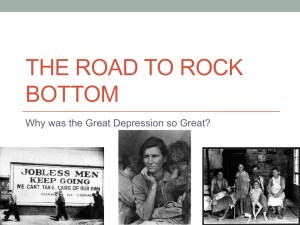

stock market CRASH

advertisement

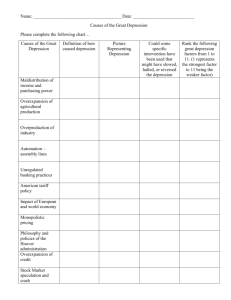

1) After WWI, absolute monarchies in Europe are replaced by weak democratic republics. What made them weak? • Little experience • Too many political parties made governance difficult (why?) • Frequent disagreement on public policies among too many competing parties • Too much turnover (change) of parties in power • A lack of strong, consistent leadership, and the inability to put stable, long-term policies in place. 2) COALITION GOVERNMENT: Temporary alliance of several minority political parties combined to form a legislative majority. 3) Kaiser Wilhelm II monarchy replaced by: the WEIMAR REPUBLIC. Problems: 1. Germans inexperienced w/ democracy. 2. too many political parties (weak coalition government) 3. BLAMED for signing the Treaty of Versailles 4. ineffective at dealing with postwar economic troubles (inflation, debt) 4) Germany’s plan to pay for WWI: Print more currency. WHY a poor policy? Resulted in hyper-inflation, made worse by the reparation payments of the Treaty of Versailles (the Weimar Republic continued the policy of printing more money). 5) Germany’s economy slowly begins to rebound in the late 1920’s: The ‘Dawes Plan’ (from U.S. banker Charles Dawes) provided a [$200 m] loan to Germany [$2.7 b in 2013], which allowed Germany to: - stabilize their currency against inflation - refinance their war reparation payments more reasonably - provide a basis for investments to strengthen the German economy U.S. investors are rewarded with positive returns on a recovering German economy, attracting additional capital. 6) Locarno Pact (1925) • France & Germany pledged peaceful relations toward one another. • Germany also agreed to respect their new borders from the Treaty of Versailles. • In return, Germany joined the League Of Nations. 7) Kellogg-Briand Pact (1929) Most nations agreed to “renounce war as an instrument of national policy” (global peace pact) BUT… … there was no ability to enforce it (weak League of Nations). 8) European postwar economic recovery most depended on U.S. investments… but the U.S. economy was flawed: • Uneven distribution of wealth: too few people had too much wealth • Overproduction by businesses AND farms • Underconsumption by U.S. consumers, who didn’t earn enough money to keep up with the production of goods. 9) Problem of overproduction + underconsumption: • Inadequate income leads to less consumption. • When consumption decreases, production decreases, leading to job layoffs & unemployment. • Unemployment leads to less consumption… reducing production even more, and causing more layoffs… a vicious cycle. 10) Agriculture production faces similar problems: Industrial farming (using new scientific methods and machinery) increased production … while global farming output & competition simultaneously increased … creating a surplus of crops, driving down farming profits (oversupply of crops) … farmers were then unable to pay off their loans, destabilizing the banks that had issued the debt. 11) The U.S. stock market in the 1920’s: 11) The U.S. stock market in the 1920’s: • Throughout the 1920’s, stock values were going up. • Many investors of more modest means (i.e. the middle class) began buying stocks “on margin” (borrowing money to buy more stocks than they could afford, anticipating continual growth in stock values to pay for it) = SPECULATIVE BUYING • HOWEVER, inflated stock values began dropping (b/c of overproduction + underconsumption!). • Investors became more panicked, trying to sell their stock shares, but in a market with few buyers. • With more sellers than buyers, the stock market crashed, and most investors lost everything they had put into stocks. • This moment marked the beginning of the Great Depression. Factors contributing to the Global Depression: → overproduction + underconsumption = too much supply (in industry AND agriculture) + too little demand drives down prices (deflation), lowers production & profits (and, subsequently, stock values) → large INCOME GAPS between rich and everyone else (investments of wealthy also lead to overproduction, while limited earnings of middle and working class cannot support enough consumption for GDP growth) → OVERSPECULATION in the stock market = too much borrowing to gamble on the stock market... followed by the stock market CRASH (panicked sell-off of investments with not enough buyers = stock values plummet) → Laissez-faire economic policies, few regulations (i.e. banks overextend credit & loans, with low cash reserves) → unpaid loans + lost investments + a run on bank deposits = BANK FAILURES = less $$$ and credit in circulation! 12) EFFECTS of the Depression: • Business failures & bankruptcies. • Bank failures & lost savings. • Lost farms, repossessed by banks. • 25% unemployment (and underemployment!) • An end to foreign loans & investments (i.e. in Europe) • High trade tariffs (by all nations) • Dramatically reduced international trade 13) BRITISH reaction to the Depression: • Increased tariffs • Increased taxes • Regulated their currency better • Lowered interest rates (encourage borrowing & spending) EFFECTIVENESS: Slow & steady recovery, preserving stable democracy. 14) SCANDINAVIAN (Northern European) reaction to the Depression: - “Cooperative community action” - Government public works projects to employ citizens - Government-funded retirement pensions & unemployment insurance to stimulate consumption - Policies funded through tax policies (on all citizens) EFFECTIVENESS: Slow & steady recovery, preserving stable democracy. 15) U.S. reaction to the Depression: U.S. President Herbert Hoover replaced by Franklin Roosevelt, who introduces the “New Deal”: • Government public works projects employ citizens • New government agencies provide financial assistance to businesses & farms • Government spending on relief programs and welfare (i.e. Social Security) • Increased government regulations to prevent problems in the stock market & the banking system (i.e. deposit requirements, limiting amount of stocks bought on margin, the FDIC, Glass-Steagall) EFFECTIVENESS: Slow & steady recovery, preserving stable democracy. 16) Italy & Germany (and Japan!) react to the Global Depression: • In the absence of strong democratic experience, citizens turned to fascism to solve their problems. • Fascist leaders intended to MILITARIZE and IMPERIALIZE to recover from the global Depression, conquering neighboring nations and stealing their assets. WWII is on the horizon!