Notes

advertisement

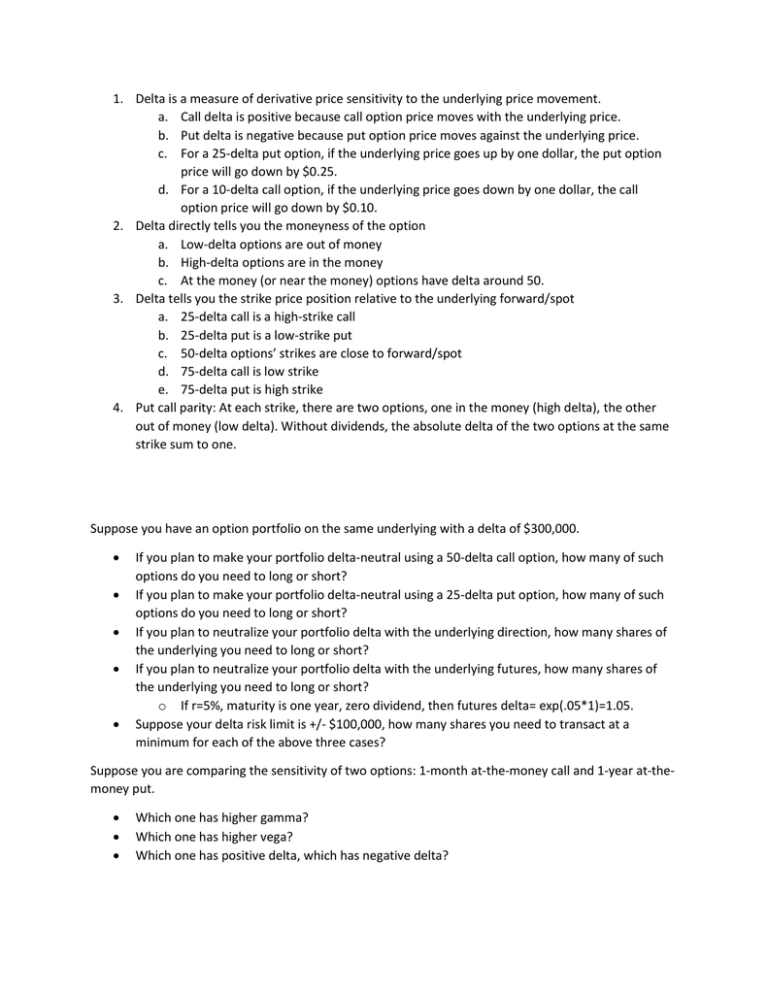

1. Delta is a measure of derivative price sensitivity to the underlying price movement. a. Call delta is positive because call option price moves with the underlying price. b. Put delta is negative because put option price moves against the underlying price. c. For a 25-delta put option, if the underlying price goes up by one dollar, the put option price will go down by $0.25. d. For a 10-delta call option, if the underlying price goes down by one dollar, the call option price will go down by $0.10. 2. Delta directly tells you the moneyness of the option a. Low-delta options are out of money b. High-delta options are in the money c. At the money (or near the money) options have delta around 50. 3. Delta tells you the strike price position relative to the underlying forward/spot a. 25-delta call is a high-strike call b. 25-delta put is a low-strike put c. 50-delta options’ strikes are close to forward/spot d. 75-delta call is low strike e. 75-delta put is high strike 4. Put call parity: At each strike, there are two options, one in the money (high delta), the other out of money (low delta). Without dividends, the absolute delta of the two options at the same strike sum to one. Suppose you have an option portfolio on the same underlying with a delta of $300,000. If you plan to make your portfolio delta-neutral using a 50-delta call option, how many of such options do you need to long or short? If you plan to make your portfolio delta-neutral using a 25-delta put option, how many of such options do you need to long or short? If you plan to neutralize your portfolio delta with the underlying direction, how many shares of the underlying you need to long or short? If you plan to neutralize your portfolio delta with the underlying futures, how many shares of the underlying you need to long or short? o If r=5%, maturity is one year, zero dividend, then futures delta= exp(.05*1)=1.05. Suppose your delta risk limit is +/- $100,000, how many shares you need to transact at a minimum for each of the above three cases? Suppose you are comparing the sensitivity of two options: 1-month at-the-money call and 1-year at-themoney put. Which one has higher gamma? Which one has higher vega? Which one has positive delta, which has negative delta?