Ch9_EE_Daly_Farley

advertisement

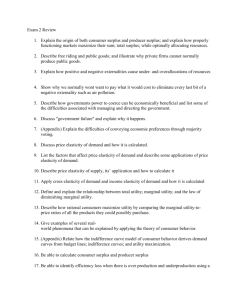

Chapter 9 Supply and Demand Geog 3890: ecological economics You can turn a parrot into an economist by getting it to squawk: “Supply and Demand!” Demand Curve Changes Shift in Curve vs. Movement Along Curve ► ► ► ► ► ► ► Shift Along Curve – Caused by Change in Price Change in Curve – Caused by changes in income, changes in preferences, changes in costs of substitutes Goods are Related as Substitutes or Complements Substitutes: Ham and Bacon, Coffee and Tea Complements: Ham and Eggs, Stapler and Staples Changes in P change Q demanded (movement along curve) Changes in relationship between P & Q (shift of curve itself) Shifting Demand & Supply Curves E. coli tainted beef outbreak. ► Bad Processing plant closes. ► S1 -> S2 ► P1 -> P2 ► Q1 -> Q2 ► Public goes soft on beef ► D1 -> D2 ► Q2 -> Q3 ► P2 -> P3 ► Shortage, Surplus, & Equilibrium ► ► ► ► ► ► P*, Q* is market equilibrium. Movement away from equilibrium forces market back to P*, Q* Price at P1 AB is a ‘Surplus’ Price at P2 CE is a ‘Shortage’ When people complain about a shortage of petroleum or of labor they are really Complaining about a shortage of cheap petroleum or cheap labor. The free market will always fix those ‘shortages’ won’t it? Yes. By raising the Price. Consumer Surplus & ‘Normal Profit’ ► Consumer Surplus ► Very large for necessities ► Producer Surplus ► aka Rent, & Differential Rent, & ‘Normal Profit’ “Tax Bads not Goods” where ‘bads’ are depletion and pollution (throughput), and ‘goods’ are value added by capital and labor (e.g. ‘earned income’). Explanations of Terms ► Consumer surplus is enormous for necessities (water for example). ► Many environmental goods and services have infinite consumer surplus. ► Rent is equivalent to producer surplus and is defined as payment over and above minimum necessary supply price. ► Normal Profit is defined as the opportunity cost of the time and money the entrepreneur has put into the enterprise. Elasticity of Demand & Supply ► Price Elasticity of Demand = % ∆ in QD / % ∆ in Price (where ∆ = change, QD = Quantity Demanded) As the price rises, the quantity demanded decreases and vice versa. Due to this concept, "% ∆ in QD" and "% ∆ in Price" will always have different sign, which always results the price elasticity of demand into negative sign. ► Based on the above formula, there are three responses. 1. Elastic: QD greatly responds to change in Price ; numerator > denominator ; Elasticity > 1 2. Inelastic: QD slightly responds to change in Price ; numerator < denominator ; Elasticity < 1 3. Unit Elastic: QD equally responds to change in Price ; numerator = denominator ; Elasticity = 1 Elasticity https://mrski-apecon-2008.wikispaces.com/Chapter+5+Elasticity+and+Its+Application ► Examples of different responses. - Goods with close substitutes are elastic because consumers have more options of goods to choose from. So when the price increases, they can buy the substitutes of that good. - Luxuries are also elastic because consumers only enjoy luxuries when the price doesn't change immensely. - Necessities are inelastic because consumers will have to buy necessities regardless of their price. Inelasticity & Profit: Peak Oil, Peak Food, & Peak Water ► What happens to total revenue as supplies diminish for a product with inelastic demand? ► What happens to elasticity of demand for gasoline as alternative energy is developed? ► Why might food and water be very lucrative products to supply as global population grows? Could driving Down agricultural productivity actually raise GDP? The Production Function (The NCE version - economists love these number free equations) Q = F(a, b, c) ► ► The quantity produced is a function of the quantities of the factors of producton a, b, and c. ► Diminishing MPP still holds. ► MPPa is a Partial derivative What is the law of increasing marginal cost? Substitutability & Complementarity ► Production functions exhibit both substitutability and complementarity between factors. But standard economists tend to see mostly substitution, whereas ecological economists emphasize complementarity. Why is this so? ► Because Ecological Economists put different things in the production function and assign different qualitative roles to the different factors in the production process. For instance, neoclassical economists treat all inputs the same – labor, capital, and resources. Ecological economists insist on a qualitative difference. The NCE production function abstracts from the difference between material (resources) and efficient (labor and capital) causes of production, and considers both to be equivalent. Ecological economists insist on the distinction. The Ecological Economics Production Function Q = F(N, K, L; r) ► ► This function embodies the fund-flow distinction ► ‘K’ & ‘L’ are funds of Capital and Labor ► ‘r’ represents flows of natural resources ► ‘N’ stands for natural capital which exists both as a stock that yields a flow of resources and as a fund providing various ecosystem services. How we think about it matters ► Question: A stock of cattle yield a flow of new cattle in a sustained yield fashion. Isn’t that a physical stock yielding a physical flow? ► Answer: Not really. It is a stock (livestock) converting a flow of inputs (grass, grain) into a flow of outputs (new cattle & Waste products). ► The correct description of “production” is transformation of a resource inflow into product outflows, with stocks (funds) of capital and labor functioning as the transforming agents. “Money Fetishism” and Fungibility ► Why are such basic facts excluded from neoclassical economics? Why does NCE choose to ignore them, to exclude natural resources from theoretical analysis right from the start? Perhaps it is a case of “money fetishism” – assuming that what is true for money in the bank, the symbol and measure of wealth, ‘must’ be true for the wealth that it symbolizes. What does “Fungibility” mean? Hint – Money is very very “fungible” The Cobb-Douglas Production Function 4 & 8 minute videos – this is what economics sounds like here: http://www.youtube.com/watch?v=SJMwcP1pLEQ and here: http://www.youtube.com/watch?v=3EYvdW_JBIs Most production functions are multiplicative forms – that is the relationship F among the factors is one of multiplication. After all, what could be more natural than “multiplying” together things that we call “Factors” to produce something that we call a “Product”. Unfortunately there is nothing in the real world process of production that corresponds at all to multiplication. There is only transformation. ► This means that substitutability is built into these production functions from the beginning as a mathematical artifact, including substitutability between r and K, and r and L (between funds and flows). ► Key Message ► As we move from the empty world to the full world economy, natural resource flows and services generated by natural capital stocks and funds become the limiting factor. Fish catches are no longer limited by the manmade capital of fishing boats, but by remaining natural capital of stocks of fish in the sea and the natural funds that support their existence. We need to economize on and invest in the limiting factor. Economic logic has not changed, but the identity of the limiting factor has. ► Because our basic NCE theory of production, when it considers natural resources at all, cannot distinguish funds from flows or recognize complementarity between them, we have been slow to recognize this change. The Utility Function ►U = F(x, y, z, …) ► Our happiness depends on what we consume (and not on our freedom, creativity, social relationships etc.) ► We experience diminishing marginal utility with increasing consumption. The neoclassical production function only contains flows of goods or services The EE Utility Function ► U = F(N; x, y, z, …) ► If ‘x’ is a pair of hiking boots then utility is dependent upon good places to hike (‘N’). ► If ‘y’ is a snorkeling mask, its utility depends on reefs and clean water to swim in (‘N’). ► Not to mention prior dependence on breathable air, drinkable water, sunlight filtered of UV etc. ► Natural Capital (‘N’) provides a complementary service without which the utilities of most consumer goods are not very great. ► Will ‘U’ increase if x, y, and z increase as ‘N’ goes down? Summary of Chapter 9’s Key Points