Document

advertisement

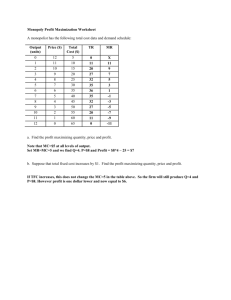

Monopoly CHAPTER 9 © 2003 South-Western/Thomson Learning 1 Barriers to Entry A monopoly is the sole supplier of a product with no close substitutes The most important characteristic of a monopolized market is barriers to entry new firms cannot profitably enter the market Barriers to entry are restrictions on the entry of new firms into an industry Legal restrictions Economies of scale Control of an essential resource 2 Legal Restrictions One way to prevent new firms from entering a market is to make entry illegal Patents, licenses, and other legal restrictions imposed by the government provide some producers with legal protection against competition 3 Patent and Invention Incentives A patent awards an inventor the exclusive right to produce a good or service for 20 years Patent laws Encourage inventors to invest the time and money required to discover and develop new products and processes Also provide the stimulus to turn an invention into a marketable product, a process called innovation 4 Licenses and other Entry Restrictions Governments often confer monopoly status by awarding a single firm the exclusive right to supply a particular good or service Broadcast TV and radio rights State licensing of hospitals Cable TV and electricity on local level 5 Economies of Scale A monopoly sometimes emerges naturally when a firm experiences economies of scale as reflected by the downward-sloping, long-run average cost curve In these situations, a single firm can sometimes supply market demand at a lower average cost per unit than could two or more firms at smaller rates of output 6 Natural Monopoly Because such a monopoly emerges from the nature of costs, it is called a natural monopoly A new entrant cannot sell enough output to experience the economies of scale enjoyed by an established natural monopolist entry into the market is naturally blocked 7 Control of Essential Resources Another source of monopoly power is a firm’s control over some nonreproducible resource critical to production Professional sports teams try to block the formation of competing leagues by signing the best athletes to long-term contracts Alcoa was the sole U.S. maker of aluminum for a long period of time because it controlled the supply of bauxite China is the monopoly supplier of pandas DeBeers controls the world’s diamond trade 8 Local Monopolies Local monopolies are more common that national or international monopolies Numerous natural monopolies for products sold in local markets However, as a rule long-lasting monopolies are rare because, as we will see, a profitable monopoly attracts competitors 9 Revenue for the Monopolist Because a monopoly, by definition, supplies the entire market, the demand for goods or services produced by a monopolist is also the market demand The demand curve for the monopolist’s output therefore slopes downward, reflecting the law of demand As seen in the following discussion this has important implications for revenues 10 Demand, Average and Marginal Revenue Suppose De Beers controls the entire diamond market and suppose they can sell three diamonds a day at $7,000 each total revenue of $21,000 Total revenue divided by quantity is the average revenue per diamond which is also $7,000 Thus, the monopolist’s price equals the average revenue per diamond 11 Demand, Average and Marginal Revenue To sell a fourth diamond, De Beers must lower the price to $6,750 total revenue for 4 diamonds is $27,000 and average revenue is again $6,750 The marginal revenue from selling the fourth diamond is $6,000 marginal revenue is less than the price or average revenue Recall that these were equal for the perfectly competitive firm 12 Firm’s Costs and Profit Maximization The monopolist can choose either the price or the quantity, but choosing one determines the other Because the monopolist can select the price that maximizes profit, we say the monopolist is a price maker More generally, any firm that has some control over what price to charge is a price maker 13 Profit Maximization Exhibits 5 and 6 repeat the revenue data from the previous exhibits and also include short-run cost data The cost data are similar to those already introduced in the preceding chapters The key issue is which price-quantity combination should De Beers select to maximize profits 14 Short-Run Losses and the Shutdown Decision A monopolist is not assured of profit The demand for the monopolists good or service may not be great enough to generate economic profit in either the short run or the long run In the short run, the loss-minimizing monopolist must decide whether to produce or to shut down If the price covers average variable cost, the firm will produce If not, the firm will shut down, at least in the short run 15 Monopolist’s Supply Curve The intersection of a monopolist’s marginal revenue and marginal cost curve identifies the profit maximizing quantity, but the price is found on the demand curve Thus, there is no curve that shows both price and quantity supplied there is no monopolist supply curve 16 Long-Run Profit Maximization For a monopoly, the distinction between the long and short run is not as important If a monopoly is insulated from competition by high barriers that block new entry, economic profit can persist in the long run However, short-run profit is no guarantee of long-run profit 17 Long-Run Profit Maximization A monopolist that earns economic profit in the short-run may find that profit can be increased in the long run by adjusting the scale of the firm Conversely, a monopoly that suffers a loss in the short run may be able to eliminate that loss in the long run by adjusting to a more efficient size 18 Price and Output Comparison Purpose here is to compare monopoly using the benchmark established in our discussion of perfect competition When there is only one firm in the industry, the industry demand curve becomes the monopolist’s demand curve the price the monopolist charges determines how much gets sold 19 Why the Welfare Loss Might Be Lower If economies of scale are extensive enough, a monopolist may be able to produce output at a lower cost per unit than could competitive firms If this is true, the price or at least the cost of production could be lower under monopoly than under competition 20 Why the Welfare Loss Might Be Lower The welfare loss shown in Exhibit 8 may also overstate the true cost of monopoly because monopolists may, in response to public scrutiny and political pressure, keep prices below what the market could bear Finally, a monopolist may keep the price below the profit maximizing level to avoid attracting new competitors 21 Why the Welfare Loss Might Be Higher Another line of thought suggests that the welfare loss of monopoly may, in fact, be greater than shown in our example If resources must be devoted to securing and maintaining a monopoly position, monopolies may involve more of a welfare loss that simple models suggest 22 Why the Welfare Loss Might Be Higher Consider, for example, radio and TV broadcasting rights confer on the recipient the exclusive right to use a particular band of the scarce broadcast spectrum In the past, these rights have been given away by government agencies to the applicants deemed most deserving 23 Why the Welfare Loss Might Be Higher Because these rights are so valuable, numerous applicants spend millions on lawyers’ fees, lobbying expenses, and other costs associated with making themselves appear the most deserving The efforts devoted to securing and maintaining a monopoly position are largely a social waste because they use up scarce resources but add not unit to output 24 Why the Welfare Loss Might Be Higher Activities undertaken by individuals or firms to influence public policy in a way that will directly or indirectly redistribute income to them are referred to as rent seeking Second, monopolists insulated from the rigors of competition in the marketplace, may also become efficient 25 Why the Welfare Loss Might Be Higher Finally, monopolists have also been criticized for being slow to adopt the latest production techniques, to develop new products, and generally lacking innovativeness 26 Price Discrimination A monopolist can sometimes increase economic profit by charging higher prices to customers who value the product more The practice of charging difference prices to different customers when the price differences are not justified by differences in cost is called price discrimination 27 Conditions for Price Discrimination Conditions The demand curve for the firm’s product must slope downward the firm has some market power and control over price There are at least two groups of consumers for the product, each with a different price elasticity of demand The producer must be able, at little cost, to charge each group a different price for essentially the same product The producer must be able to prevent those who pay the lower price from reselling the product to those who pay the higher price 28 Model of Price Discrimination Consumers are divided into two groups with different demands 29 Examples of Price Discrimination Because businesspeople face unpredictable yet urgent demands for travel and communication, and because employers pay such expenses, businesspeople are less sensitive to price than householders Telephone companies are able to sort out their customers by charging different rates based on the time of day 30 Perfect Price Discrimination If a monopolist could charge a different price for each unit sold, the firm’s marginal revenue curve from selling one more unit would equal the price of that unit the demand curve would become the marginal revenue curve A perfectly discriminating monopolist charges a different price for each unit of the good 31 Perfect Price Discrimination Perfect price discrimination gets high marks based on allocative efficiency Because such a monopolist does not have to lower price to all customers when output expands, there is no reason to restrict output In fact, because this is a constant-cost industry, Q is the same quantity produced in perfect competition 32 Perfect Price Discrimination As in perfect competition, the marginal benefit of the final unit of output produced just equals its marginal cost And although perfect price discrimination yields no consumer surplus, the total benefits consumers derive just equal the total amount they pay for the good Since the monopolist does not restrict output, there is no deadweight loss 33