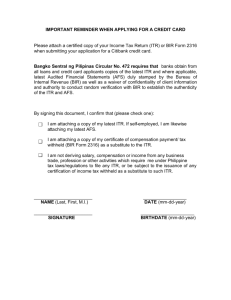

BIR Form No. 1902

advertisement

TAX UPDATE FOR THE PhALGA DESIGNATING THE APPROPRIATE WITHHOLDING AGENTS & FIXED OFFICIAL RESPONSIBILITY TO GOVERNMENT OFFICES STATUTORY BASIS EO 651 RR 1-87 RR 6-96 RR10-97 RMO14-98 OFFICERS & EMPLOYEES REQUIRED TO DEDUCT & WITHHOLD BARANGAY BRANGAY TREASURER MUNICIPALITIES/ MUNICIPAL CITIES /CITY BARANGAY CAPTAIN CHIEF ACCOUNTANT MAYOR CHIEF ACCOUNTANT GOVERNOR CHIEF ACCOUNTANT HEAD OF OFFICE TREASURER PROVINCES DEPARTMENTS BUREAUS GOCCS OTHER GOVT OFFICES PROVINCIAL TREASURER (Official holding the highest position such as Secretary, Regional Director, etc.) Personally CHARGED with the duty to deduct, withhold and remit taxes on compensation, expanded, final and government money payments including franchise taxes. The responsibility and liability SHALL NOT BE DELEGATED to subordinate officials and employees. They shall be jointly and solidarily liable for the additions to tax. SUBMISSION OF NAMES The names of the incumbents of such positions shall be submitted by the head of office concerned to the Commissioner of Internal Revenue within 30 days from receipts by such office of notification requiring such information and any changes of such incumbents shall be reported and the names of replacements submitted within 10 days from such change or replacements. Any public officer or employee presently charged with the responsibility to deduct, withheld and remit taxes but who does not qualify under these regulations, shall be promptly replaced by qualified officers or employees and their designation submitted to the CIR thru the Revenue District Officer where the government office is located within the period prescribed in Sec 2b of RR 1-87 as amended. . Duties & Obligations of a Withholding Agent To register To deduct and withhold To remit the tax withheld To file withholding tax returns To issue withholding tax certificate MARIVICGALBAN- WITHHOLDING TAX DIV. Kinds of Compensation Regular Compensation includes basic salary, fixed allowances for representation, for transportation and others paid to an employee. Kinds of Compensation Supplementary Compensation -includes payments to an employee in addition to the regular compensation as follows: Commission Overtime pay Fees, including director’s fees Profit sharing Monetized vacation leave Sick Leave Fringed benefit received by rank & file employee Hazard pay Taxable 13th month pay (in excess of P30,000) Other remuneration received from an employeeemployer relationship th 13 month + other benefits 13th month = one month basic salary + Other benefits P30,000 non-taxable Term “EMPLOYEE” An individual performing services under an employer-employee relationship. The term covers all employees including officers and employees, whether elected or appointed, of the Government of the Philippines, or any political subdivision thereof or any agency or instrumentality. Thus, the official and employees of the barangays are employees of the Government and shall be subjected to WITHHOLDING TAX, if applicable, pursuant to Section 79(A) of the Tax Code as implemented by Section 2.79(A) of RR 2-98, as amended EXEMPTION Personal Exemption: P50,000; Additional Exemption: P25,000 each but not exceeding four (4) Qualified Dependent Children Qualified Dependent Child A dependent means a legitimate, illegitimate or legally adopted child chiefly dependent upon and living with the taxpayer if such dependent is not more than 21 years of age, unmarried and not gainfully employed or if such dependent, regardless of age, is incapable of self-support because of mental or physical defect. The husband shall be the proper claimant of the additional exemption for qualified dependent children unless he explicitly waives his right in favor of his wife in the Application for Registration for Individuals (BIR Form No. 1902) or Certificate of Update of Exemption and of Employer’s and Employee’s Information (BIR Form No. 2305). Provided, however, that where the spouse of the employee: is unemployed or is a non-resident citizen deriving income from foreign sources, the employed spouse within the Philippines shall be automatically entitled to claim the additional exemptions for children. Annualized Withholding Tax (Year-End Adjustment) PURPOSE: TAX DUE = TAX WITHHELD WHEN: • On or before the end of the calendar year, prior to the payment of compensation for the last payroll period. • If terminated (e.g. resigned, retired, death etc), on the day on which the last payment of compensation is made. Annualized Withholding Tax Gross Compensation Income (present + previous employer) P xxx Less: Non-taxable/Exempt Compensation Income a.) 13th month pay and other benefits 30,000 b.) Other non-taxable benefits incl. de-minimis xx c.) SSS, GSIS,PHIC, HDMF& Union Dues (employees share only) xx xxx Less: a.) Personal and additional exemption b.) Health /Hospitalization premium payment Taxable Compensation Income Tax Due Tax Withheld (Jan. – Nov. OR termination date) (if applicable) xx xx xxx xxx xxx xxxx ==== Collectible: Tax due > tax withheld Collect before payment of last wage Refund: Tax due < tax withheld Refund on or before Jan. 25th of the year /last payment of wage Break even: Tax due = tax withheld Do not withhold for December salary Requisites for individuals qualified for substituted filing and must not file BIR Form No. 1700 1. Receiving purely compensation income regardless of amount; 2.. Working for only one employer in the Philippines for the . calendar year; 3. Income tax has been withheld correctly by the employer (tax due equals tax withheld); 4. The employee’s spouse also complies with all the three conditions stated above; Employer filed to BIR Form 1604-CF with Alphalists of employees ; 6. The employer issues each employee BIR Form No. 2316 (October 5. 2002 ENCS or any later version). Note: All of the above requisites must be present. The Annual Information Return of Income Taxes Withheld on Compensation and Final Withholding Taxes (BIR Form No. 1604-CF) filed by their respective employers duly stamped “Received”, shall be tantamount to the substituted filing of income tax returns by said employees. USES of BIR Form 2316 (substituted ITR) 1. Proof of financial capacity for purposes of . loans, credit card, or other applications; . 2. Proof of payment of tax or for availing tax credit in the employee’s home country; 3. Securing travel tax exemption, when necessary; 4. Other purposes with various government agencies . Revenue Regulations No. 11-2013 dated May 20, 2013 Subject: Filing/Submission of Hard Copy of the Certificate of Compensation Payment/Tax Withheld (BIR Form 2316) Covering Employees Who are Qualified for Substituted Filing, thereby Amending Revenue Regulations (RR) No. 2-98, as last amended by RR No. 010-08. Section 2.83 of RR 2-98, as amended, is hereby further amended to read as follows: "Sec. 2.83. Statements and Returns. — Section 2.83.1.Employees Withholding Statements (BIR Form No. 2316). — In general, every employer or other person who is required to deduct and withhold the tax on compensation including fringe benefits given to rank and file employees, shall furnish every employee from whose compensation taxes have been withheld the Certificate of Compensation Payment/Tax Withheld (BIR Form No. 2316) on or before January 31 of the succeeding calendar year, or if employment is terminated before the close of such calendar year, on the day on which the last payment of compensation is made. Employers of MWEs are still required to issue BIR Form No. 2316 (June 2008 Encs version) to the MWEs on or before January 31 of the following year. However, in cases covered by substituted filing, the employer shall furnish each employee with the original copy of BIR Form No. 2316 and file/submit to the BIR the duplicate copy not later than February 28 following the close of the calendar year. Penal Provisions - under Section 250 of the Tax Code , for failure to file information penalty of P1,000 for each such failure but not to exceed P25,000 a year. Section 255 any employer/withholding agent, including the government or any of its political subdivisions and government owned and controlled corporations, who/which fails to comply with the above filing/submission of BIR Form 2316 within the time required by this Regulations for two consecutive years. upon conviction thereof, be punished by a fine of not less than Ten Thousand Pesos (P10,000.00) and suffer imprisonment of not less than one (1) year but not more than ten (10) years.” In settlement under this situation, the compromise fee shall be P1,000 for each BIR Form No. 2316 not filed without any maximum threshold CREDITABLE / EXPANDED WITHHOLDING TAX Under this system, taxes withheld are intended to EQUAL or AT LEAST APPROXIMATE THE TAX DUE payable of the payee on the income payment. The tax withheld is credited against the final tax liability in the tax return filed by the payee. Income payments made by the GOVERNMENT to its local/resident supplier of goods and local/resident supplier of services other than those covered by other rates of withholding tax 1% PURCHASE OF GOODS 2% PURCHASE OF SERVICES * GOCCs shall withhold in their capacity as government. N. INCOME PAYMENTS MADE BY THE GOVERNMENT Purchase of goods 1% Purchase of service 2% EXCEPT ANY CASUAL/ SINGLE PURCHASE OF P10,000 & BELOW •local/resident suppliers of goods •local/resident supplier of services other than those covered by other rates of withholding tax REGULAR SUPPLIERS • engaged in business or exercise of profession/calling • at least six (6) or more transactions regardless of amount per transaction, either in the previous year or current year CASUAL SUPPLIERS • non-regular or single purchase P10,000 or more - taxable GOVERNMENT OFFICE • national LGU GOCC attached agencies/bodies GOCC shall withhold under (N) rather than as corporation under (M) RMC NO. 23-2007 – MARCH 20, 2007 COMPUTATION OF WTs ON GOVT MONEY PAYMENTS 5% FINAL VAT 3% PERCENTAGE TAX 1% EWT ON PURCHASE OF GOODS 2% EWT ON PURCHASE OF SERVICES BASIS: 1) GOVT PURCHASES FROM VAT REGISTERED SUPPLIERS ALWAYS NET OF VAT IMPOSED ON THE SAID PURCHASES OF GOODS AND/OR SERVICES 2) GOVT PURCHASES FROM NON-VAT REG SUPPLIERS ON INVOICE AMOUNT WHAT ARE COVERED? ALL PURCHASES OF THE GOVERNMENT THAT ARE COVERED BY PURCHASE ORDERS DULY SIGNED BY THE AUTHORIZED OFFICIALS AS WELL AS PURCHASES USING THE PETTY CASH FUND. WHAT ARE NOT COVERED? PURCHASES BY ANY GOVT OFFICIAL AND EMPLOYEE RECORDED AS REIMBURSABLE ALLOWANCE, BENEFIT OR INCENTIVE TO GOVT OFFICIAL AND EMPLOYEE BY THE CONCERNED GOVT OFFICE (EX. RATA) Example for VAT: a) Purchase of Goods Selling Price Output VAT (P1,000.00 x 12%) Invoice Amount Less: 5% withholding of final VAT (P1,000.00 x 5%) 1% withholding of Income Tax (P1,000.00 x 1%) P 1,000.00 120.00 P 1,120.00 50.00 10.00 Amount Payable to supplier of Goods P 1,060.00 C O M P U T A T I O N (VAT registered payee -professional) NEW BILLING REQUIREMENT VAT SEPARATELY BILLED GROSS ADD: 12% VAT GROSS BILLING less: EWT 10% x 100,000 NET AMOUNT DUE P100,000 12,000 P112,000 10,000 P102,000 Example for Non-VAT: a) Purchase of Goods Selling Price Less: 3% withholding of Percentage Tax (P1,000.00 x 3%) 1% withholding of Income Tax (P1,000.00 x 1%) P 1,000.00 Amount Payable to the supplier of Goods P 30.00 10.00 960.00 VAT SALES INVOICE (SI) / Sale of GOODS or properties CASH INVOICE (CI) VAT OFFICIAL RECEIPT (OR) Sale of SERVICES or lease of goods or properties FORMS TO BE USED AND DEADLINES 5% FINAL VAT 3% PERC TAX 1% EWT ON GOODS 2% EWT ON SERVICES BIR FORMS BIR FORM 1600 BIR FORM 2306 DEADLINES 10TH DAY/JAN 15 20TH DAY after the end of the qtr./upon demand BIR FORM 1600 BIR FORM 2307 10TH DAY/JAN 15 20TH DAY after the end of the qtr./UPON DEMAND BIR FORM 1601E BIR FORM 2307 10TH DAY/JAN 15 20TH DAY after the end of the qtr./UPON DEMAND BIR FORM 1601E BIR FORM 2307 10TH DAY/JAN 15 20TH DAY after the end of the qtr./UPON DEMAND Monthly Alphalist of Payees (MAP) is a consolidated alphalist of income earners from whom taxes have been withheld by the payor of income for a given return period and in whose behalf, the taxes were remitted. It contains a summary of information on taxes withheld and remitted through the monthly remittance returns (BIR Form Nos. 1601-E, 1601-F, 1600) showing , among others, total amounts of income/gross sales/gross receipts and taxes withheld and remitted. FORMAT Annex “B” BIR REGISTERED NAME TRADE NAME ADDRESS TIN MONTHLY ALPHALIST OF PAYEES (MAP) RETURN PERIOD (mm/yyyy) TIN Seq no. 1 Including branch code Registered Name (Alphalist) 3 Return period mm/yy 4 ATC 5 Nature of income payment 6 AMOUNT Tax base 7 Tax rate 8 Tax Withheld 9 2 1 2 3 4 5 TOTAL AMOUNT P I declare under the penalties of perjury, that this has been made in good faith, verified by me, and to the best of my knowledge and belief, is true and correct pursuant to the provisions of the NIRC, and the regulations issued under the authority thereof; that the information contained herein completely reflects all income payments with the corresponding taxes withheld from payees are duly remitted to the BIR and proper Certificates of Creditable Withholding Tax at Source (BIR Form Nos. 2304/2307/2306/2316) have been issued to payees; that, the information appearing herein shall be consistent with the total amount remitted and that, inconsistent information shall result to denial of the claims for expenses. __________________________ Signature over printed name Taxpayer/Authorized representative Attachments to BIR Form Nos. 1601-E, 1601-F, 1600 RETURNS with Annual Alpahists of Employees / Payees BIR Form No. 1604-CF + Alphalists of Employees (due January 31) BIR Form No. 1604-E + Alphalists of Payees (due March 1) RETURNS with Monthly Alphalists of Payees (MAP) BIR Form No. 1601-E + MAP BIR Form No. 1601-F + MAP BIR Form No. 1600 + MAP REVENUE REGULATIONS NO. 1-2014 SUBJECT : Amending the Provisions of Revenue Regulations (RR) No. 2-98, as Further Amended by RR No. 10-2008, Specifically on the Submission of Alphabetical List of Employees/Payees of Income Payments. “Section 2.83.3 Requirement for list of payees – All withholding agents shall, regardless of the number of employees and payees, whether the employees/payees are exempt or not, submit an alphabetical list of employees and list of payees on income payments subject to creditable and final withholding taxes which are required to be attached as integral part of the Annual Information Returns (BIR Form No. 1604CF/1604E) and Monthly Remittance Returns (BIR Form No. 1601C, etc.), under the following modes: 1) As attachment in the Electronic Filing and Payment System (eFPS); (2) Through Electronic Submission using the BIR’s website address at esubmission@bir.gov.ph; and (3) Through Electronic Mail (email) at dedicated BIR addresses using the prescribed CSV data file format, the details of which shall be issued in a separate revenue issuance.” “Accordingly, the manual submission of the alphabetical lists containing less than ten (10) employees/payees by withholding agents under Annual Information Returns BIR Form No. 1604CF and BIR No. 1604E shall be immediately discontinued beginning January 31, 2014 and March 1, 2014, respectively, and every year thereafter.” PENALTIES. – Any violation of these Regulations shall be subject to the corresponding penalties under the pertinent provisions of the NIRC of 1997, as amended, and applicable regulations. DATA ENTRY MODULE preparation of MAP / SAWT DOWNLOAD: www.bir.gov.ph IMPORT FACILITY( conversion to flat files) TIN LIBRARY (auto populate of registered name) AUTOMATIC CALCULATIONS (indicate tax base & ATC, system auto compute vertical and horizontal summation) AUTOMATIC PREPARATION & PRINTING OF CERTIFICATE – BIR FORM NO. 2307 /2316 AUTOMATIC PREPARATION & PRINTING OF RETURN UNDER MAP (1601E,1601F,1600) esubmission@bir.gov.ph . EMAIL BIR RECONCILIATION SAWT FORMAT MAP FORMAT Annex “B” Annex “B” BIR REGISTERED NAME TRADE NAME ADDRESS TIN BIR REGISTERED NAME TRADE NAME ADDRESS TIN MONTHLY ALPHALIST OF WITHHOLDING TAXES (MAWT) RETURN PERIOD MONTHLY ALPHALIST OF WITHHOLDING TAXES (MAWT) RETURN PERIOD Seq no. TIN 1 2 Registered Name (Alphalist) 3 Return period mm/yy 4 Nature of income payment 5 ATC 6 Tax rate Tax base 7 Tax Withheld 8 Seq no. TIN 1 2 2 2 3 4 5 TOTAL AMOUNT P P Return period mm/yy 4 Nature of income payment 5 ATC Tax rate Tax base Tax Withheld 6 7 8 9 1 9 1 3 4 5 Registered Name (Alphalist) 3 BIR TOTAL AMOUNT P P • UNDER DECLARATION OF INCOME • OVER STATEMENT OF CREDITS • UNDER/ NON-REMITTANCE OF TAXES WITHHELD • LATE/ NON-ISSUANCE OF CERTIFICATES CONSEQUENCES FOR FAILURE TO WITHHOLD 1. 25% SURCHARGE; 50% WILLFULL 2. 20% INTEREST PER ANNUM 3. COMPROMISE PENALTY OR CRIMINAL LIABILITY 4. DISALLOWANCE OF EXPENSES / PUCHASES AS DEDUCTION With proof that payee reported the incomeinterest and penalties Without proof that payee reported the incomewithholding tax, interest and penalties PENALTY PROVISION: Sec. 80 LIABILITY FOR THE TAX A. Municipality/Barangay – He shall be liable for the withholding and remittance of the correct tax due. He shall be liable for penalties or additions to the tax with respect to such failure to withhold and remit. B. EMPLOYEE – When an employee fails or refuses to file withholding exemption or willfully supplies in accurate information, the tax required to be withhold by the employer shall be collected from him including the penalties or additions to the tax. If there is an excess, it shall no longer be refunded but forfeited in favor of the government. PENALTY PROVISION In addition to the imposition of administrative penalty, willful failure by such person to keep any record and to supply the correct and accurate information at the time required herein, shall be subject to the criminal penalty under the relevant provisions of the Tax Code of 1997, upon conviction of the offender. The imposition of any of the penalties under the Tax Code of 1997 and the compromise of the criminal penalty on such violations, notwithstanding, shall not in any manner relieve the violating taxpayer from the obligation to submit the required documents Penalties for Non-Compliance •LATE FILING Non-withholding Under withholding Under remittance Failure to refund excess taxes withheld on compensation • overwithholding • overremittance Revenue Memorandum Order No. 16-2013 Subject: Directive to inform all Government Offices including any of its agencies, political subdivisions or instrumentalities, or government- owned or controlled corporations (GOCCs), to act and serve as “Role Model” to the Taxpaying Public with regards to Tax Compliance 1. To inform the aforementioned Government offices and GOCCs under their respective jurisdictions to strictly comply with all the provisions with NIRC, as amended and its implementing rules and regulations; 2. To treat these Government offices and GOCCs in equal manner with the other taxpaying public in matters of enforcement and collection of taxes with no exception; 3. To impose and assess the necessary legal increments. 4. No special treatment. 5. In cases of violations and/or failure to comply. Be civil and criminally charged. 6. To recommend the filing of civil and/or criminal actions, if necessary, on these erring Heads, Executives, Directors and Officers of these Government offices or GOCCs in accordance with the provisions of the NIRC, as amended and other applicable laws. ask not what your country can do for you – ask what you can do for your country. JFK Thank you very much . . . End of presentation