F&C Functional Competency Framework

advertisement

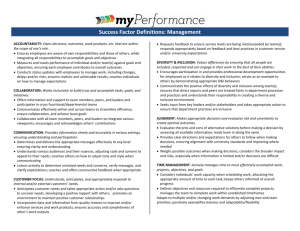

F&C Functional Competency Framework View this presentation in Slide Show mode for audio narration April 2014 F&C Functional Competency Framework What A functional specific complement to the Nestlé Leadership Framework A combination of knowledge, skills and behavior that can be observed, measured and evaluated An identification of the broad competencies which make the biggest difference for performance in our function, globally A reflection of the key elements that contribute to success in a given job across all F&C functional areas 2 April 2014 F&C Competency Framework Why The Needs….. Of the Business Functionally-based competencies Globally consistent standards of skills, knowledge and behaviors that support Nestlé’s strategy In Finance, these should support the OMP, align to the 4 pillars and thus identify the most acute capability gaps Of line managers Clarity and focus around developmental activities for their people including trainings and job rotations The implications…. The Solution Globally aligned standards around skills, knowledge and behaviors that clearly differentiate performance A system of communicating what these competency standards are for specific types of jobs A model robust enough to cover the most important elements, but compact enough to be practical and user-friendly Content for completing ‘technical competency’ section in PDGs and Job Success Profiles For the Business A way to clearly communicate capability expectations across the organization A tool to help make people choices that best support strategic goals For line managers A framework to better direct development opportunities Content for completing PDGs and JSPs according to global standards Of Individual employees Better understanding of capability expectations which will help them perform better in their current job Better understanding of where to focus development to meet the needs of future jobs Of Individual employees Clarity around current expectations and what is required to change positions. A framework for understanding developmental needs and focus 3 April 2014 F&C Competency Framework F&C Functional Competencies – FLT key messages* 1/2 Broad business understanding, with early exposure to non-finance functional areas such as Sales and Supply Chain; developing better business acumen in which to apply sound governance and controls, link cause and effect to drive meaningful decisions, act strategically to help shape the future of the Nestlé Group Deep financial knowledge with end-to-end vision of the business value chain, developed via the traditional building blocks of Accounting, Costing, Audit, Controlling, etc.; enabling solid analysis for sound judgment calls and the ability to challenge while delivering insights with the right perspective More influential stakeholder management, both internal and external, through advocacy and the “right of voice” gained by integrating sharp F&C analytical skills with deep business knowledge * from interviews conducted with members of the Finance Leadership Team: essential elements for an effective F&C function, which you will find embedded across the 5 competencies according to their relevance 4 April 2014 F&C Competency Framework F&C Functional Competencies – FLT key messages 2/2 Deeper emphasis on the balance sheet, particularly Liabilities which requires sustained exposure to specialist areas such as Corporate Finance/Treasury, Tax, Pensions, M&A; enabling full custodianship of the health of our business Mastery of business processes and systems, to drive efficiencies across the organization Soft skills or the behavioral aspects of how we apply our technical skills and knowledge are equally important and must be reinforced throughout the development journey * from interviews conducted with members of the Finance Leadership Team: essential elements for an effective F&C function, which you will find embedded across the 5 competencies according to their relevance 5 April 2014 F&C Competency Framework Finance & Control Functional Competencies - Definitions Ensures rock solid financial management, effective organizational oversight and an integrated approach to Governance, Risk Management and Compliance (GRC) Acting as a trusted business partner, integrates strong F&C skills and experience with comprehensive enterprise knowledge to drive stakeholder alignment behind the strategic goals of the business Rock Solid Financial Management, Governance, Risk & Compliance Strategy & Stakeholder Alignment Effective Business Planning Building on internal and external insight, develops business relevant scenarios and forecasts, promoting the implementation of aligned plans that project realistic business targets and objectives 6 April 2014 F&C Competency Framework Ensures optimal design and maximum leverage of business processes and systems, promoting simplicity, efficiency and effectiveness through innovation and continuous improvement Insightful Business Analysis & Reporting Has a deep understanding of what information is relevant for the business, and the ability to analyze and interpret the data, providing meaningful insights for sound decision making Finance & Control Functional Competencies – Activities* Internal & External Standards and Laws (NAS, NIBS, Costing,…) Portfolio management Business partnering M&A and strategic advisory Industry & other external networking / influencing Data & Process Integrity Internal Control System (ICS) Enterprise Risk Management / BCP Technical finance skills (Accounting, Costing, Tax, Treasury, Pensions, Insurance,…) Rock Solid Financial Management, Governance, Risk & Compliance Strategy & Stakeholder Alignment Effective Business Planning MBS, DF, CAPEX Target setting Scenario Planning Pre-evaluations Cash Flow / Treasury Forecasting Tax Planning * illustrative and non-exhaustive 7 April 2014 F&C Competency Framework Period End Close MBP / DF Cycle, DPF tool GLOBE solutions / BE Nestlé Audit Tool Treasury, Tax, Pensions & Insurance & other financial systems Insightful Business Analysis & Reporting Internal & external benchmarking Data modeling & valuations Sensitivity analysis Value Chain simulation Post-evaluations Business reporting KPI Dashboards F&C Competencies - Proficiency Levels Knowledge not acquired / required 1 8 1/3 2 3. Can practice with help 4. Can do alone 5. Can transform Basic knowledge but no skill Ensures rock solid financial management, effective organizational oversight and an integrated approach to Governance, Risk Management and Compliance (GRC). Rock Solid Financial Management, Governance, Risk & Compliance Financial Management Caries out timely and accurate data capture according to a defined set of standard procedures, ensuring that all accounting / financial data is backed by relevant supporting documentation Consistently applies revenue, cost, asset and/or liability assignments and allocations in strict accordance with established procedures and guidelines, according to job scope Delivers complete, accurate and timely financial statements and reports according to a defined set of requirements for the business Carries out all relevant / established set of cross-checks and reconciliations to ensure consistency and plausibility of financial figures Tracks and reports on key elements of the P&L, Balance Sheet, Cash Flow statements and/or other F&C related data, according to job scope Ensures completeness, accuracy and timeliness of all data capture as well as the relevance and authenticity of supporting documentation or other evidence for all accounting / financial data by monitoring and enforcing procedures across the business Ensures that all revenue, cost, asset & liability assignments and allocations drive optimal value for the business and are made in strict accordance with established principles Identifies the information needs and requirements of internal and external stakeholders, then ensures the completeness, accuracy and timeliness of all financial statements and reports Applies technical knowledge of accounting & finance, as well as good judgment, to ensure consistency and soundness of financial figures Ensures constant monitoring and interpretation of financial transactions & statements, and can justify any conclusions reached Defines the parameters for relevant accounting / financial data needs and all related procedures of the business, while ensuring alignment with local and/or international statutory standards & requirements Sets the parameters for optimal revenue, cost, asset & liability assignments and allocations, and defines protocol for the way they are applied in the business Seeks out relevant developments in the area of financial management and drives the evolution of financial options and related information requirements for the organization Uses sound financial and business judgment to define the scope of information to be disclosed, both internally and externally, as well as the optimal way to present it Defines the scope and materiality levels for data monitoring and reporting, and ensures required transparency April 2014 F&C Competency Framework F&C Competencies - Proficiency Levels Ensures rock solid financial management, effective organizational oversight and an integrated approach to Governance, Risk Management and Compliance (GRC). 1 2 3. Can practice with help Rock Solid Financial Management, Governance, Risk & Compliance 2/3 4. Can do alone 5. Can transform Ensures adherence to Company principles, policies and procedures within the execution of assigned responsibilities; including but not limited to NAS, NIBS, Costing Standards, retention policies and local laws Promotes the enterprise-wide understanding and adherence to Company principles, policies and procedures, leading expert networks and/or driving change as required Ensures application of sound business ethics and rock solid governance across the organization, leading by example and continuously reinforcing the importance and nonnegotiable character of these principles Champions Corporate Governance and actively promotes the Corporate Business Principles and Code of Conduct across the organization to include challenging or escalating instances where business integrity or ethics are under threat Effectively applies the various components of the internal control system, with the purpose of helping the organization to retain and protect value by supporting an integrated and sustainable internal control environment within Nestlé Steers or implements innovative changes to manage the internal control system (ICS) to include both internal and external views of emerging risks and trends in GRC related areas 9 Basic knowledge but no skill Knowledge not acquired / required Governance (G) Understands applicable internal/external principles, policies and standards and is able to apply them during their daily operational work; including but not limited to NAS, NIBS, Costing Standards, retention policies and local laws Demonstrates a general understanding of business ethics and the significance of ensuring rock solid accounting & GRC activities Understands the expected outcomes of having an effective and efficient internal control system in place which includes the following components: Control Environment, Risk Assessment, Information & Communication, Control Activities, Monitoring April 2014 F&C Competency Framework F&C Competencies - Proficiency Levels Ensures rock solid financial management, effective organizational oversight and an integrated approach to Governance, Risk Management and Compliance (GRC). 10 2 Basic knowledge but no skill Knowledge not acquired / required 1 3. Can practice with help Risk Management (R) Identifies and analyzes risks within a specific business area or process, including both internal and external factors, and escalates when a known or potential material risk is observed Understands how key risk and control activities are applied within the scope of current job Compliance (C) Ensures data integrity before producing output, using data validation and integrity checks Understands the importance of the proper execution of control and compliance activities in support of the internal control environment, and further executes routine control activities as defined within areas of responsibility April 2014 Rock Solid Financial Management, Governance, Risk & Compliance 3/3 4. Can do alone 5. Can transform Skilled in the identification and analysis of risk within a specific business area or process, including having a broader understanding of their impact on the interfaces with other business areas or processes Takes timely corrective action to address known or anticipated business risks, ensuring that all relevant decision makers are informed and decisions carried through Steers the systematic application of processes and structures that enable an organization to identify, evaluate, analyze, optimize, monitor, improve or transfer risk, whether financial or other Ensures that all compliance gaps are resolved in a manner to promote effectiveness and efficiency via sustainable solutions Coordinates and develops measures to ensure compliance with both internal and external policies and procedures, audits and compliance activities Executes and monitors identified key control activities to give reasonable assurance that the internal control environment is operating as designed, and provides appropriate and timely guidance on policy remediation to drive controls improvement Effectively adapts the identified key control activities and monitoring processes to the changes within the environment including new requirements and/or business units, and further builds capabilities within others to do the same F&C Competency Framework Drives the discussion, with all relevant stakeholders, on changes in the risk profile of a business or specific area of operations, adapting the associated risk tolerance or appetite accordingly F&C Competencies - Proficiency Levels Ensures optimal design and maximum leverage of business processes and systems, promoting simplicity, efficiency and effectiveness through innovation and continuous improvement of the End to End (E2E) process. 11 2 Basic knowledge but no skill Knowledge not acquired / required 1 Business Processes & Systems 3. Can practice with help 4. Can do alone 5. Can transform Understands the full scope of systems and related E2E processes relevant to their area of responsibility, and has the operating knowledge required to perform all activities within the scope of their work in a timely way Ensures effective use of business systems in optimizing F&C activities, while ensuring flawless execution of E2E processes by establishing, driving and monitoring the objectives and timelines for the relevant organizational entity / business Drives development and implementation of critical E2E business processes, tools and systems, balancing cost effectiveness, statutory compliance and ethical obligations, leading continuous improvement through internal benchmarks and industry best practices Understands the Procedures, Guidelines and Standards applicable within a defined set of business processes, and can exercise a disciplined approach in following them Exercises full knowledge of Procedures, Guidelines and Standards, ensuring their execution across the relevant business processes, and is able to clearly articulate the rationale and purpose when process and system gaps are identified Develops capability and knowledge within the function to ensure flawless execution and active contribution to the improvement, innovation and streamlining of business processes and systems, so as to eliminate gaps and optimize performance, accuracy, costs and visibility across the organization Does simple problem solving using systematic methodology, such as Nestlé Continuous Excellence Go/See/Think/Do (GSTD), to help identify system and process gaps; provides feedback for ongoing improvement Identifies system and process innovation or improvement opportunities, conducts complex problem solving to identify root causes and benchmarks to propose concrete, implementable solutions Drives integration and change management cycle during the implementation phases of new processes and systems, instilling a problem-solving mindset with early identification of potential barriers and timely execution of solutions April 2014 F&C Competency Framework F&C Competencies - Proficiency Levels Has a deep understanding of what information is relevant for the business, and the ability to analyze and interpret the data, providing meaningful insights for sound decision making 3. Can practice with help 4. Can do alone 5. Can transform Finds and links financial information that is relevant to the business, using internal and external data sources Applies solid enterprise & industry knowledge to define and carry out meaningful business analysis, using relevant competitive, industry and macro-economic data to draw correlations and interpret trends Uses strong business acumen and financial literacy as well as solid enterprise & industry knowledge to (a)define and steer focus areas of analysis in relation to business risks & opportunities, (b)lead competitive advantage value chain analyses and competition reaction studies, and (c)define scenarios and scope of assumptions relevant to the business Basic knowledge but no skill 2 Knowledge not acquired / required 1 Insightful Business Analysis & Reporting 12 April 2014 Understands the business’ data structures and draws on the relevant information to populate financial models Understands and applies simulations and other financial analysis models such as variance, trend, break-even, cost benefit and sensitivity, to monitor or control activities and provide input for decision making Identifies basic irregularities or material variances in financial figures that help identify business issues or opportunities based on sound financial analysis Delivers financial analyses to the business following an agreed upon reporting framework, providing relevant data points and analytics as input for decision making; can clearly identify when analytical outcomes need to be escalated Masters data structures and connections and fully exploits multidimensional information sources to create or leverage financial models Builds impact analyses and complex studies with multiple variables that provide actionable business insight (e.g. portfolio analyses) Spots, thoroughly investigates and diagnoses root causes, then takes appropriate action on irregularities or material variances in financial figures and related business issues Clearly communicates business relevant financial analyses to support informed decision making, explaining, commenting and challenging deviations while highlighting opportunities, all in an actionable manner based on a good understanding of the level of financial acumen of the audience F&C Competency Framework Defines the parameters for business relevant data and data structures, ensuring an optimal level of financial information and data flows across the organization Steers the development of data models that anticipate the evolution of business needs, to ensure accuracy and relevance of financial analysis Actively addresses the root causes of irregularities or variances, driving heightened awareness and concrete action to improve reliability and usability of financial data Drives informed decision making across the organization while ensuring timely action, by weighing in the most relevant outputs of data analysis and simulations needed by the business; ensures full understanding by all F&C Competencies - Proficiency Levels Building on internal and external insight, develops business relevant scenarios and forecasts, promoting the implementation of aligned plans that project realistic business targets and objectives 3. Can practice with help 4. Can do alone 5. Can transform Quantifies and validates defined number of drivers & assumptions relevant to the business plans Identifies key business drivers and draws on internal / external insights to develop relevant assumptions for long and short range planning and business forecasting Defines the objectives, priorities, milestones and resources needed to achieve the agreed business strategy, and ensures the relevance of all assumptions throughout the planning cycles Models forward looking data, ensuring integrity of the model as well as accuracy of inputs and results Provides the business with fact-based and forward looking decision making support, then develops and monitors implementation plans based on agreed decisions Ensures that adequate planning & forecasting capability is developed, resourced and cascaded through the organization, driving forward looking business acumen across the organization Quantifies impact of different scenarios when evaluating forecasts or business plans / strategy Develops and validates scenarios and impact assessments with key stakeholders, ensuring alignment with business objectives and resources while continuously evaluating and comparing courses of action Links the interdependencies and their impact between market issues, business opportunities and external events, to provide strategic and tactical direction for scenario development, to lead idea generation and to define focus areas for impact assessment Applies knowledge of allocation keys and methodology to determine the apportionment of budgets across the business Ensures the correct and consistent use of allocation keys and methodology, seeing to a fair, defendable and transparent apportionment of budgets across the business Ensures that a business-aligned and coherent allocation framework is defined, regularly benchmarked and consistently deployed, taking into account all of the complexities of the organization and the external environment Basic knowledge but no skill 2 Knowledge not acquired / required 1 Effective Business Planning 13 April 2014 F&C Competency Framework F&C Competencies - Proficiency Levels Acting as a trusted business partner, integrates strong F&C skills and experience with comprehensive enterprise knowledge to drive stakeholder alignment behind the strategic goals of the business 1 2 3. Can practice with help Strategy & Stakeholder Alignment 4. Can do alone 5. Can transform Is familiar with Nestlé strategic documents and how it relates to the business; can explain to others Guides own business area based on a well-developed understanding of the overall business strategy Takes a key role in defining and implementing mid to long term overall business & functional F&C strategy Contributes to short /medium term strategy development and provides support in defining key drivers for tactical implementation Explains implications of business decisions, continuously assesses existing direction and opportunities, constructively challenges areas of concern, identifies potential issues and provides alternatives Ensures alignment between long and short term interests of the business and establishes a framework in which opportunities can be evaluated, using business insight to drive decision making Brings strong financial expertise and business acumen to strategic projects, ensuring an active role in their definition, development and deployment Drives strategic projects, such as target identification for acquisitions & business development, divestitures, restructuring, tax, financing, pension, insurance,… Knowledge not acquired / required Basic knowledge but no skill Strategy Development & Execution 14 Provides basic financial acumen and techniques in support of strategic projects (e.g. M&A, competitive assessment, portfolio management, tax & treasury planning) Stakeholder Alignment (internal & external) Communicates financial information in a clear and convincing manner, in support of strategy development and implementation Understands the needs and point of view of key stakeholders and ensures they have the relevant level and transparency of financial information for informed decisions Pro-actively seeks guidance on the needs of key stakeholders for financial information and ensures transparency of data for informed decisions Draws on financial acumen and an understanding of how data relates to stated business objectives, to present and defend arguments with all business stakeholders Seeks involvement with external organizations, to gain insight and build conduits to raise industry issues Participates actively with external organizations and individuals, building alliances and bringing financial and other insight to the business April 2014 F&C Competency Framework Leads key stakeholders in defining, sharing and exploiting the relevant level of financial information required to align the organization against the business objectives Influences key decisions amongst all business stakeholders through authority of knowledge and expertise Has an active share of voice with external organizations, institutions and other influencing bodies, benefiting the business and the industry as a whole Acknowledgments This Finance & Control Competency Framework was made possible through the full support and active contributions of the F&C Leadership Team, as well as the devotion of several close colleagues who committed long hours to bring this initiative to fruition Cornera Wiskott, Terri Hill, Joanne Wood, Peter Scrivener, Robert Paty and Gustav Quast Thanks also to Corporate Training & Learning for their help with the methodology. Mike Scales April 2014 15 April 2014 F&C Competency Framework