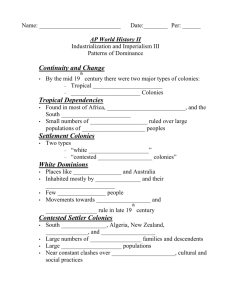

Lecture series slides

advertisement