UNIVERSITY OF KENT

MODULE SPECIFICATION TEMPLATE

SECTION 1: MODULE SPECIFICATIONS

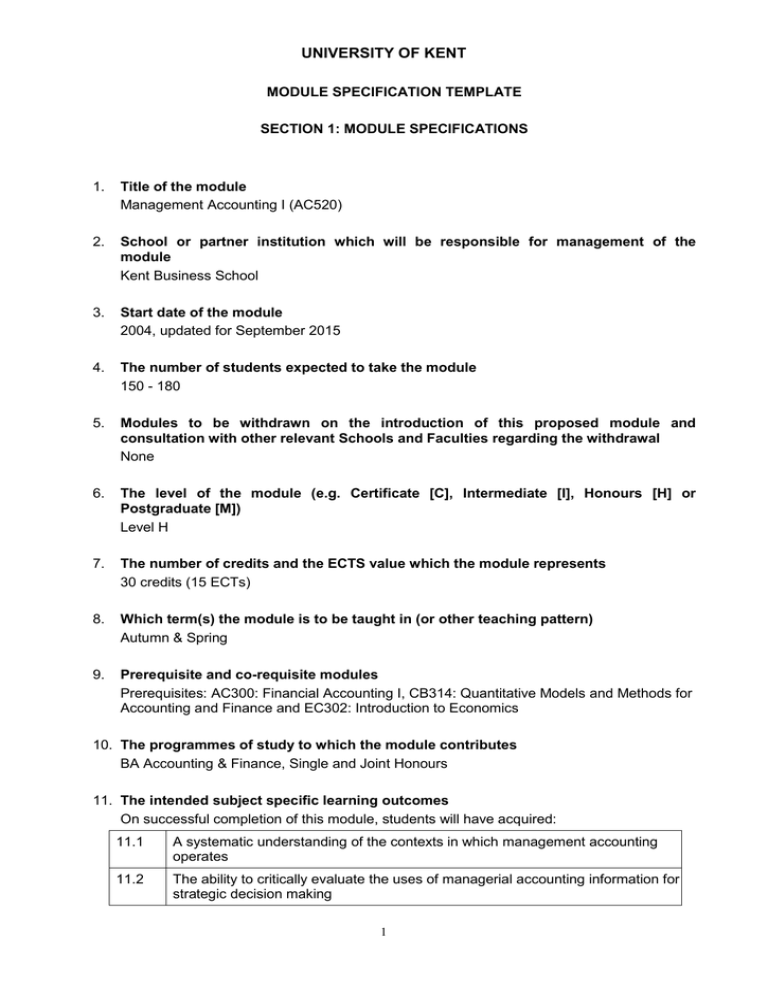

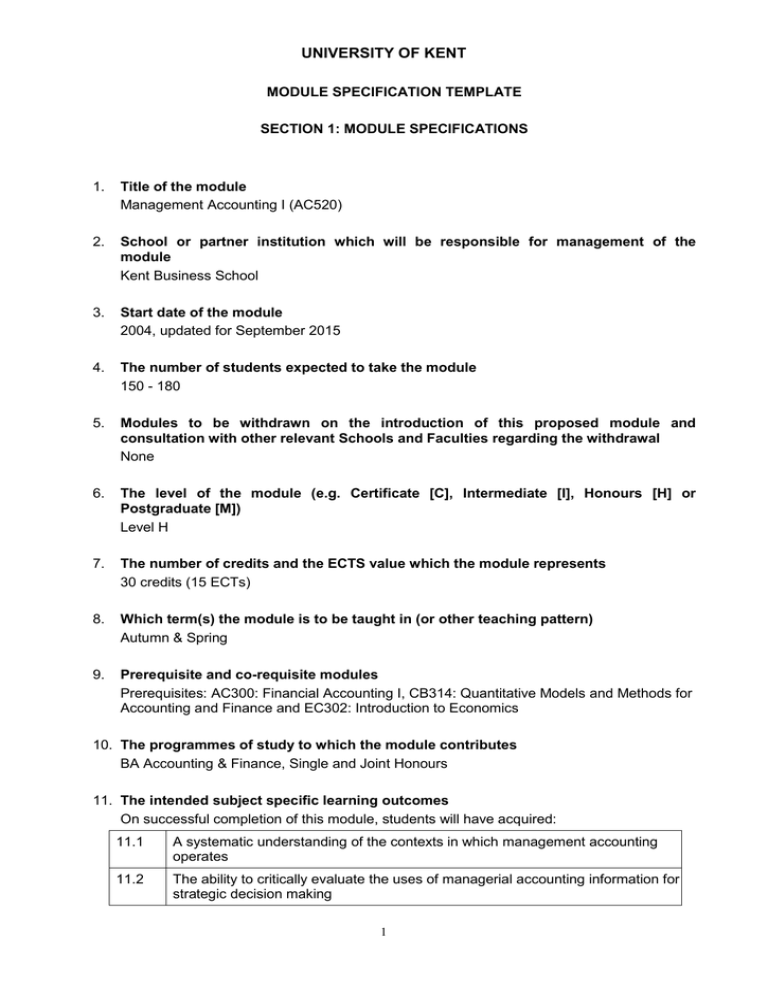

1.

Title of the module

Management Accounting I (AC520)

2.

School or partner institution which will be responsible for management of the

module

Kent Business School

3.

Start date of the module

2004, updated for September 2015

4.

The number of students expected to take the module

150 - 180

5.

Modules to be withdrawn on the introduction of this proposed module and

consultation with other relevant Schools and Faculties regarding the withdrawal

None

6.

The level of the module (e.g. Certificate [C], Intermediate [I], Honours [H] or

Postgraduate [M])

Level H

7.

The number of credits and the ECTS value which the module represents

30 credits (15 ECTs)

8.

Which term(s) the module is to be taught in (or other teaching pattern)

Autumn & Spring

9.

Prerequisite and co-requisite modules

Prerequisites: AC300: Financial Accounting I, CB314: Quantitative Models and Methods for

Accounting and Finance and EC302: Introduction to Economics

10. The programmes of study to which the module contributes

BA Accounting & Finance, Single and Joint Honours

11. The intended subject specific learning outcomes

On successful completion of this module, students will have acquired:

11.1

A systematic understanding of the contexts in which management accounting

operates

11.2

The ability to critically evaluate the uses of managerial accounting information for

strategic decision making

1

UNIVERSITY OF KENT

11.3

A systematic understanding of the current technical language and practices of

management accounting.

11.4

The ability to record and summarise economic events through the preparation of

profit and loss accounts for management purposes

11.5

A systematic understanding of various costing systems in management accounting

and cost allocation for supporting strategic managerial decisions

11.6

The ability to design and prepare budgets and perform variance analysis for

strategic planning and control

12. The intended generic learning outcomes

On successful completion of this module, students will have acquired the:

Ability to communicate and learn effectively using information technology.

12.1

12.2

Ability to analyse the operations of business and prepare financial projections.

12.3

Ability to manage their own learning, and to make use of scholarly reviews and

primary sources (e.g. refereed research articles and/or original materials

appropriate to the discipline

12.4

Ability to critically evaluate arguments, assumptions, abstract concepts and data

(that may be incomplete), to make judgements, and to frame appropriate questions

to achieve a solution to a problem

13. A synopsis of the curriculum

The work of accountants permeates all aspects of management and accountants provide

information that is relevant for both managers and external stakeholders in the context of

planning and controlling an organisation. This module will introduce and develop the

principles and techniques used to provide appropriate financial information for managers to

enable them to make better informed decisions. Topics may include:

An introduction to management accounting

The role of management accountants in an organisation

Cost terms and purposes

Cost determination

Cost-Volume-Profit (CVP) analysis

Measuring relevant costs & revenues for decision making

Job order costing

Cost allocation

Activity based costing

Joint and by-product costing

Pricing, target costing and customer profitability analysis

Motivation, budgets and responsibility accounting

Flexible budgets, variances and management control

Value based management and strategic management

Performance management and management control

Environment cost accounting: Sustainability

2

UNIVERSITY OF KENT

14. Indicative Reading List

Recommended text:

Seal, Garrison, Noreen (2012) Managerial Accounting 4rd Edition London: McGraw-Hill

Bhamini, Horngren, Data, Rajan (2012) Management and Cost Accounting 5th edition

London: FT-Prentice Hall

Drury (2012) Management and Cost Accounting 8th Edition Independence, Kentucky:

Cengage Learning ISBN 978-1-84480-566-2 (2012)

Atkinson, Kaplan, Matsumura and Young (2007) Management Accounting London: Pearson

Prentice Hall

15. Learning and Teaching Methods, including the nature and number of contact hours

and the total study hours which will be expected of students, and how these relate to

achievement of the intended module learning outcomes:

This module delivers 44 hours of lectures at 2 hours per week and 21 hours of seminars at

1 hour per week. Key topics are introduced in lectures. Examples and exercises are also

worked through in lectures in preparation for seminar work. Seminars present solutions to

pre-set seminar questions and lead discussions on designated topics.

Hours Subject LOs

Generic LOs

Lectures

44

11.1 – 11.6

12.1, 12.2, 12.4 & 12.5

Seminars

21

11.1 – 11.6

12.1, 12.2, 12.4

Other Self-Managed

Learning

235

11.1 – 11.6

12.1 – 12.4

Total hours

300

16. Assessment methods and how these relate to testing achievement of the intended

module learning outcomes

Weighting

Subject LOs

Generic LOs

Examination – 3 hour closed-book

70%

11.1 – 11.6

12.2, 12.4

In class test

10%

11.1 – 11.6

12.2, 12.4

Essay topic research and planning

– 1200-1500 words

10%

11.1 – 11.6

12.1, 12.3, 12.4

VLE test

10%

11.1 – 11.6

12.1, 12.4

3

UNIVERSITY OF KENT

The module will be assessed by both an end of year examination (70%) and coursework.

(30%). 66.7% of the coursework weighting will be test-based

The coursework consists of three elements:

An in-class test: The in-class test will consist of questions under time-constrained

conditions to give students practice in deploying management accounting

techniques in a timely fashion.

An essay topic research and planning (a full essay is not required) assignment: it

assesses student’s ability to demonstrate knowledge and understanding of the

contextual and conceptual features of management accounting, and their ability to

critically evaluate arguments and evidence. 1200 – 1500 words

A VLE test: it consists of mainly multiple choice questions and some computational

questions using VLE.

17. Implications for learning resources, including staff, library, IT and space

None

18. The School recognises and has embedded the expectations of current disability

equality legislation, and supports students with a declared disability or special

educational need in its teaching. Within this module we will make reasonable

adjustments wherever necessary, including additional or substitute materials,

teaching modes or assessment methods for students who have declared and

discussed their learning support needs. Arrangements for students with declared

disabilities will be made on an individual basis, in consultation with the University’s

disability/dyslexia support service, and specialist support will be provided where

needed.

19. Campus(es) where module will be delivered:

Canterbury

Module Specification Template

Last updated October 2014

4