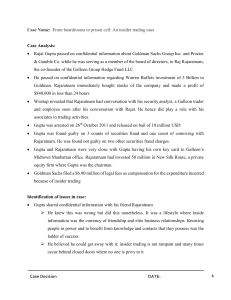

Analysis

advertisement

RAJAT GUPTA AND INSIDER TRADING By Todd Shimamoto Overview Significance How it Played Out Analysis Deontological and Virtue Ethical Theory/Recommendations Sources • Rajat Gupta, corporate director at Goldman Sachs (and once at Mckinsey). • Found guilty of 3 securities frauds and of relaying confidential Goldman Sachs boardroom information to hedge fund titan Rajaratnam at Galleon Group. • Caught via government-placed wiretaps listening to Rajaratnam and Gupta discussing Warren Buffett's Berkshire Hathaway Inc.’s $5 billion investment and Goldman Sachs’s first quarterly loss. • Rajaratnam bought Goldman Sachs shares for profit. • Found guilty of 3 securities frauds and of relaying confidential Goldman Sachs boardroom information to hedge fund titan Rajaratnam at Galleon Group. • Faced 20 years for fraud charges, 5 for conspiracy charge, but went for 2. Overview Why Is This Case So Significant? Goldman Sachs is a leading investment banking and financial consulting firm. Ranked 68 by Fortune 500 in 2013. Other small sources constantly rate them high up. McKinsey and Co. is a leading senior management consulting firm. Ranked No. 1 under Vault’s consulting rankings for 2014 Short answer, many big/small businesses rely on managers and employees at these firms. Manager in question is has been on board of directors for both companies, as well as The Bill and Melinda Gates Foundation, American Airlines, and Proctor and Gamble. Backdrop for the accused situation is the 2008 financial meltdown. How it Occurred • 2 described court meetings in 2012 and 2014. • Wiretaps reveal insider trading between Rajaratnam and Gupta. • Gupta is convicted. • 11 of the 12 jury members believe he is guilty, until evidence convinces the 12th. • Took only 10 hours, compared to Rajaratnam’s case taking 12 days. • Gupta was put up as “free on bail” for a second count. • He planned to appeal. How it Occurred Pt. 2 Lawyers challenge conviction by mentioning a $10 million fallout Gupta had with Rajaratnam. Lawyers also claim Rajaratnam never traded based on the exchanged information. Prosecutors said Rajaratnam tipped Gupta off. Lawyers claim Gupta never benefitted or traded on any tip. Prosecutors pieced together phone calls and other exchanges supported by testimonies that included Goldman Sachs CEO Lloyd Blankfein. How it Occurred Pt. 3 • Gupta wanted new trial in 2014, but court rejected it. • Wiretaps are mentioned again, and lawyers say what Rajaratnam says is “the self-serving hearsay of a known fabulist.” • Prosecutors claim it is nonhearsay. • Gupta was sentenced to 2 years, freedom pending appeal. • Appeal is rejected. Aftermath Defendants write about judge undercutting theory of Rajaratnam’s insider being another Goldman Sachs employee (i.e. Goldman Sachs Vice President David Loeb). Complain about judge cutting Gupta’s daughter’s testimony short (“My dad was upset with Rajaratnam” when she wanted to say “Rajaratnam stole money from my dad”). Court claims their shortening of the testimony may have been an error, “but it was harmless.” Wiretaps. Judge receives letters from celebrity figures such as Bill Gates to let him go, discussing the life he lived and his contributions. Type of Ethical Problem: Duty and character Duty Character-Based Boardroom information is meant to remain confidential (unless company has a specified reason for disclosure). • He was an advisor. • If he was higher up, this scandal could have cost employees their jobs. • Breaching of rules has affected trust in Goldman Sachs. • • Rajat is a face of the company. He was supposed friends with Rajaratnam – may have done this because of that if he was truly at fault. • He was an advisor who can no longer fill his role. • Deontological and Virtue Ethics/Recommendations Business associations between people empathizing with each other can be catastrophic. Consult the rest of your board before taking any action. A person’s hardships are not to be considered against their crime. SOURCES Bray, C., Rothfeld, M., Albergotti, R., Steinberg, J., Chung, J., & Strumpf, D. (). Insider Case Lands Big Catch Rajat Gupta, Ex-Goldman, P&G Director, Found Guilty; Initial Holdout on Jury. the Wall Street Journal, Protess, B., & Raghavan, A. (2014, April 20). Federal Court Rejects Gupta's Appeal for New Trial. DealBook Federal Court Rejects Guptas Appeal for New Trial Comments. Retrieved from http://dealbook.nytimes.com/2014/03/25/court-rejects-rajat-guptasappeal/ Former Goldman Sachs Director Rajat Gupta seeks re-hearing of insider trading conviction. (2014, April 9). The Economic Times. Retrieved , from http://articles.economictimes.indiatimes.com/2014-04-09/news/48999807_1_rajatgupta-geetanjali-gupta-gary-naftalis