Assignment 1 - Mr Lingard Economics & Business

Year 13

Unit 7 – Management Accounting

BTEC Business Level 3

Student name

Date issued

16th November 2015

Qualification

Assessor name

Mr A Lingard

Completion date

18 th December 2015

Submitted on

Unit number and title (Credit Value)

Edexcel BTEC Business Level 3 Business

Unit 7 - Management Accounting

Assignment title

In this assessment you will have opportunities to provide evidence against the following criteria.

Indicate the page numbers where the evidence can be found.

Assignment title

The purpose of this assignment is to:

1 Understand how production costs are determined and used to calculate prices

Costs: direct costs (raw materials, unfinished goods, direct labour costs, direct expenses); variable costs; depreciation; semi-variable costs; stepped costs; indirect costs; fixed costs; cost centres; profit centres; non-production (service) department overheads; overhead allocation; apportionment; overhead absorption rate; absorption costing; activity-based costing; marginal costing; standard costing

Prices: cost plus; discounting; impact of pricing policies on production and costs; income

2 Be able to use break-even analysis

Break-even analysis: contribution; break-even formula; break-even graph; break-even point; area of profit; area of loss; margin of safety; budgeted activity and sales levels; numerical calculation; changing overheads; direct costs; selling prices and budgeted activity levels; target profit levels of activity; use of computerised spreadsheet (tabulation, charts, goal-seeking); limitations and assumptions (sales levels being identical to production levels, consistency of selling price, contribution and overhead behaviour); external factors

(inflation, interest rates)

Scenario

You are working as a trainee small business manager at a branch of a national bank. One of your first tasks is to advise a new business start-up under the supervision of your manager. This means that before you can advise the client your work needs to be checked for accuracy by your line manager. To do this your manager has set you a case study task based on a small florists.

Sources of information

www.businessstudiesonline.co.uk

,

www.tutor2u.net

,

www.ttimes100.co.uk

Criteri a refere nce

P1

P2

M1

D1

To achieve the criteria the evidence must show that the student is able to: describe the purpose of accounting for an organisation

Tas k no. explain the difference between capital and revenue items of expenditure and income assess the implications of different activity levels using the results of a breakeven analysis for a selected organisation evaluate the reliability of break-even analysis in estimating budgeted activity levels for a selected organisation

Expected

Evidence in

Feedback folder

Learner declaration

I certify that the work submitted for this assignment is my own and research sources are fully acknowledged.

Learner signature: Date:

This brief has been verified as being fit for purpose

Assessor

Signature

Internal verifier

Signature

Andrew Lingard

Nicola May

ACTION Y/N

Date

Date

To be submitted onononresubmitted

Final Grade Points

18

th

December 2015

Criteria

met

Y/N

Task 1 (P2) Deadline: Tuesday 1 st December 2015

Software needed: Spreadsheet programme (Excel or similar), Presentation software (Powerpoint, Prezi or similar)

Using the attached case study you need to create a break-even analysis.

Explain what is meant by break-even analysis.

Describe how you would use the break-even technique to explain the relationships between costs and income.

Calculate the break-even point from the information in the case study’s break-even-chart.

Calculate the margin of safety.

Calculate the target profit levels of activity.

Using the same information, create a break-even chart, o Label the break-even chart. o Label the break-even point on the chart. o Label the margin of safety, o Label the area of profit, o Label the area of loss

Task 2 (M1) Deadline Tuesday 8 th December 2015

Software needed: Presentation Software (Powerpoint, Prezi or similar)

You now need to advise Graham about what level of output he needs to aim at. To do this you need to suggest activity levels using the results of break-even analysis for a selected organisation. a): Has Graham set an appropriate sales price for his cakes? Explain why you think that. b): In order to be a successful business and to expand in the future, advise Graham what level of sales he should be aiming at.

Make sure that your suggestions take into account the appropriate mark-up on cost, that you take account of the current market prices (i.e. you can refer to links in an internet site for current prices), and that you take the break-even point and the required margin of safety into account.

Task 3 (D1) Deadline Friday 11 th December 2015

Software needed: Desk Top Publishing Software (MS Publisher or similar)

As part of your job at the bank your manager has asked you to write a guide for small businesses about what breakeven is and the problems that could be caused from using it. Your guide should take the form of a booklet and should include;

1.

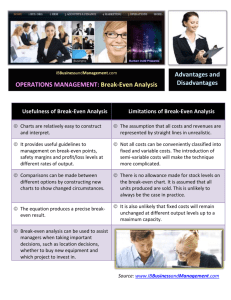

What are the limitations of using the break-even technique?

2.

What inaccurate assumptions are made with regard to the relationships between cost and income when you use the break-even technique?

3.

Why might costs and income change in relation to one another at differing levels of activity?

4.

Why is it dangerous to assume that all products being made, or that could be made, will be sold?

5.

It appears that only one product is making a contribution. What might be the implications if another product was introduced that makes a different level of contribution?

6.

What might be the impact on the business if inflation were (a) to rise, (b) to fall?

7.

What might be the impact on the business if interest rates were (a) to rise, (b) to fall?

Task 2 (P1) Deadline: Friday 18 th December 2015

Software needed: Word Processor (MS Word or similar)

For Task 2 you should describe - using between (50-100 words) for each point - the following:

1.

The main cost elements that a business needs to consider, citing the nature of these costs. For example use the following equation to illustrate your direct costs:

Gross profit = Sales Revenue – Costs of sales

Where “Costs of Sales” is made-up of the following Direct Costs: Labour, Material & Energy

For example use the following equation to illustrate your indirect costs:

Net profit = Gross profit – Expenditure

Where “Expenditure” is made-up of the following In-direct Costs: Marketing, Delivery &

Administration

2.

Variable-costs and give an example.

3.

Fixed costs and give an example.

4.

Semi-fixed or semi-variable costs and give examples.

5.

The concept of absorption of overheads.

6.

What is meant by marginal costs (explaining the equation)

7.

Give two or more examples of ways in which a business might set the price of the products or services that it offers (you can include pricing based on the costs incurred by the business).