PPT - MUES

advertisement

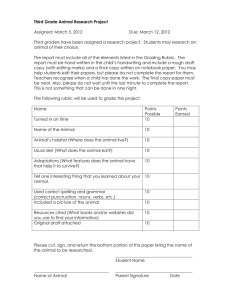

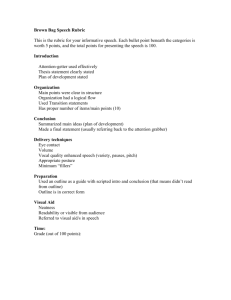

Reiner Martin Deputy Head of Division Macro-Financial Linkages European Central Bank Mendel University Brno 16 October 2015 Banking sector stress tests in the EU* *The views presented in this paper are exclusively those of the authors and not necessarily those of the ECB. Use as rubric line or delete on slide master Rubric Outline • Introduction and terminology • Banking sector stress tests at the ECB/SSM • The ECB top-down stress testing framework • The Comprehensive Assessment 2014 • Outlook 2 www.ecb.europa.eu Introduction terminology Use as rubric line and Rubric or delete on slide master ECB-RESTRICTED DRAFT • Banking sector stress tests gained significantly in importance since the start of the financial crisis in 2007/08 • On-going debates / discussions with(in) ECB/SSM, EBA, NCAs/NCBs, IMF…as well as in the financial sector itself! • Terminology – (Constrained) Bottom-up vs. Top-down – Solvency vs. Liquidity – Contagion / Networks www.ecb.europa.eu Banking sector stress atmaster the ECB / SSM Use as rubric Rubric line or delete tests on slide ECB-RESTRICTED DRAFT • Top-down – for macroprudential purposes – Quarterly risk impact assessment for the ESRB (EU-wide) – Bi-annual corresponding exercise for the Financial Stability Review (public) – Regular macroprudential impact assessment for the Eurosystem • Top-down for system-wide exercises – (Crisis) country-specific and SSM-wide • Bottom-up – for microprudential purposes – SSM-wide (banks' results for publication) – Input into regular bank-specific supervision (SREP) www.ecb.europa.eu The ECB’s top-down stress testing UseECB Rubric as rubric line orstress delete on slide masterframework The top-down testing The ECB’s top-down stress testing framework Key features of the model: • Uses granular data of around 130 large SSM banks • Is contingent on a macroeconomic scenario • Accounts for direct impact on banks’ balance sheets • Is complemented with modules to take into account : • Dynamic reaction of banks to macro-prudential policies • Contagion across banks • Macroeconomic models accounting for second round effects on the real economy 5 www.ecb.europa.eu A. ECB Stress Testing Framework: Overview The ECB’s top-down stress testing framework UseECB Rubric as rubric line orstress delete on slide master The top-down testing framework Top-down banking sector stress testing framework Forward-looking solvency analysis Scenario Funding shock Financial shocks Macro models Satellite models Balance sheet Feedback Loan loss models Credit risk models Market risk and securitisation models Profit models 6 Sources: Henry and Kok (eds.), ECB Occasional Paper 152, October 2013. RWA Contagion models Balance sheet and P&L tool => Solvency Dynamic adjustment model Macro feedback models www.ecb.europa.eu A. ECB Stress Testing Framework: Overview The ECB’s top-down stress testing framework UseECB Rubric as rubric line orstress delete on slide master The top-down testing framework Cross-country macro scenario design has to balance various factors: Adherence to macro-financial story line Model-based versus expert-based approach to shock-calibration Model consistency vs. ad hoc assumptions Need to ensure substantial stress being imposed on all banks in the exercise? A mixture of model-based and judgemental assumptions Cross-check: use top-down stress test framework during bottom-up scenario design process to gauge severity 7 www.ecb.europa.eu The ECB’s top-down stress testing UseECB Rubric as rubric line orstress delete on slide masterframework The top-down testing framework Elements of the scenario design EU macro: “Stress Test Elasticities” (STE) Multi-country EU-wide shock simulation tool based on impulse response functions (from EU central banks’ models) of endogenous variables to pre-defined exogenous shocks Allow for country-specific shocks and incorporate EU-wide spillovers (via a trade link block) CRE prices outside the system and modelled by satellite equations Non-EU macro: external models (e.g. NIGEM) A separate toolbox is used to derive pure financial shock scenarios: non-parametric copula approach to simulate joint/multivariate forward distribution of financial variables (model free, can handle large # variables) 8 www.ecb.europa.eu The ECB’s top-down stress testing UseECB Rubric as rubric line orstress delete on slide masterframework The top-down testing framework Satellite models Credit risk: • • Estimation of country aggregate, product-specific model equations LGD model based on stressed collateral values and LTV ratios (a function of house prices) Net interest income: • • Estimation of country aggregate, product-specific model equations Models for retail interest rates and for wholesale funding costs Other pre-provision income: • • Based on assumptions rooted in EBA methodology Fee & commission income model (bank panel regression framework) Market risk and securitisation: • • • Asset shock calibration (distinguishing between Held for Trading and Available for Sale / portfolios) Projections of Credit Valuation Adjustments (CVA) Projection of securitisation book using rating migration matrices 9 www.ecb.europa.eu The ECB’s top-down stress testing UseECB Rubric as rubric line orstress delete on slide masterframework The top-down testing framework Overview of solvency calculation Input from profit and loss module Definition of capital (country specific) Existing capital Solvency ratio (minimum threshold) ≤ + Net operating income Risk weighted assets potential capital shortfall Input from RWA module 22 www.ecb.europa.eu The ECB’s top-down stress testing The top-down testing framework UseECB Rubric as rubric line orstress delete on slide masterframework Interbank network and contagion models are used to: • Select relevant interbank networks of direct exposures – Static network: can be based on observed networks (e.g. EBA collection, Target 2) or simulated networks (Hałaj & Kok (2013,2015)) – Dynamic network: changes in the network take changes in market parameters impacting banks’ counterparty credit risk into account • Simulate default cascades, initiated by banks with shortfalls projected by the BST – Knock-on (domino) effects: default causes other defaults (based on LGD assumptions); – Clearing payment: equilibrium payment after all flows of payments stabilise (endogenous LGD) 11 www.ecb.europa.eu The ECB’s top-down stress testing The top-down testing framework UseECB Rubric as rubric line orstress delete on slide masterframework Macro feedback models Used to calculate the impact of the changes in bank balance sheets on macroeconomic variables (GDP, investment, consumption, housing, etc.) 1) Vector autoregressive models (GVAR/VAR): estimate endogenous relationships between real and financial variables including proxies for regulatory/macro-prudential measures, such as capital and liquidity ratios. (Gray, Gross, Paredes and Sydow (2013), Gross (2013), Gross and Kok (2013) ) 2) Dynamic general equilibrium models: derive macroeconomic and financial relationships from microeconomic principles modelling directly the pass-through mechanism of shocks to macroeconomic and financial variables. (Żochowski (2014), Darracq Pariès, Kok and Rodriguez Palenzuela (2011)) 12 www.ecb.europa.eu The Comprehensive Assessment 3.2 back to the STmaster bit2014 – combination of the 2 UseLooking Rubric as rubric line or delete onCA slide ECB-RESTRICTED DRAFT Key features of the Comprehensive Assessment 2014 • One-off exercise: starting point for and pre-condition to SSM • Next time will be different – now the SSM is there! • Timeline, methodology, templates, publication (largely) in common with EBA • 2 Components - an Asset Quality Review and a constrained bottom-up stress test with top-down quality control www.ecb.europa.eu The Comprehensive Assessment 2014 4.2. projected to decrease 4% under the adverse scenario UseCET1 Rubric as rubric line or delete on slide by master Reduction in bank capital ratios under the adverse scenario SSM median: 4.0% 14 www.ecb.europa.eu The Comprehensive Assessment 2014 4.4. theline adverse, SSM average CET1 declines from 11.8 to 8.8% UseUnder Rubric as rubric or delete on slide master Breakdown of aggregate impact of ST under the adverse scenario 1. Weighted means; excluding the AQR impact on starting point capital NB: LLP and NII key drivers to the deviations from baseline CET1. 15 www.ecb.europa.eu The Comprehensive Assessment 2014 4.3. least with capital shortfall in 11 of the 19 countries UseAt Rubric as rubricone line bank or delete onaslide master Capital shortfall by country Total shortfall 2.37 8.72 1.14 9.68 0.07 0.86 0.87 0.54 0.23 0.13 0.03 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 (€ BN) 16 www.ecb.europa.eu The Comprehensive Assessment 2014 5.2. Comparing and Top-Down results Use as Rubric rubric line orBottom-Up delete on slide master ECB-RESTRICTED DRAFT Top-down vs. Bottom-Up results • Top Down results were generally somewhat more “conservative” • So called ‘Quality Assurance Process’ led to gradual convergence of results over time • Supervisory dialogues meetings bridged the remaining gap at the end of the process • Top-down results helped the QA process and ultimately helped to boost credibility of the SSM banking sector www.ecb.europa.eu The Comprehensive Assessment 2014 banks closer to other firms 5.3. Around – The exercise brought Use as Rubric rubricthe line CA or delete on slide master Bank equity prices came closer to those of other firms Source: Bloomberg 18 www.ecb.europa.eu The Comprehensive Assessment 2014 5.5. Around – Decoupling banks from sovereigns Use as Rubric rubricthe line CA or delete on slide master Decoupling banks from sovereigns Source: Datastream 19 www.ecb.europa.eu Outlook Use as rubric line or delete on slide master Rubric ECB-RESTRICTED DRAFT • The ECB/EBA banking sector stress test 2016 will again be a constrained bottom-up exercise with top-down-driven QA (but no AQR!) • Other countries follow different approaches, e.g. the US • Stress test ‘construction sites’: – Solvency stress tests – Stress tests for non-bank financial firms (insurers, pension funds, ‘shadow banks’) – Network analysis (within sectors and beyond) www.ecb.europa.eu Use as rubric line or delete on slide master Rubric Annex slides 21 www.ecb.europa.eu The ECB’s top-down stress testing UseECB Rubric as rubric line orstress delete on slide masterframework The top-down testing framework Overview of P&L calculation Balance sheet Evolution of main balance sheet items Net interest income Interest Income and expenses calculation Loan loss calculation Loan loss and impairment calculation Market risk Trading income Profit and loss calculation Net interest income + Net fee and commission + Net trading income – Staff expenses – Depreciation and amortization – Administrative expenses – Other net operating income = OPERATING PROFIT/LOSS – Provisions on loans and advances – Other provisions (e.g. financial assets, goodwill) = PROFIT/LOSS BEFORE TAXES – Taxes – Minority interest Foregone interest income on NPL = NET Balance sheet assumptions Input from interest rate models Input from loan loss models 2 Input from various models INCOME/LOSS Input for other income/expense components www.ecb.europa.eu