $10.00)] Other Comprehensive Income - Gain © 2008 Clarence Byrd Inc. Debit Credit $2,000 $2,000 20 Available For Sale Example ► Sale Of Investment January 1, 2009 Cash [(1,000)($13.00)] Other Comprehensive Income – Reclassification Investments ($10,000 + $2,000) Investment Income (Net Income) © 2008 Clarence Byrd Inc. Debit Credit $13,000 2,000 $12,000 3,000 21 Cost Method ► Applicability Can be used when available-for-sale securities do not have quoted market prices ► Procedures Investment at cost Earnings only when received or receivable © 2008 Clarence Byrd Inc. 22 Cost Method ► Return of capital: Occurs when dividends received exceed the investor’s share of earnings since acquisition © 2008 Clarence Byrd Inc. 23 Return Of Capital Example EXAMPLE: On January 1, 2008, Norton Inc. acquires 10 percent of the voting shares of Montage Ltd. for $500,000. During 2008, Montage has Net Income of $350,000 and pays dividends of $250,000. During 2009, Montage has Net Income of $100,000 and pays dividends of $250,000. © 2008 Clarence Byrd Inc. 24 Return Of Capital Example ► Acquisition Of Investment January 1, 2008 Investment In Montage Cash © 2008 Clarence Byrd Inc. Debit Credit $500,000 $500,000 25 Return Of Capital Example ► Receipt of 2008 dividends During 2008 Cash [(10%)($250,000)] Investment Income © 2008 Clarence Byrd Inc. Debit Credit $25,000 $20,000 26 Return Of Capital Example ► Receipt of 2009 dividends During 2009 Cash [(10%)($250,000)] Investment Income [(10%)($350,000 - $250,000 + $100,000)] Investment In Montage [(10%)($250,000 - $100,000 - $100,000)] © 2008 Clarence Byrd Inc. Debit Credit $25,000 $20,000 5,000 27 Subsidiaries ► Paragraph 1590.03(b) – A subsidiary is an enterprise controlled by another enterprise (the parent) that has the right and ability to obtain future economic benefits from the resources of the enterprise and is exposed to the related risks. © 2008 Clarence Byrd Inc. 28 The Concept Of Control 1590.03(b) Control of an enterprise is the continuing power to determine its strategic operating, investing, and financing policies without the co-operation of others. © 2008 Clarence Byrd Inc. 29 The Concept Of Control ► In general, based on ownership of more than 50 percent of the outstanding voting shares ► Exceptions Control may exist without majority ownership Control may not exist even with majority ownership © 2008 Clarence Byrd Inc. 30 The Concept Of Control 60% P © 2008 Clarence Byrd Inc. 55% A B 31 The Concept Of Control 70% P X 60% 30% 40% Y © 2008 Clarence Byrd Inc. Z 32 Subsidiaries ► Accounting Procedures Paragraph 1590.16 An enterprise should consolidate all of its subsidiaries. (January, 1992) Consolidation procedures will be covered in Chapters 4, 5, and 6 © 2008 Clarence Byrd Inc. 33 Significantly Influenced Companies ► Defined IAS 28 Significant influence is the power to participate in the financial and operating policy decisions of the investee, but is not control over those policies CICA has a 20 percent guideline Judgment would have been better Key is the ability to elect directors © 2008 Clarence Byrd Inc. 34 Significantly Influenced Companies ► Required Accounting Procedures: Section 3051 requires the use of the equity method © 2008 Clarence Byrd Inc. 35 Equity Method Procedures ► Accounting for the investment asset Investment is recorded at cost Adjusted each year for the investor’s shares of the investee’s change in Retained Earnings © 2008 Clarence Byrd Inc. 36 Equity Method Procedures ► Accounting for investment income Investment income is equal to the Investor’s share of the reported Net Income of the Investee. © 2008 Clarence Byrd Inc. 37 Equity Method Example EXAMPLE: On January 1, 2008, Fortin Inc. pays $800,000 for a 25 percent interest in the voting shares of Beauchamp Ltd. This investment gives Fortin Inc. significant influence over Beauchamp Ltd. During the year ending December 31, 2008, Beauchamp Ltd. has net income of $300,000 and pays dividends of $180,000. During the year ending December 31, 2009, Beauchamp Ltd. has a net loss of $100,000 and pays dividends of $150,000. On January 1, 2010, Fortin’s holding of Beauchamp securities is sold for $1,200,000. © 2008 Clarence Byrd Inc. 38 Equity Method Example ► Acquisition Of Investment January 1, 2008 Investment In Beauchamp Cash © 2008 Clarence Byrd Inc. Debit Credit $800,000 $800,000 39 Equity Method Example ► 2008 Income And Dividends Year Ending December 31, 2008 Cash [(25%)($180,000) Investment In Beauchamp [(25%)($300,000 - $180,000)] Investment Income [(25%)($300,000)] © 2008 Clarence Byrd Inc. Debit Credit $45,000 30,000 $75,000 40 Equity Method Example ► 2009 Income And Dividends Year Ending December 31, 2009 Cash [(25%)($150,000)] Investment Loss [(25%)($100,000)] Investment In Beauchamp [(25%)(- $100,000 – $150,000)] © 2008 Clarence Byrd Inc. Debit Credit $37,500 25,000 $62,500 41 Equity Method Example ► Sale Of Investment January 1, 2010 Cash Debit Credit $1,200,000 Investment In Beauchamp ($800,000 + $30,000 - $62,500) Gain On Investment Sale © 2008 Clarence Byrd Inc. $767,500 432,500 42 Equity Method ► © 2008 Clarence Byrd Inc. Results of discontinued operations and extraordinary items of the investee must be shown in the investor’s Statement Of Net Income as separate line items after Income Or Loss Before Discontinued Operations And Extraordinary Items. 43 Equity Method ► EIC No.8: negative balance can be shown if: Investor has guaranteed obligations of the investee The investor is committed to provide further financial support The investee seems assured of returning to profitability © 2008 Clarence Byrd Inc. 44 Equity Method ► Significant Influence To Control Consolidation is required © 2008 Clarence Byrd Inc. 45 Equity Method ► Significant Influence To No Influence Will become held-for-trading or available-for-sale The “new cost” will be the equity value at the time of the change © 2008 Clarence Byrd Inc. 46 Equity Method ► Consolidation Adjustments All of the adjustments that would be required in preparing consolidated statements are required here. See Chapters 5 and 6 for illustrations of these procedures. © 2008 Clarence Byrd Inc. 47 Significantly Influenced Companies ► Disclosure Basis of valuation Separate disclosure of the class in both the Balance Sheet and the Income Statement Treatment of the difference between the cost of the investment and the underlying book value of the investee’s assets at the date of acquisition. © 2008 Clarence Byrd Inc. 48 Joint Venture Arrangements ► Paragraph 3055.03(c) A joint venture is an economic activity resulting from a contractual arrangement whereby two or more venturers jointly control the economic activity © 2008 Clarence Byrd Inc. 49 Joint Venture Arrangements ► Current accounting rules require the use of proportionate consolidation ► Proportionate consolidation will be covered in Chapter 8 ► IASB will eliminate proportionate consolidation and require the equity method © 2008 Clarence Byrd Inc. 50 Impairment Of Significantly Influenced Companies ► Paragraph 3051.18 When there has been a loss in value of an investment that is other than a temporary decline, the investment should be written down to recognize the loss. The write-down should be included in the determination of net income and may or may not be an extraordinary item. © 2008 Clarence Byrd Inc. 51 Impairment Of Significantly Influenced Companies ► Indicators Depressed market prices Severe or continued losses Suspension of trading Liquidity or going concern problem Current fair value less than carrying value © 2008 Clarence Byrd Inc. 52 Impairment Of Significantly Influenced Companies ► Subsequent recoveries Write downs cannot be reversed © 2008 Clarence Byrd Inc. 53 Impairment – Other Investments ► Held for trading Already at fair value ► Available for sale at fair value ► Available for sale at cost If impaired, transfer from comprehensive to net income Same rules as significantly influenced companies ► Subsidiaries and Joint Ventures Subject to provisions that relate to specific assets (e.g., 3063 deals with impairment of plant) © 2008 Clarence Byrd Inc. 54 Differential Reporting Options ► Subsidiaries Qualifying enterprises may elect to use either the cost method or the equity method for these investees ► Additional procedures and disclosures are required © 2008 Clarence Byrd Inc. 55 Differential Reporting Options ► Significantly Influenced Companies Qualifying enterprises may elect to use the cost method for these investees ► Additional required © 2008 Clarence Byrd Inc. procedures and disclosures are 56 Differential Reporting Options ► Joint Ventures Qualifying enterprises may elect to use either the cost method or the equity method for these investees ► Additional required © 2008 Clarence Byrd Inc. procedures and disclosures are 57 International Convergence ► Held-for-trading and available-for-sale investments: covered in IAS 39 © 2008 Clarence Byrd Inc. 58 IAS 39 Differences ► “Held-for-trading” replaced by “financial asset at fair value through profit or loss” ► Generally doesn’t allow arbitrary designation as held for trading ► Allows cost when fair value “not readily determinable” as opposed to no quoted market value ► Does not provide an optional treatment of transaction costs ► Requires the reversal of impairment write downs when there is a recovery © 2008 Clarence Byrd Inc. 59 International Convergence ► Significantly influenced companies: covered in IAS 28 © 2008 Clarence Byrd Inc. 60 IAS 28 Differences ► Uses the term “associated companies” rather than “significantly influenced companies” ► Impairment when recoverable amount is less than the carrying amount. Recoverable amount based on present value of future cash flows ► IAS 28 requires the reversal of an impairment loss when a recovery has occurred © 2008 Clarence Byrd Inc. 61 International Convergence ► Subsidiaries and joint ventures – Differences will be covered in later chapters © 2008 Clarence Byrd Inc. 62 © 2008 Clarence Byrd Inc. 63