Course Syllabus

advertisement

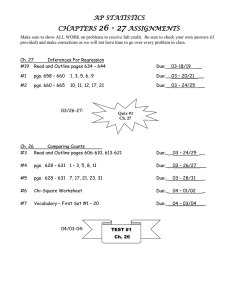

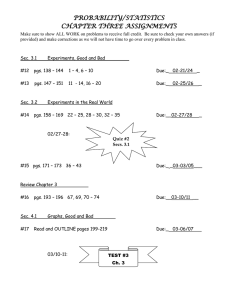

Concurrent Enrollment Course Outline High School Name: Unatego Central School District Date Proposal Submitted/Prepared: August 25, 2015 Instructor: Sonnet Constable TC3 Course #: BUAD 109 TC3 Course Title: Personal Money Management Credit Hours: 3 Student Audience – Grade Level(s): Grade Level(s): 11th and 12th grade Semester(s) Offered: Semester Fall (September-January) or Spring (January-June) or Full Year (September-June) Instructor e-mail and/or phone #: tjackson@Unatego.stier.org (607) 988-5098 This course addresses finance at a personal and practical level. Students examine current economic conditions focusing on how they can impact their personal economic situations. Ethics, personal management of cash, debt, credit, investments, insurance, and home buying are examined. Course Description: Course Prerequisites: MATH 090 if required by placement testing; prior completion or concurrent enrollment in RDNG 099 if required by placement testing. Minimal writing (short written responses) and basic mathematical skills utilized. Reading of mostly beginning college-level materials. Minimal Basic Skills Needed to Complete Course Successfully: By successfully completing this course, the student will be able to create a cash budget, plan for major purchases, and understand & use credit. They will: Establish financial goals & implement a budget Understand how banking services work; fees, interest rates, services Understand credit ratings & how to protect them Understand how to identify scams & protect against identity theft Understand the basics of income & payroll taxes Understand different methods of investment & saving for retirement Evaluate insurance for motor vehicles, houses, apartments, health, & life Learn how to evaluate competing consumer loans for automobiles, homes, education and consumer goods Gain an appreciation of the importance of understanding economic decisions, and asking questions before signing agreements. Course Objectives: Introductions to Business, 5th edition by Betty J. Brown & John E. Clow. McGraw-Hill. Copyright 2003. Required Texts and Materials/Optional Materials as Appropriate: Required Supplement(s): Hand-held calculator Instructional methods will include explaining concepts/topic introduction, multimedia lecture with PowerPoint, problem demonstrations, group discussions, banking simulation, on-line interactive stock market game, on-line interactive financial literacy program, and in-class activities. Class Modalities/Alternative Learning Strategies: Students are expected to complete daily assigned reading from the text and homework problems prior to class. Completion of the daily readings, homework assignments, and in-class activities are crucial to obtain an understanding of the underlying business concepts and skills necessary for passing exams. Students will have a test at the end of each chapter with a cumulative test at the end of the course. Students must come prepared for class with their textbook, work book, completed homework, calculator, pen/pencil and contribute to class discussions and activities. Required Readings, Presentations, Written Assignments, etc.: Course Content Presented in Units or Segments: See attached sheet Evaluation/Grading System: 94-100 = A 74-77= C 91-93=A71-73=C- 88-90=B+ 68-70=D+ 84-87 = B 64-67=D 81-83=B60-63=D- 78-80 = C+ 0-59 = F Final TC3 Grade Determined by: Tests and Quizzes 70% Homework 30% Final Exam 20% Final Unatego Grade Determined by: Tests and Quizzes 90% Homework 10% Final Exam 20% Overall Test Retakes: Students will be given the opportunity to retake a test one time. The higher of the two (original and retake) grades will be used. All students at Unatego Central School District are expected to act in an academically honest fashion in all aspects of his/her academic work. Any action taken by a student that would result in misrepresentation of someone else’s work or actions as the student’s own such as cheating, plagiarism, or other forms of academic dishonesty will not be tolerated. Students found guilty of academic dishonesty will receive a zero for those assignments and risk the possibility of a loss of credit for the course. Statement of Academic Integrity: Tompkins Cortland Community College’s Statement of Academic Integrity Every student at Tompkins Cortland Community College is expected to act in an academically honest fashion in all aspects of his or her academic work: in writing papers and reports, in taking examinations, in performing laboratory experiments and reporting the results, in clinical and cooperative learning experiences, and in attending to paperwork such as registration forms. Any written work submitted by a student must be his or her own. If the student uses the words or ideas of someone else, he or she must cite the source by such means as a footnote. Our guiding principle is that any honest evaluation of a student's performance must be based on that student's work. Any action taken by a student that would result in misrepresentation of someone else's work or actions as the student's own — such as cheating on a test, submitting for credit a paper written by another person, or forging an advisor's signature — is intellectually dishonest and deserving of censure. Students will be allowed one week to make up late/missing assignments and/or revisions. Assignments will be assessed a late penalty unless there is a legal excuse. Make-Up Policy/Late Work: Attendance will be taken in accordance with Unatego and TC3 policies. Students are expected to attend every class. If a student is absent on the day a lab, quiz, or exam is due, the instructor decides whether the work may be submitted late. If a student misses class for any reason, the student is responsible for any material, announcements, and assignments. Attendance Policy: Student participation in class discussions and activities, as well as keeping up with all assigned work will help individuals grasp concepts and identify areas that need additional instruction. Office hours are available for further clarification and/or assistance. Student Responsibilities: Personal Money Management (TC3 BUAD 109) T. Jackson 2015-2016 Syllabus Following are the chapters and topics to be covered along with the weekly listing of reading assignments, tests, labs, & projects. (Note: Subject to change). Week 1-3 4-6 7-9 10-12 Unit 10: Money Management Ch 28: Planning a Budget Ch 29: Checking Accounts Ch 30: Savings Accounts Ch 31: Investing in Stocks, Bonds, & Real Estate 16-18 Unit 11: Risk Management Ch 33: Vehicle Insurance Ch 34: Property Insurance Ch 35: Life & Health Insurance 19-20 Review & Final Exam 13-15 Note: Chapter & Topic to be Covered Unit 1: The Economy & You: Ch 1 A Look at Needs & Wants Ch 2 Economic Resources Unit 3: Money & Financial Institutions Ch 12: Money & Financial Institutions Unit 9: Credit Ch 25: What is Credit? Ch 26: How to Get & Keep Credit Ch 27: Your Credit & the Law Unit 9 Appendix: Identity Theft How to identify scams & protect against Identify theft Assignment Register for Foolproof Wkbk pgs 7981 Test/Project/Lab *See Note Below Wkbk pgs 184, 186-187 TxtBk pg 414415 Q 1-20, 23, 25 Wkbk pgs 191196 & 198 TxtBk pg 430 Q 1-25, & 29 TxtBk pg 444 Q 1-20 Budget & Checking simulation Wkbk pgs 225230 6 week on-line stock market activity Wkbk pgs 249-253 Wkbk pgs 257-258; 262263 Wkbk pg 268 Final Exam 20% Overall Chapter Tests after every chapter MarketWatch.com (on-line stock market interactive game) Foolproofme.com (independent on-line financial literacy program) KhanAcademy (independent tutorial) Complete FoolProof (FP) Mod #1 Complete FP Mod #2 Complete FP Mod #4 Complete FP Mod #5 Final Exam!!