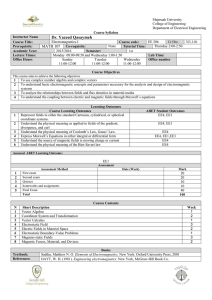

the roadmap of joint value creation beyond price

advertisement

JOINT VALUE CREATION BEYOND PRICE Advisory Group, February 4 2005 UPDATE • • • • Nominations Work Program Schedule Conference Call for nomination responses Retailers Confirmed A.Heijn, dm, Interdis, Selex, Superquinn, Tesco, Tradeka, Veropoulos Manufacturers:Confirmed Barilla, Colgate Palmolive, Ferrero, Heinz, Heineken, Henkel, Kraft,Sara Lee, Pernod Ricard, P&G, Unilever Others: University Of St Gallen, IGD BACKGROUND • Market place increasingly challenged by deflation and declining or stagnant market size. • Manufacturers and retailers rely more and more on “price” as the only value driver. BOARD • The current trading environment, shaped among others by discounters, has emerged because ECR retailers and manufacturers have not yet been able to totally fulfil consumer wishes. • Price is only one value driver. ECR Europe recognises the role played by other value drivers (e.g. health, convenience, proximity, changes in household profiles). • Major roadblock to value creation, implementation of ECR demand creation processes: the buyer-seller relationship looking on quick return rather than looking to build sustainable value for o the consumers and shoppers o for the companies. . THE RECOMMENDATION • ECR Europe shall set up a project to improve Joint Value Creation Beyond Price. The project aims at: • Encouraging a wider usage of Joint Business Planning to increase shopper and consumer attraction and loyalty • Review: explain/understand the environment • Present innovative solutions in the shopping experience and product offer which lead to market growth by addressing other consumer/shopper value than price. Joint Business Plan Objectives -Profit & Loss -KPIs what do you want to achieve • sharing company target/vision How to achieve business objectives Collaborative Projects Data sharing Supply chain efficiencies Category management Source:adapted IGD Research New product development -POS - Loyalty Cards - Panels - Surveys - …. Value creation beyond price Program Framing the issue: Deflation, commoditisation, reduce share of wallet for grocery – Definition of different values (consumer, manufacturer, retailer) – Roadblock: buyer-seller/cash/margin culture – Environment changes : – Socio economic changes: demographics, culture and aspiration, consumption patterns – Competition: other industry sectors, new channels, affecting consumption and share of wallet – Innovation : ability to answer to changing needs and aspirations (in grocery and in other sectors) – Industry structural change due to globalisation, IT development (ie use of internet) – The creation of long term value: economist and financial perspectives, benchmark with other sectors, benchmark across categories Process • Strategic alignment (roadmap of joint value creation collaboration) • Principles of Joint Business Planning • Business Planning: how to integrate various business processes within your company and with your trade partners (Organisational design) • Scorecard (measurement of value created and return ) Value Creation • Case studies - Shifting money from price to other value drivers • Benchmark categories: which are growing and how/what is driving their growth. A contrario : categories destruction by price strategy Break out session - draft • Presentation of the project group (why the issue, why the group, how session will • The environnement –The key elements of value in retail • Supply chain, Sales Growth, Margin –Danger of sole focus on discount and price –What the financial markets are seeing Speaker: Financial retail analyst (TBC: DavidMc Carthy) • The Values Definition: What is your definition of value ? (electronic vote) • Working together to grow sustainably : the roadmap of joint value creation beyond price • Heineken and Carrefour (Italy)