20.01 - TFS Rules and Procedures

advertisement

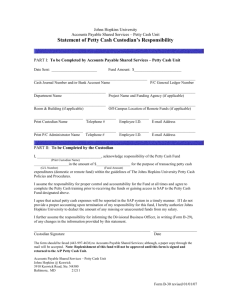

ADMINISTRATIVE PROCEDURES 20.01 Petty Cash Funds Revised: October 20, 2014 1. GOVERNING REGULATIONS The use of petty cash funds is governed by A&M System Regulations 21.01.02 Receipt, Custody, and Deposit of Revenues, 21.01.03 Disbursement of Funds, and 21.01.11 Working Funds. 2. GENERAL 2.1 The purpose of a petty cash fund is to facilitate and expedite the purchase of small dollar goods and services. Employees should utilize direct billing or the procurement card whenever possible. Purchases with petty cash funds must comply with all procurement, documentation and accountability requirements associated with purchases made through the standard procurement process. 2.2 A petty cash fund is placed in the custody of one person who assumes the operating responsibilities of the fund. The custodian is responsible for safeguarding and use of the petty cash fund. The fund should be maintained in a locked box or bag and secured in a locked desk, file cabinet, storage cabinet, safe, etc. The key(s) should be kept by only the custodian; the key(s) should not be left in a drawer or kept by any other person. 3. ESTABLISH FUND 3.1 A department head with budget authority must submit a Petty Cash Fund Request form to the Budgets and Accounting Department Head to establish a petty cash fund. The request must justify the need for the fund, indicate the amount needed, identify the custodian, and describe how the fund will be safeguarded. Someone other than the custodian of the fund must approve the request. 3.2 Upon review and approval of the fund by the Budgets and Accounting Department Head, the accounts payable office establishes a vendor identification number for the fund under the custodian’s name, issues a check to the custodian for the fund, and provides a copy of these procedures to the custodian. Page 1 of 4 3.3 Upon receipt of the petty cash fund, the custodian is required to sign the Petty Cash Fund-Responsibility Statement and return it to the Budgets and Accounting Department. 4. REPLENISH FUND 4.1 System Regulation 21.01.03 requires the custodian to replenish the petty cash fund at least monthly. 4.2 The custodian must complete a payment document (Invoice Transmittal or Purchase Voucher) with all necessary information and attach the completed Petty Cash Count form and applicable receipts. Account numbers and amount totals for account distribution are required on all forms. The completed payment document package is approved by both the custodian and applicable department head and submitted to the Budgets and Accounting Department for processing. The custodian maintains copies of all documentation. 4.3 The accounts payable office will review the payment document and receipts for completeness, accuracy, and allowability. A replenishment check will be issued for the approved voucher. 5. UNALLOWABLE EXPENSES The following expenditures are not allowed from petty cash funds: Any expense not allowed through the standard procurement process Cashing checks or funding short-term borrowings Computer software or computer accessories (unless approved by Information Resources Department) Gasoline purchases (unless for a TFS fleet vehicle, machinery or classroom use) Membership fees Mileage reimbursements (travel expense) Moving expenses (See Administrative Procedure 40.10 – Employee Relocations.) Payments to individuals for services Salaries and wages Travel expenses (excluding parking fees and road tolls within the employee’s designated headquarters) Utilities (including telephone, internet, cable, and trash) 6. DECREASE FUND 6.1 A department head or the Budgets and Accounting Department Head may determine that the amount of a petty cash fund exceeds current needs. The Page 2 of 4 excess amount of the petty cash fund must be returned to the Budgets and Accounting Department. 6.2 Complete the custodian information, decrease or close fund, and approvals sections of a Petty Cash Fund Request form. 6.3 If sufficient cash is on hand in the fund, obtain a money order for the excess amount. Remit the money order in a departmental deposit, coded to account 021203-1125. Include the approved Petty Cash Fund Request form in the deposit package. 6.4 If the fund has paid receipts which equal or exceed the excess amount, prepare a payment document to replenish the fund and include a credit line for the excess amount coded to account 021203-1125. Include the approved Petty Cash Fund Request form in the payment document support. 7. CLOSE FUND 7.1 A petty cash fund no longer needed by a custodian must be returned to the Budgets and Accounting Department. A petty cash fund may not be transferred to another employee. 7.2 A petty cash fund may be closed at any time by completion of the following: 7.3 Petty Cash Fund Request form (section requesting closure of fund) Petty Cash Count form Payment document for any outstanding receipts. Bank Deposit form [Note: Any currency must be converted to a money order payable to TFS. FAMIS account 021203-1125, custodian name, and vendor ID should be clearly noted on Bank Deposit form.] The Budgets and Accounting Department Head may require the closing of a petty cash fund if proper operating procedures are not followed. 8. ACCOUNTABILITY FOR FUND 8.1 The custodian must count and balance the petty cash fund at least monthly so that shortages or other discrepancies can be noticed, reported, and corrected on a timely basis. The custodian retains these Petty Cash Count forms for subsequent review. Page 3 of 4 8.2 Each year the custodian is required to submit a completed Petty Cash Count form as of August 31st to the Budgets and Accounting Department Head, as required by A&M System Regulation 21.01.03. 8.3 In the event of an overage or shortage, the custodian contacts the Budgets and Accounting Department Head for assistance with properly resolving the difference. 8.4 The petty cash fund may be counted at unannounced times by a member of the Finance and Administration staff or System Internal Audit Department 8.5 Theft or suspected irregularities involving petty cash should be reported directly and immediately to the Associate Director for Finance and Administration. CONTACT: Budgets and Accounting Department Head, 979/458-6640 Page 4 of 4