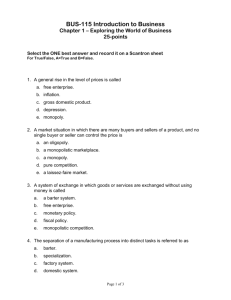

Monopolistic Competition

advertisement

Market Structures [How many sellers in each industry] Competition Greyhound Natural Monopoly TXU Competition would be chaotic. It is natural to give it to one co. Waste Management Ex: Utilities Beauty Shops Barber Shops Monopolistic Competition Forney High Owned & operated by G Ex: U.S. Mail State Highways U.S. Mail Geographic Monopoly Only seller in a specific area Example: Remote Store Monopoly [mono(1) poly (seller)] Control over price: Total Product: unique Ex: Comcast Cable TV Rubik’s Cube Cable TV Perfect Competition Monopolistic Competition Market Perfect Control over price: None Competition Products: Identical Monopolistic (Agricultural & fishery) Competition Oligopoly Pure Monopoly Price Taker Control over Price Structures [How many sellers] Very many [100s] of sellers Many [25-75] sellers Control over price: Some Ex: Blue Jeans Monopoly Oligopoly [buyer & seller] Technological Monopoly “Patent” Ex: Rubik’s Cube [Element of monopoly with “product differentiation”] “Price Makers” DART Government Monopoly Blue Jeans Basic Cable Rate Perfect Competition Most Competitive Oligopoly Oliogo (few) poly (seller) [A few control 70% of market Duopoly Control over price: Fair Amount Differentiated or Identical Reebok Oligopoly Differentiated Differentiated Products Autos & Sneakers [undifferentiated] Pure Oligopoly Identical Products (steel) DART Basic Cable Rate Forney High Greyhound Waste Management DART Government Monopoly Owned & operated by G Ex: U.S. Mail State Highways U.S.Mail “Price Makers” Monopoly Rubik’s Cube Natural Monopoly Competition would be chaotic. It is natural to give it to one co. Ex: Utilities Cable TV TXU [mono(1) poly (seller)] Control over price: Total Product: unique Cable TV Ex: Comcast Cable TV Technological Monopoly “Patent” Ex: Rubik’s Cube Cable TV Geographic Monopoly Only seller in a specific area Example: Remote Store Monopoly – the “power of one” Greyhound Natural Monopoly TXU Competition would be chaotic. It is natural to give it to one co. Waste Management Ex: Utilities Beauty Shops Barber Shops Monopolistic Competition Forney High Owned & operated by G Ex: U.S. Mail State Highways U.S. Mail Geographic Monopoly Only seller in a specific area Example: Remote Store Monopoly [mono(1) poly (seller)] Control over price: Total Product: unique Ex: Comcast Cable TV Rubik’s Cube Cable TV Perfect Competition Monopolistic Competition Market Perfect Control over price: None Competition Products: Identical Monopolistic (Agricultural & fishery) Competition Oligopoly Pure Monopoly Price Taker Control over Price Structures [How many sellers] Very many [100s] of sellers Many [25-75] sellers Control over price: Some Ex: Blue Jeans Monopoly Oligopoly [buyer & seller] Technological Monopoly “Patent” Ex: Rubik’s Cube [Element of monopoly with “product differentiation”] “Price Makers” DART Government Monopoly Blue Jeans Basic Cable Rate Perfect Competition Most Competitive Oligopoly Oliogo (few) poly (seller) [A few control 70% of market Duopoly Control over price: Fair Amount Differentiated or Identical Reebok Oligopoly Differentiated Differentiated Products Autos & Sneakers [undifferentiated] Pure Oligopoly Identical Products (steel) The “invisible hand” is omnipotent. Many Market Structure Vocabulary U.S. States Sue Big Music over Price-Fixing This price-fixing lawsuit against the 5 major recording labels charged that they increased the price of CDs in violation of antitrust laws. “Because of these conspiracies, tens of millions of consumers paid inflated prices to buy CDs of artists including Santana, Whitney Houston, Madonna and Eric Clapton.” The FTC estimated that the recording companies policies[$40 billion industry] forced U.S. consumers to pay as much as $480 million more than they should have for CDs and other music over the last three years. Auto body shops sued paint companies, including Sherwin-Williams, for fixing prices on paint, primer and fillers. Four major toy manufacturers (Hasbro, Little Tykes, Mattel, & Toys R’Us) were sued for conspiring to fix prices of toys. Toys R’Us was accused of brokering an illegal agreement with toy manufacturers to not sell their most popular products to the warehouse clubs. 4.0 1.4 1.6 The average child sees 245 ads per day. They see around 30,000 commercials in 1 year. By age 65, on average, we see 3 mil. commercials, which is like watching 3 years of non-stop commercials. 3 Perfect Competition – has a very large number of sellers (hundreds or thousands) of the same product (any agriculture or fishery product). They are all selling the same undifferentiated products (oranges). 4 Competition 5 Market Structure – degree of competition – economic rivalry among businesses. among firms operating in the same market (autos). Four Market Conditions Necessary For Perfect Competition 6A 1. Very large number of sellers (hundreds or thousands). Each seller will have only a small share of the market. B 2. Similar or identical products (sweet corn/brocolli/eggs) which means there is no reason for non-price competition. C 3. Easy entry and exit into the market. D 4. Absence of price controls (too many sellers & consumers). Perfect Competition and Price No one firm controls price. Lowering price would lower profits as consumers would buy similar substitutes. Prices are set by the market rather than by the firms. These firms are “price takers.” 1. Jeans 2. Shampoo What Is The Best? 5. Aspirin 6. Razor 3. Cologne 4. Perfume 7. Gas 8. Ice cream 9. Toothpaste 10. Batteries Some of these differences are “perceived” rather than “real”. Is A Beer A Beer? [Differentiation may be perceived rather than real] To show that some differentiation is perceived rather than real, blind taste tests on beer were conducted on 250 participants. Four cans of identical beer with different labels were presented to the subjects as four different brands of beer. In the end, all of the subjects believed that the brands of beer were different and that they could tell the difference between them. Another interesting result came out of the taste test – most of the participants commented that at least one of the beers was unfit for human consumption. Tastes Great. Not fit for human consumption 20 Monopolistic Competition – fairly large number (25-75) of sellers competing to sell slightly differentiated products. Product differentiation (real or imaginary) is vital. This is the most common market structure. Sellers try to decrease competition by making their products different from the others. Since each firm attempts to make its product unique, unique, there is an “element of monopoly”, thus monopolistic competition. Product differentiation, when it is successful, enables a firm to “establish a kind of monopoly” so that loyal customers will prefer it rather than buy from the competition. [They try to monopolize a small portion of the market.] 21 Even virtually identical products may be differentiated by brand name, packaging, or design but they are still similar. They have all the conditions of perfect competition except for product “differentiation.” 22 They use “nonprice” methods of competition such as advertising and improved service to increase sales. Reputation is important [builds loyalty]. Most manufactured goods are made by only a few producers. 4 Market Conditions For Monopolistic Competition 1. 25-75 buyers and sellers must exist. Firms act independently but no single firm is large enough to change the supply or price of a good. 2. The products are similar but they emphasize product differentiation (differences among products). This is the one thing that separates monopolistic competition from perfect competition. The differences may be real or imaginary (a refrigerator with plastic or metal trays). Aspirin, by federal law, has to have certain chemicals but people believe highly advertised aspirin is better. Revlon offers 157 shades of lipstick – 41 are pink. 3. Buyers must be well informed about differences in products. Monopolistic competitors rely on informative and competitive advertising. 4. Easy to enter or exit the industry. Few restrictions exist. Monopolistic Competition [element of monopoly [differentiation uniqueness] so called monopolistic competition] This is the most common market structure – over 99% of all firms. Examples of Monopolistic Competition Blue Jeans Dry Cleaners Shoe Stores Toothpaste Restaurants Barbershops Grocery Stores Rock Concerts Cassette players Book Stores Vacuum Cleaners Beauty Parlors Candy Bars Pizza Chicken Soaps and detergents Furniture Stores Econ Textbook Co’s “Econ” Other Monopolistic Competition Examples Janitorial Services Air Conditioning Auto Dealers Karate Body Shops Pet Shops Electrical Contractors Window Cleaners Dermatologists Copying Locksmiths Pest Control Alcohol Treatment Centers Carpet Cleaning Fingernail Saloons Upholstery Cleaners Tire Companies Masonry Contractors Dry Wall Contractors Party Suppliers Dog Grooming Accountants Monopolistic Competition and Price 23 There is some control over price because differentiation creates buyer loyalty [jeans]. Non-price competition is used to control price. Developing brand name loyalty will enable a firm to marginally increase price without losing customers. If the increase is too much, buyers will switch to a competitor’s product. The “Real World” The “real world” of competition involves monopolistic competition & oligopolies. Over 99% of all firms are monopolistic competitors. However, a few thousand oligopolies produce most of the products in the U.S. So, our big firms are oligopolists and our smaller firms are monopolistic competitors. Monopolistic Competition Cost Curves [Like beauty, product differentiation is in the eye of the beholder] [“One turkey farmer tries to convince you that his naked turkeys are better than someone else’s naked turkeys.”] What are you really buying when you go to a fancy restaurant? Surely not just a meal. Undoubtedly, you’ll order something on a somewhat higher culinary plane than a Big Mac, a large fries, and a Coke, but is that meal worth $80? It is when it is served by a waiter with a phony French Accent, there are flowers on the table, a nice linen table cloth, candlelight, soft music, a solicitous maitre d’, and the restaurant is a restored 17th century carriage house. PRICE AND OUTPUT IN MONOPOLISTIC COMPETITION Expect New Competitors in this industry. Price and Costs Profits are above costs “Yippee, an economic profit, good times ahead.” M C ATC P1 A1 Short-Run Economic Profits D MR Q1 Quantity PRICE AND OUTPUT IN MONOPOLISTIC COMPETITION Expect New Competitors Price and Costs Profits are above costs M C ATC “Yippee, an economic profit, good times ahead.” P1 New competition drives down the price level – leading to economic A1 losses in the short run. Short-Run Economic Profits D MR Q1 Quantity PRICE AND OUTPUT IN MONOPOLISTIC COMPETITION Many firms exit the industry Going out of business sale Price and Costs “I’ve got to stay upbeat, even though it is a SR economic loss.” MC ATC A2 P2 Short-Run Economic Losses D Costs exceed the profits MR Q2 Quantity PRICE AND OUTPUT IN MONOPOLISTIC COMPETITION Going out of business sale Price and Costs “I’ve got to stay upbeat, even though it is a SR economic loss.” MC ATC A2 P2 With economic losses, firms will exit theShort-Run market – Stability occurs Economic profits are zero when economic Losses Costs exceed the profits MR Q2 Quantity D Price and Costs PRICE AND OUTPUT IN MONOPOLISTIC COMPETITION MC Long-Run Equilibrium ATC Normal Profit Only P3 = A3 D MR Q3 Quantity 24 Oligopoly – “the chosen few” (3 or 4) firms control 70% of the market. Monopoly – 1 firm industry (Cable TV) Duopoly – 2 firm industry. (Coke & Pepsi) [P&G (47%) & Kim-Clark (30%) in diapers] “Oligo” – few in an industry. (“Big 3 or 4” or even “Big 5 or 6”) Two Types of Oligopolies 25 Pure (Undifferentiated) Oligopoly – 3 or 4 producers dominate the production of an identical product (steel, zinc, copper, aluminum, lead, cement, industrial alcohol) Differentiated Oligopoly – 3 or 4 producers dominate the production of differentiated (similar) products. [typewriters, tires, soap, cigarettes, refrigerators, cereals, TVs & autos] Duopoly – when 2 firms dominate an industry. Coke products have 43% of the market and Pepsi products have 32%. 1. Coke Classic 2. Pepsi Cola 3. Diet Coke 4. Mountain Dew 5. Diet Pepsi 6. Sprite 7. Dr. Pepper 8. Caffeine Free Diet Coke 9. Diet Dr Pepper 10. Sierra Mist Pepsi’s first commercial in 1939 became so popular, it became a hit record and was played in jukeboxes. A 12-ounce bottle sold For a nickel. Here it is. Big 3 Subscribers[mil.] 51.6 M Cingular Wireless 47.4 M Verizon Wireless Oligopoly Examples 40.4 M Sprint Nextel Market Share of Phone Sales Nokia 34% Siemens 7% Motorola 16% L.G.Telecom 7% Samsung 11% Sony 6% Autos – “Big 3” – GM, Ford, Daimler-Chrysler-Benz Athletic Shoes–“Big 4”–Nike, Reebok, New Balance, Adidas, [Nike made $10 billion in 2004] Shox is Nike’s latest Beer – “Big 3” – Anheuser-Busch, hot seller. It is modeled on a 10,000 year old Miller, & Coors sandal discovered in an Oregon cave. Cereals – “Big 3” – Quaker Oats, General Mills, & Kelloggs TV Networks – “Big 4” – NBC, CBS, ABC & Fox There are also oligopolies in chewing gum, light bulbs, typewriters, photocopiers, and sewing machines. Four Market Conditions For Oligopolies 1. A few sellers control over 70% of market. 2. Firms offer identical or differentiated products (real or imaginary). Advertising important. 3. Product information must be easily available. They use informative advertisement (price, quality, and special features) to introduce new products. 4. There are huge barriers to entry into the industry. The three major barriers are technological knowledge, money, & brand name loyalty. In 1980, it cost Ford $3 billion to equip a factory that would produce two new subcompacts. Entry is difficult because many have patents or own essential raw materials. This makes it difficult for new firms to try to compete. Oligopoly and Price Oligopolies control price to some degree by creating brand name loyalty and using non-price competition. 26 Price Leadership – when one firm, usually the largest and most powerful in the industry, offers a new product at a certain price. The others then follow because they fear a price war or because they would be better off financially by doing so. In other words, oligopolists play the game, “follow the leader”. Price leadership is legal (unlike collusion) because it does not involve any agreement among competitors. If the competition does not follow the leader’s price, the leading firm may be forced to change its price and fall in line with the prices of the competition. 27 Collusion – a formal price agreement among competitors. This is illegal because it presents a danger to free competition. Even one email from one manager to another is illegal. OLIGOPOLY BEHAVIOR A Game-Theory Overview RareAir’s Price Strategy Uptown’s Price Strategy High A $12 Low B $15 High $12 C $6 $6 D Low $15 $8 $8 OLIGOPOLY BEHAVIOR A Game-Theory Overview RareAir’s Price Strategy Uptown’s Price Strategy High A $12 Low B $15 High $12 C $6 $6 D Low $15 $8 $8 Greatest Combined Profit OLIGOPOLY BEHAVIOR A Game-Theory Overview RareAir’s Price Strategy Uptown’s Price Strategy High A $12 Low B $15 High $12 C $6 $6 D Low $15 $8 $8 Independent Actions Stimulate Response OLIGOPOLY BEHAVIOR A Game-Theory Overview RareAir’s Price Strategy Uptown’s Price Strategy High A $12 Low B $15 High $12 C $6 $6 D Low $15 $8 $8 Independent Actions Stimulate Response Gravitating to the Worst Case OLIGOPOLY BEHAVIOR A Game-Theory Overview RareAir’s Price Strategy Uptown’s Price Strategy High A $12 Low B $15 High $12 C $6 $6 D Low $15 $8 $8 Collusion Invites a Different Solution OLIGOPOLY BEHAVIOR A Game-Theory Overview RareAir’s Price Strategy Uptown’s Price Strategy High A $12 Low B $15 High $12 C $6 $6 D Low $15 $8 $8 Collusion Invites a Different Solution OLIGOPOLY BEHAVIOR A Game-Theory Overview RareAir’s Price Strategy Uptown’s Price Strategy High A $12 Low B $15 High $12 C $6 $6 D Low $15 $8 $8 Collusion Invites a Different Solution But, the incentive to cheat is very real The Prisoner’s Dilemma Strategic behavior characterizes oligopoly. The most well-known example is the prisoner’s dilemma. 2 people have been arrested for a crime, but the evidence against them is weak. There is not enough evidence to convict either without the testimony of the other. They can get a lighter sentence if they confess & testify against their partner in crime. The sheriff keeps the prisoners separated and offers each a special deal. If one confesses, he can go free as long as only he confesses, and the other will get 10 or more years in prison. If both confess, each will receive a reduced sentence of two years in jail. The prisoners know that if neither confesses they will be cleared of all but a minor charge and will serve only two days in jail. The problem is that they do not know what deal the other is offered or if the other will take the deal. The Prisoner’s Dilemma The options available are shown. Prisoner B’s options are shown along the horizontal & A’s along the vertical. In the upper left cell is the result if both confess. In the lower left if B confesses but A does not. In the upper right, A confesses but B does not. In the lower right, neither confesses. The dominant strategy for both is to confess and to receive 2 years of jail time. If the prisoners had been loyal to each, they would have received a much smaller penalty. Both chose to confess so each is worse off than if each had known what the other was doing. In the contest of interdependence of the decisions, each made the best choice. Price-fixing In 1996, Archer Daniels Midland Company, one of the country’s most influential corporations, pleaded guilty to criminal price-fixing charges and was fined $100 million. That fine was by far the largest ever obtained by the Justice Department in a price-fixing case. The charge was that Archer Daniels conspired to fix the prices of lysine, a feed additive, and citric acid, used in a number of food products. Price-Fixing Fines Vitamin Makers Hoffman La Roche 40% $500 million fine BASF AG 20% $225 million fine Rhone-Paulene 15% Spilled the beans on co-conspirators Both had to pay a total fine of $725 million because of massive price-fixing that inflated the cost of everything from breakfast cereal to hamburgers over the past decade. The suits were brought by livestock farmers and other purchasers of bulk vitamins who allege they were forced to pay illegally inflated prices. It hurt every American consumer who took a vitamin, drank a glass of milk, or had a bowl of cereal. What was the result of the MIT 1993 Price-Fixing Case? Eight Ivy League schools agreed to stop colluding to fix prices, and MIT was found guilty of price fixing. DART Basic Cable Rate Forney High Greyhound Waste Management DART Government Monopoly Owned & operated by G Ex: U.S. Mail State Highways U.S.Mail “Price Makers” Monopoly Rubik’s Cube Natural Monopoly Competition would be chaotic. It is natural to give it to one co. Ex: Utilities Cable TV TXU [mono(1) poly (seller)] Control over price: Total Product: unique Cable TV Ex: Comcast Cable TV Technological Monopoly “Patent” Ex: Rubik’s Cube Cable TV Geographic Monopoly Only seller in a specific area Example: Remote Store Monopoly – the “power of one” 7 Pure Monopoly – one firm industry [“monopolist”] Pure Monopoly’s Market Condition 1. One firm is the only seller. Advertising promotes image. 2. No close substitute goods are available. 8 3. Prohibitive barriers to entry in the industry. High investment costs and technological expertise prevent others from entering the market. Legal restrictions make entry in government-supported monopolies nearly impossible. 4. Almost complete control of market price. 9 Monopolist have much control over price because they are the only seller. A higher price would hurt demand. The state may control the price on some legal monopolies. These single suppliers are “price makers.” Four Types of Legal Monopolies 11 1. Natural Monopoly – where competition would be chaotic, it is natural to give the business to one firm. Imagine the confusion if 5 different busses raced each other to the corner to pick up a passenger. Competition would be impractical, inconvenient, & unworkable. Greyhound 12 Examples: Public Utilities (electric & gas) – privately owned companies (buses-Continental Trailways) but regulated by the government. Comcast Cable TV in Plano. The government monitors the natural monopolies to ensure that they provide quality service at reasonable rates. AT&T had a long-distance telephone natural monopoly for 75 years. Waste Management TXU Electric Natural Monopoly • Where competition • Ex’s are utility companies would be chaotic, and cable TV therefore, it is natural to give the business to one firm • They are privately owned, but regulated by the government • Market where average costs are lowest when all output is produced by a single firm 13 Government Monopoly – monopoly owned and operated by the government. The difference between natural [privately owned] & government monopolies [government owned] is that these monopolies are owned operated by any level of government. Examples would be interstate highway system, public libraries, public schools, Postal Service, & DART. In most cases, government monopolies deal with economic products needed for the public welfare but which people would not be provided adequately by private industry. Most tend to provide goods that enhance the general welfare rather than seek profits. Pilot Point High [Local G] State G Federal G Dart Dart Examples of Government Monopoly • The Government has control over: • U.S. Mail, • State highways, and • Public schools Another mugging at Bryan Adams Bryan Adams 14 Geographic Monopoly – when a firm is the only seller of a good in a specific location. The “Last Chance Gas Station” is the last one within 50 miles of Mexico. A general Store in a remote community has a monopoly because the area can’t support two stores. Geographic monopolies are not guaranteed. Examples of Geographic Monopoly • “Last Chance Gas Station” Last Chance Gas • A general store in the middle of nowhere 14 4. Technological Monopoly – results from the invention of a new product (patent) or when technology changes the way a good is produced. General Dynamics is the only defense contractor with the technology to build Trident Submarines. 16 A patent gives an individual or firm exclusive right to produce, use or dispose of an invention or discovery for 20 years from the date of filing. To obtain a patent, you must go to the Patent Office after doing research to make sure the patent has not already been patented. Then You hire a patent lawyer to file your patent. All of this takes about 18 months. The total cost for a patent runs about $5,000. 17 It is very expensive to wage a patent infringement suit, around $300,000. Polaroid’s camera patent prevailed & won $929 million. Polaroid had accused Kodak of infringing on 7 instant photo patents & it took 10 years to make it to the Supreme Court. Fiscal Year 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 Applications Filed 116,427 121,611 126,407 137,069 151,331 163,571 167,715 172,539 174,553 186,123 221,304 191,116 220,773 240,090 261,041 293,244 326,081 333,688 333,452 355,527 384,228 Patents Filed Each Year Richardson’s Heeling won a patentinfringement lawsuit against Skechers which had to stop shipment of its 3Wheelers shoes. The dispute was over the combo athletic shoe and one-wheel skate that allows the wearer to both walk and roll. Drox Sunshine agreed to change its Drox character so it will look less like a doughboy and Pillsbury agreed not to pursue a lawsuit, which saves dough. 18 Copyright – gives the author or artist the exclusive right to publish, sell or produce his work for his life + 50 years. So, copyrights protect written works of art. Top-Earning Dead Celebrities 1. 2. 3. 4. 5. 6. 7. Kurt Cobain $50 Elvis Presley $42 Charles Schulz $35 John Lennon $24 Albert Einstein $20 Andy Warhol $19 Theodor Geisel (Dr. Seuss) $10 8. Ray Charles $10 9. Marilyn Monroe $8 10. Johnny Cash $8 11. J.R.R. Tolkien $7 12. George Harrison $7 13. Bob Marley $7 14. Jerry Garcia $5 http://www.nucleusinc.com/animation.php Around 266,000 total knee replacements & 160,000 artificial hip implants will be done this year. Competition and the Market Structure The Government’s Record Of Regulating The Economy This is a Senate Of the Monopolists By the Monopolists For the Monopolists Antitrust Legislation Since the 1880s, the federal government had aided competition. To promote efficiency, certain legal monopolies have been allowed to exist. 28 Trusts – legally formed combinations of corporations or companies. In the latter half of the 1800s, cutthroat competition and mergers created trusts in steel, meatpacking, oil, sugar, coal, and tobacco. They were actually large cartels. By the 1880s, the government passed laws to protect competition. Anti-trust legislation – designed to monitor and regulate big business, prevent monopolies and break up existing monopolies. 1. Interstate Commerce Act-1887 – created the ICC to oversee railroad rates. Today it regulates railroads, motor vehicles, & other freight carriers. 29 2. Sherman Anti-trust Act-1890 – the “cornerstone of anti-trust legislation.” It prohibited any agreements, contracts or conspiracies that would restrain interstate trade or cause monopolies to form. This act protected trade against unlawful restraint & monopoly. It was the 1st significant act against monopolies. Later legislation defines the principles in this act. The Sherman Anti-trust’s failure to define key terms such as “trusts” and 30 “restraint of trade” made it somewhat ineffective. It was not clear what was legal or illegal. This act also ran contrary to the economic theory of laissez-faire (hands-off by the government) attitude of the past 100 years. Progressive Era (1901-1920) Legislation (A Reform Minded Era) 1.Clayton Antitrust Act – 1914 spelled out specific illegal businesses practices. It gave the government power against monopolies. It outlawed price discrimination-charging customers different prices for the same product – where it might lessen competition or lead to monopolies. Large retail outlets had gotten price breaks. The Clayton put some teeth into the Sherman Act by specifying what acts were in restraint. Federal Trade Commission Act – 1914 – created the FTC to investigate charges of unfair methods of competition. (false and misleading advertising) Robinson-Patman Act (Anti-price Discrimination Act) – 1936 It strengthened the Clayton Act on price discrimination. It protected small retail businesses by prohibiting wholesalers from charging small retailers higher prices than they charged large chain stores and by prohibiting large retailers from setting artificially low prices. All rebates had to be available to all. Celler-Kefauver Act (Celller Anti-merger Act)–1950 – prevented mergers and the purchase of competitor’s assets when such acquisition would reduce competition. By the Early 1890s, a number of businesses were convicted under the Sherman Antitrust Act. In 1911, the Supreme Court declared that the Standard Oil Company was practicing unreasonable “restraint of trade” and ordered that its 90% monopoly be broken up into 34 smaller companies. They became known as Exxon, Mobil, Chevron, Amoco, etc. Broken up were American Tobacco, Standard Oil, and Northern Securities. American Tobacco was charged with using predatory pricing [underselling others until they were driven out of business, then raising prices] and other means to monopolize the cigarette business. It was split into 16 firms like R.J. Reynolds & British American Tobacco. AT&T was accused of using its monopoly of local phone service to exclude competitors from the related long-distance and telephone equipment markets. The two sides settled in 1982. They agreed to spin off seven local phone companies known as the “Baby Bells.” And What About Microsoft? Should They Be Broken Up Into The “Baby Bills”? Microsoft was accused of forcing computer makers to install its browser [Internet Explorer] as a condition of licensing Windows. 31. Economies of Scale [“economies of mass production”] Exist when firms are large enough to take advantage of mass production techniques. Or, “Why it may cost only a little more to produce twice as much.” Variable costs may not change Fixed cost don’t change much if workers were underworked and the oven was not being used to capacity. Third-Party Costs and Benefits (Externalities) 32 [Externalities are the effects of production (pollution) or consumption (smoking) of a product on people external (3rd parties) to the transaction] Supplier Consumer The transaction above (buying donuts from Shipley’s) doesn’t affect a third party. Shipley’s Donuts, the supplier is happy. Shipley’s and the consumer bear all the costs and benefits. A third party external to the buyer and seller is not impacted. 33 If a third party is affected in a negative way, it is called a negative externality. 34 If a third party is affected in a positive way, it is called a positive externality. External Cost [Negative Externality] Third Party Product(cigs) Supplier Consumer Wife becomes impotent Hurts asthma Here, we have an external cost of production. The seller and consumer have happy faces. The consumer receives the product and pays the seller. The consumer thinks this voluntary transaction is worthwhile. The seller’s happy face reflects his satisfaction at the price for the product. However, the third party is so sad that she is crying because of a negative externality . [Think cancer from downstream toxic waste because a company wants to save money] Examples are pollution, smoking, litterbugs, drunk drivers, robbers, and aircraft noise. All are a cost because they cause dirtier air, polluted water, more accidents, and more policemen, etc. Another example: “A noisy stereo next door prevents you from studying “economics.” External Benefit [Positive Externality] Education Third Party Supplier(A&M) Consumer Less crime, fewer police, lower taxes Here, we have an external benefit of production. The third party has a happy face because he benefits from a transaction even though he paid none of the costs of producing the product. Examples: If your neighbor buys a very large dog, It may frighten burglars from your house too. A dam built to generate electric power would also benefit in flood control and as a lake for recreation. It would also help in fishing, swimming, and boating. The classic example is education. It means the government collects more taxes from college grads. There is less crime and therefore less demand for policemen. Let’s Look Some Ways Failure To Finish High School Affect Us Poverty – 9% of people live below the poverty level but 22% of those without a high school education live in poverty. Public assistance – 140,000 welfare recipients in Texas were high school dropouts. 2 million are in U.S. prisons and 80% read below a 7th grade level. Prisons – 100,000 of 151,000 Texas prisoners didn’t finish high school and 50,000 of the 100,000 were functionally illiterate. It cost $8,000 a year to get a student thru public high school, it costs $34,000 for a year in prison. Unemployment – When unemployment was 4%, it was 1% for college grads and 7.1% for high school dropouts. So, we can educate now or – incarcerate later. Lost earning power – Average salary for dropouts: $19,000; For high school grads: $27,000; & for college grads: $44,000. Some public schools in the inter-city are feeder schools for prisons. If they hadn’t dropped out… - The 630,000 dropouts in the D-FW area earn $8,000 less than a high school graduate. In theory, if those 630,000 had a diploma, the D-FW area would have had about $5 billion more in income. The G.I. Bill [“If you think education is expensive, try ignorance.” – Derok Bok of Harvard] In 1950, 328,841 Americans graduated from the country’s colleges – three times greater than the number of graduates just a decade earlier. Before the G.I. Bill, a college education was the exclusive experience of children of affluent parents. Only 5% of Americans over 25 had completed college. Today, it is about 28%. Harvard President James Conant was adamant in his opposition. He expressed concern that the arrival of veterans would inevitably lower academic standards. He feared that the vets would turn American colleges into “educational hobo jungles.” Later, Conant admitted his error and called veterans on his campus “the most mature and most promising students Harvard has ever had.” Some 7.8 million veterans, about half of those eligible, enrolled in a school or job-training program. The cost of the G.I. Bill was around $14.5 billion but it has been returned at least 7 times over to the U.S. Treasury in the form of increased tax revenues. It produced 450,000 engineers, 240,000 accountants, 230,000 teachers, 97,000 scientists, 67,000 doctors, 122,000 dentists and – by the early 1960s - One half of the membership of the U.S. Congress. ACCOUNTING FOR GROWTH Changes Educational Attainment U.S. Adult Population Percent of U.S. Population 100 80 60 40 20 0 1950 1960 College Graduates or More 1970 1980 1990 2000 High School Graduates or More Source: U.S. Census Bureau 30% of America’s high school students will leave without graduating. How will they compete in the global economy? 35% of whites graduate from college, but only 17% of blacks and 11% for Hispanics, and 61% for Asians. 31% of women graduate from college, for men it is only 26%. [5% in 1945] 4-17-2006 96% of Asians graduate from high school, 93% for whites, 88% for blacks, & 62% for Hispanics Who is Smarter? Men or Women • For every 100,000 men who graduate college, • There are 133,000 women who graduate. • There are 2.7 million in prison. • Only 7% of them are women. • Perhaps women are smarter at getting away with crime. • OK, women must be smarter. So, What Should We Do About Benefits and Costs “If we subsidize, we get more; And if we tax, We get less.” The End Greyhound Natural Monopoly TXU Competition would be chaotic. It is natural to give it to one co. Waste Management Ex: Utilities Beauty Shops Barber Shops Monopolistic Competition Forney High Owned & operated by G Ex: U.S. Mail State Highways U.S. Mail Geographic Monopoly Only seller in a specific area Example: Remote Store Monopoly [mono(1) poly (seller)] Control over price: Total Product: unique Ex: Comcast Cable TV Rubik’s Cube Cable TV Perfect Competition Monopolistic Competition Market Perfect Control over price: None Competition Products: Identical Monopolistic (Agricultural & fishery) Competition Oligopoly Pure Monopoly Price Taker Control over Price Structures [How many sellers] Very many [100s] of sellers Many [25-75] sellers Control over price: Some Ex: Blue Jeans Monopoly Oligopoly [buyer & seller] Technological Monopoly “Patent” Ex: Rubik’s Cube [Element of monopoly with “product differentiation”] “Price Makers” DART Government Monopoly Blue Jeans Basic Cable Rate Perfect Competition Most Competitive Oligopoly Oliogo (few) poly (seller) [A few control 70% of market Duopoly Control over price: Fair Amount Differentiated or Identical Reebok Oligopoly Differentiated Differentiated Products Autos & Sneakers [undifferentiated] Pure Oligopoly Identical Products (steel) Name 1. ________________ Name 2.________________ Market Structure Word Scramble [From the word scramble below, pick out the 5 correct answers for each market structure] *Write the bold face type. Oligopoly 1._______________________ 2._______________________ 3._______________________ Natural, Geographic, 4._______________________ Technological, & Gov. 5._______________________ Perfect Competition Nike, Reebok, New 1._______________________ Balance, and Adidas 2._______________________ Homogeneous product 3._______________________ 4._______________________ [Identical] 5._______________________ Pure Monopoly Identical (pure) or differentiated products 1._______________________ 2._______________________ 3._______________________ Price Leadership 4._______________________ is used 5._______________________ Polaroid Instamatic Monopolistic Competition McDonald’s, Wendy’s, 1._______________________ 2._______________________ and Burger King 3._______________________ Product differentiation 4._______________________ 5._______________________ gives an element of monopoly A few control 70% of the market Very many (100’s) sellers Price takers Many [25-75] sellers One seller Easiest to enter Comcast Cable TV Economics (college) Textbook Companies (over 50 of these and they are differentiated Black eyed peas Blue Jean Companies (dozens and differentiated) Price Maker Beauty Shop Name 1. ________________ Answers Name 2.________________ Market Structure Word Scramble [From the word scramble below, pick out the 5 correct answers for each market structure] *Write the bold face type. Oligopoly 1. Few control 70% 2. Nike, Reebok, N.Bal., & Adidas 3. Identical or differentiated Natural, Geographic, 4. Price Leadership Technological, & Gov. 5. McD’s, Wendy’s, & Burger King. Perfect Competition Nike, Reebok, New 1. Easiest to enter Balance, and Adidas 2. Homogeneous product Homogeneous product 3. Very many sellers 4. Price Takers [Identical] 5. Black eyed peas Pure Monopoly Identical (pure) or differentiated products 1. Nat, Geog, Tech, & Gov. 2. Polaroid Instamatic 3. One seller Price Leadership 4. Comcast Cable TV is used 5. Price Maker Polaroid Instamatic Monopolistic Competition McDonald’s, Wendy’s, 1. Product differentiation 2. Many sellers and Burger King 3. Econ Textbook Co’s Product differentiation 4. Blue jean companies 5. Beauty Shop gives an element of monopoly A few control 70% of the market Very many (100’s) sellers Price takers Many [25-75] sellers One seller Easiest to enter Comcast Cable TV Economics (college) Textbook Companies (over 50 of these and they are differentiated Black eyed peas Blue Jean Companies (dozens and differentiated) Price Maker Beauty Shop