Strategic IT Decisions - Connect for Health Colorado

advertisement

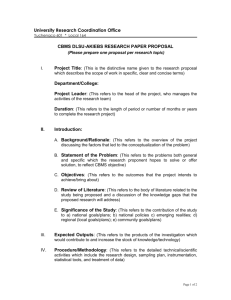

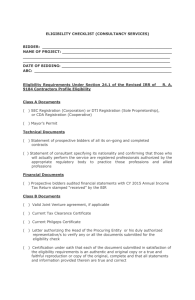

Preliminary Discussions with IT and Implementation Subcommittee – Strategic IT Decisions November 21, 2011 • Role is to provide guidance to COHBE executive leadership and early input into major strategic decisions such as IT investments, acquisition of services and procurement strategy • These initial acquisition decision(s) will likely be in the order of tens of millions of dollars over the first 3 – 5 years • Procurements will be structured to be competitive, fair and transparent • Due to the political sensitivities and visibility surrounding the COHBE, it is important that there be no real or apparent conflicts of interest in procurements activities and operational decisions 2 1. Should the Exchange use a SAAS model or acquire (borrow/build/buy) the capital IT Exchange assets? – analysis framework provided 2. Should the Exchange consider the Federal partnership model? If so, for which of the core areas? – analysis framework provided 3. Should the State develop a vision and strategy for replacing or upgrading CBMS so that investments in modifying CBMS and PEAK to meet the requirements of healthcare reform are rationalized against the strategic direction? – Yes and analysis framework confirmed with HCPF After analysis frameworks (alternatives and criteria) are confirmed with COHBE Board, analysis will be completed and presented in mid-December COHBE “owns” #1 and #2 State (HCPF, DHS) “owns” #3 3 High-Level Timeline – COHBE Policy & Business Decisions and IT 2011 11/11 2012 01/12 03/12 Policy & Business Decisions and Activities Policy & Business Decisions Impacting IT 05/12 07/12 2013 09/12 11/12 01/13 Supreme Court Ruling on Mandate 03/13 05/13 07/13 COHBE Certification by HHS Operational Activities Evolving Policy and Business Decisions based on CCIIO/CMS/Board/Executive Director/Legislative Oversight/etc. Start-up and Operational Decisions Start-up Activities IT/Systems Pilot Phase 04/13 – 10/13 HIX - SHOP Analysis/Confirmation of Current Approach & Prel RFP Procure IT Systems & Services for HIX Design/Build/Test HIX Systems for SHOP HIX SHOP Integration Testing HIX Deployment Establish PMO Pilot Phase 06/13 – 10/13 HIX - Individual Analysis/Confirmation of Current Approach & Prel RFP Procure IT Systems & Services for HIX Design/Build/Test HIX Systems (Eligibility/Enrollment/Plan Mgmt and Associated Services Interface w/ Federal Data Hub, Other Data Sources, MMIS, PEAK/CBMS) HIX Integration Testing HIX Deployment Note: Accompanying timeline for required enhancements to PEAK & CBMS not shown 4 • Schedule is extremely tight for a product release of this magnitude and complexity, i.e. 20 months until SHOP “go-live” • Implementation dependencies with changes to CBMS and PEAK increase complexity and schedule risk • Asset acquisition (with federal funds) likely to result in lower sustainability costs vs. SAAS model with lower upfront costs • Three major components must be procured: • • • • Exchange technology solution (acquire/license or rent) Exchange technology solution hosting (outsource) Exchange administrative and customer support services (outsource) Procurements will be: • • • • • Well-structured Efficient Competitive Fair Transparent • Opportunities to coordinate solutions, procurements, etc., with other states is challenging and becomes more challenging daily; coordinating across states (and multiple state agencies for each state) in this political environment creates additional dependencies and increases execution risk • Federal Exchange partnership model is not compatible with Colorado having its own Exchange 5 Exchange Alternatives • • SAAS Model COBHE Acquires Asset; Operated by 3rd Party Criteria • Cost • • • Risk • • • • • • • • • • Implementation 5-Year operations Schedule risk Cost risk Consumer experience Reliability/simplicity in getting consumers enrolled Reliability/backend complexity of having all solution components fully functioning Ability to share solution components with CBMS Privacy and security Impact on COHBE operations/and alignment with ops plan Strategic direction and latitude Stakeholder acceptability 6 Should the Exchange use a SAAS model or acquire the IT Exchange assets and have the asset operated by a 3rd party? Alternative Description/ Functions SAAS Model Cost Risk Implementati 5-Year Schedule Operationa on Risk Costs l Costs Cost Risk Consumer Experience Employer/ Employee (Richness of Features & Functionality Reliability/ Simplicity in Getting Consumers Enrolled Reliability/Back Ability to Impact on end Complexity Share Privacy COHBE of Having All Solution and Operations Solution Componen Security /and Components ts w/ Alignment Fully Functioning CBMS w/ Ops Plan Strategic Direction and Latitude Political Acceptability w/ or w/o shared rules engine Acquire Asset Operated by 3rd Party Other-TBD 7 Eligibility Enrollment HIX Customer A Carrier Systems Screening & Eligibility Determination Plan Shopping & Selection Enrollment MA/CHIP/PTC/RCS Carrier Systems Federal and State Real-Time Data Exchanges Interoperability Layer What interoperability is feasible? MA/CHIP Eligibility Rules & Real-time Eligibility Decision State Systems/ Programs CBMS Customer B PEAK SNAP, TANF, MA/CHIP/MA ABD/LTC MMIS 8 Considerations of Federally-facilitated Exchange: • Cost of Federally-facilitated Exchange is TBD; likely to charge carriers • HHS is responsible and accountable for ensuring the Exchange meets all of the standards; State role is limited • Two proposed areas of partnership that can be operated by states as part of the agreement are Plan Management and some Consumer Services • For Plan Management, State helps select plans and collects a standardized set of data on them to plug into Federally-facilitated Exchange's eligibility and enrollment functions. • For Consumer Services, HHS coordinates with the State regarding plan oversight, including consumer complaints and issues 9 2. Should the Exchange consider the Federal partnership model? If so, for which of the two optional areas?. Core Exchange Functions High-Level Exchange Requirements Which Functions Are Candidates to be Met via the Partnership Model Partnership Model for Each Core Function YES NO Accept applications (web/phone/mail) Conduct verifications of applicant information Eligibility Determine eligibility for enrollment in QHP and for insurance affordability programs Connect Medicaid and CHIP-eligible applicants to Medicaid and CHIP Conduct redeterminations and appeals Operated and maintained by HHS Enromment of consumers into QHPs Enrollment Plan Management Transactions with QHPs and trasmissions of information necessary to initiate advance payments of premium tax credit and cost-sharing reductions Plan selection approach (e.g. active purchaser or any willing plan) Collection and analysis of plan rate and benefits package information Issuer monitoring and oversight On-going issuer account management Issuer outrach and training Operated and maintained by HHS State helps select plans and collects a stardardized set of data on them to plug into Federally-facilitated Exchange's eligibility and enrollment functions. HHS coordinates with the State regarding plan oversight, including consumer complaints and issues with enrollment reconcilliation. Data collection and analysis for quality Consumer support assistors Education and outreach Navigator management Consumer Assistance Call center operations Website management Written correspondence with consumers to support eligibility and enrollment User fees Financial Management Consumer assistnace functions that a State would operate under this propoposed partnership option include: - In-person assistance - Navigator management - Outreach and education Consumer assistance functions that HHS would operate under this proposed partnership option include: - Call center operations - Website management - Written correspondence with consumers to support eligibility and enrollment Financial integrity Operated and maintained by HHS? Need to Confirm Support of risk adjustment, reinsurance and risk corridor programs 10 Category Exchange Functions, Features and Business Processes Guiding Principle Meet the minimal requirements of federal regulations; enhanced functions, features and integration will be considered in the future. New business processes to execute Exchange business processes shall minimize the impact to other State agencies’ business processes or systems. Exchange Customers Customers of the Exchange are individuals and small business owners and their employees. There will be a single Exchange. The Exchange will have two business lines: 1) the SHOP Exchange and 2) and Business Lines the Individual Exchange Market Competition Encourage competition in the market whether it is inside or outside the Exchange. Continuity of Care Ensuring continuity of care is a personal responsibility; the Exchange will not pro-actively enroll or change enrollments of consumers (i.e. individuals and small employers and their employees). Integration with Medicaid Minimize integration with Medicaid eligibility in the near-term; consider tight integration (and possible upgrade of State’s eligibility system) in long-term (i.e. 3-5 years); make investments based on this strategy. Send consumers to the “right” door first but enable cross (MAGI) eligibility determination. Federal Deadlines Work with State Medicaid agency but do not jeopardize meeting federal and state deadlines. Solution Acquisition Leverage existing solutions and solution components from other states and federal partners to the maximum extent possible. Inter-agency Partnerships Work in concert with all State agencies, e.g. HCPF, DHS, OIT and Insurance Department. Regulatory Authority Maintain the Colorado Insurance Department as the single regulator. 11